Nebraska collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Presently, the percentage of road tax in this state is 7%.

Plaza Lights Httpwwwfantasticplacescom Kansas City Missouri Christmas House Lights Christmas Lights

4.25% motor vehicle document fee.

Nebraska vehicle tax calculator. The motor vehicle tax is the only deductible item for nebraska. 33.20 cents per gallon of regular gasoline and diesel. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

The nebraska income tax calculator is designed to provide a salary example with salary deductions made in nebraska. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Find your state below to determine the total cost of your new car, including the car tax.

A permit issued for vehicles weighing up to 95,000 pounds on the national system of interstate and defense highways (interstate). The most common types of businesses affected are hotel operators, car rental companies, telecommunications providers, restaurants, and bars. 8 am to 4:45 pm.

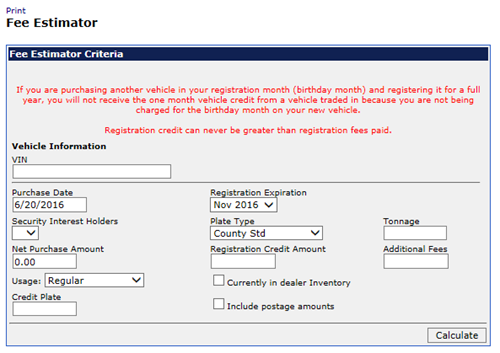

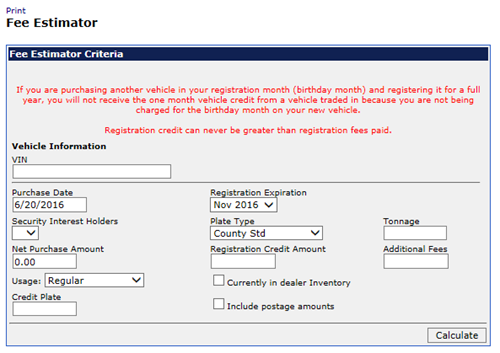

Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. To use our nebraska salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. Nebraska's maximum marginal income tax rate is the 1st highest in the united states, ranking directly.

Sales tax must be paid on all new or used vehicles within the first 30 days following the purchase in order to prevent a penalty. If you purchased the vehicle from a licensed nebraska dealer you must supply us the nebraska sales and use tax form 6 as the bill of sale. Depending on local municipalities, the total tax rate can be as high as 7.5%, but food and prescription drugs are exempt.

What vehicle registration fees are tax deductible in nebraska? Mtr veh tax , mtr veh fee , co/rr/ dmv /ems, reg fee , handling fee. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator.

Proof of insurance is required to license a new vehicle or to renew an existing license. This means that, depending on your location within nebraska, the total tax you pay can be significantly higher than the 5.5% state sales tax. These fees are separate from.

The ne tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in nes. No vehicle can exceed 20,000 pounds on a single axle or 34,000 pounds on a tandem axle. Nebraska charges a motor vehicle tax and a motor vehicle fee that is based upon the value and weight of the vehicle being registered, so the charges will vary.

The percentage of the base tax applied is reduced as the vehicle ages. New residents must license their motor vehicles within 30 days after moving into the state of nebraska. If the vehicle was purchased from a private individual a handwritten bill of sale is acceptable.

The nebraska state sales and use tax rate is 5.5% (. Nebraska has a 5.5% statewide sales tax rate, but also has 295 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.547% on top of the state tax. In 2012, nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Once the msrp of the vehicle is established, a base tax set in nebraska motor vehicle statutes is assigned to the specific msrp range and motor vehicle tax is then assessed. 6.35% for vehicle $50k or less. The overall gross weight of a group of two or more consecutive axles must conform to the requirements of the nebraska bridge.

Note that transfer tax rates are often described in terms of the amount of tax charged per $500. Nebraska provides no tax breaks for social security benefits and military pensions while real estate is assessed at 100% market value. Sales tax calculator | sales tax table the state sales tax rate in nebraska is 5.500%.

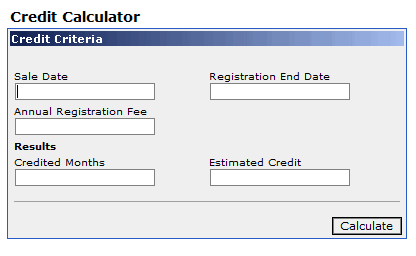

Like the federal income tax, nebraska's income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. You can estimate your taxes using nebraska's tax estimator. There are two common references to “occupation tax” in nebraska law.

1st street papillion ne 68046. Nebraska real estate transfer taxes: With local taxes, the total sales tax rate is between 5.500% and 8.000%.

The tax must be applied uniformly and fairly to the types of businesses on which it is imposed. After a few seconds, you will be provided with a full breakdown of the tax you are paying. This calculation is based on $1.60 per thousand and the first $500.00 is exempt.

The nebraska (ne) state sales tax rate is currently 5.5%. The msrp on a vehicle is set by the manufacturer and can never be changed. Motor vehicle tax calculation table msrp table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/gvwr of 7 tons or less.

7.75% for vehicle over $50,000. The base rate is based on manufacturer's suggested retail price in the case of passenger cars, motorcycles, pickups, vans and suvs and the manufacturer's rated weight for commercial vehicles. The tax on any particular motor vehicle is the result calculated by multiplying the base rate of tax times a factor that declines with age.

The nebraska tax calculator is updated for the 2021/22 tax year. Registration fees for all passenger and leased vehicles are: Sales tax, personal property tax, plate fees and tire fees will be collected in our office.

Sarpy county 1102 building 1102 e. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Vehicle And Boat Registration Renewal Nebraska Dmv

Dmv Fees By State Usa Manual Car Registration Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

What Are You Doing For Others -mlk Celebrate His Life And Remember His Dream Reflect On His Teachings And Serve Others In His Honor Mlkd Teachings Life Mlk

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Forensic Accounting Report Template 6 – Templates Example Templates Example Report Template Forensic Accounting Forensics

Vehicle Accident Report Form Template 1 – Templates Example Templates Example Report Template Car Accident Free Brochure Template

Dmv Fees By State Usa Manual Car Registration Calculator

School Incident Report Template 8 Professional Templates Incident Report Form Report Template Incident Report

Dmv Fees By State Usa Manual Car Registration Calculator

Which Us States Charge Property Taxes For Cars – Mansion Global

Calculate Your Transfer Fee Credit Iowa Tax And Tags

How To Get A Bahamas Investment Fund License Investing Bahamas Fund

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Car Depreciation How Much It Costs You – Carfax

Car Title Vs Registration Whats The Difference – Rategenius

Incident Hazard Report Form Template 4 – Templates Example Templates Example Incident Report Form Incident Report Report Template