These payments include all required employment security, job development fund, reemployment fund. Thank you for using the rhode island online registration service.

Pet Food Processing Market To Showcase Continued Growth In The Coming Years Food Animals Growth Marketing Competitive Analysis

The amount of the rhode island tax withholding should be:

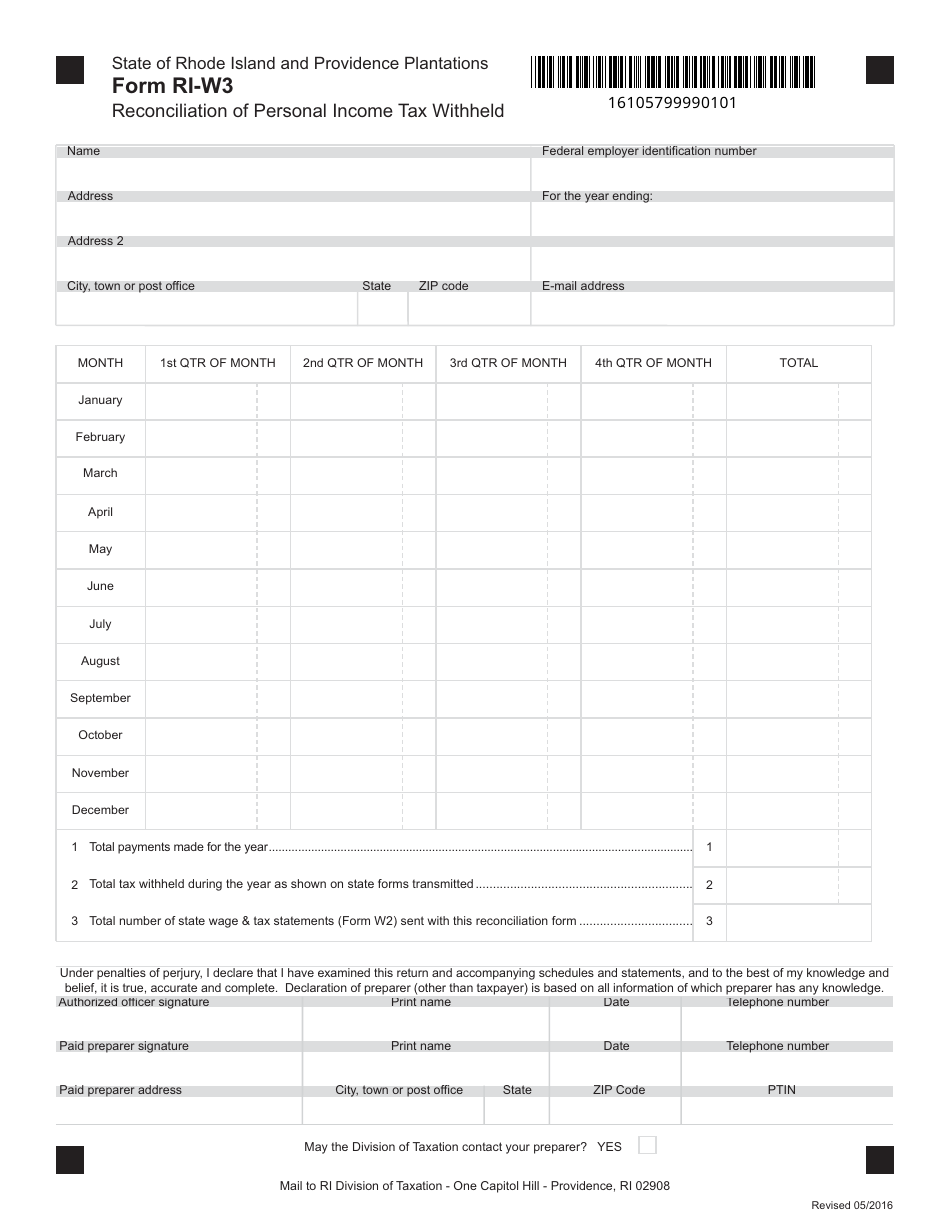

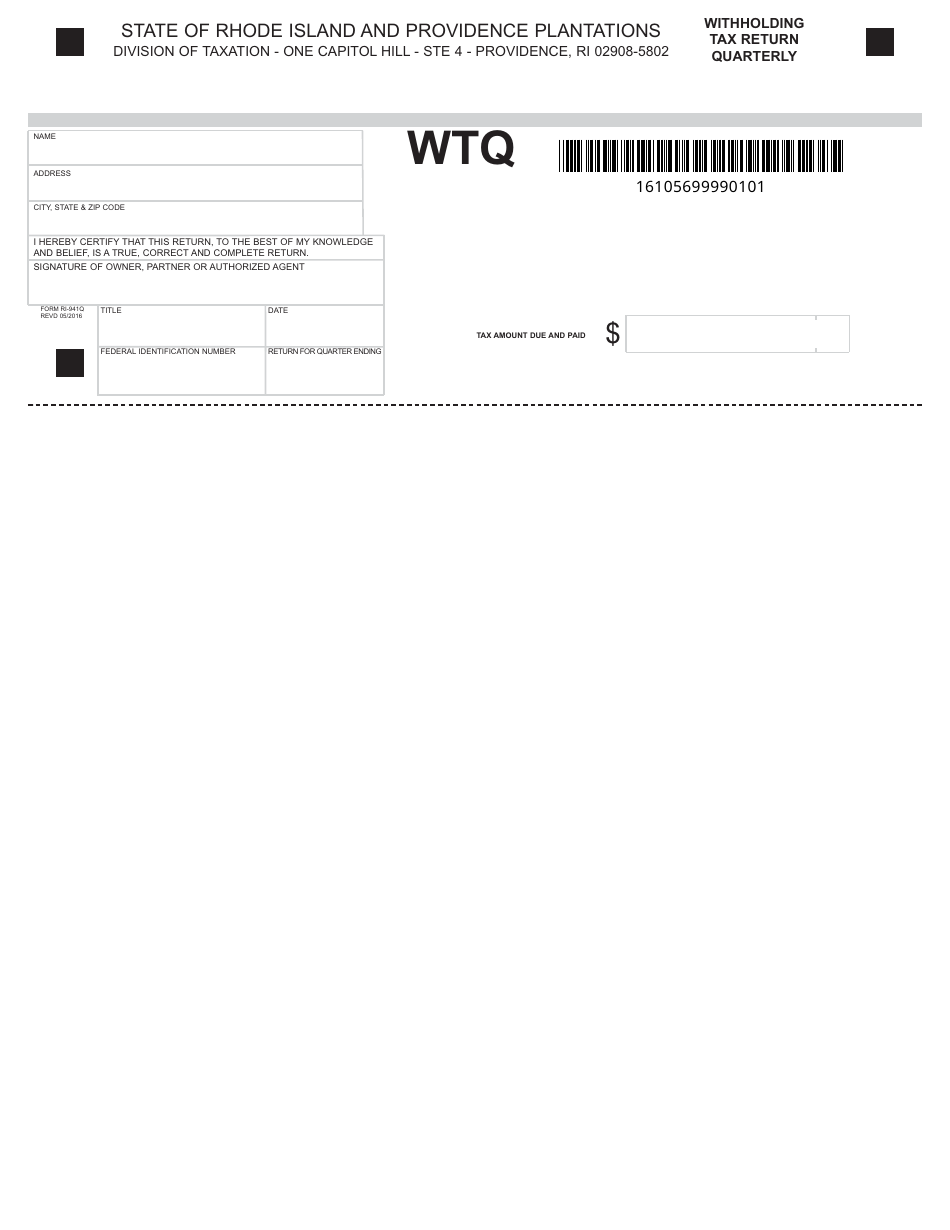

Rhode island state tax withholding. Ad a tax advisor will answer you now! Reporting rhode island tax withheld: Employers must report and remit to the division of taxation the rhode island income taxes they have withheld on the following basis:

No action on the part of the employee or the personnel office is necessary. Effective for wages paid on or after july 1, 2001 , employers are required to compute the rhode island withholding tax in accordance with the percentage method schedule or the withholding tax tables. If your small business has employees working in rhode island, you'll need to withhold and pay rhode island income tax on their salaries.

Here are the basic rules on rhode island. The supplemental withholding rate for 2020 continues at 5.99%. Withholding formula >(rhode island effective 2021)< subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages.

Rhode island's maximum marginal income tax rate is the 1st highest in the united states, ranking directly below rhode island's %. Questions answered every 9 seconds. This is in addition to having to withhold federal income tax for those same employees.

Download rhode island state tax withholding forms for free formtemplate offers you hundreds of resume templates that you can choose the one that suits your work experience and sense of design. The annual taxable wage table has changed. How much is rhode island withholding tax?

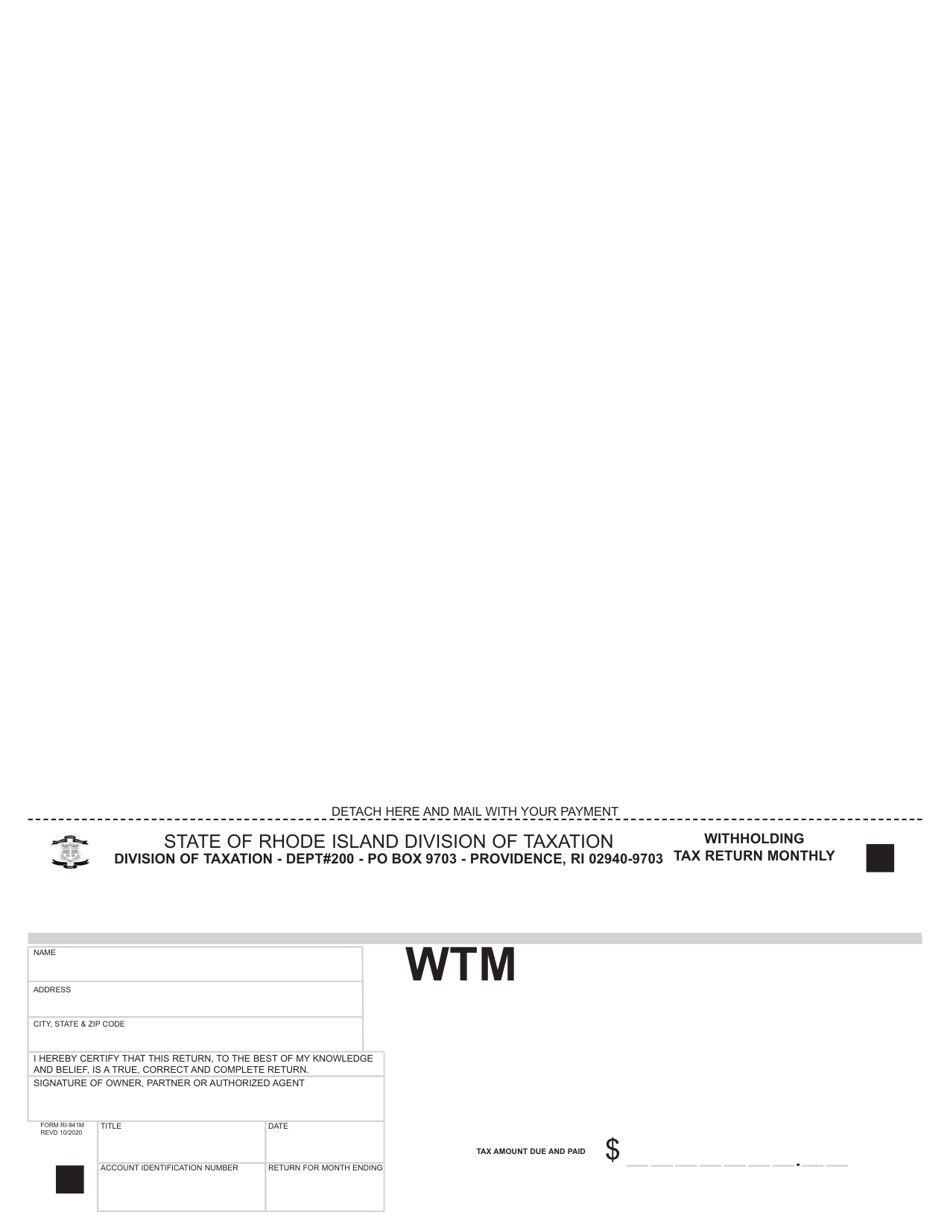

The annualized wage threshold where the annual exemption amount is eliminated has increased from $221,800 to $227,050. Withholding tax forms now contain a 1d barcode. To have forms mailed to you, please call 401.574.8970.

The income tax withholdings for the state of rhode island will include the following changes: Ad a tax advisor will answer you now! If you are not a resident of rhode island or a corporation that isn’t formed in rhode island, the buyer of your property will have to file income tax on your behalf.

The annualized wage threshold where the annual exemption amount is $0.00 will increase from $217,350 to $221,800. The income tax withholding for the state of rhode island includes the following changes: Please use microsoft edge browser to get the best results when downloading a form.

Questions answered every 9 seconds. Rhode island collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. The rhode island state income tax rate ranges from 3.75% to 5.99%.

Any individual, partnership, joint venture, corporation, state, municipal government, or exempt organization awarding a construction contract in rhode island to a nonresident contractor is required pursuant to r.i. Withholding formula >(rhode island effective 2020)< subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. You can also make a new resume with our online resume builder which is free and easy to use.

The withholding tax should be within the state income tax rate range. Unlike the federal income tax, rhode island's state income tax does not provide couples filing jointly with expanded income tax brackets. Due to a recent change in the rhode island income tax law, the state withholding tax is no longer a percentage of the federal ta x withheld.

All forms supplied by the division of taxation are in adobe acrobat (pdf) format. The rhode island division of taxation has released the state income tax withholding tables for tax year 2020. Since rhode island withholding tax withheld is used to pay for employee’s rhode island state income tax, the withholding tax should correlate with state income tax bracket.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Farm Books Accounting Software List Of Reports Payroll Template Resume Template Free Payroll Checks

Form Ri-941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

Form Ri-w3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

State W-4 Form Detailed Withholding Forms By State Chart

Cleverus Wins Most Promising Awards At Star Outstanding Business Awards Soba 2019 Business Awards Internet Marketing Strategy Online Marketing

Pin On Class Warfare

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

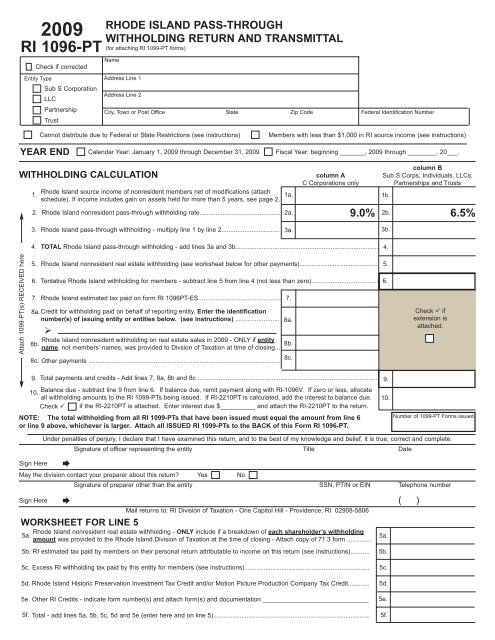

For Attaching Ri 1099-pt Forms – Rhode Island Division Of Taxation

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2

State Of Rhode Island Division Of Taxation Division Rhode Island Government

2

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Pin En Personal Financial Literacy For Ells

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Unlike Federal Government Ri Will Fully Tax Unemployment Benefits Wpricom

State W-4 Form Detailed Withholding Forms By State Chart

2