The dividend is paid with respect to a Residents deriving that category of income from the treaty country.

United States Of America – Perjanjian Penghindaran Pajak Berganda P3b – Perpajakanid

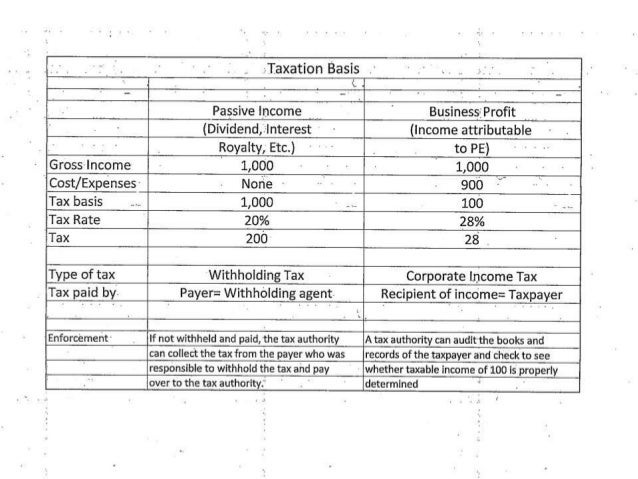

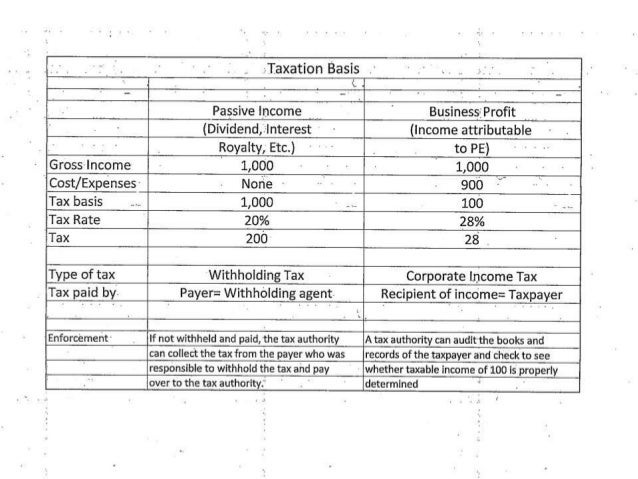

The corporate tax rate for a branch is the same as for a subsidiary.

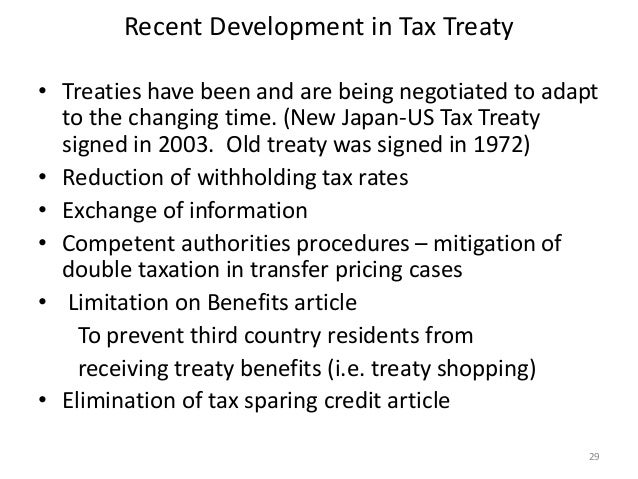

Us japan tax treaty dividend withholding rate. Paying agent would withhold on that dividend at the appropriate treaty rate (assuming the payee is otherwise entitled to treaty benefits) because reduced withholding is a benefit enjoyed by the resident of japan, not by the dual Tax treaty january 31, 2013 similarly, the protocol expands japan’s taxation rights in respect of real property situated in japan. Beneficially entitled to that income.

These tables may provide information about the rate of tax that the treaty partner could imposed on u.s. Dividend to a resident of japan, the u.s. First, us investors must file form 5000 that establishes a residency status.

Withholding tax dividends a 20% withholding tax normally is levied on dividends paid to a nonresident, unless the rate is reduced under a tax treaty. Under the protocol, japan is permitted to tax u.s. Second, to reclaim the overseas tax, investors have to file form 5001.

5% tax rate if the corporate shareholder owns at least 10% of the reit’s voting stock and in the case of reit dividends paid to a corporation resident in cyprus or egypt, no more than 5% of the reit’s gross income consists of interest and dividends. 15% rate (10% rate in bulgaria and japan) only if: This change should be welcome news to existing.

Residents on capital gains arising from the sale of shares of a. 0 / 0 / 0 (note that a rate of 49% applies in the case of interest and certain. The protocol entered into force on 30 august 2019, the date japan and the us exchanged instruments of ratification, and applies to withholding taxes on dividends and interest paid or credited on or after 1 november 2019.

In accordance with the special taxation measure law, the tax rate imposed on dividends derivedfrom listed shares, etc.** is 15.315%*** until 31 december 2037. A 2.1% surtax increases the domestic rate to 20.42%. The 10% rate applies if the beneficial owner is a company that directly or indirectly holds at.

Under us domestic tax laws, a foreign person generally. A resident of the particular tax treaty country; From united states tax to interest received by residents of japan on debt obligations guaranteed or insured or indirectly financed by those japanese banks or insured by the government of japan.

5% when holding at least 10% for six months; 5% for holding at least 10% (direct or indirect) shares for six months. 61 rows summary of us tax treaty benefits.

For other taxes, the protocol will apply to taxable years beginning on or. Exempted when holding at least 25% for 18 months; If a tax treaty between the united states and your country provides an exemption from, or a reduced rate of, withholding for certain items of income, you should notify the payor of the income (the withholding agent) of your foreign status to claim the benefits of the treaty.

Are different from those indicated in the above table and were not amended. Exempted when paid by a company of japan, holding at least 15% (direct or indirect) or 25% (direct) shares for six months; The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both:

In some instances, however, the rates applied are not bilateral, and the other country could apply a different rate or impose different. Countries australia has tax treaties with and their required withholding tax rates are in the income tax treaties external link. The 5% rate applies if the beneficial owner is a company that directly or indirectly holds at least 50% of the capital of the company paying the dividends or has invested more than usd 10 million, or the equivalent in luxembourg or vietnamese currency, in the capital of the company paying the dividends.

Interest interest on loans paid to a nonresident corporation generally is subject to a 20% withholding tax, while that on deposits and bonds is. 3.the definition of direct investments for purposes of the 10 percent withholding rate on dividends would be Following this procedure will ensure that a withholding tax rate on foreign dividends is 15% treaty rate at a source in france.

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

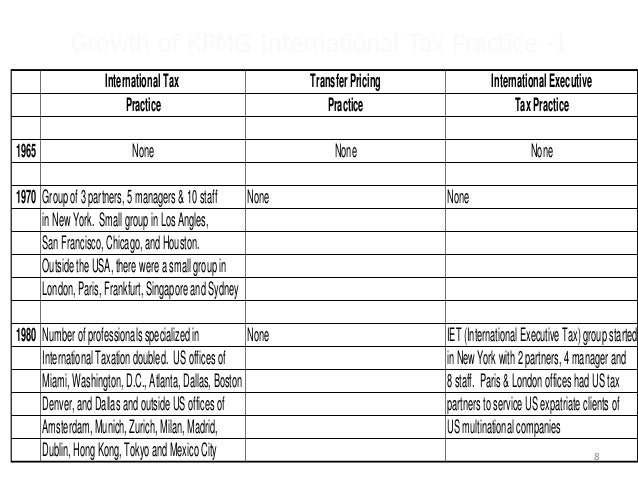

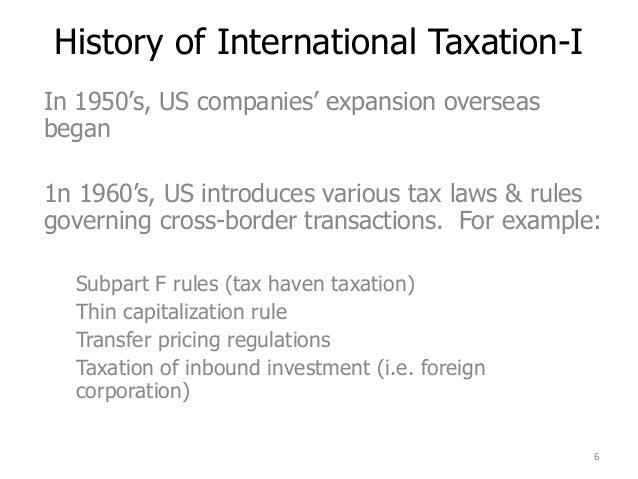

International Taxation

International Taxation

Doing Business In The United States Federal Tax Issues Pwc

2

Pdf Income Shifting In Us Multinational Corporations

Chapter 8 Are Tax Treaties Worth It For Developing Economies In Corporate Income Taxes Under Pressure

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

Unraveling The United States- Japan Income Tax Treaty And A Closer Look At Article 46 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

International Taxation

2

Us Tax Services Global Tax Deloitte Japan Tohmatsuus Taxus Corporate Tax Us Individual Income Taxus Payroll Taxus Withholding Taxincome From The International Operation Of Ships And Aircraftqualified Intermediariesqifatca

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

International Taxation

Top 8 Things To Know About Us Taxes Living Abroad In Indonesia

The King Of The North Military King In The North Military Units

Pdf Withholding Taxes On Income Paid To Nonresidents Removing A Canadian- Us Border Irritant

Tax Spillovers From Us Corporate Income Tax Reform In Imf Working Papers Volume 2018 Issue 166 2018

Us Ch Pension Plans And Treaty Benefits – Kpmg Global