See agency history on the. The mtc is now updating the form to reflect the wayfair decision and states’ new sales and use tax economic nexus laws.

Multi State Sales Tax Exemption Certificate – Fill Online Printable Fillable Blank Pdffiller

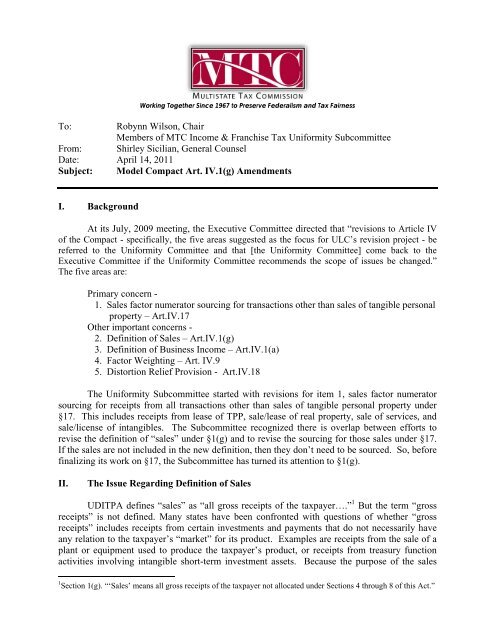

Its actions do not have the force of.

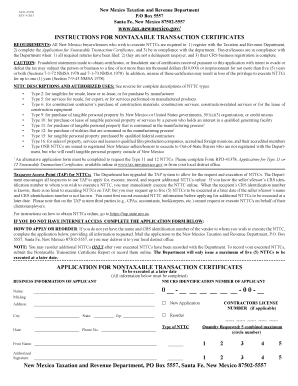

Multistate tax commission form. Report of the subcommittee on state taxation of s corporations: The mtc is requesting responses and revisions from the participating states by november 30 th, 2020. Multistate tax commission, the multistate tax commission working draft of a proposed model rule for a.

Use fill to complete blank online multistate tax commission (dc) pdf forms for free. Model s corporation income tax act and commentary, 42 the tax lawyer, 1001 (1989); Information regarding the multistate tax commission and this form may be obtained from their website at.

However, the selling dealer must also obtain a resale authorization The multistate tax commission is an interstate instrumentality located in the united states. Use get form or simply click on the template preview to open it in the editor.

Learn more texas sales and use tax exemption certification. 1 a seller in texas may simply a resale. Drs does hear the multistate tax commission's uniform sales use tax certificate.

With the next round of substantial federal and state tax law changes in process, companies need to identify the changes that may affect their organization to help manage their state tax posture. Start completing the fillable fields and carefully type in required information. All forms are printable and downloadable.

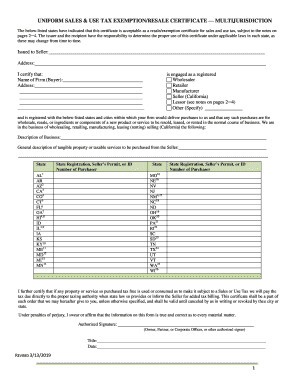

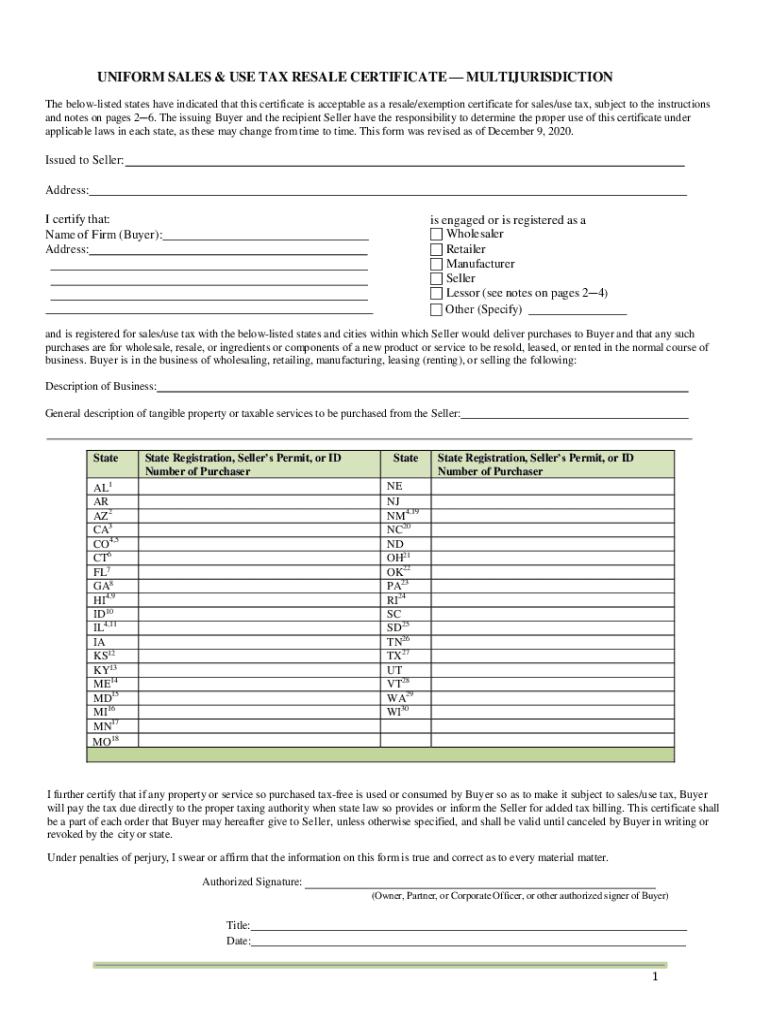

Once completed you can sign your fillable form or send for signing. An agency can be labeled inactive if it has been abolished, had a title change, was merged into a different agency or split into different agencies. The commission has developed a uniform sales & use tax resale certificate that 36 states have indicated can be used as a resale certificate.

Multistate tax commission 47 form laws in 1957. Carriers of freight and passengers if you’re in the business of transporting passengers, The commission has developed a uniform sales & use tax resale certificate that 36 states have indicated can be used as a resale certificate.

On august 4, 2021, the mtc’s member states formally adopted updates to its p.l. The certificate itself contains instructions on its use, lists the states that have indicated to the commission that a properly filled out form satisfies their requirements for a valid resale certificate, and sets forth specific requirements and limitations on its use. Use the cross or check marks in the top toolbar to select your answers in the list boxes.

Form 2 the multistate tax compact's resale form or 3 other exemption form. Formation of the mtc the purposes of the multistate tax compact, as set out in article i, are to: Commission members, acting together, attempt to promote uniformity in state tax laws.

Idaho has adopted the multistate tax commission (mtc) regulations for the following special industries. It is the executive agency charged with administering the multistate tax compact. As of 2021, the district of columbia and all 50 states except for nevada are members in some capacity.

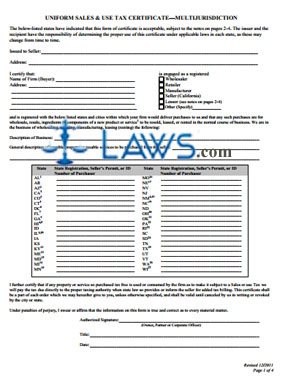

Office of multistate tax compact commission for texas. Uniform sales & use tax resale certificate. Examples of the computations of these factors are found in the applicable mtc regulations.

Any states that request to be removed or do not respond will be removed from the revised form. See, e.g., american bar association subcommittee on state taxation of s corporations; In article vi, it established the multistate tax commission (the mtc or the commission) to promote the purposes of the compact and to effectuate various specific provisions of the compact.

You can find them under laws and rules at tax.idaho.gov. I understand that it is a criminal offense to give an exemption certificate to the seller. Many companies use it, even for documenting exemptions in only one state, mostly because it is so widely available.

The proposed draft of the revised form can be found here. The issuer and the recipient have the responsibility of determining the proper use of this certificate under applicable laws in each state, as these may Allows the multistate tax commission's uniform sales and use.

A blanket resale certificate is applicable to multiple transactions between a buyer and a seller. This agency is currently inactive. The multistate tax commission has created a uniform sales and use tax exemption certificate to meet this need and the mtc multistate tax form has been accepted by 38 states for use as a blanket resale certificate.

Free Form Uniform Sales And Use Certificate – Free Legal Forms – Lawscom

WordPressstorageaccountblobcorewindowsnet

What Does Mtc Stand For

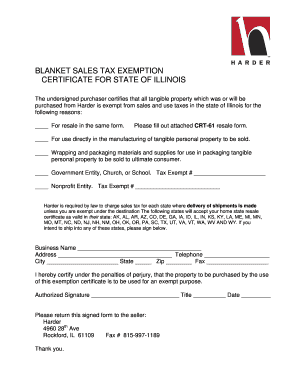

Tax Exempt Certificate – Fill Out And Sign Printable Pdf Template Signnow

Mtc Form – Fill Out And Sign Printable Pdf Template Signnow

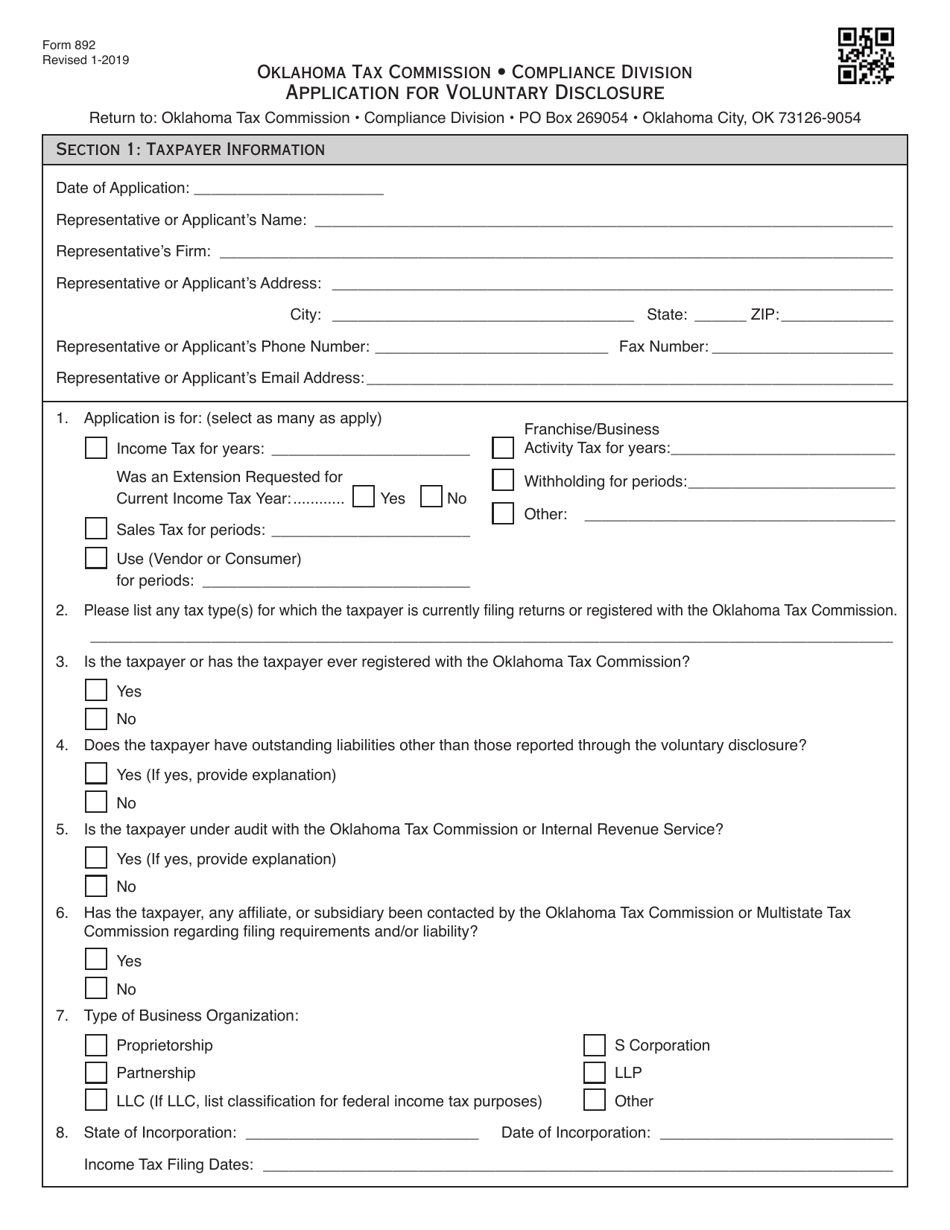

Otc Form 892 Download Fillable Pdf Or Fill Online Application For Voluntary Disclosure Oklahoma Templateroller

1 Exemption Administration Training Prepared By The Streamlined Sales Tax Governing Board Audit Committee Prepared January Ppt Download

Uniform Sales And Use Tax Exemption Certificates – Accuratetaxcom

Sales Use Tax Certificate – Fill Online Printable Fillable Blank Pdffiller

Multistate Tax Commission – Home

Uniformity Committee Memo – Multistate Tax Commission

Mtc Mission Values Vision Goals – Multistate Tax Commission

Multistate Tax Commission – Home

2020 Mtc Uniform Sales Use Tax Certificate – Multijurisdiction Fill Online Printable Fillable Blank – Pdffiller

Multistate Tax Commission – News

Multistate Tax Commission Issues New Interpretation On Pl 86-272 Pertaining To E-commerce Bkd Llp

Multistate Tax Commission – Home

Multistate Tax Commission – News

Gl-22051 Ndgov Tax Indincome Forms 2008