Our cde service area is in the heart of american poverty in the rural south. New markets tax credit program allocatees can make investments in all 50 states, the district of columbia, puerto rico, and certain u.s.

New Markets Tax Credit Investments In Our Nations Communities

Nmtc is a program that works for rural america.

New market tax credit map 2020. Our interactive geographic information systems show a visual representation of statistics over different geographic areas. This easy to use mapping tool helps you determine if a project can qualify under various criteria for the nmtc program based on its location within eligible. To date, esnmc has received two new markets tax credit (“nmtc”) allocation awards.

The community development financial institutions (cdfi) fund published a notice of allocation availability in the sept. Known as community development entities, allocatees have approved service areas that range from local to national in scale. Treasury department's community development financial institutions (cdfi) fund today announced the “notice of allocation availability” for the calendar year 2020 allocation of the new markets tax credit (nmtc) program.

Everyday, we see the impacts that building businesses with lasting impact in low income communities have on these areas with the most need. On december 20, 2019, president trump signed a bill that extends the new markets tax credit program through 2020 at an allocation level of $5 billion. • total credit equals 39% of the original amount invested in the cde.

Treasury department through the cdfi fund has awarded more than $3.5 billion in tax credit allocation to community development entities. Empire state new market corporation (“esnmc”), a subsidiary of empire state development (“esd”), is a certified community development entity under the federal department of treasury’s community development financial institutions (“cdfi”) fund. Cdes must apply annually to the cdfi fund to compete for new markets tax credit program allocation authority.

The new markets tax credit (nmtc) program, enacted by congress as part of the community renewal tax relief act of 2000, is incorporated as section 45d of the internal revenue code. Projects closed on or after nov. New markets tax credit program maps.

23 federal register, making $5 billion in new markets tax credit (nmtc) allocation authority available for the 2020 nmtc allocation round. Your project may be eligible for the program based on its location in a qualified census tract. Under the new markets tax credit program, fnm leverages private capital with funds derived from the sale of tax credits to investors.

Treasury announces new markets tax credit (nmtc) allocations for 2020, increased to $5 billion. Ofn congratulates all of the allocatees, particularly the 22 ofn members, who received $973,485,000, representing more than 27 percent of the allocation. The new market tax credit was first authorized by congress in 2000 to “bring down the cost of capital in communities outside of the economic mainstream,” as paul anderson, vice president at rapoza associates, a public interest lobbying firm, explained to leverage.com.

View demographic maps, see crime rates, map real estate trends and more. The new markets tax credit program provides tax credits to investors that make equity investments in specialized financial intermediaries called community. The new markets tax credit (nmtc) is sponsored by the treasury department through the community development financial institutions (cdfi) fund.

The new markets tax credit (nmtc) program provides tax credits for new private sector investment in economically distressed communities by certified community development entities (cdes). New markets tax credit extension act of 2019 Find local businesses, view maps and get driving directions in google maps.

This code section permits individual and corporate taxpayers to receive a credit against federal income taxes for making qualified An article in the october novogradac journal of tax credits omitted that fact. Investors receive tax breaks for qualified nmtc investments into.

The federal tax credit also designates a severely distressed area. On july 15, the cdfi fund announced $3.5 billion in new markets tax credit (nmtc) allocations through the 2019 allocation round to 76 community development entities (cdes). Gis mapping services from policymap allow you to map data quickly and easily.

Either census database may be used to evaluate eligibility through a transition period ending october 31, 2018*. The nmtc program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified community development entities (cdes). The incentive to investors is a 39% federal income tax credit earned over seven years for every dollar invested in.

The federal new markets tax credit program (nmtc program) helps economically distressed communities attract private investment capital by providing investors with a federal tax credit. • the credit rate is: This credit aims to incentivize economic growth and community development in distressed communities. according to its website, the nmtc has generated $8 of private investment for every $1 of federal.

How Aca Marketplace Premiums Are Changing By County In 2021 Kff

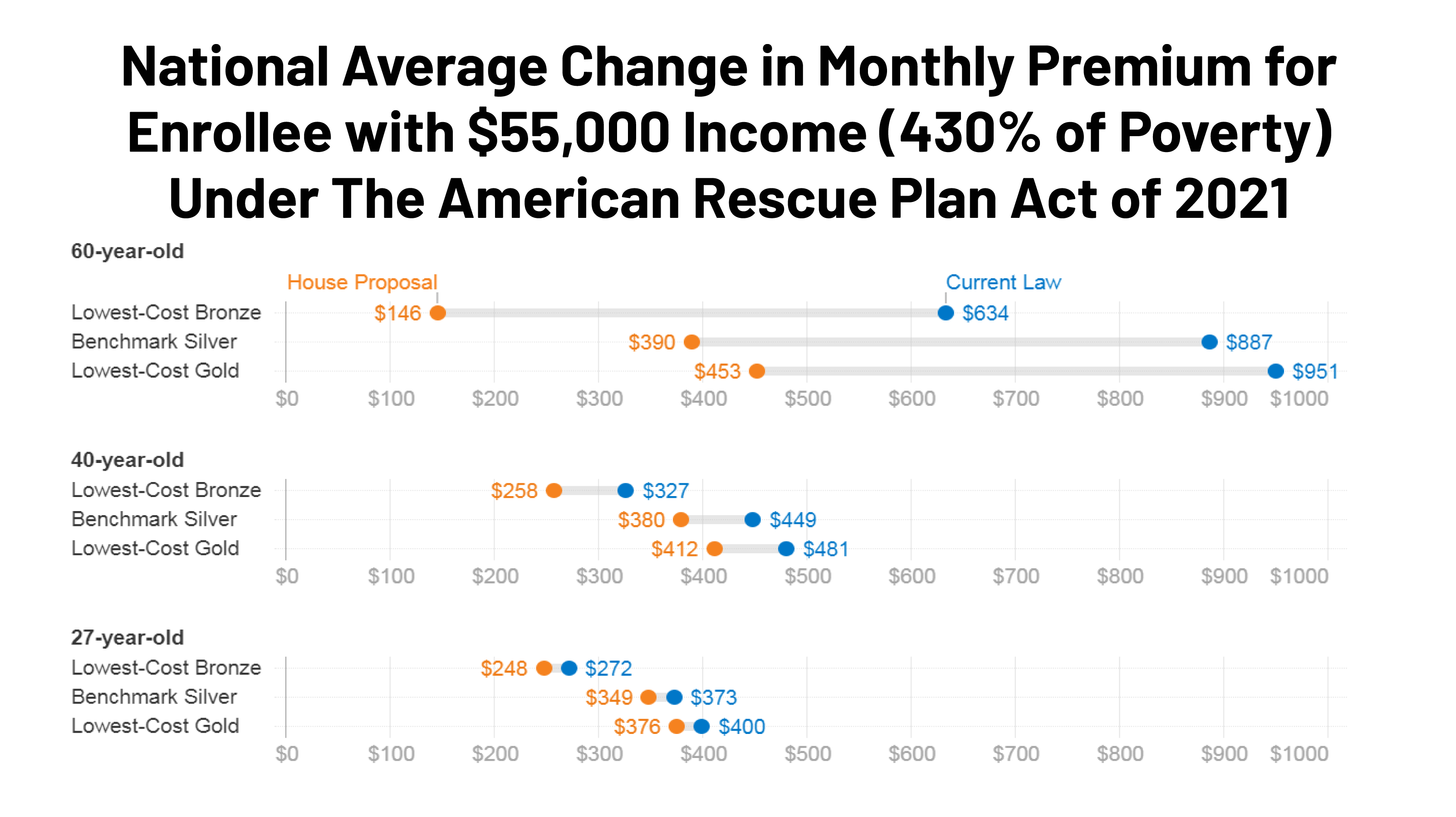

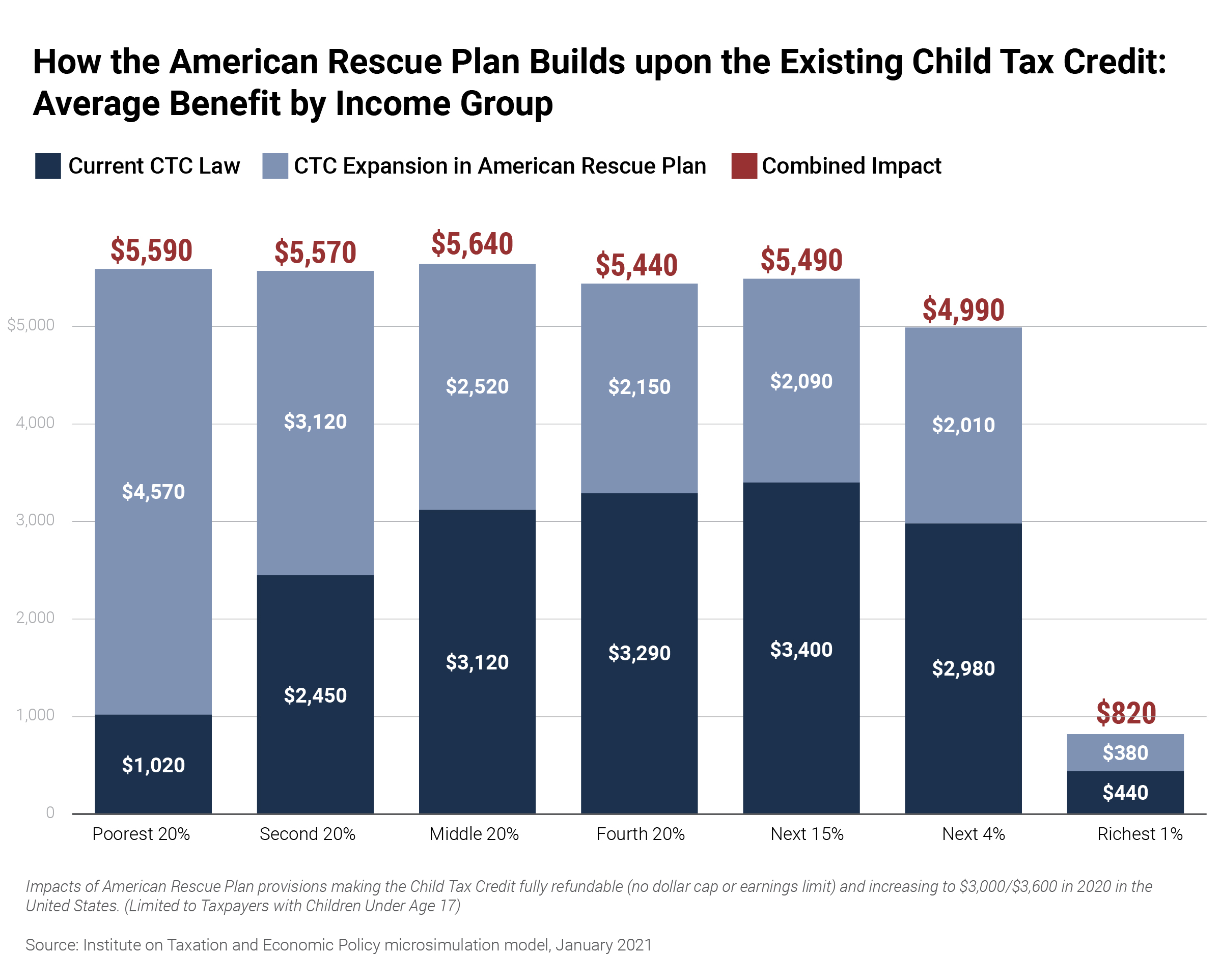

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid-19 Relief On Marketplace Premiums Kff

New Markets Tax Credit Investments In Our Nations Communities

Low Income Housing Tax Credit – Ihda

Low Income Housing Tax Credit – Ihda

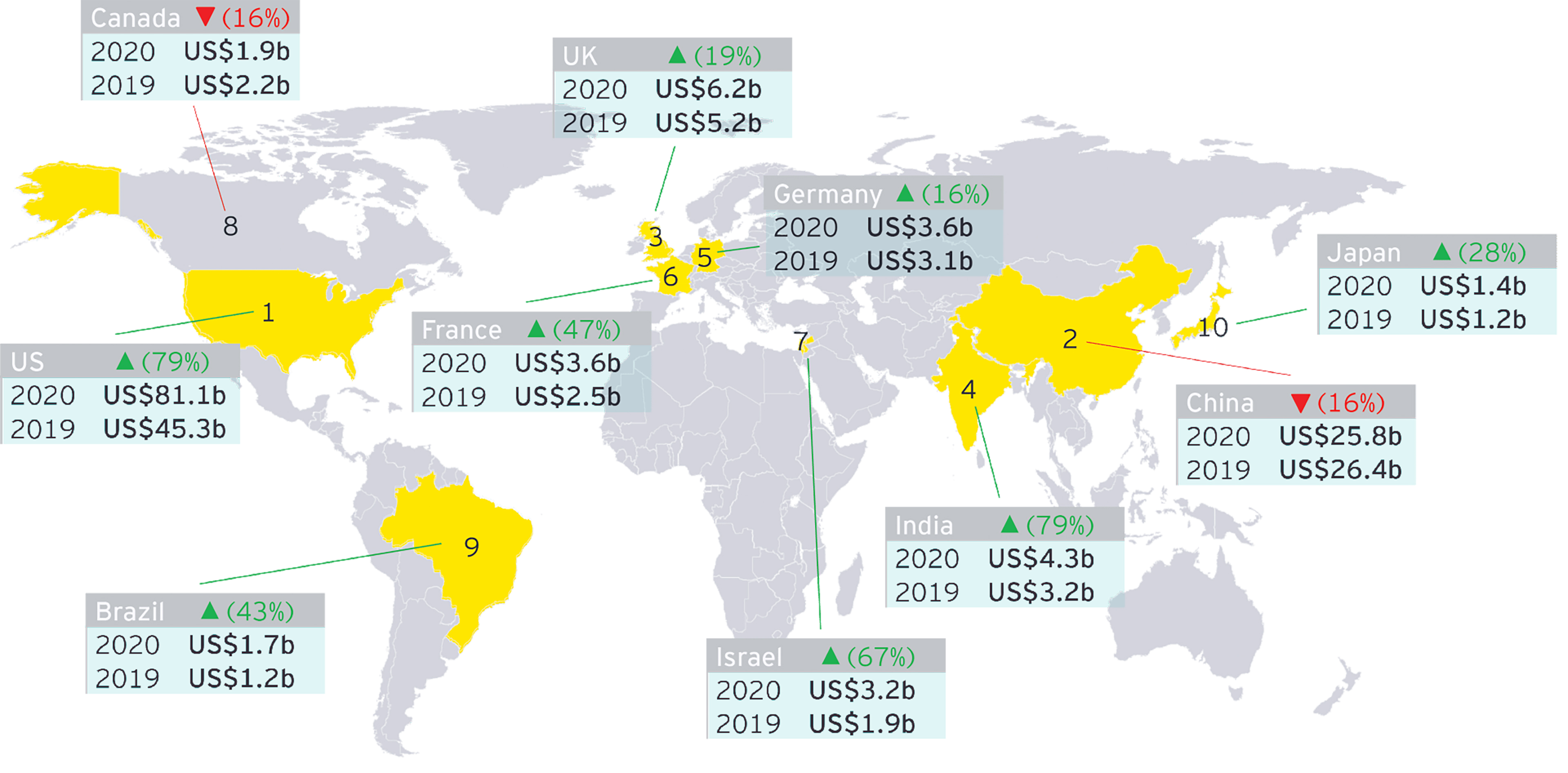

European Venture Capitals Resilience Through A Global Pandemic Ey Luxembourg

15 Fintech Maps Showcasing The State Of Fintech In Asia Fintech Singapore In 2021 Fintech Startups Fintech Start Up

Illinois Income Tax Calculator – Smartasset Income Tax Income Tax Return Federal Income Tax

Global Carbon Account In 2020 – I4ce

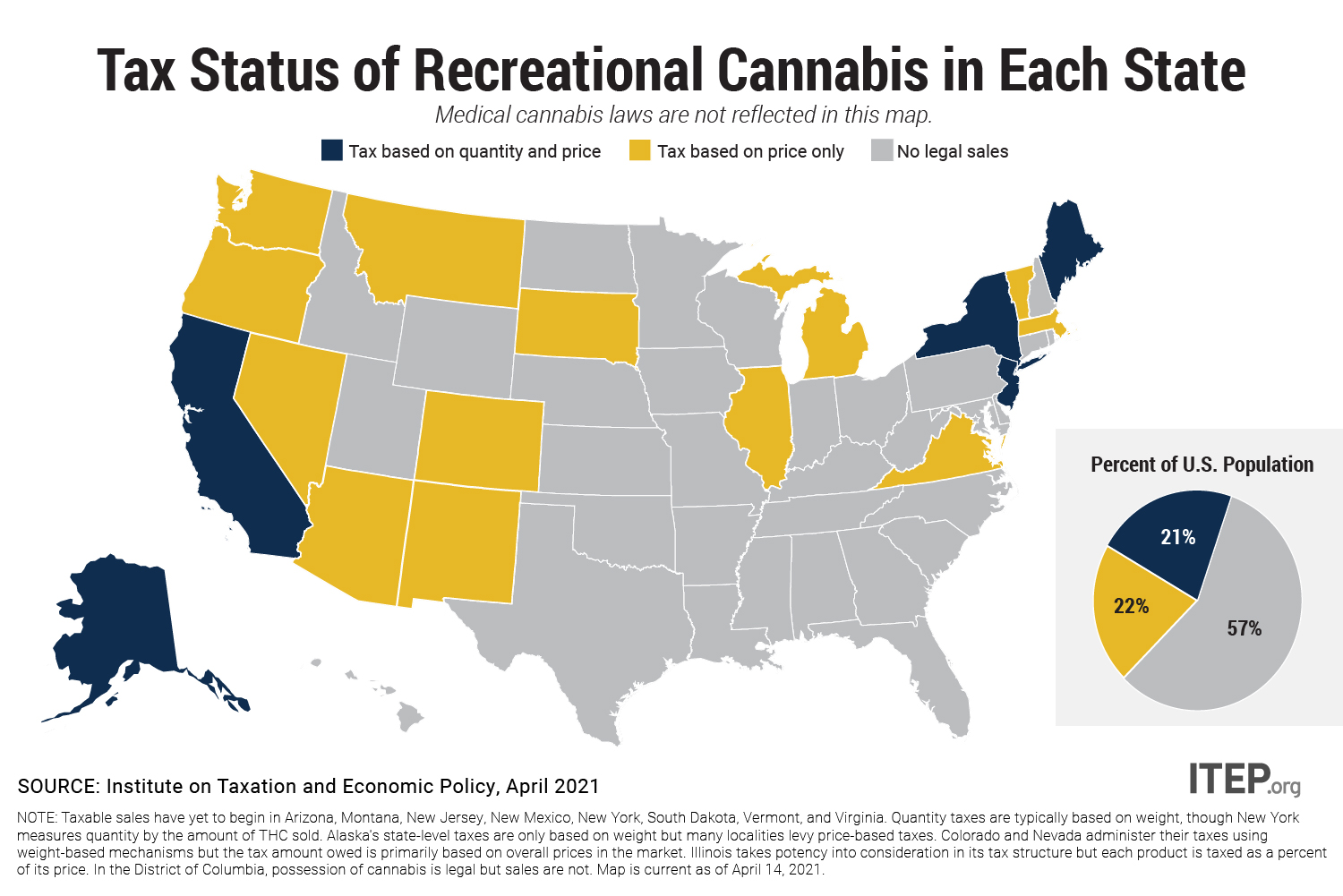

Maps Itep

Carbon-map Greenhouse Gases Marketing Global

Visualizing The Importance Of The Industrial Economy In The World Economy World Developing Country

New Markets Tax Credit Investments In Our Nations Communities

New Markets Tax Credit Investments In Our Nations Communities

Layers Of Finance Historic Tax Credits And The Fiscal Geographies Of Urban Redevelopment – Sciencedirect

Maps Itep

Maps Itep

Amazoncom United States Topographic Wall Map By Raven Maps Laminated Print Topographic Usa Wall Map Posters Prints

Premiums And Tax Credits Under The Affordable Care Act Vs The American Health Care Act Interactive Maps Kff