This data is subject to change at any time. Include a phone number so that we may call you back and as much of the following information you have with your request:

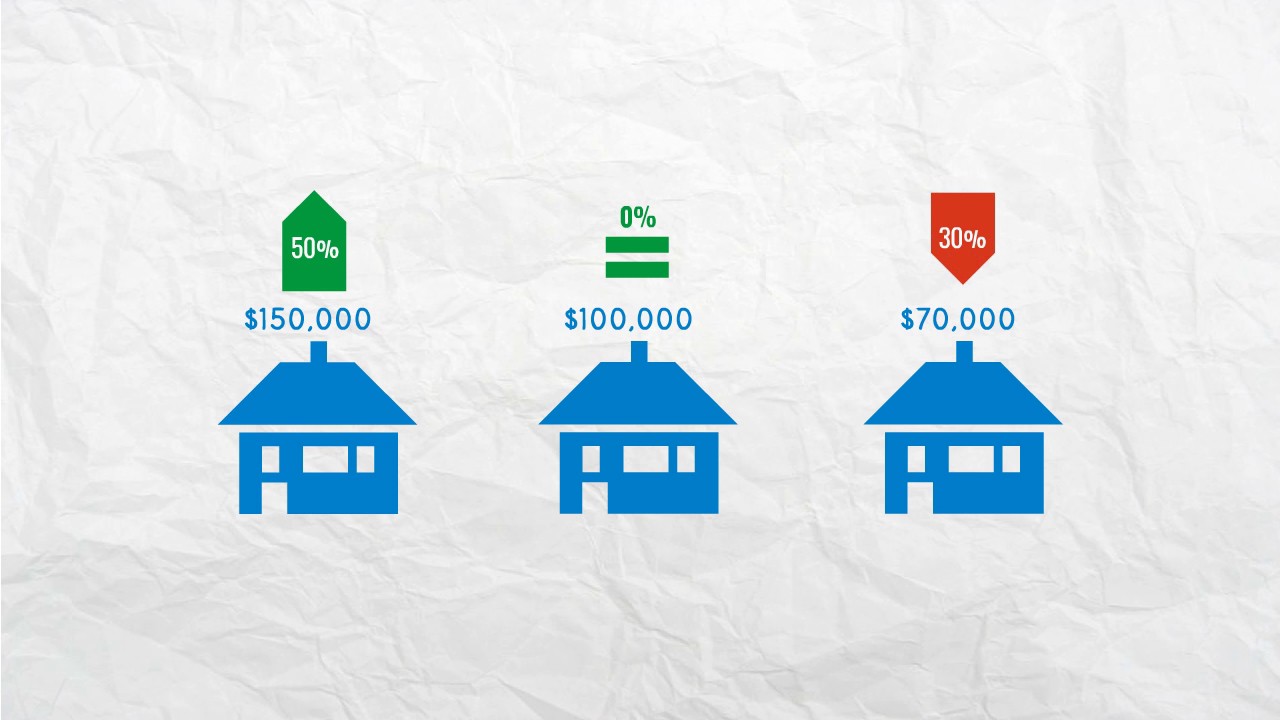

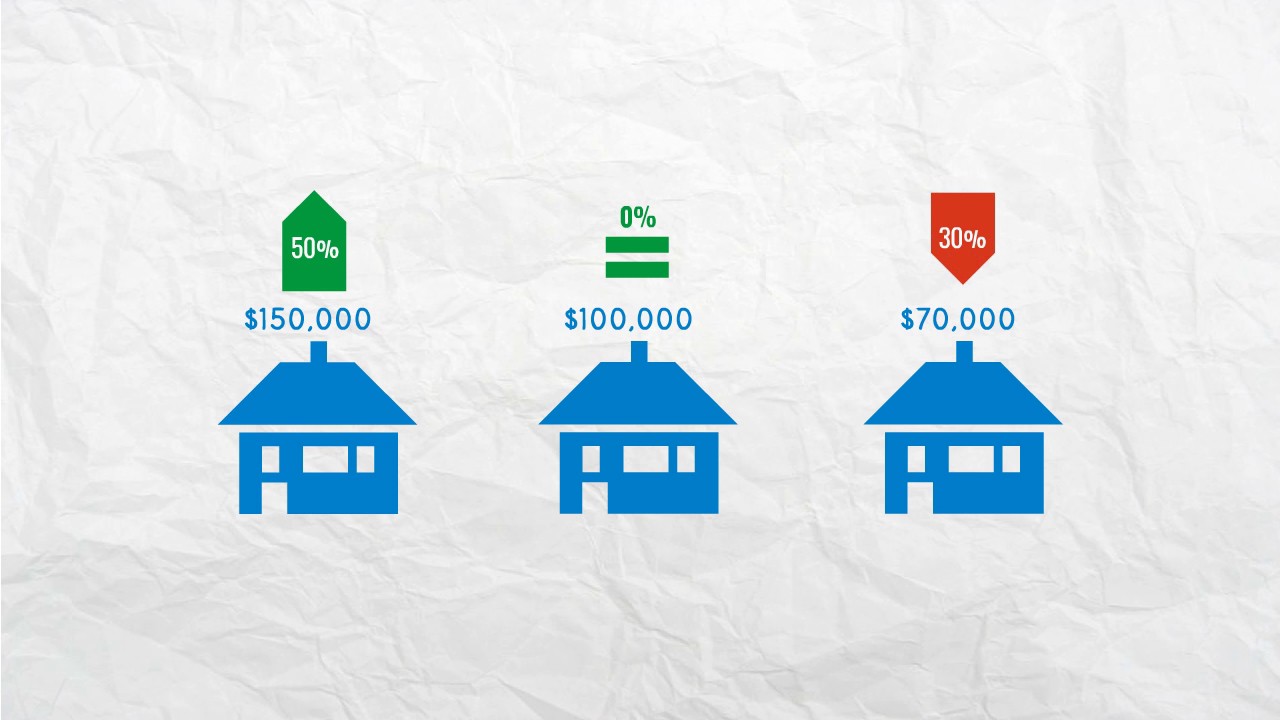

Property Tax Appeal Tips To Reduce Your Property Tax Bill

8:30 am to 4:30 pm.

Wise county tax office property search. This county tax office works in partnership with our vehicle titles and registration division. Members can search wise county, tx certified property tax appraisal roll data by owner name, street address, or property id. The purpose of the recorder of deeds is to ensure the accuracy of wise county property and land records and to preserve their continuity.

The real estate tax rate is set in the spring, during budget deliberations by the board of supervisors. How does a tax lien sale work? When contacting wise county about your property taxes, make sure that you are contacting the correct office.

Other locations may be available. Payments made by credit card will be posted in the tax office after the funds are received in the tax office bank account. The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap).

Interested in a tax lien in wise county, va? Box 359 decatur, tx 76234 number: If you have documents to send, you can fax them to the wise.

Wise county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in wise county, texas. 400 east business 380 decatur, texas 76234. If you wish to have the most recent values, you must be a registered user and print a.

Acceptable forms of payment vary by county. Payments made by credit card will be posted in the tax office after the funds are received in the tax office bank account. The wise county recorder of deeds, located in wise, virginia is a centralized office where public records are recorded, indexed, and stored in wise county, va.

Interested in a tax lien in wise county, tx? Wise county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in wise county, virginia. Please enclose a check or money order and address your request to:

Tax payments made by 12:00 (midnight) on the last day of any month will be honored as having not accumulated. As of september 10, wise county, va shows 14 tax liens. Shop tools used in any business or.

Taxnetusa members with a wise county, tx pro subscription can search both certified and preliminary appraisal data by year built, square footage, deed date, value range, property type, and many more advanced search criteria. The information contained within this site is provided as a public service by the wise county commissioner of the revenue's office. Remember to have your property's tax id number or parcel number available when you call!

Wise county appraisal district is responsible for the fair market appraisal of properties within each of the following taxing entities. These records can include wise county property tax assessments and. From the time a payment is submitted, there are 3 to 7 business days before the tax office receives the funds.

These records can include wise county property tax assessments and assessment challenges, appraisals, and income taxes. Please contact your county tax office, or visit their web site, to find the office closest to you. As of december 2, wise county, tx shows 27 tax liens.

Equipment, machinery and tools, etc. Find wise county tax records. If requesting a search by mail, the nonrefundable fee is a $10 per document.

Wise county property tax search. For 2021, the rate is $0.69 per $100 of assessed value. Wise county, tx tax liens and foreclosure homes.

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Critics Of Property Tax Appeals Board Say Its Time To End The Experiment Chicago News Wttw

Mcgm Bmc Property Tax Mumbai Step-wise Payment Procedure

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition – Stessa

Home Sale Exclusion Hr Block

Property Taxes Resort Municipality Of Whistler

Tax Records Could Offer Surprisingly Rich Details About Your Ancestors Genealogy Resources Genealogy Free Genealogy

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

Wise County Virginia Wise County Wise County

Ontario Property Tax Rates Lowest And Highest Cities

Look Uppay Property Taxes

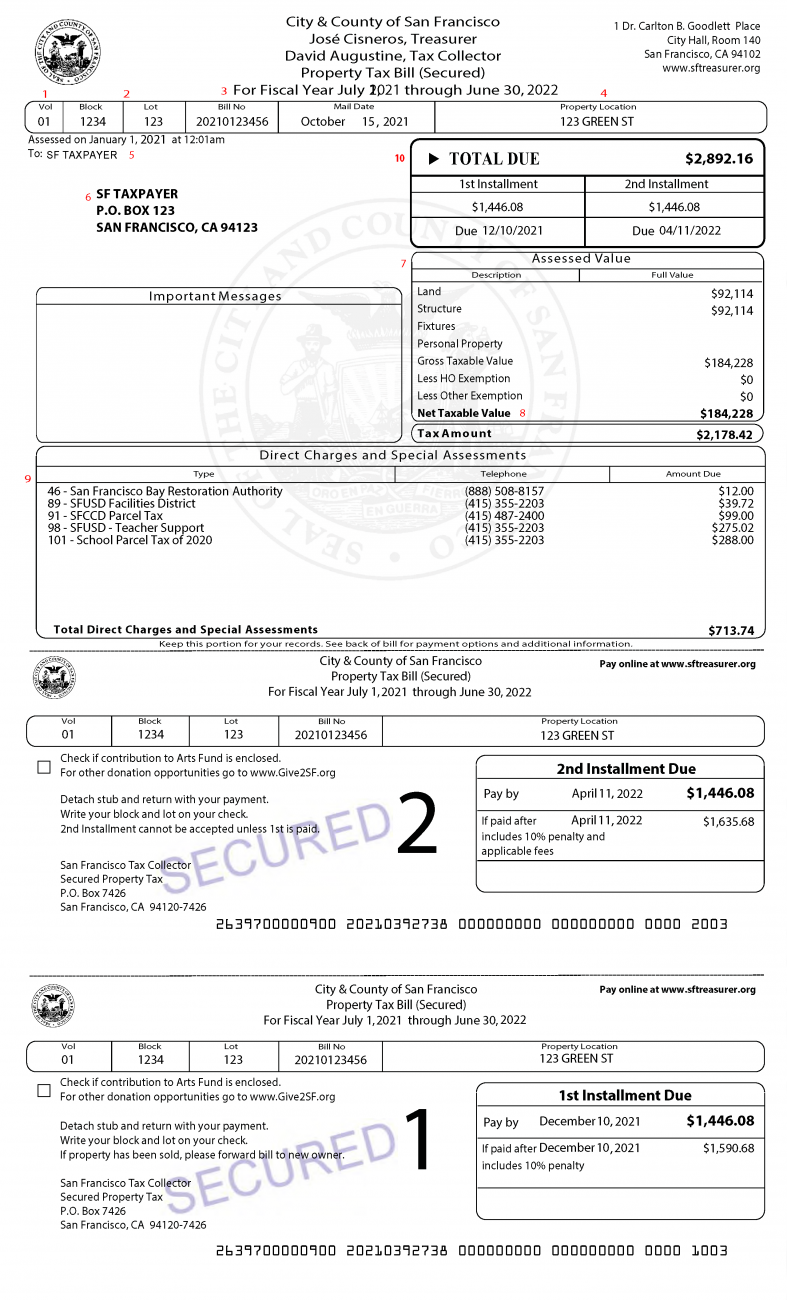

Secured Property Taxes Treasurer Tax Collector

Lowest Property Taxes In Texas By County In 2019 Tax Ease

What Is A Tax Sale Property And How Do Tax Sales Work

Property Assessment

Secured Property Taxes Treasurer Tax Collector

5 Ways To Reduce Or Avoid Property Income Tax – Property Notify

Home Business Cooking All Home Business Definition Home Business Forums Home Based Business Insu Interior Design Quotes Design Quotes Interior Design Advice

Lowest Property Taxes In Texas By County In 2019 Tax Ease