The government’s electric car grant is paid out by the department for transport’s office for zero emission vehicles (ozev), and is designed to make the transition to electric car (ev) ownership more affordable for more drivers. All pure electric cars are currently exempt from paying road tax.

What Other Countries Are Doing To Encourage Electric Vehicle Sales Rac Wa

The biggest tax benefits are offered to business car drivers.

Tax incentives for electric cars uk. This rate also applies to hybrid vehicles with a co2 emissions figure of below 50g/km and a pure electric range of 130 miles. Percentage used in tax benefits of electric cars (registered before 6th april 2020) To put that into perspective the bik on a £40,000 petrol car would probably be thousands a year.

More initiatives like those in italy and croatia would really help bring electric vehicle tax incentives to more people, covering all bases and pockets. The incentives include direct subsidies for the acquisition of new electric cars for up to 25% of the purchase price, before tax, to a maximum of €6,000 per vehicle (us$8,600), and 25% of the gross purchase price of other electric vehicles such as buses and vans, with a maximum of €15,000 or €30,000, depending on the range and type of. There are further financial incentives associated with driving an electric vehicle.

It’s available to dealerships and manufacturers who’ll take the value of the grant off the price when you buy an electric vehicle. The maximum grant for cars is £2,500, while the grant will pay a maximum of £3,000 for small vans, £6,000 for large vans, and £16,000 for trucks. Road tax for electric cars.

That represents a very large personal tax saving. Zero emissions cars costing less than £40,000 are also exempt from paying road tax. By choosing a tesla car, your business can claim a 100% year one deduction for the cost of the vehicle.

Aside from the electric car tax benefits outlined above. Tax relief for leasing or buying electric cars. At only £5,250 or £19.99 a week,.

On a car costing around £40,000 this could amount to a tax relief of £7,600 in the first year. Company car tax incentives to go electric. Electric cars do not pay road tax.

Other electric car tax benefits. Benefit in kind, company car tax rules, review of wltp and vehicle taxes, budget 2020. Drivers who find themselves requiring access to the london congestion charge zone in an electric vehicle can save £15.00 per day.

Capital allowances on electric cars. Typically a dedicated slow (3 kw) or fast (7 kw) unit costs under £1,000 to install by a qualified electrician. However, the government’s april 2020 tax update may spark change over the coming months and years, with some generous tax incentives laid out for any business adding electric powered vehicles to their company fleet.

Cars with co2 emissions of less than 50g/km are also eligible for 100% first year capital allowances. Also, there are reductions for electric hybrids depending on their electric only range. Therefore, this will cease to apply for higher priced vehicles.

Tax on benefits in kind (bik) effective from 6th april 2020, fully electric cars will be zero bik for 2020/21, 1% for 2021/22 and 2% for 2022/23. On an electric car it would be £0 and next year it would rise to 1% of the sale price. Travel incentives for electric vehicle owners

100% first year allowance (fya) first year allowance is claimable for up to 100% of the cost of qualifying low emission and electric cars.

Low Zero Tax Cars – Gul

A Guide To Company Car Tax For Electric Cars – Clm

The Uptake Of Plug-in Hybrid Electric Vehicles In Europes Company Car Fleets Trends And Policies International Council On Clean Transportation

How Much Does It Cost To Run An Electric Car In The Uk Sust-it

Road Tax Company Tax Benefits On Electric Cars Edf

Fiscal Incentives How Do They Impact Electric Vehicle Sales Eu Science Hub

Fiscal Incentives How Do They Impact Electric Vehicle Sales Eu Science Hub

![]()

Home – Gul

Purchase Subsidies Zero-rate Tax And Toll-free Travel How To Incentivise Emobility – Skoda Storyboard

What Are The Tax Benefits Of Having An Electric Vehicle

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Tax On Company Cars Does It Now Pay To Go Electric With Your Fleet Rouse Partners Award-winning Chartered Accountants In Buckinghamshire

Whats Put The Spark In Norways Electric Car Revolution Motoring The Guardian

Road Tax Company Tax Benefits On Electric Cars Edf

A Complete Guide To Ev Ev Charging Incentives In The Uk

Government Electric Car Grants – Save On Your Ev Leasing Options

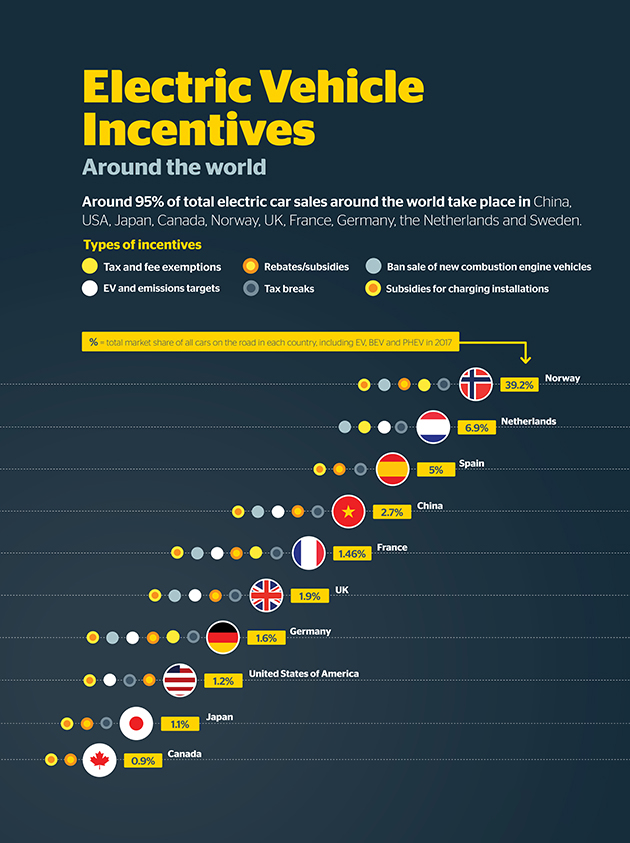

Which Governments Are Promoting Electric Vehicles The Most

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Road Tax Company Tax Benefits On Electric Cars Edf