A tribe that opts in may opt out at any time for any reason it deems necessary. Yes, as described in the proposed rules, an employee may opt out of the program and all associated taxes and benefits if (1) the employee is 18 years old.

Washington Long-term Care Tax How To Opt-out To Avoid Taxes

Exemptions will take effect the quarter after your application is approved.

Washington state long term care tax opt out rules. November 1, 2021, is the deadline to avoid the new tax by purchasing a private long term care policy. 1 of this year and dec. The website has been overwhelmed with visitors.

For someone with annual wages of $50,000, that’s $290 a year in premiums. Private insurers may deny coverage based on age or health status. One of the worst pieces of legislation i have ever seen was passed in 2019 by the washington state legislature and signed into law by gov.

You must then submit an attestation that. Awc will monitor agency rulemaking related to this new law and ensure that washington’s cities are represented in the process. But according to the association for washington business, an amendment passed this year that removed much of that flexibility.

After an employee’s application for exemption is processed and approved, they will receive an approval notification from esd. Disqualified from accessing wa cares benefits in your lifetime. Washington state enacts first social insurance program for ltc.

Required to present your exemption approval letter to all current and future employers. Employers must maintain copies of any approval letters received. The maximum lifetime benefit will be $36,500 per person, with future increases tied to the consumer price index.

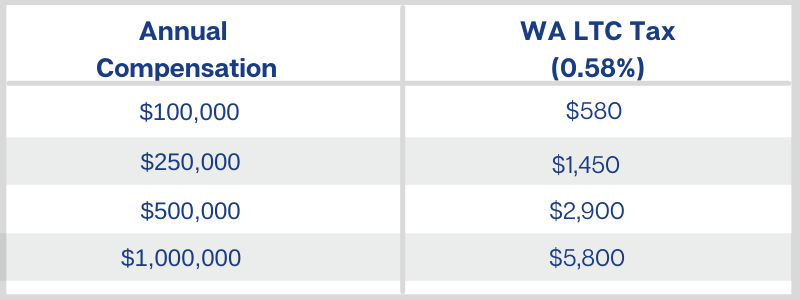

The employee must provide this approval letter to their current and future employers. The current rate for wa cares premiums is only 0.58 percent of your earnings. The move follows a frenzy of interest in the costly insurance policies prompted by a.

The application for the exemption is only valid from oct. Shb 1323 provides a pathway for federally recognized washington tribes to elect coverage into the ltss program. You can then apply for an exemption from the state between oct.

The employee must provide proof of their esd exemption to their employer before the employer can waive collecting the premium assessment. Yes, it is possible to opt out, but employees should act quickly to preserve this ability. Any traditional employee must “opt out” in order to avoid the payroll tax on all washington state compensation for as long as the program is in existence.

Why To Consider Opting Out Of Washington States Long-term Care Trust Act King5com

Ltca – Long Term Care Trust Act – Worth The Cost

Washington Long-term Care Tax How To Opt-out To Avoid Taxes

Washington State Long-term Care Tax Avier Wealth Advisors

What You Need To Know About The New Washington State Long-term Care Act – Coldstream Wealth Management

Should You Opt Out Of Washington States New Long Term Care – Toyer Dietrich And Associates

State Senator Only Gov Inslee Has The Power To Pause Washingtons Long-term Care Tax

Faq New Long-term Care Insurance Program And Payroll Tax Washington State House Republicans

Can You Opt Out Of The Washington Long-term Care Trust Act

Faq New Long-term Care Insurance Program And Payroll Tax Washington State House Republicans

.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary).jpg)

The Private Ltc Insurance Option For Washington State Workers

Some Plan To Opt Out Of New Washington Long-term Care Insurance – The Columbian

Kuow – Want To Opt-out Of Washingtons New Long-term Care Tax Good Luck Getting A Private Policy In Time

Washingtons First-in-the-nation Long-term Care Program Starts In January With Opt-out Deadline Soon Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur Dalene

:quality(70)/d1hfln2sfez66z.cloudfront.net/10-02-2021/t_4922061171d34a7a9716ccbbbccad5ed_name_file_960x540_1200_v3_1_.jpg)

In Or Out Washingtons Long-term Care Tax Is For Life And The Deadline Is Looming Kiro 7 News Seattle

Washington State Long Term Care Tax – Heres How To Opt Out

Making Sense Of Washingtons New Long-term Care Law – Parker Smith Feek Business Insurance Employee Benefits Surety

Updated Get Ready For Washington States New Long-term Care Program Sequoia

What You Need To Know About The New Washington State Long-term Care Act – Coldstream Wealth Management