The social security tax, they pay at a rate of 15.3% of net earnings (temporarily lowered to 13.3% for 2012). It will take into account any factors that can affect your savings.

1973 Sharp Calculator Advertisement Newsweek April 16 1973 Advertising Old Ads Vintage Advertisements

New jersey corporate income tax comparison.

S corp tax calculator nj. For example, if the profits of the s corp are $100,000 and there are four shareholders, each with a 1/4 share, each shareholder would pay taxes on $25,000 in profits. A home business grossing $55,000 a year pays $0.00. When an s corporation with a new jersey corporation business tax (cbt) allocation factor of 100 percent reports entire net income that is subject to federal corporate income taxation on the new jersey cbt return and the corporate tax return of another state and the tax paid to the other state qualifies for a reduction on the new jersey cbt return, the amount of.

If a pte were to elect to be taxed as a state c corporation under the bill, the owners would be entitled to claim a refundable gross income tax credit. As you know, most of the people are limited through their state and local income tax deduction to $10,000 on an individual tax return. Each member share of the entity level tax equals:

From the authors of limited liability companies for dummies. Additional new jersey corporate income tax legislation establishes a tax rate of 7.5% for businesses earning between $50k and $100k in taxable income, and a tax rate of 6.5% for businesses earning up to $50k in taxable income. It's a recent law passed in new jersey to help calculate new jersey tax owed through your business, through a partnership, or s corporation, and allow you a federal tax deduction, which is great.

Six basic steps to start an llc and elect s corp status: Starting an llc and electing s corp tax status is easy. The owners of the s corp pay income taxes based on their distributive share of ownership, and these taxes are reported on their individual form 1040.

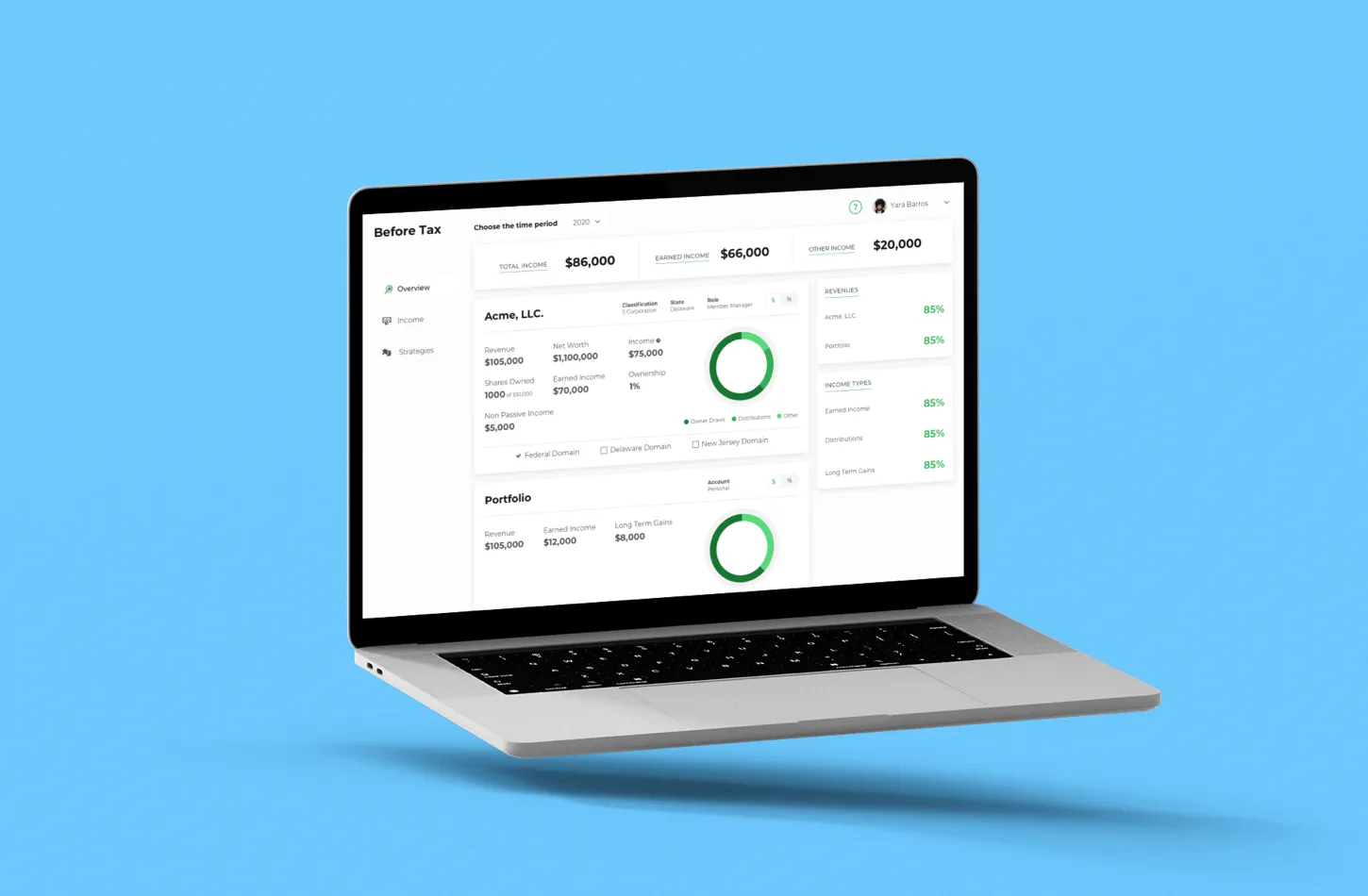

On march 18, 2019, new jersey lawmakers referred s.b. You can use an s corporation tax calculator to calculate how much income you take as a salary, how much income is spent as a distribution, and how this affects your annual taxes. The s corporation tax calculator below lets you choose how much to withdraw from your business each year, and how much of it you will take as salary (with the rest being taken as a distribution.) it will then show you how much money you can save in taxes.

This tax calculator shows these values at the top of your results. Considerations in calculating s corp salary vs. S corp status also allows business owners to be treated as employees of the business for tax purposes, which can result in tax savings.

If your company is taxed at a high level try our s corp tax savings calculator. New jersey electing s corporation. From there, we'll take your revenues and subtract out your expenses, and then apply the correct tax rate to come up with an estimate of what you should be paying for taxes.

The new jersey source pro rata share of a Each new jersey resident member’s share of the entity level tax equals ($750,000/$1,500,000 x $108,687.50) = $54,343.75. This calculator helps you estimate your potential savings.

The tax rate is 9.00% (.09) of entire net income that is subject to federal income taxation or such portion thereof as may be allocable to new jersey. Periods beginning on and after 1/10 is. An s corporation (s corp) is a tax status under subchapter s of the irs tax code that you can elect for your limited liability company ( llc) or corporation.

You can use our guides to start an llc with the s corp status yourself, or you can hire a service provider like zenbusiness to do it for you. All tax tips and videos; If you’re new to personal taxes 15.3% sounds like a lot less than the top bracket of 37%.

S corp vs llc calculator. Then we’ll connect you with a cpa already successfully operating s corporations in your state. How does your small business tax calculator work?our small business tax calculator uses the figures provided to estimate your tax expenses.

Each new jersey resident member’s share of the entity level tax equals ($450,000/$900,000 x $56,567.50) = $28,238.75. If a federal s corporation makes the election to be treated as an s corporation for new jersey purposes, the pro rata share of a new jersey resident shareholder is his/her pro rata share of the s corporation’s income, regardless of where the income is allocated. 3246 and its companion, a.b.

Need A Deductions Working Sheet – Paper Size A3 Heres A Free Template Create Ready-to-use Forms At Formsbankcom Paper Size Deduction Sheet

Western New England University School Of Law Offers Many Ways To Earn A Law Degree In Addition To Our Three-year Full-time Pr New England University Western New England Business Professional Attire

S Corp Vs Llc Calculator – When To Elect S Corp How To Start An Llc Guide

Exclusive S-corp Tax Calculator – Newway Accounting

S Corp Tax Calculator – Llc Vs C Corp Vs S Corp

S Corp Tax Calculator – Llc Vs C Corp Vs S Corp

Hector Garcia Cpa – Youtube Quickbooks Tips Quickbooks Hector Cpa

S Corp Tax Calculator – Llc Vs C Corp Vs S Corp

S Corp Tax Calculator – Llc Vs C Corp Vs S Corp

Despite The Law Clearly Stating That Every Illegal Construction In Mumbai In India Is To Be Levied With Twice The Amount O Construction Property Tax Department

Tax Deadlines Hr Block

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

Pin On Accessories

Taxes For Bloggers How To File Taxes On Your Blogging Income 2021

S Corp Tax Calculator – Llc Vs C Corp Vs S Corp

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Rates Mortgage Interest

Scheduling Wheel And Perpetual Calendar On Back Custom Imprinted With Your Business Name Paper Spinners Imprinting Chart

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Bone Biologics Corp Completes Financing With Hankey Capital Llc Ortho Spine News Accounting Best Life Insurance Companies Accounting Help