Return the corporate tax rate to 28 percent from the current 21 percent. Contribute to your superannuation fund.

Tax Minimisation Strategies For High Income Earners

Minimize use of taxable bonds.

Tax saving strategies for high income earners canada. Canadian tax law allows for several ways to reduce your taxes owed if. This is a conversation you should have yearly, well before the end of the calendar. The secure act, which became law at the end of 2019, includes several provisions that apply to high income earners.

You receive an immediate income tax deduction in the year you contribute to your daf. That means that if you earn more than $163,301 in gross income as a single earner and $326,601 if you're married filing jointly, you are a high income earner. Since aef is a public charity, contributions immediately qualify for maximum income tax benefits.

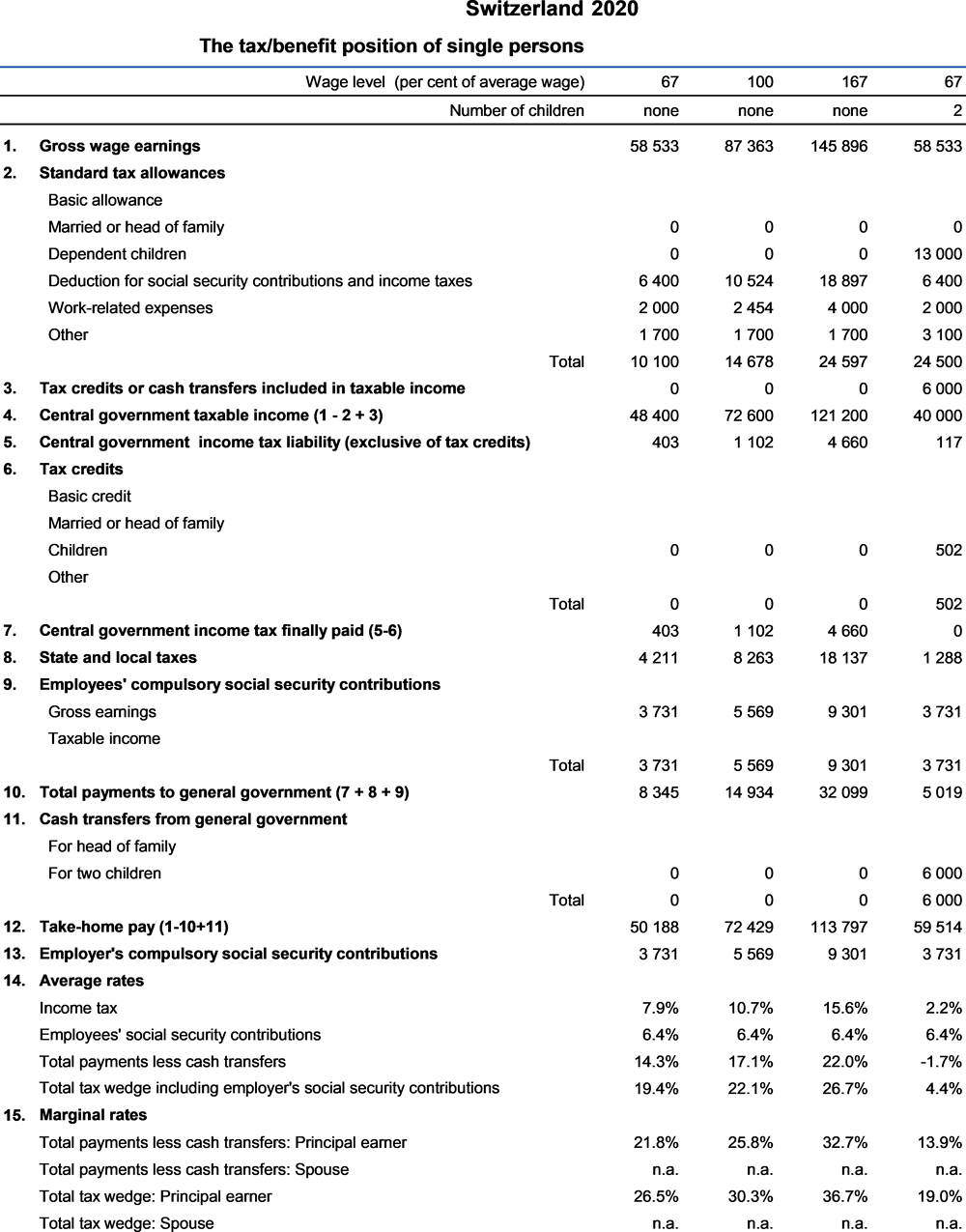

So, what are the top tax planning strategies for high income employees? Find out how to lower your tax bill for 2020. Across all canadians, the average tax rate has hovered around the 15% to 20% range.

Home » investing » 5 sneaky but legal ways to save on taxes in canada. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. However, lawmakers change tax code regularly, both temporarily and permanently.

You can also read our guide on 7 secrets to high net worth investment, management, estate, tax and financial planning. Tax saving strategies for high income earners canada. The dividend earning is $584.

Make a loan to your spouse. And one spouse has a higher income than the other. Be careful to not exceed your ‘contribution cap’ for deductible superannuation contributions.

Like equities, taxable bonds produce capital gains every time the fund manager buys or. In contrast, the bottom 50% pays an income tax rate of roughly 5%. Contribute to your superannuation fund.

For the sake of this post, we'll consider anybody in the top three tax brackets as a high income earner. David rotfleisch, founding tax lawyer of toronto firm rotfleisch and samulovitch, recommends registered retirement savings plans (rrsps) to everyone. There are four initial ways that high income earners could benefit from using a donor advised fund (daf) to lessen their tax burden:

So, what are the top tax planning strategies for high income employees? The first way you can reduce your taxable income (and therefore your tax on that income) is through additional superannuation contributions. Withdrawals get hit with a withholding tax that is paid upon withdrawal.

Your best bet is to talk with your accountant and financial advisor to get their input based on the current year. Canada’s highest income earners — those in the top 10% — are paying effective tax rates of 25% to 40%. Your spouse is then able to earn investment income on these funds and pay taxes at their lower marginal tax rate.

You will have to pay income tax.

Switzerland Les Impots Sur Les Salaires 2021 Oecd Ilibrary

17 Best Income Tax Saving Schemes Plans In 2021

State-by-state Guide To Taxes On Retirees Retirement Locations Map Retirement Advice

Savings Hierarchy Savings Strategy Financial Planning Hierarchy

Bulletproof Your Future And Avoid Forced Retirement Retires Great Retirement Retirement Finances Saving For Retirement

Calculation Of Income Tax For Employment Income Earners In Japan Download Scientific Diagram

Tax Saving Income Tax Saving For Fy 2020-2021

17 Best Income Tax Saving Schemes Plans In 2021

Tfsa Vs Rrsp How To Choose Between The Two 2021 Finances Money Personal Finance Investing

2

Germany Taxing Wages 2021 Oecd Ilibrary

What Are Real Assets And How To Diversify Your Wealth By Investing In Them Investing Diversify Business Management

High-income Earners Need Specialized Advice Investment Executive

17 Best Income Tax Saving Schemes Plans In 2021

Who Should Bother With An Rrsp – The Financial Pipeline Retirement Savings Plan Canadian Money Saving For Retirement

The Top 9 Tax Planning Strategies For High Income Employees

Combine Pilates With Uk Caravan Hire Rentmycaravancom Caravan Hire Caravan Holiday Caravan

How Can I Reduce My Taxes In Canada

The 4 Tax Strategies For High Income Earners You Should Bookmark – Monument Wealth Management