20113 arizona coalition for tomorrow charitable fund inc. This charity fund has a $1,000,000 cap for refundable arizona tax credits, so it’s best to get your contribution in early during the year.

Charitable Contributions Count In Arizona – Tempe Community Council

Jcrc's making a difference every day:

Arizona charitable tax credit fund. Only organizations that have been approved by the state of arizona to operate as a qualified charitable organization. To claim the tax credit: Only organizations that have been approved by the state of arizona to operate as a qualified charitable foster care organizations.

Giving through the arizona charitable tax credit is an easy way to redirect the money you would otherwise be paying in taxes. This tax code allows for donations to qualifying organizations be returned to the taxpayer not as a deduction but as a. You’ve probably heard of the az charitable tax credit,.

Jewish family & children's services of southern arizona. Jfcs is a qualifying organization to receive your charitable tax credit donation. Arizona tax credits support the work of local jewish organizations.

• if you made cash contributions to more than three qualifying charitable organizations, complete the continuation sheet on page 3 and include it with the credit form. The state of arizona provides a variety of individual tax credits, including the arizona charitable tax credit and the public school tax credit. The arizona charitable tax credit allows an individual to donate up to $400 and a couple to donate up to $800 and receive the full amount back when you file your arizona state taxes.

Arizona charitable tax credit fund. Contributions for the 2021 tax year can be made through april 15th, 2022. File arizona tax forms 352 and 301 with your state tax return.

Mail checks or donate online by may 17, 2021 for 2020 tax returns; Your tax credit feeds hungry students! Place this code on form 352 when filing your arizona tax return.

Donors can then decide how to distribute grants of. Qualifying charitable organizations tax credit program. Information on the arizona charitable tax credit.

Donor advised funds allow donors to create an account designated for charitable contributions and immediately receive a tax deduction. (a) qualifying charity code (b) name of qualifying charity (contributions to qualifying foster care charitable organization are claimed on az form 352) (c) cash contribution 6 00 7 00 8 00 What organizations can receive a qualified charitable tax credit donation?

What organizations can receive a qualified charitable tax credit donation? By leveraging the arizona charitable tax credit, you take control of where your tax dollars go. Once $1,000,000 in donations is reached, contributions must be returned, therefore it's best to send your donation in early, so you are ensured a credit on your arizona tax return.

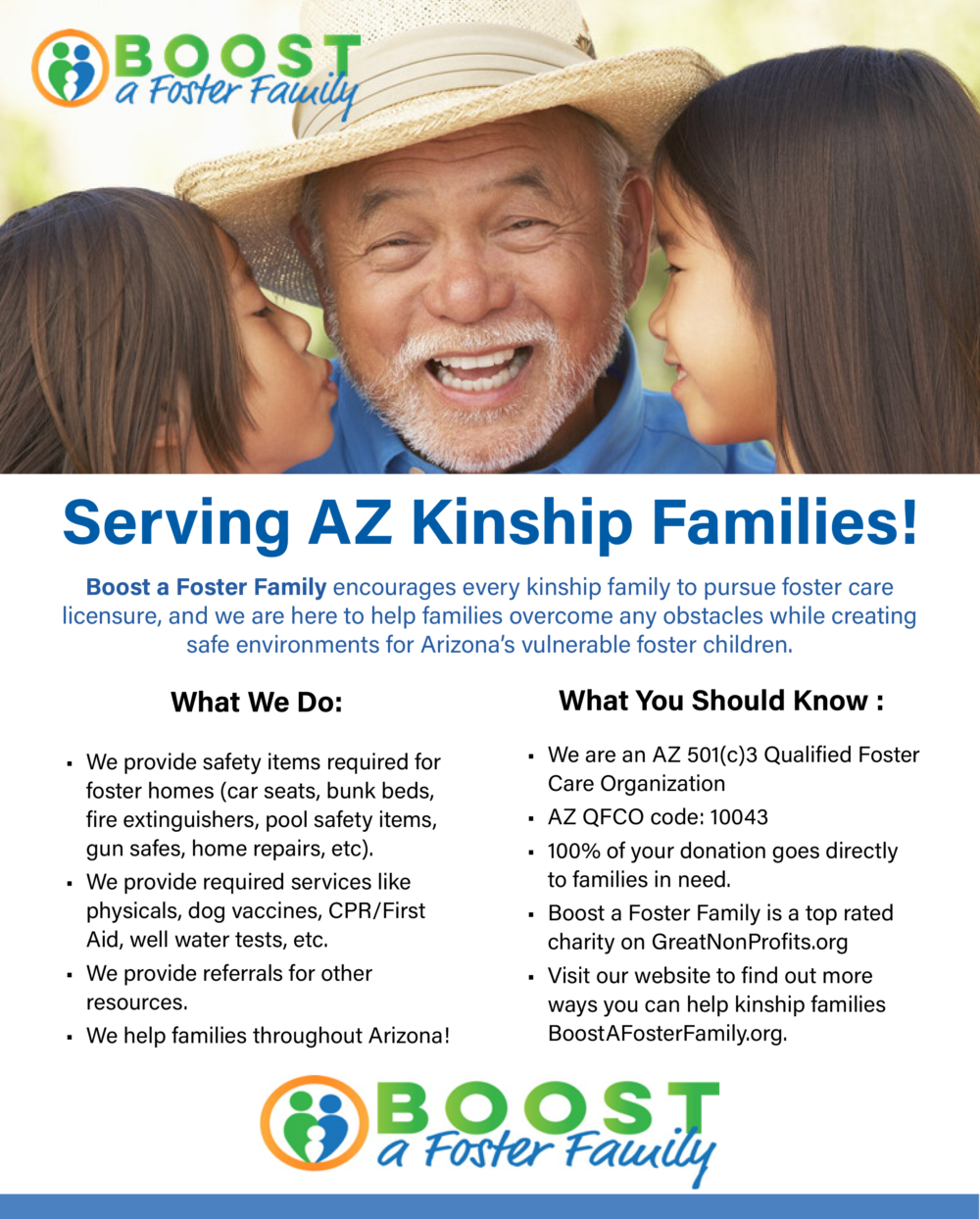

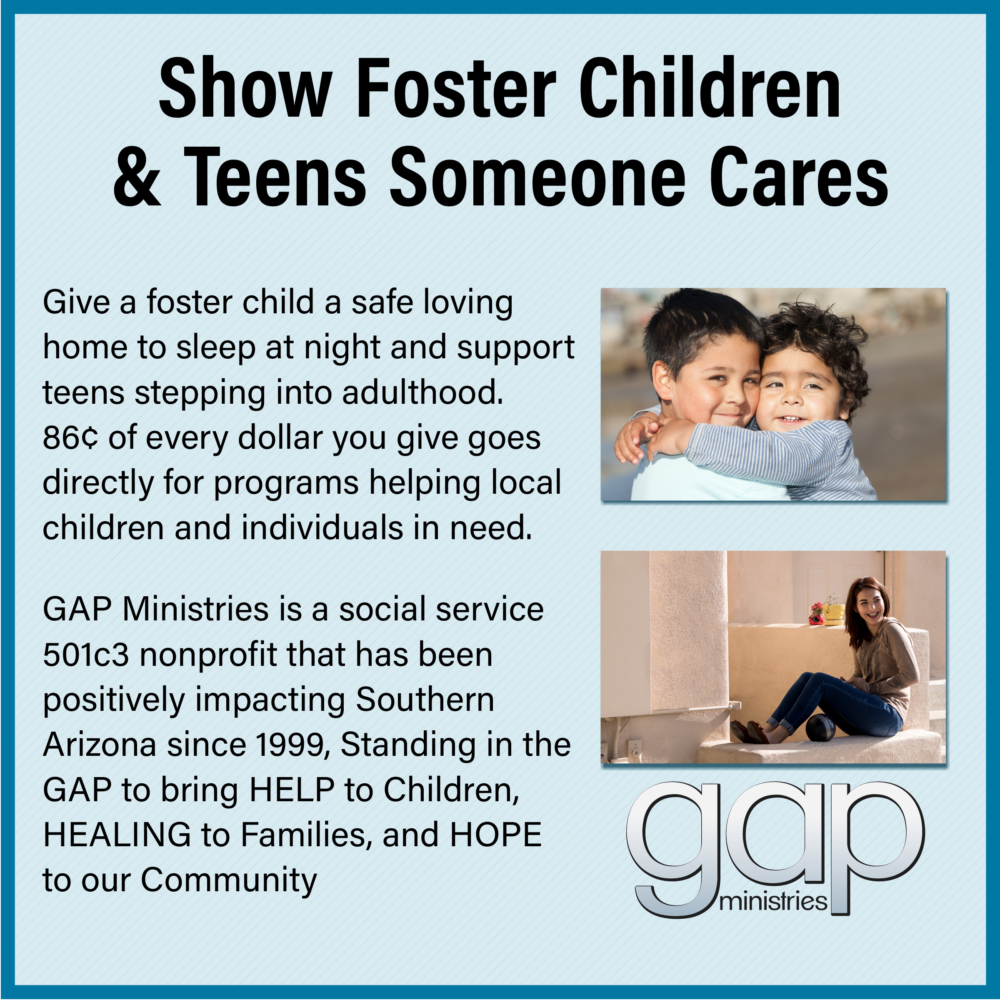

Aask’s qualifying foster care charitable organization (qfco) code is 10026. The arizona charitable tax credit is intended to spur donations to charitable organizations that provide a significant number of services for arizona residents experiencing financial insecurity. Creating a lasting impact for arizona’s children and families.

You can donate to any private school in the state. If your total tax credit contributions exceed your tax liability, the unused portion for the first four (4) credits listed below can.

Qualified Charitable Organizations – Tucson Tax Credit Funds

Arizona Qcfo

Arizona Qcfo

Qualified Charitable Organizations – Az Tax Credit Funds

Frontdoorsnews Publisher Publications – Issuu

Cdt Kids Charity Arizona Tax Credit

![]()

Qualified Charitable Organizations – Az Tax Credit Funds

Arizona Charitable Tax Credit Fund Paradise Valley Community College

Qualified Charitable Organizations – Az Tax Credit Funds

Qualified Charitable Organizations – Az Tax Credit Funds

Start The Process – Az Tax Credit Funds

Qualified Foster Care Charitable Organization – Az Tax Credit Funds

Arizona Tax Credit Donations

Qualified Charitable Organizations – Tucson Tax Credit Funds

Cdt Kids Charity Arizona Tax Credit

Tax Creditcharitable Giving For Free Fsl

Arizona Qcfo

Arizona Qualifying Contributions

Qualified Charitable Organizations – Az Tax Credit Funds