New hampshire’s excise tax on cigarettes totals $1.78 per pack of 20. New hampshire does not have a mortgage, excise or recordation tax.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Strafford county is located in eastern new hampshire, along the border with maine.

Nh transfer tax calculator. Strafford county is located in eastern new hampshire, along the border with maine. That tax applies to both regular and diesel fuel. To calculate the annual tax bill on real estate when the property owner isn’t eligible for any exemptions, multiply the assessed value by the total tax rate and divide the result by 1,000.

The gas tax in new hampshire is equal to 22.20 cents per gallon. Please click here to visit the nh motor vehicle kiosk May not be combined with other offers.

The following steps provide information about how the transfer tax is calculated. Chapter 17, laws of 1999, increased the permanent tax rate assessed on the sale, granting, and transfer of real estate and any interest in real estate to $.75 per $100, or fractional part thereof, of the price or consideration. Valid receipt for 2016 tax preparation fees from a tax preparer other than h&r block must be presented prior to completion of initial tax office interview.

The new hampshire housing finance authority; For transactions of $4,000 or less, the minimum tax of $40 is imposed (buyer. Who pays the transfer tax in new hampshire?

The rett is a tax on the sale, granting, and transfer of real property or an interest in real property. For further discussion of the ambiguities in the real estate transfer tax, see part ii of this article. The new hampshire real estate transfer tax is $0.75 per $100 of the full price of or consideration for the real estate purchases.

The new hampshire real estate transfer tax is $0.75 per $100 of the full price of or consideration for the real estate purchases. New hampshire real estate transfer tax calculator the state of nh imposes a transfer fee on both the buyer and the seller of real estate at the rate of $7.50 per $1000 of the total price. Video of the day step 2 identify the sale price of the house.

Houses (7 days ago) real estate transfer tax (rett) nh department of revenue. New hampshire salary tax calculator for the tax year 2021/22 you are able to use our new hampshire state tax calculator to calculate your total tax costs in the tax year 2021/22. The calculation of the tax is often the task of the closing agent and is detailed in the settlement statement.

To calculate the annual tax bill on real estate when the property owner isn’t eligible for any exemptions, multiply the assessed value by the total tax rate and divide the result by 1,000. In nh, transfer tax is split in half by buyer and seller. New hampshire real estate transfer tax calculator the state of nh imposes a transfer fee on both the buyer and the seller of real estate at the rate of $7.50 per $1000 of the total price.

Does new hampshire have a mortgage, excise or recordation tax? Select purchase or refi 2. An overview of new hampshire real estate transfer taxes.

New hampshire transfer tax calculator real estate. Absolute title, llc new hampshire fee calculator select a different state: Transfer tax endorsements loan premium owners premium lender premium lender premium [reissue] owner premium.

Advertisement step 1 identify the amount of the state's transfer tax. The tax is imposed on both the buyer and the seller. The tax is $.75 per $100 of the price of consideration or the transfer.

For transactions of $4,000 or less, the minimum tax of $40 is imposed (buyer and seller are each responsible for $20). $4,500 / 2 = $2,250 while it's not a fun number to calculate, your portion of the transfer tax will be accounted for on your closing disclosure when you receive your final numbers. The rett is a tax on the sale, granting, and transfer of real property or an interest in real property.

$.10 per $100 or fraction of: The tax is imposed on both the buyer and the seller at the rate of $.75 per $100 of the price or consideration for the sale, granting, or transfer. The new hampshire real estate transfer tax is $0.75 per $100 of the full price of or consideration for the real estate purchases.

The real estate transfer tax (rett) was first enacted in 1967. The amount of tax due is based on the standing rate on the day that a closing takes place and the deed is recorded. The tax is assessed on both the buyer and the seller, with a minimum charge of $20 each.

Transfer tax rates may change from time to time. New hampshire online real estate transfer tax (rett. This part is intended as a broad overview of the real estate transfer tax and any particular situation requires careful review of the statute, the rules, relevant cases and dra’s guidance.

Nh motor vehicle kiosk this web site provides new hampshire residents with an easy way to estimate the costs of registering their motor vehicles. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates. Transparency, new hampshire, state of new hampshire.

Some states have what is called transfer tax or grantor's tax on conveyance of real estate. We do this by matching your vehicle to similar vehicles in our database of actual registrations and providing you with both the average cost and the highest cost for those similar vehicles. (b) the rate of the tax is $.75 per $100, or fractional part thereof, of the price or consideration for such sale, grant, or transfer;

For our example, let's say it is $2 for each $500, or a fraction of that amount.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

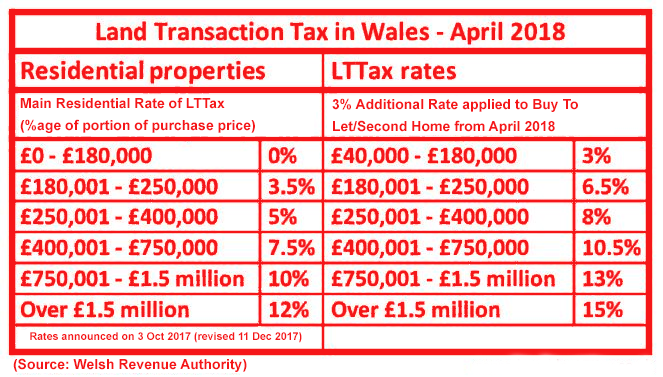

Stamp Duty Calculator Wales Sam Conveyancing

Transfer Tax Calculator 2021 For All 50 States

How To Calculate Transfer Tax In Nh

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Resources Nh Barristers Title Closing Services

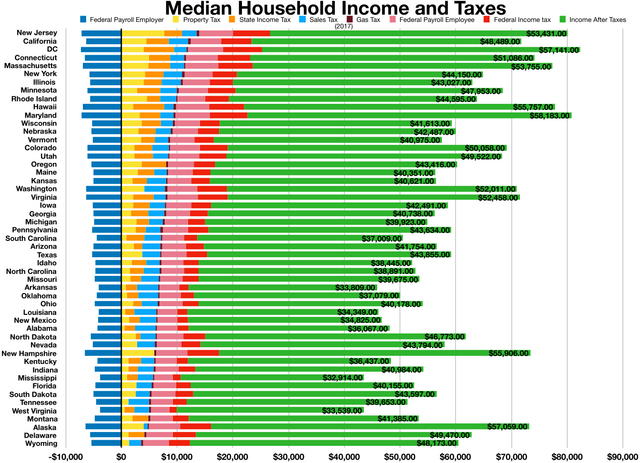

Sales Taxes In The United States – Wikipedia

How To Calculate Transfer Tax In Nh

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Florida Property Tax Hr Block

New Jersey Transfer Tax Calculator Two Rivers Title Company Llc

New Hampshire Mortgage Closing Cost Calculator Mintratescom

How To Calculate Transfer Tax In Nh

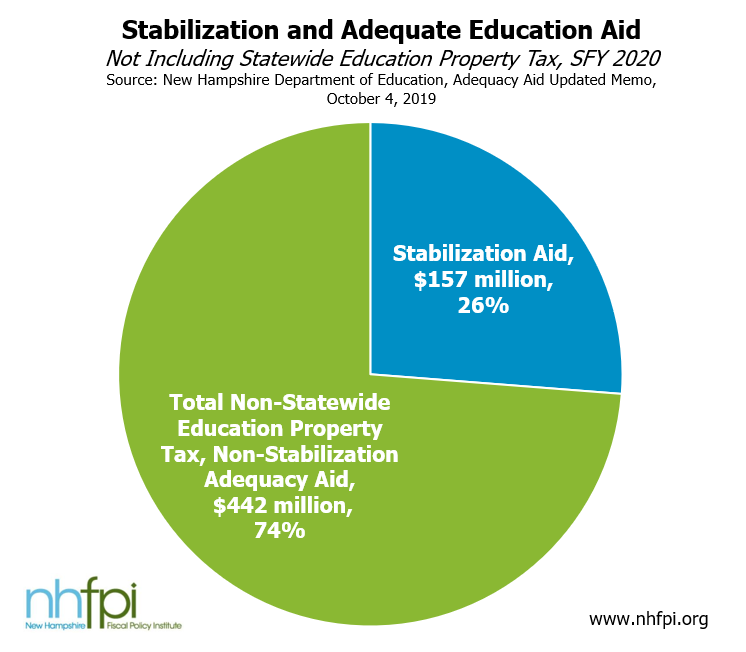

The State Budget For Fiscal Years 2020 And 2021 – New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Tax Calculator Return Refund Estimator 2020-2021 Hr Block

Resources Nh Barristers Title Closing Services

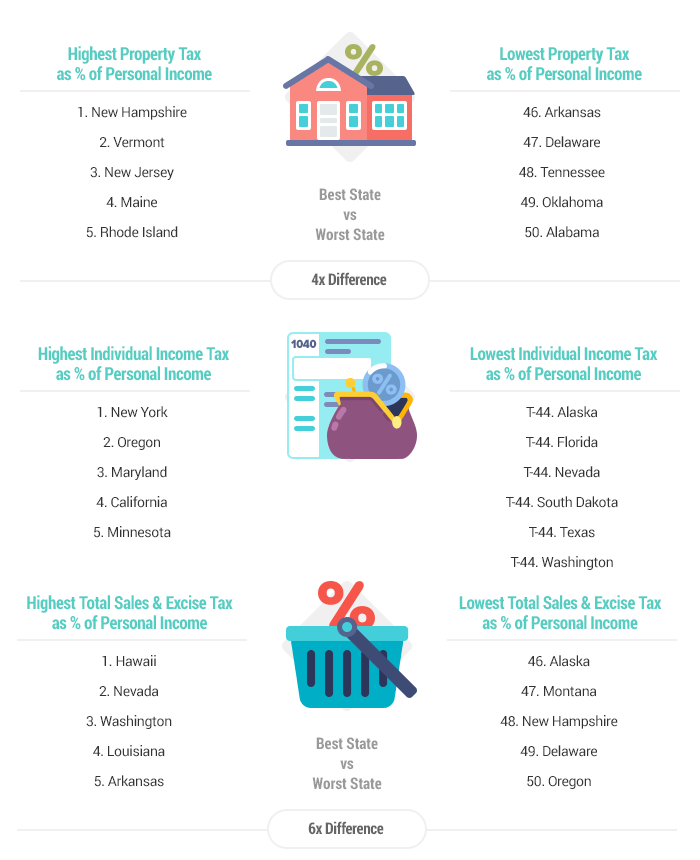

Tax Burden By State