An inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. You would owe kentucky a tax on your inheritance because kentucky is one of the six states that collect a state inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estates worth less than $25,000;

Does idaho have inheritance tax. They may have related taxes to pay, for example if they get rental income from a house left to them in a will. So if you placed this money in a bank and earned $500 interest, income tax would need to be paid on the $500. You can, however, breathe a little easier as there are now only eight states that impose an inheritance tax [indiana, iowa, kentucky, maryland, nebraska, new jersey, pennsylvania and tennessee].

However, you would need to pay federal income tax on the income generated by the $47,000. How the inheritance tax works. Idaho has no gift tax or inheritance tax, and its estate tax expired in 2004.

Inheritance laws from other states may apply to you, though, if a person who lived in a state with an inheritance tax leaves something to you. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. As of 2019, iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania have their own inheritance tax.

An inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. No estate tax or inheritance tax illinois:

So it really depends on where the beneficiary lives and where the estate assets are. Idaho has no state inheritance or estate tax. The top estate tax rate is 16 percent (exemption threshold:

If you live in a state that does have an estate tax, you may be expected to pay the death tax on the money you inherit from a death in nc The beneficiary of the property is responsible for paying the tax him or herself—not the estate. For more details on idaho estate tax requirements for deaths before jan.

Inheritance tax is only applied if the amount is above each state’s threshold and is assessed on the amount that exceeds that threshold. The tax is levied on property that passes under a will, the intestate laws of succession, and property that passes under. More good news for you, idaho does not impose an inheritance tax.

The us does not impose an inheritance tax, but it does impose a gift tax. He lived in kentucky at the time of his death. However there are sometimes taxes for other reasons.

For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. Life insurance policies paid to named beneficiaries Idaho has no state inheritance or estate tax.

There is no inheritance tax in nc. To have your inheritance and estate tax questions answered by a division representative, inquire as to the status of an inheritance or estate tax matter, or have inheritance and estate tax forms mailed to you, contact the inheritance and estate tax service center by: No estate tax or inheritance tax

Idaho inheritance and gift tax. But certain inheritance laws in other states could be applicable. However, like all other states, it has its own inheritance laws, including the ones that cover.

However, like all other states, it has its own inheritance laws, including the ones that cover. No inheritance tax in nc. You would not need to pay any federal income tax on the inheritance.

The inheritance tax is a tax on the beneficiary's gift. Idaho also does not have an inheritance tax. The inheritance tax is imposed on the clear value of property that passes from a decedent to some beneficiaries.

People you give gifts to might have to pay inheritance tax, but only if. There is no federal inheritance tax. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate.

Let's say you live in california—which does not have an inheritance tax—and you inherit from your uncle's estate. These are some of the taxes you may have to think about as an heir.

Idaho Retirement Tax Friendliness – Smartasset

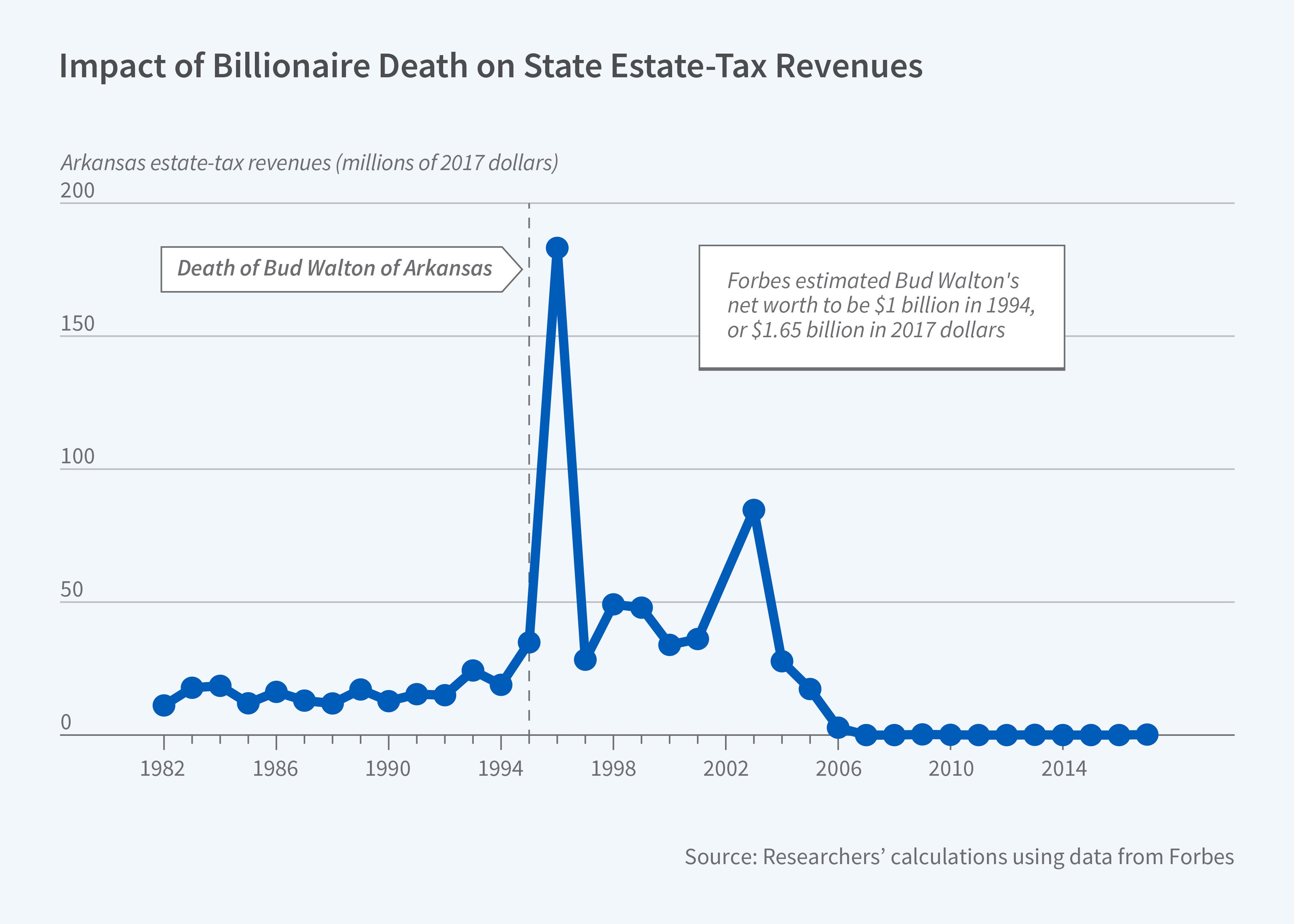

State-level Estate Taxes Spur Some Billionaires To Move Nber

Retirees Arent Moving To Idaho For Its Taxes Idaho Business Review

Double Death Tax The Wrong Way To Go Opinion Argusobservercom

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Apa Arti Inheritance Tax Dalam Bahasa Indonesia

Taxes 1099-r Public Employee Retirement System Of Idaho

States With An Inheritance Tax Recently Updated For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Idaho Opportunity Zones Oz Funds Investing Id Tax Benefits

2

How Is Tax Liability Calculated Common Tax Questions Answered

4 Things You Need To Know About Inheritance And Estate Taxes

Historical Idaho Tax Policy Information – Ballotpedia

Focus Shifts To State Estate-tax Planning – Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep