The following documents must be submitted along with the application for katha and payment of betterment charges. Betterment appears to have eliminated the plus account and renamed it the premium,.

Pin On Make Money

You guessed it, simple and straightforward.

Where to find betterment tax documents. Betterment has calculated this figure for you, which you can find on your supplemental tax statement in the documents section of your account under the tax forms tab. In the unlikely event that there are corrections to your form 1099, a revised document will be posted as soon as the correction has been filed, generally in late february or early march. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere.

$100,000 funded account managed by betterment for a mere $400 per year. Get the current filing year’s forms, instructions, and publications for free from the internal revenue service (irs). Please note that while most customers will receive a supplemental tax statement, a small subset of customers will not, due to various holdings that are not generally included in our main portfolio strategies here at betterment.

Right click on the title link. Get tax forms and publications. No minimum required to get started.

You don’t need receipts for the sales tax; Order, list of ways and parcels not abutting the ways to be assessed (identify in same way as of prior january 1 for tax purposes Order, plan and estimates within 90 days of (1) date order adopted or (2) town acceptance of street layouts, relocation or alterations, if acceptance required.

Type the name of a document (or a keyword from it) into the search box on the taskbar. To view a file, click on the hyperlink. Find your files in windows 10 using one of these methods.

Pdf files can be viewed and saved using adobe reader software. To save the file without viewing it first: Usually the homeowner contracts with a licensed installer and engineer to perform the.

For a betterment premium account, which requires a $100,000 minimum account balance, the annual fee is 0.40%. A copy of the sale deed(certified copy or notarised copy) up to date tax paid receipt up to date encumbrance certificate form no.9 form no.10 dc conversion order copy a copy of the layout plan(if any or if… The tax on a major purchase, however, can be added to the table amount, so keep those receipts.

Your tax documents can be found on the documents page, which is accessed from the top menu of your account. We’ll also provide you with a supplemental tax form that calculates key tax information for your taxable accounts, including how much you earned from u.s. When saving a file, be sure to use save function of adobe reader rather than the web browser's save.

As an active investor, be aware that your category box a sales without adjustments do not require form 8949, so there is no reason to import or key in those transactions. The irs provides tables with average amounts you can claim. Over the 30 years, you would lose about 5.89% of your returns (or $69k) to fees.

Click on the three dots to the right of the account you want to change and you’ll see the option to change your funding account. If you file your taxes by paper, you’ll need copies of some forms, instructions, and worksheets. At the high end, that's 7.52% of your returns being.

After logging in, tap the three bars on the top left. Select “settings” and then select “funding accounts.”. Betterment keeps track for you and provides all the tax documents you need.

To make things more concise, you will be receiving a 1099 consolidated form. What i don’t like about betterment 1. You'll see results for documents across your pc and onedrive under best match.

Select save target as (internet explorer) or save link as. Government interest, your income from foreign sources, and your dividends from state municipal bonds both inside and outside your state of residence. You can’t take advantage of market swings.

With the pressure off, i started. A betterment is a financial agreement between a homeowner and the community. Visit the florida department of economic opportunity's tax information webpage to view options for requesting tax documents.

The tax forms that betterment will send you will be completely dependent on the type of accounts that you hold with them.

Advice For People In Their Twenties Quotes To Live By Quotes And Notes Photo Quotes

Start The New Year Off Right 5 Resolutions For Better Business – The New Year Is The Perfect Time To Reaffi Graphic Design Course Personal Branding Leadership

Betterment Review 2021 The Easiest Way To Start Investing Investing Investing In Stocks Best Investments

2

6 Tax Strategies That Will Have You Planning Ahead

Betterment Roth Ira Experiment – Run The Numbers For Yourself By Clicking Here To See Whether Investing In A Roth Ira Versus A Traditional Ir Roth Ira Ira Roth

Services Provided By A Title Company Title Insurance Title Property Tax

Betterments 2015 Tax Calendar To Help You Make It Through Tax Season Via Betterment Tax Season Season Calendar Tax Help

The Next Fintech Global Open Finance Infrastructure Fintech Finance Financial Institutions

Software Requirements Document Template Check More At Httpsnationalgriefawarenessdaycom44156software-requirements-document -template

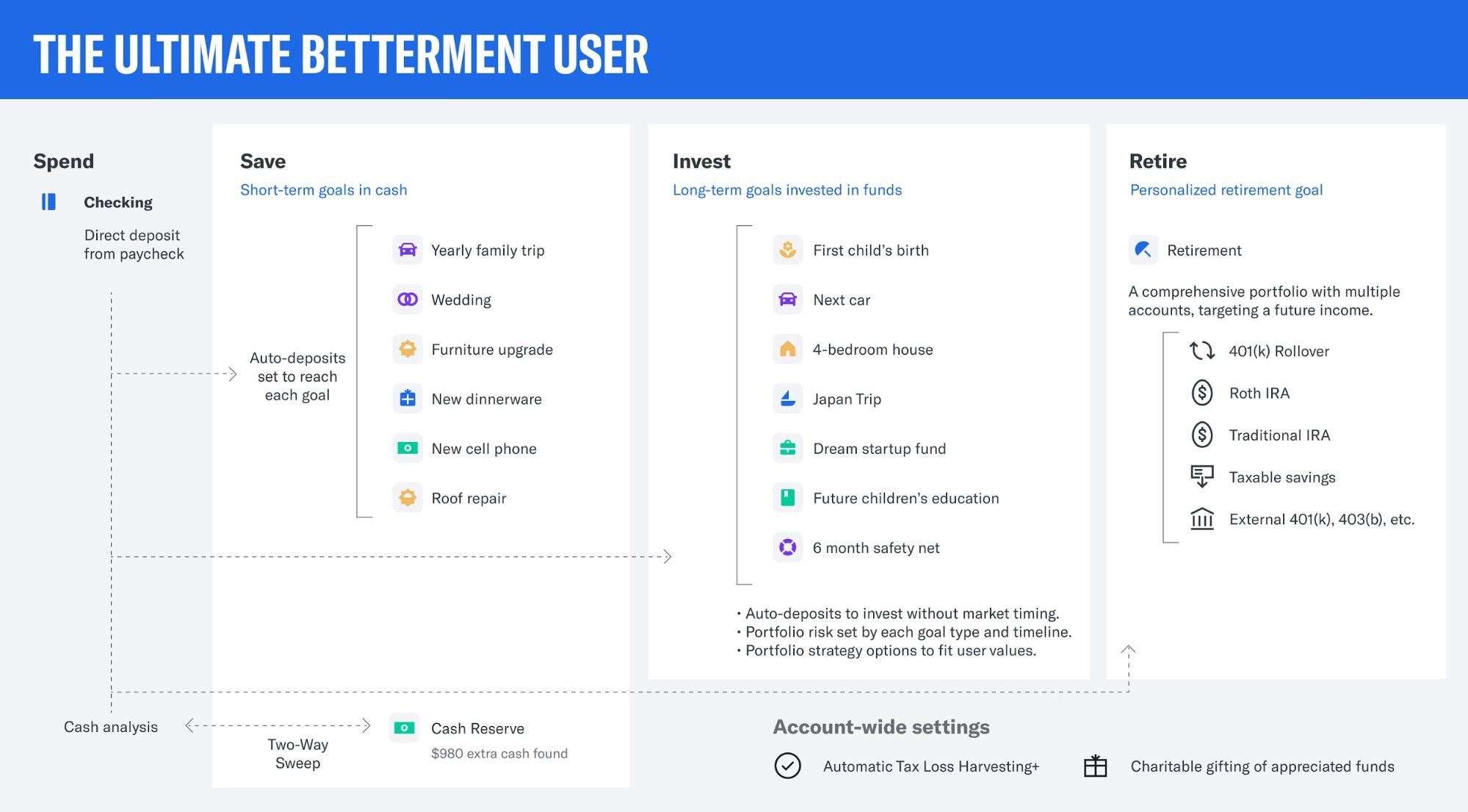

What The Ultimate Betterment User Looks Like

How To Get Organized For Tax Preparation Tax Preparation Tax Organization Tax Deductions List

Tax-aware Migration Strategies

10 Job Description Templates Word Excel Pdf Templates Job Description Template Job Description Job

41717 Geographic Robot Heatmap V7 Robo Advisors Advisor Fintech

How To Start Investing With Betterment Investing Start Investing Robo Advisors

Smart Money Management System Money Management Money Management Advice Smart Money

Betterment Review In 2021 Good Things Career Education Investing

Bettermentcom Review Easy Investing For Busy People Investment Advice Portfolio Investing