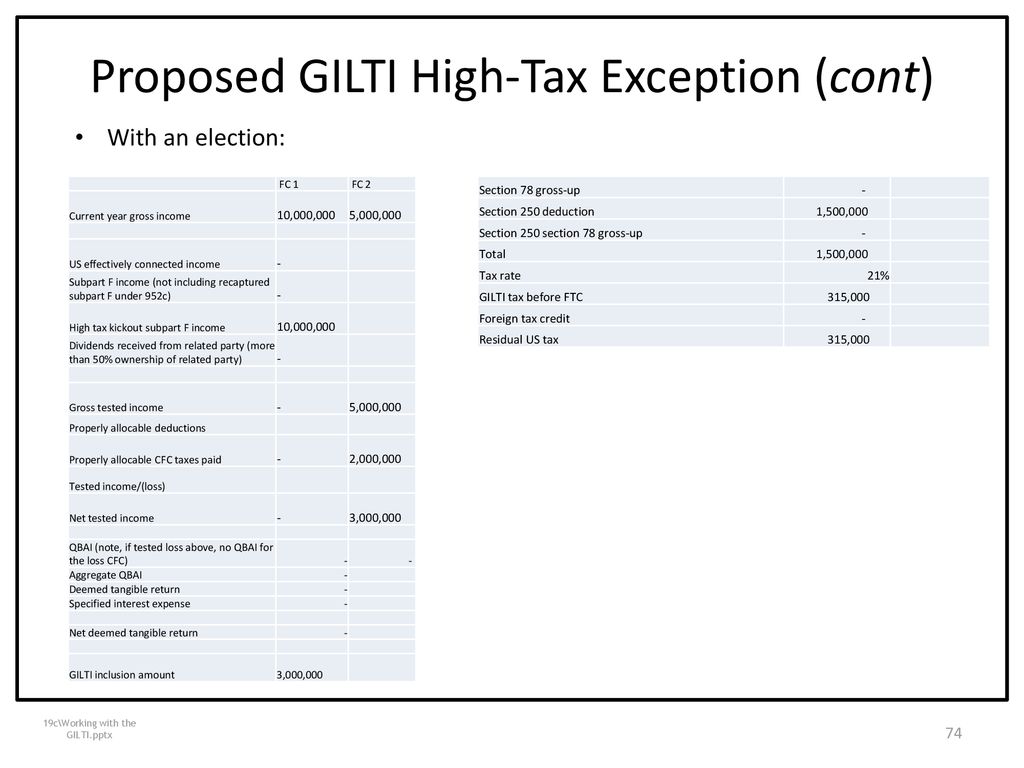

Shareholder that owns a cfc. Exceptions.5 under the gilti statute, tested income and tested loss exclude, among other items of income, any income that is subpart f income or that is not subpart f income “by reason of” an election to apply the

Lwcom

Shareholder that owns a cfc.

Gilti high tax exception tested loss. To be eligible for the exclusion, the cfc’s earnings must be subject to an effective foreign corporate income tax rate that is greater than 90% of the current u.s. Shareholders have historically incurred losses or if they expect no incremental u.s. If the cfc is incorporated in a country that has entered into a bilateral tax treaty with the united states, the deferred foreign could qualify.

The computation of tested income or tested loss applies regardless of whether a cfc or its u.s. What is gilti tested loss? New administrative burdens await for taxpayers.

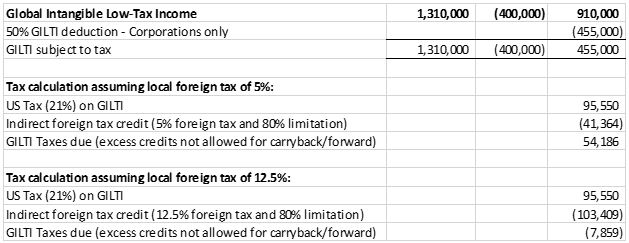

Thus, in the example above, the $20× of subpart f income would be included by the shareholder in subpart f income. 951a(c)(2)(b)(ii) provides that the tested loss is not taken into account for purposes of applying the e&p limitation. Corporate tax rate, which is 21%).

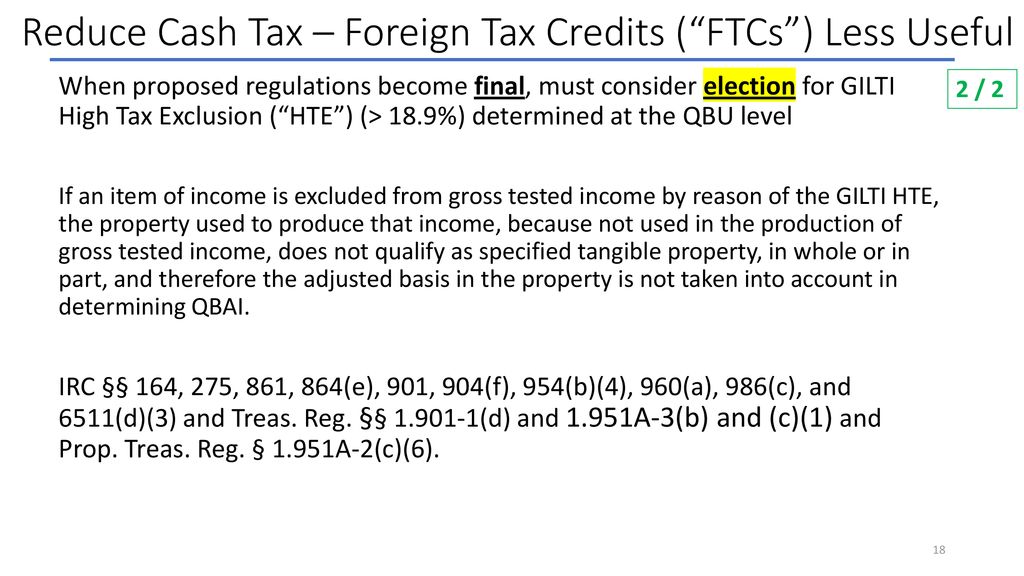

On july 23, 2020, the u.s. If the cfc earns income from a foreign jurisdiction with a high tax rate, the high tax exception rules. The gilti high foreign tax exception allows a complete exclusion of gilti tested income from the federal taxable income of a u.s.

This means, if the cfc’s effective foreign tax rate exceeds 18.9 percent, a cfc shareholder can elect to make a high tax exception and defer the recognition of foreign income for purposes of gilti. Tax liability as a result of the. Another misconception is that the computation of tested income or tested loss is not required if it would not result in the payment of incremental u.s.

The final regulations largely finalize regulations previously. The term tested loss means the excess (if any) of a controlled foreign corporation's allowable deductions (including taxes) properly allocable to gross tested income (or that would be allocable to gross tested income if there were gross tested income) for a cfc inclusion year, over the gross tested income of the controlled foreign corporation for the cfc inclusion year (a controlled. Shareholder of a controlled foreign corporation (cfc) can exclude from its gilti inclusion items of a cfc's gross tested income if the cfc's effective foreign rate on the gilti gross tested income exceeds 18.9 percent and the u.s.

Federal corporate income tax rate. What is the gilti high tax exception? This threshold is unchanged from the proposed regulations.

Cfc now constitutes a “tested loss” under the gilti rules.

International Aspects Of Tax Cuts And Jobs Act 2017 – Ppt Download

Global Intangible Low-tax Income – Working Example Executive Summary – Mksh

Lwcom

Insight Fundamentals Of Tax Reform Gilti

Cross-border Mas Post-tcja Three Things Advisers Should Know

Gilti Regime Guidance Answers Many Questions

Harvard Yale Princeton Club – Ppt Download

Harvard Yale Princeton Club – Ppt Download

International Aspects Of Tax Cuts And Jobs Act 2017 – Ppt Download

International Aspects Of Tax Cuts And Jobs Act

International Aspects Of Tax Cuts And Jobs Act

Lwcom

5 Things To Know About The Gilti High-tax Exclusion Crowe Llp

Insight Fundamentals Of Tax Reform Gilti

Assetskpmg

Irs Releases Final Gilti Regulations Grant Thornton

Lwcom

International Aspects Of Tax Cuts And Jobs Act

Is The Gilti High Tax Exception A Benefit For Controlled Foreign Corporations