The marin wildfire prevention authority measure c is a special tax charged to all parcels of real property located in marin county within the defined boundary of the “member taxing entities.”. The median property tax (also known as real estate tax) in marin county is $5,500.00 per year, based on a median home value of $868,000.00 and a median effective property tax rate of 0.63% of property value.

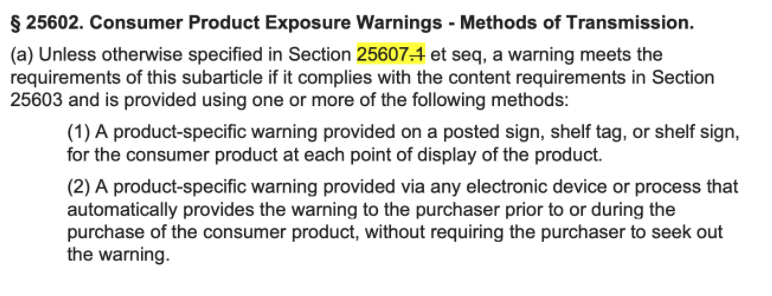

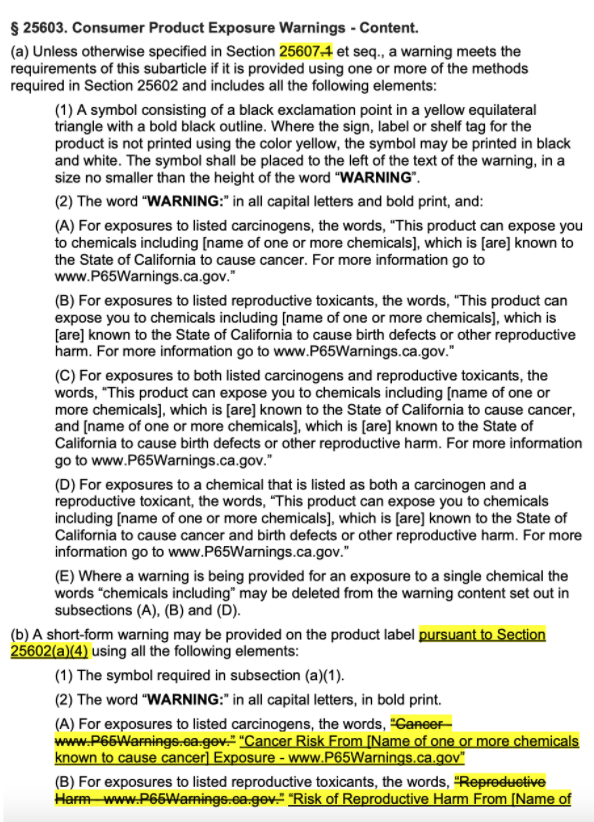

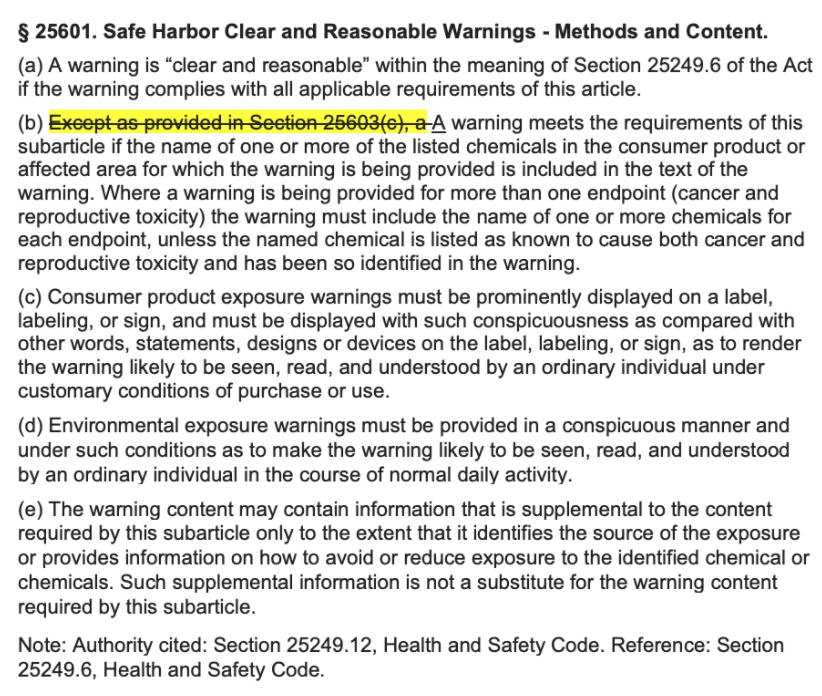

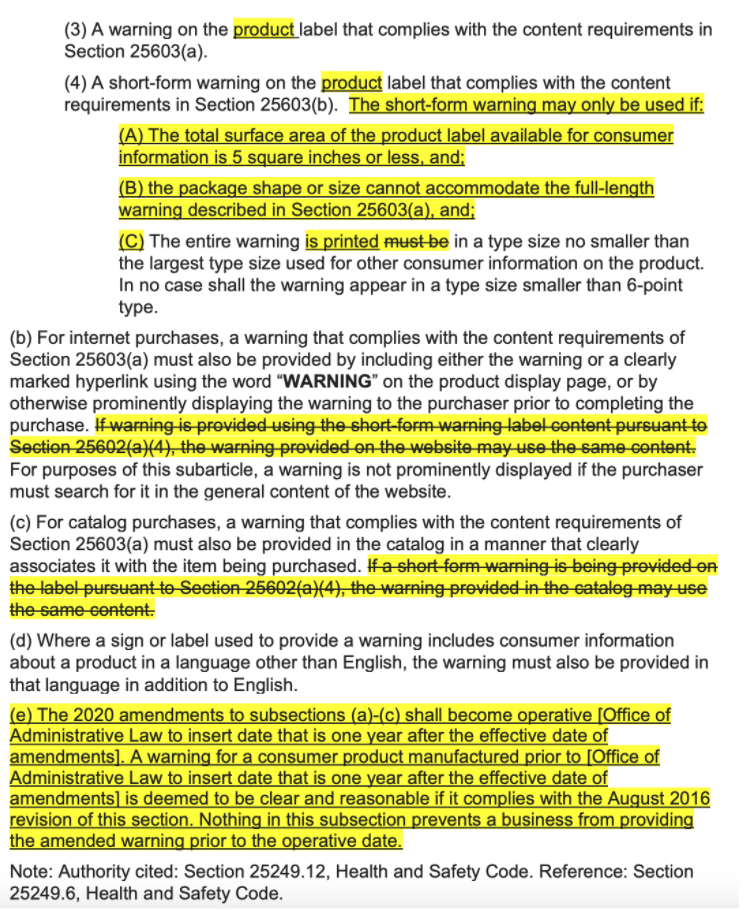

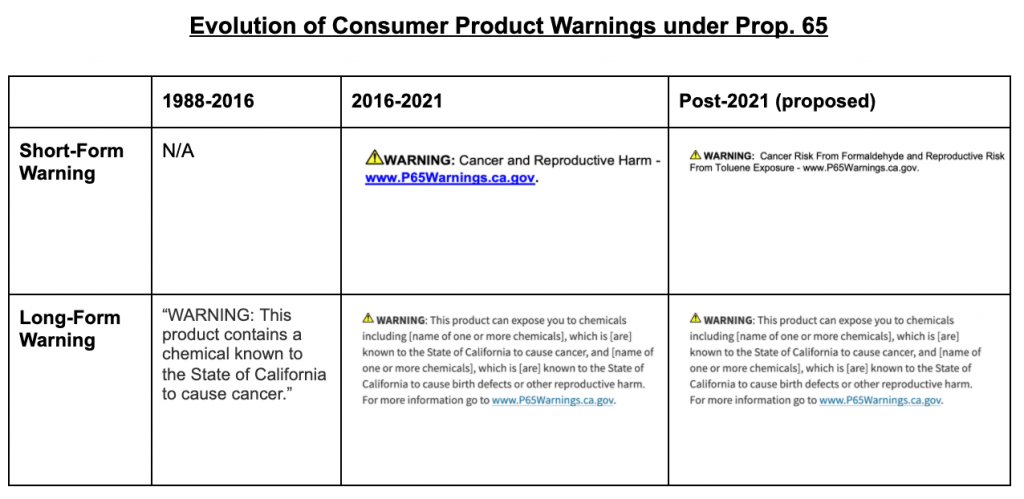

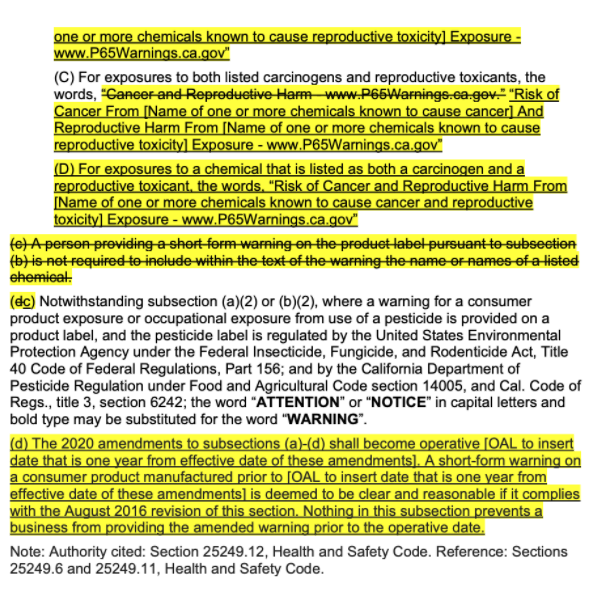

Changes To Prop 65 Warning Rules Proposed Again Law Offices Of Omar Figueroa

Where your property tax dollars go;

Marin county property tax rate 2021. The median property tax paid by homeowners in the bay area’s contra costa county is $4,941 per year. The measure, set to go into effect in early 2021, has two distinct. The 2018 united states supreme court decision in south dakota v.

It's also home to the state capital of california. Property class assessment value total tax rate property tax; The voters approved this parcel tax in march 2020, by approximately 71%, for a period of ten years starting with the 2020/21 fiscal year.

Counties in wyoming collect an average of 0.58% of a property's assesed fair market value as property tax per year. The median property tax in marin county, california is $5,500 per year for a home worth the median value of $868,000. Marin countywide successor agency oversight board;

All parties of interest associated with properties offered at tax sale have until close of business the day prior to the tax sale to redeem the defaulted taxes and remove the property from tax sale. Proposition 19 will benefit marin county and california homeowners when they sell their homes. On november 3rd, california voters approved proposition 19, a measure designed to give homeowners more freedom to change residences while closing tax loopholes on inherited properties.

Marin county collects, on average, 0.63% of a property's assessed fair market value as property tax. Secured property taxes are payable in two (2) installments which are due november 1 and february 1. Property tax appraisals the marin county tax assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis, based on the features of the property and the fair.

Marin county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. City of san rafael redevelopment successor agency;

The adjusted virus rate needs to be below 2.0 per 100,000 residents to advance, but marin’s rate on may 3. The local sales tax rate in marin county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.25% as of november 2021. This year’s tax roll of $1,262,606,363, is up 3.19% over last year.

Penalties apply if the installments are not paid by december 10 or april 10, respectively. Marin county has one of the highest median property taxes in the united states, and is ranked 26th of the 3143 counties in order of. That is nearly double the national median property tax payment.

Marin county tax collector county of marin civic center, room 202 p.o. Send the correct installment payment stub (1st or. The california state sales tax rate is currently %.

Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes. However, the county did not advance from the “moderate risk” to the more open “minimal risk” tier. Marin was eligible to advance to yellow tier 4, further opening the economy and taking another step toward prepandemic normalcy.

13 rows the county of marin department of finance makes every effort to share all pertinent parcel. Statewide the unemployment rate was 6.1 % in october and 4.3% nationally. The first installment is due november 1 and must be paid on or.

The minimum combined 2021 sales tax rate for marin county, california is. The city is offering a sanitary sewer 25% service fee credit for the upcoming 2021/22 property tax bill for those who participate on the pg&e california alternative rates for energy ( care ) program. County of marin redevelopment successor agency;

The marin county, california sales tax is 8.25%, consisting of 6.00% california state sales tax and 2.25% marin county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 2.00% special district sales tax (used to fund transportation districts, local attractions, etc). The county mailed the bills on friday. This is the total of state and county sales tax rates.

The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00. Villalobos said that between october 2020 and october 2021, marin added 5,300 jobs. Start filing your tax return now :

The marin county sales tax rate is %. Real property information about all types of taxable residential property, from real estate to boats and aircraft. The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Wyoming has one of the lowest median property tax rates in the united states, with only eleven states collecting a lower median property tax than wyoming. Rate category sewer service charge lisrap charge with 10% discount low water use $395 $355 average water use $657 $591 high water use $1,181 $1,063 Secured property tax bills are mailed only once in october.

County of marin property tax rate book reports. Property tax bills are mailed annually in late september and are payable in two installments. The median property tax in wyoming is $1,058.00 per year for a home worth the median value of $184,000.00.

The county’s average effective property tax rate is 0.81%. At that rate, the total property tax on a home worth $200,000 would be $1,620. See detailed property tax report for 123 park st, marin county, ca.

Rate Assistance Program Ross Valley Sanitary District Ca

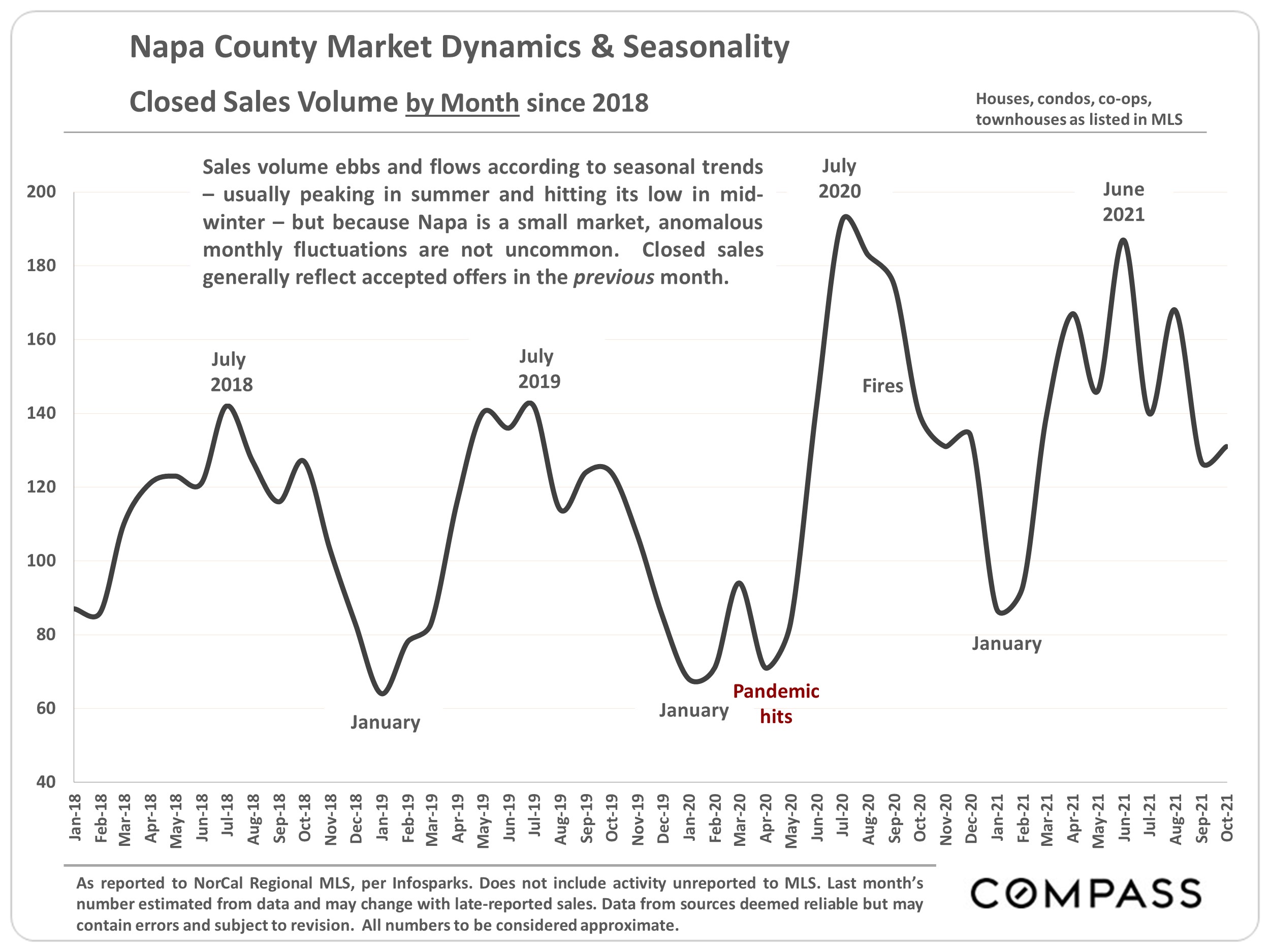

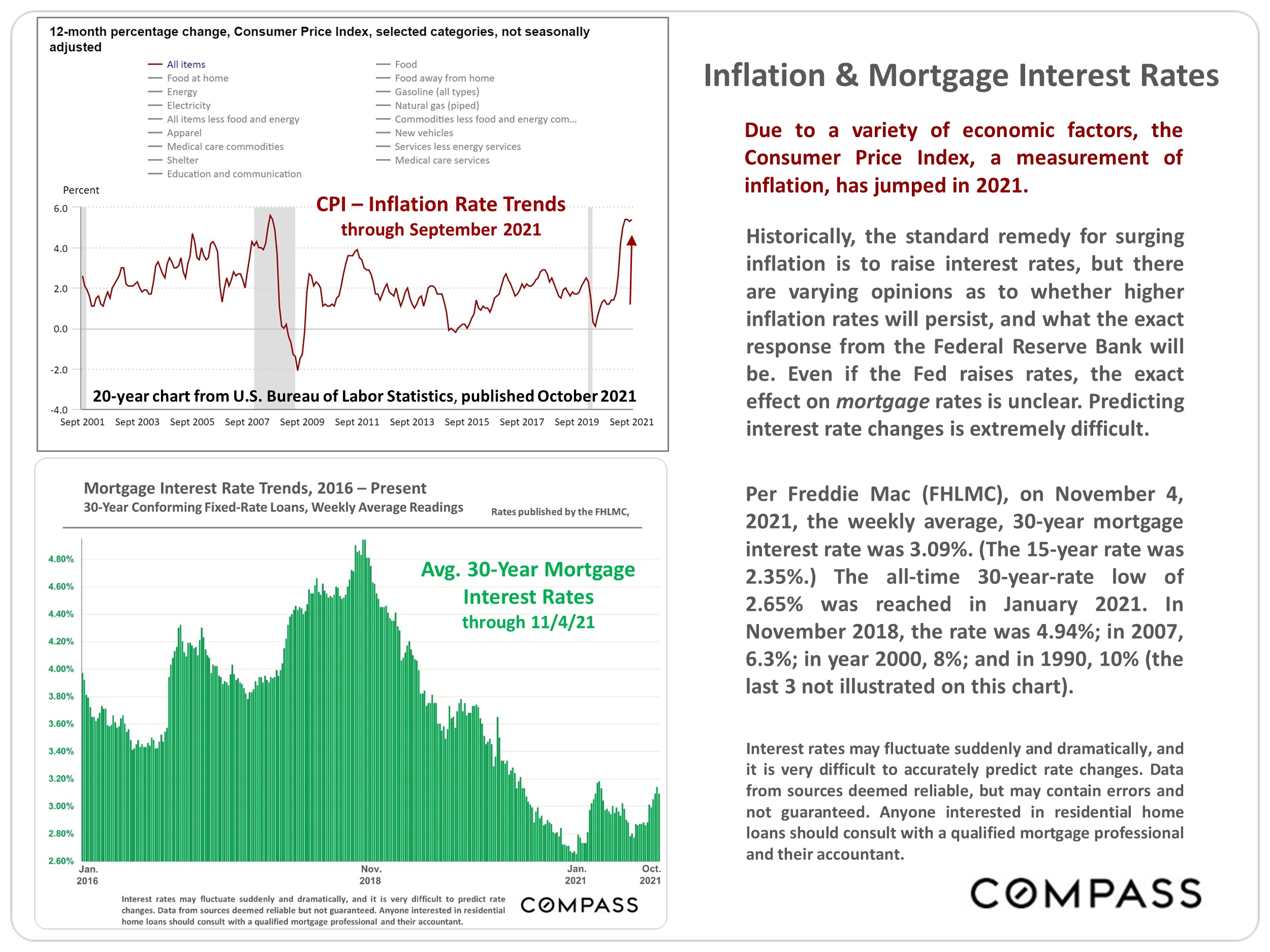

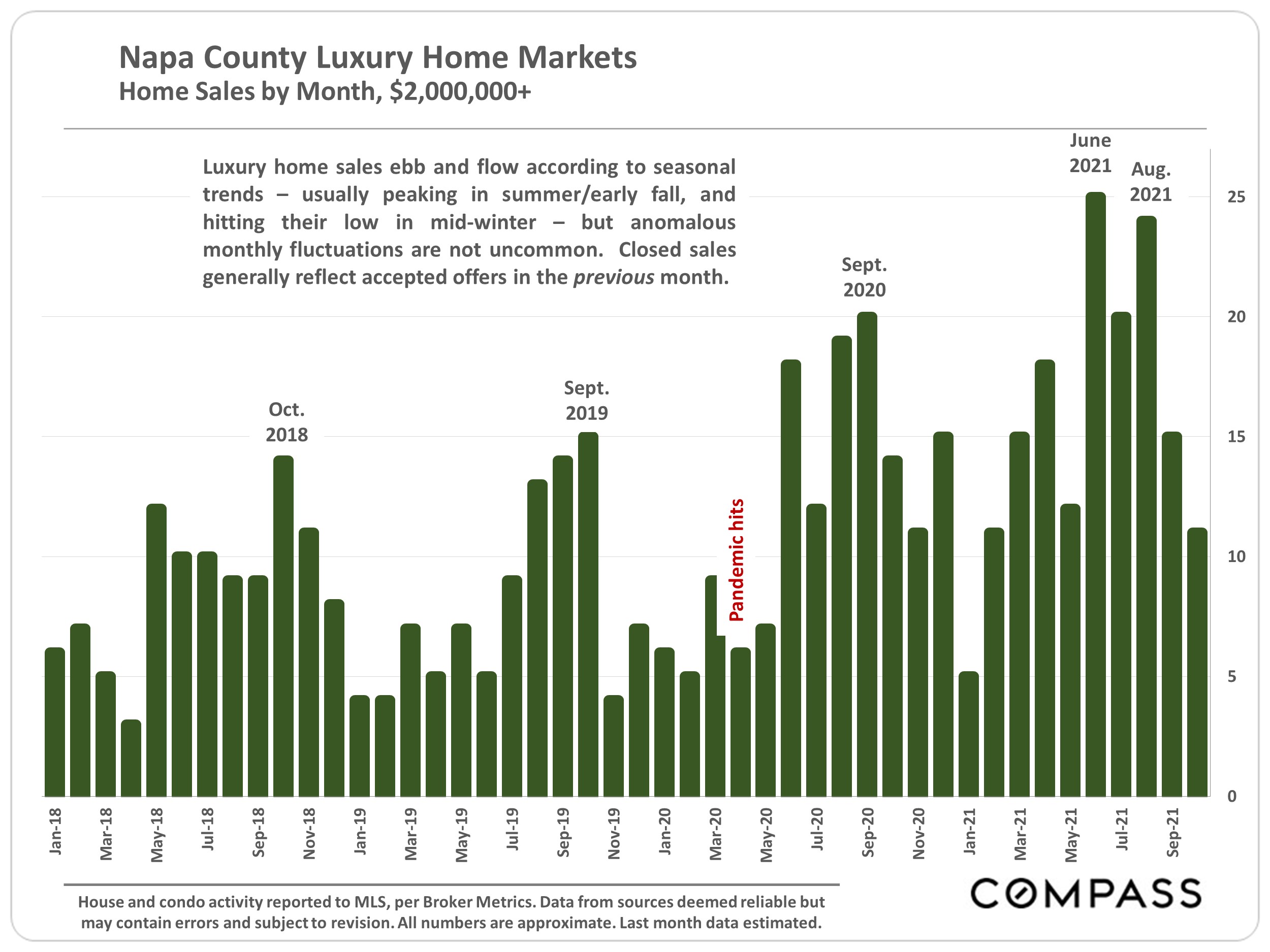

Napa County Home Prices Market Conditions – Compass

Napa County Home Prices Market Conditions – Compass

2

Index-tribune Editorial Cartoon Oct 29 2021

Napa County Home Prices Market Conditions – Compass

Changes To Prop 65 Warning Rules Proposed Again Law Offices Of Omar Figueroa

2

Changes To Prop 65 Warning Rules Proposed Again Law Offices Of Omar Figueroa

2021 Housing Forecast Infographic Real Estate Marketing Housing Market Real Estate Infographic

2

Changes To Prop 65 Warning Rules Proposed Again Law Offices Of Omar Figueroa

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

Energies July-2 2021 – Browse Articles

Changes To Prop 65 Warning Rules Proposed Again Law Offices Of Omar Figueroa

Tennessee Property Taxes By County – 2021

Changes To Prop 65 Warning Rules Proposed Again Law Offices Of Omar Figueroa

Californians Adapting To New Property Tax Rules

House Numerology Lucky Real Estate Pricing – Real Estate 101 – Trulia Blog House Numerology Real Estate Estates