Cap and trade is different from a straight carbon tax. The second is cap and trade, which sets the maximum quantity.

Economists View Carbon Taxes Vs Cap-and-trade

However, a carbon tax is easy to administer and straightforward to.

Cap and trade vs carbon tax canada. Each approach has its vocal supporters. September 13th, 2016, 3:21 pm pdt. With a cap you get the inverse.

Earlier this month, ontario, quebec and mexico struck the first international climate change deal since the. British columbia introduced a carbon tax on july 1, 2008 at a rate of $10 per tonne. Carbon trading is aimed at the wrong.

A carbon tax is one way to put a price on emissions. A carbon tax doesn’t discriminate between individuals and industries. In this he was incorrect.

Both can be weakened with loopholes and favors for special interests. With a tax you get certainty about prices but uncertainty about emission reductions; Their plans differ in timing and scope — but the real problem is that carbon trading won’t do the job, and makes it harder to develop and implement real solutions.

With a carbon tax, there is an immediate cost to firms for polluting. Eighty per cent of canadians live in jurisdictions (with one or the other). trudeau lays. You can tweak a tax to shift the balance;

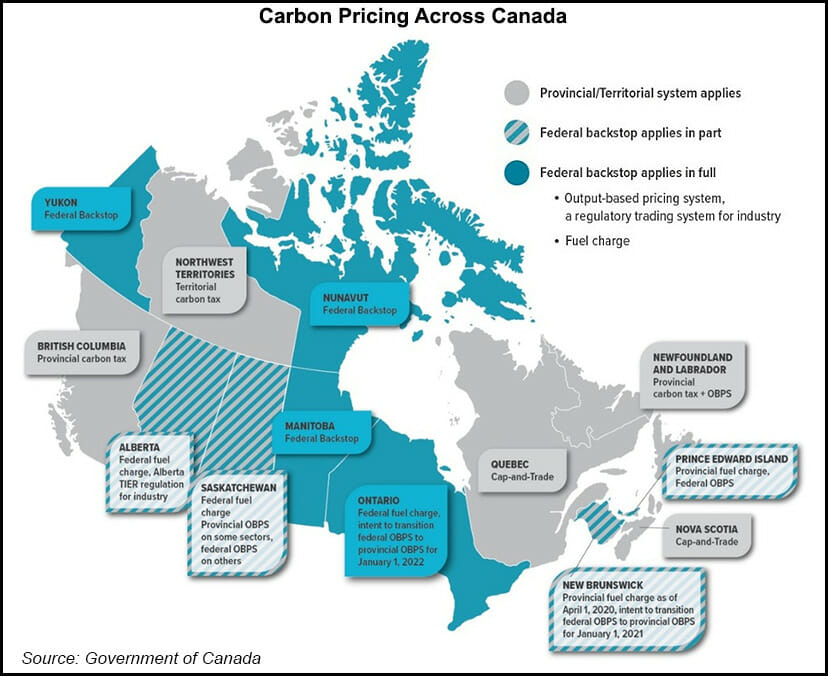

In quebec and nova scotia, the governments cap the amount of emissions they’ll allow each year, then hold quarterly auctions so companies can buy emissions credits within that amount. A carbon tax targets the emission of greenhouse gases, like the extra taxes drivers pay at the gas station. The first is a carbon tax, which sets a price on carbon directly and lets individuals and companies decide how much carbon to produce.

Under a cap and trade system, on the other hand, governments place a firm. Before the policy, the intersection of the supply and demand curves for. The regulatory authority stipulates the

Most of the rest of canada either already has a carbon pricing plan or will have one. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas (ghg) emissions. The province increased its rate by $5 annually, reaching its current level of $30 per tonne in 2012.

Critics blast government spending on court battle against federal carbon tax. In canada, all five mainstream political parties are promoting some form of “cap and trade” system to reduce greenhouse gas emissions. Obps and cap and trade systems are described below.

Here is the econ 101 version of how the two work: Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved, has been shown to effectively work to.

Cap And Trade

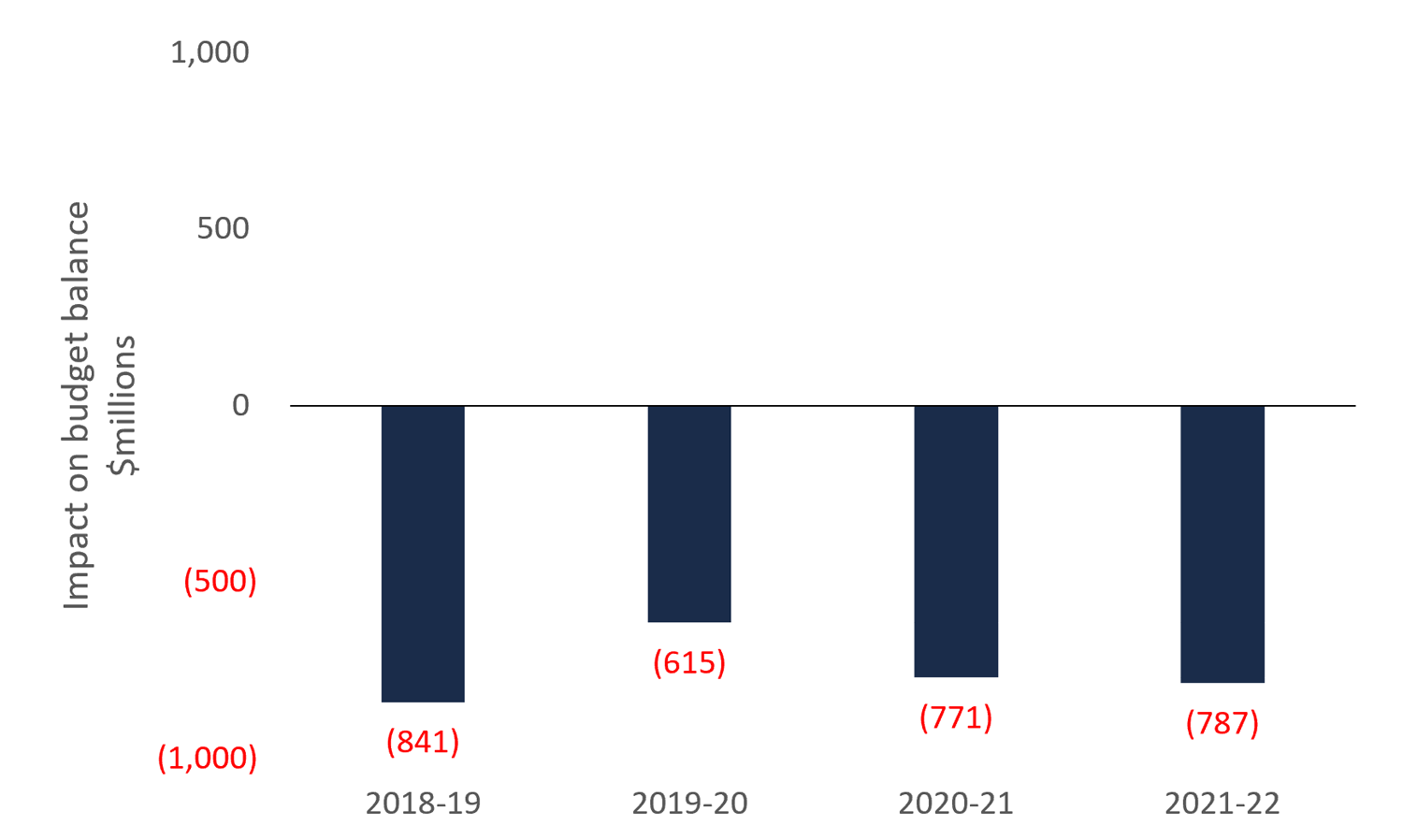

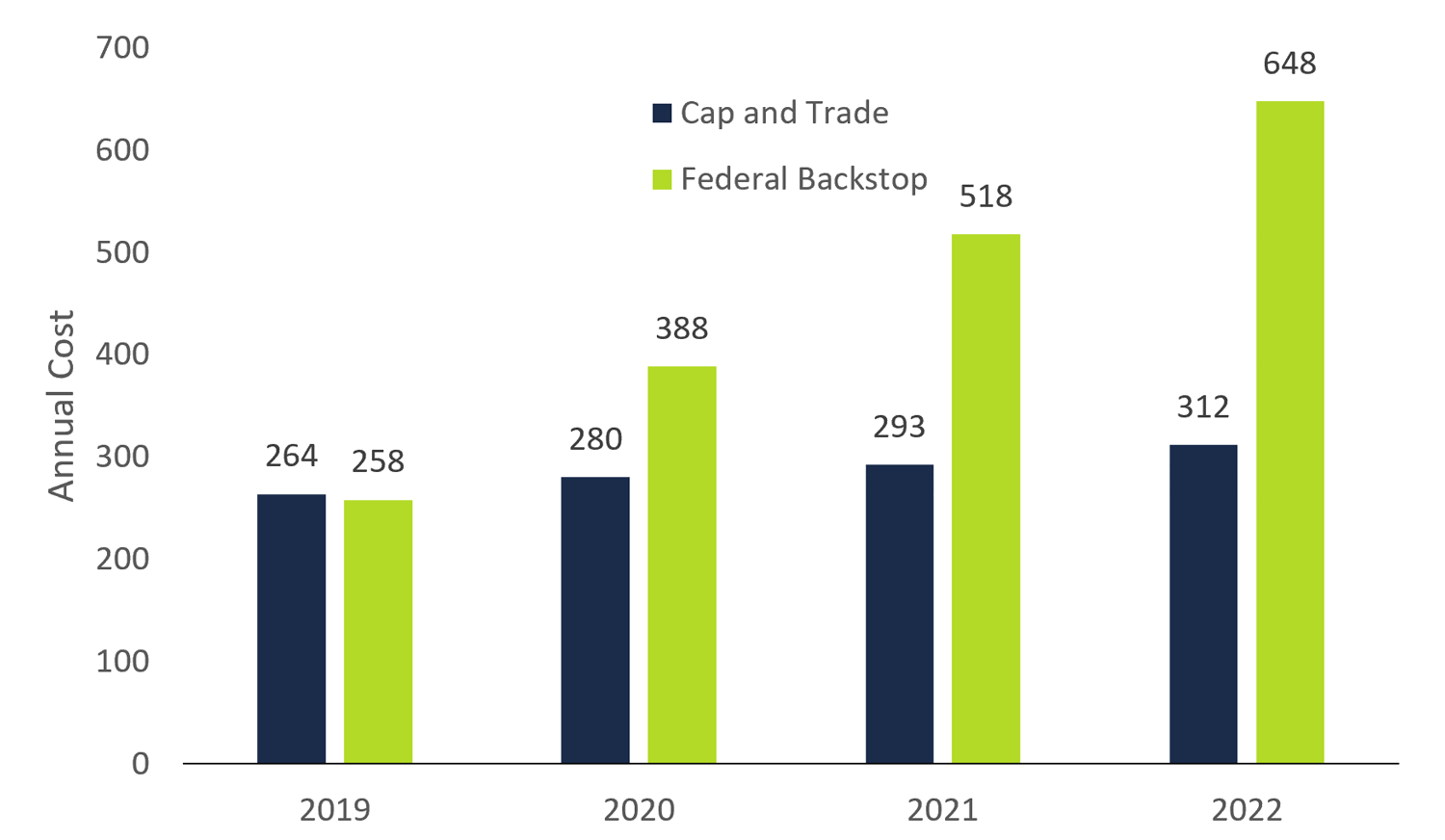

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Emissions Trading Cap And Trade Finds New Energy – An Emerging Coalition Is Implementing Carbon Trading Despite Politic Climate Policy Cap And Trade Emissions

Carbon Taxes Rebates Explained Province By Province

Nova Scotias Cap-and-trade Program Climate Change Nova Scotia

Lowdown On The New Federal Carbon Pricing System

Pin On Infographics

The Carbon Tax For Dummies – Why Do We Need It And What Will We Pay Greenhouse Gases Energy Conservation Greenhouse Gas Emissions

The Carbon Market A Green Economy Growth Tool

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

The Pros And Cons Of Carbon Taxes And Cap-and-trade Systems Semantic Scholar

Carbon Pricing Is Expanding Initiatives Now Valued At Nearly 50 Billion Cap And Trade Climate Adaptation Climate Reality

Difference Between Carbon Tax And Cap And Trade Difference Between

Difference Between Carbon Tax And Cap And Trade Difference Between

Canadas Scheduled Carbon Tax Increases Said To Pose Implementation Risk – Natural Gas Intelligence

Difference Between Carbon Tax And Cap And Trade Difference Between

Pin By Yvonne Williams On Canada Oh Canada Cap And Trade Gas Prices The Province

Cap Trade System Climate Change Connection

The Pros And Cons Of Carbon Taxes And Cap-and-trade Systems Semantic Scholar