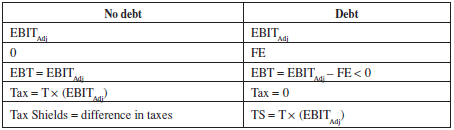

The interest tax shield is positive when the ebit is greater than the payment of interest. The most significant advantage of debt over equity is that debt capital carries significant tax advantages as compared to equity capital.

What Is A Tax Shield Depreciation Tax Shield – Youtube

It is ascertained by multiplying interest expense with rate of tax provided.

Interest tax shield explained. What is a tax shield? What is a tax shield? These deductions reduce the taxable income of an individual taxpayer or a corporation.

(equity and debt holders) and therefore the tax shield increases the value of the company. Since a tax shield is a way to save cash flows, it increases the value of the business, and it is an important aspect of business valuation. The present value of the interest tax shield is therefore calculated as:

In damodaran (2010) the interest tax shield is expressed in a similar vein: This interest payment therefore acts as a “shield” to the tax obligation. Corporate tax rate = 35%.

Such allowable deductions include mortgage interest, charitable donations, medical expenses, amortization, and depreciation. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as. (1) there are also two different formulations of the value of tax shield.

A tax shield refers to an allowable deduction on taxable income, which leads to a reduction in taxes owed to the government. Interest rate on debt = 8%. The value of a company is based on the total value available to all investors!

And, and that $2.8 million, some people refer to that as a tax shield. Moreover, this must be noted that interest tax shield value is the present value of all the interest tax shield. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

Interest tax shield refers to the reduction in taxable income which results from allowability of interest expense as a deduction from taxable income. A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed. In addition to the method of quantification of interest tax advantage in eq.

While tax shields are used for tax savings for both personal and business tax returns, this article focuses on tax shields for businesses. That is, because i have a debt, because i have interest, i have to pay interest, i do not get to pay $2.8 million in taxes. Stated another way, it's the deliberate use of taxable expenses to offset taxable income.

They find no evidence that interest tax shields contribute to the market value of the firm. As you can see from the tax shield value example, the company that borrowed using debt issued at 8% is really borrowing it at an effective rate of. The person gets the benefits while he offsets his taxable income.

Amount borrowed for company b = $100,000. How to calculate adjusted present value (apv) to determine the. The total cash available to both equity holders and debt holders.

If this is the case, there may be no incentive for firms to add more debt to take advantage of the tax shields. Tax shields do not only benefit the wealthy, however. A tax shield is a reduction in taxable income by taking allowable deductions.

Tax shield is calculation has been explained with example below. The value of these shields depends on the effective tax rate for the corporation or individual. A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed.click here to learn more about this topic:

We can calculate this by taking interest expense and multiplying it by the marginal tax rate (which we should find in the footnotes): (4) ∑ = + = n t 1 t f f s (1 r) r dt e it is assumed that interest rate is equal to risk free rate and that appropriate discount rate Tax shield on interest expense is another fancy way of saying the tax deduction that the business will receive on the interest it must pay as it makes its debt payments.

For having debt, and therefore for paying interest. (tax rate * debt load * interest rate) / interest rate. That is a tax saving that the second company gets.

It involves the interest tax shield only for that specific year. Common expenses that are deductible include depreciation, amortization, mortgage payments and interest expense Tax relief on interest or tax saving on interest is technically known as tax shield on interest.

It is important to note that tax relief is discounted using the rate of interest (pre tax) on cost of debt. Interest payments on loans are deductible, meaning that they reduce the taxable income. An interest tax shield approach is useful for individuals who want to purchase a house with a mortgage or loan.

The next thing to consider is the present value of interest tax shield. Income earned for comparison = $100,000. On balance, the documented evidence suggests that taxes seem to play a moderate role in explaining the capital structure of firms.

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculation – Wall Street Prep

The Interest Tax Shield Explained On One Page – Marco Houweling

Tax Shield Formula Step By Step Calculation With Examples

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shield Formula And Calculation – Wall Street Prep

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shields Financial Expenses And Losses Carried Forward

Interest Tax Shields Meaning Importance And More

Pdf Tax Rate And Non-debt Tax Shield

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Berk Chapter 15 Debt And Taxes

Tax Shield Meaning Importance Calculation And More

Tax Shield Definition

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example