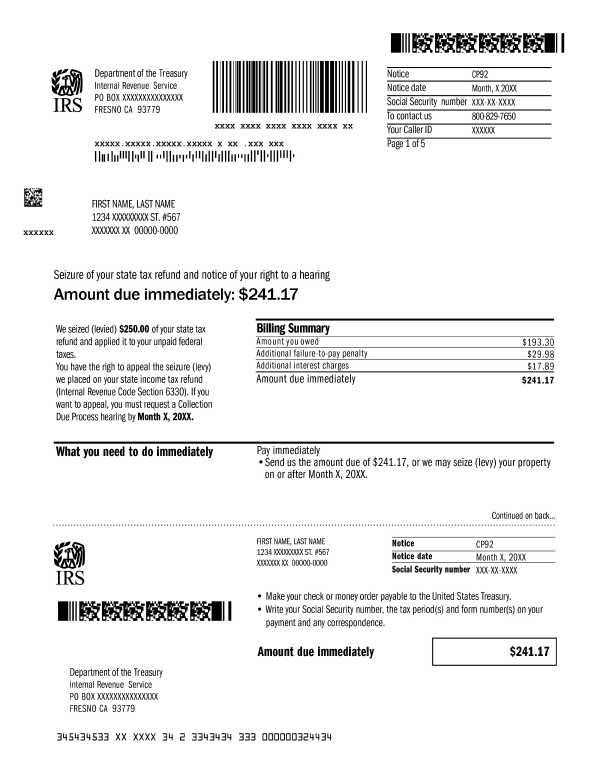

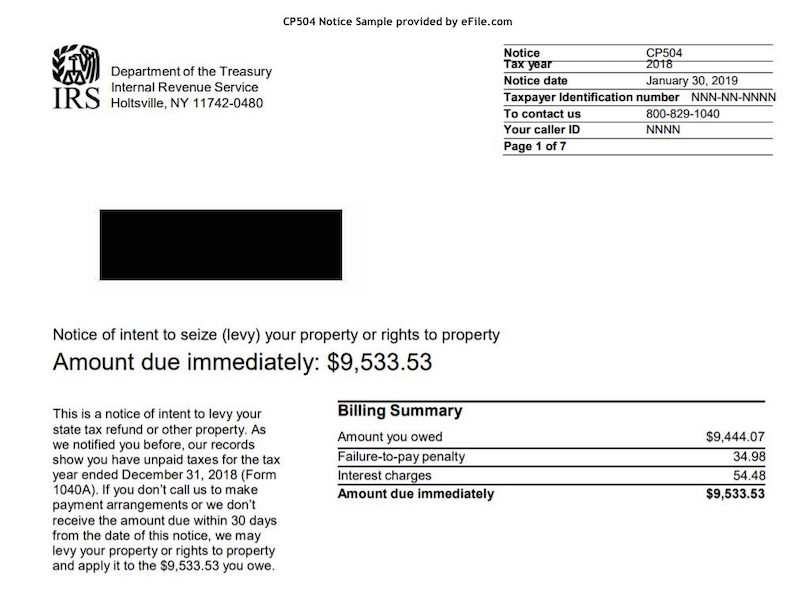

While asset seizure is certainly a possibility, tax levies are most often used as a last resort. An irs levy permits the legal seizure of your property to satisfy a tax debt.

Tax Office Homepage

A tax levy is a legal seizure of a taxpayer’s property to pay their unpaid taxes.

What is a tax levy on a house. Money in your checking account; By levying a tax on every property owner, the local government gains a wide net of income resources that it can use to support government operations. The irs may seize (levy) your property or your rights to property on or after april 1, 2020.

A levy generally comes into play after a lien has already been placed on your assets. It gives the taxing authority the right to seize your assets as repayment. An irs tax levy is a legal seizure of your property to compensate for your tax debt.

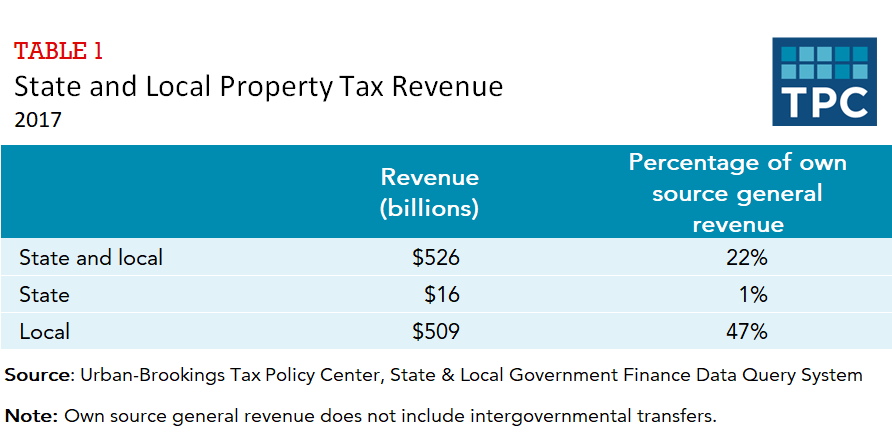

These fees are dependent on your property type and are paid to the authority which services your property such as a body corporate or municipality. State and property tax levies. The irs may levy a variety of assets:

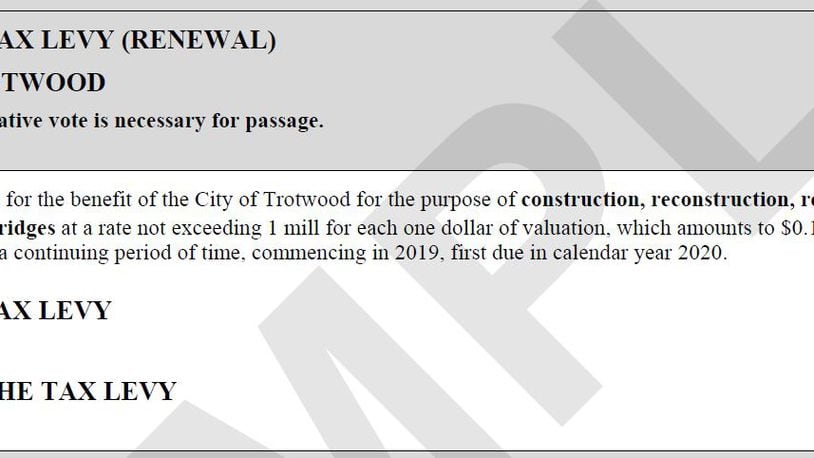

Property seizure when most taxpayers hear the term tax levy, they typically think of property seizure. The irs uses a tax lien to secure that you pay off what you. Each district must follow a process described in ohio law in order for taxes to be levied on property within the district.

This involves collecting assets and seizure of your property, either tangible or intangible, in a variety of ways. Just about every municipality enforces property taxes on. A tax levy is a collection procedure used by the irs and other tax authorities, such as the state treasury or bank, to settle a tax debt that you owe to them.

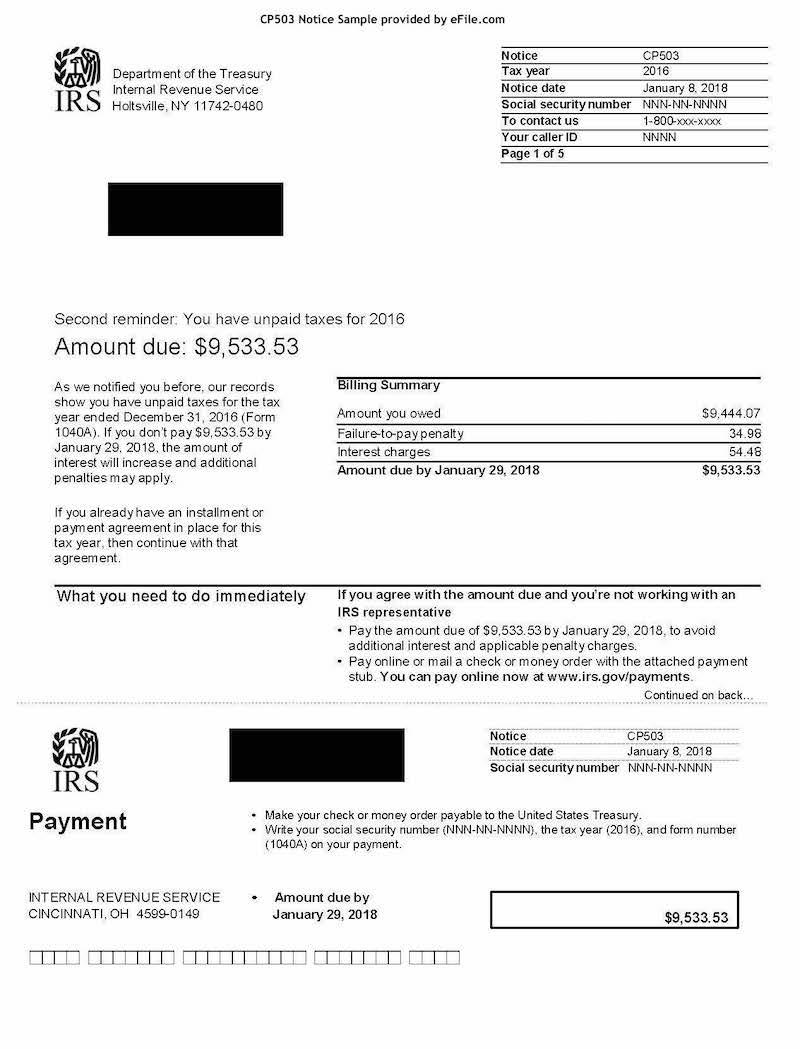

A tax levy is a collection process used by the irs and certain local governments to help satisfy any unpaid tax debt. A tax levy is the seizure of property to pay taxes owed. A lien is a claim used as security for the tax debt, while a levy actually enables the irs to take property in order to satisfy the tax debt.

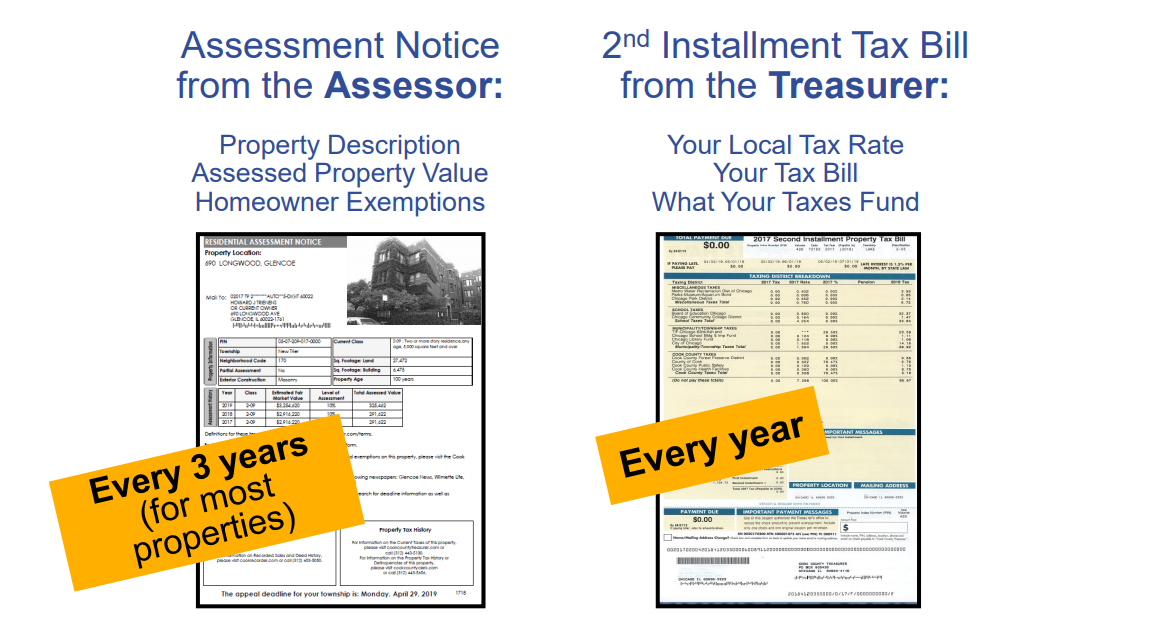

The tax levy is the amount of money to be raised by the property tax. These are the costs involved in running the complex, and include municipal rates and taxes, limited building insurance coverage, as well as repairs and maintenance. If you are buying a sectional title property such as a property in a complex or a flat, you will be charged levies.

A tax levy is a process that the irs and local governments use to collect the tax money that they're owed. What is a tax levy? Unlike a tax lien , a tax levy is not simply a claim on the assets but it’s an actual confiscation.

A tax levy will allow the bank or financial institution to seize the assets of the tax payer. Property taxes are a way of funding local governments. Miami beach island home by choeff levy fischman home.

What is a levy on your property. The municipal tax authority sets a percentage rate for imposing taxes, called a levy rate, which is then calculated against the assessed value of each homeowner’s property ad valorem (literally. In the instance that a taxpayer defaults on his obligation to pay tax, the government enforces something called a tax levy.

Tax levies can include penalties such as garnishing wages or seizing assets and bank accounts. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt. A tax levy is the legal right to seize your property to satisfy outstanding back taxes.

Rates, taxes and levies are fees paid to the authority that services your property such as a body corporate or municipality. A tax levy is when the irs places a “fine” on a taxpayer’s assets or property due to unpaid tax debt. The process is similar to garnishment or seizure and can be filed against a taxpayer’s accounts receivable, wages, bank accounts, retirement accounts, or subcontractor pay.

Some items can’t be seized. If the taxpayer defaults, the government will sell off the assets that were seized to recover the tax payments that are due. Property that can be levied includes real property like cash in a bank account, a house, car or boat.

If you own property, then here is your guide to understanding a. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt. Unless the internal revenue code (irc) exempts the property, any assets that a taxpayer owns or has an interest in is eligible to be levied.

What is a tax levy? In the u.s., the irs has the authority to levy an individual's property to satisfy a tax debt. Levies are different from liens.

A levy actually takes the property to satisfy the tax debt. A property tax levy is different from a tax lien as the lien is only a legal claim against your assets. These generally fall into the following categories.

The irs defines a tax levy as a legal seizure of your property to satisfy a tax debt. a levy is different from a lien because a levy actually takes the property to satisfy your tax debt, while a lien is a legal claim against your property and current and future rights to property as security for payment of the tax debt. How does a tax levy work?. Levies are different from liens.

Boards of education propose additional local tax revenues by board Types of tax levy the irs can use a tax levy to seize a variety of different funds and assets. E.g., if the levy is 4.2 mills, the result is.0042.

A tax levy is the next step in the collection process after a tax lien and occurs when the irs seizes your property to pay taxes owed. The state may file for a tax warrant seeking a legal order to issue a tax levy. A property tax levy is the collection of taxes charged on the value of property.

Note that levies are different from liens. Through a tax levy, you may have money taken from your bank account, garnished from wages, seized through the property you own, and more. A levy is a legal seizure of your property to satisfy a tax debt.

A levy is a legal seizure of your property to satisfy a tax debt. A tax levy is the collection method through which they actually claim that property. A levy is a legal seizure of your property to satisfy a tax debt.

Property Taxes Explained Klickitat County Wa

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage – Ppt Download

What Is A Tax Lien Credit Karma Tax

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Florida Property Tax Hr Block

Property Tax City Of Mesa

Can The Irs Take Your House Community Tax

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

How Do State And Local Property Taxes Work Tax Policy Center

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Irs Tax Lien Vs Irs Tax Levy Whats The Difference – Landmark Tax Group

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Tax – Wikipedia

Ohio Bill Targets Property Tax Levy Language Changes Education Groups Among Opponents Police Fire Roads Politics Education Jobs Economy Real Estate Mike Dewine

Your Assessment Notice And Tax Bill Cook County Assessors Office

Tax Levy Understanding The Tax Levy A 15 Minute Guide

How Are Your Property Taxes Determined

How The 1 Property Tax Levy Limit Works San Juan County Wa