The planning tab also includes a tool that is specifically designed to help you experiment with your withholding amounts—the tax withholding estimator. Review your transactions throughout the year make a habit of logging into quicken once a week to categorize transactions while they’re still.

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Make sure you have assigned the pretax contribution categories to the correct tax form lines.

Quicken tax planner problem. You can import data from tax software, change your marital status, enter annualized values for certain types of income or expenses, and estimate the amount you owe or the size of your refund. The quicken app makes it easy to see a comprehensive record of your investment funds and portfolio. The quicken tax planner is your tax management control center.

To use the tax planner, take the following steps: Choose the tax planner command. What should happen when we set up a paycheck reminder with a 401k deduction is that the deduction should go against salaries in tax planner, it should also show up in the tax reports as a 401k deduction and it should also be a transfer into the 401k account.

If you manually selected your filing status, the program may reset it back to the default filing status. The amount shown in the total tax field in the tax planner is the estimated amount of tax you will owe for the tax year. Choosing between quicken online and quicken desktop is really difficult.

It is your tax liability before other taxes and credits are calculated. A new authentication service from quicken. If you’re using quicken for windows, you can explore the optimal investing allocation.

You can update this information as you work through the tax planner wizard. In the form list, select the tax form or schedule containing the tax planner data items you want to examine. Quicken for mac imports data from quicken for windows 2010 or newer, quicken for mac 2015 or newer, quicken for mac 2007, quicken essentials for mac, banktivity.

Quicken 2012 comes with a very powerful, very useful tax planner. If you use that version's tax planner in 2021, quicken displays your current. Yet this has existed in every version after quicken 2007 was released.

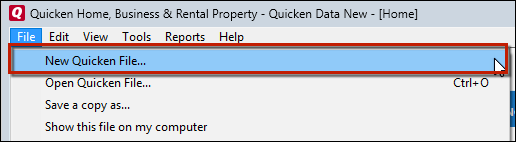

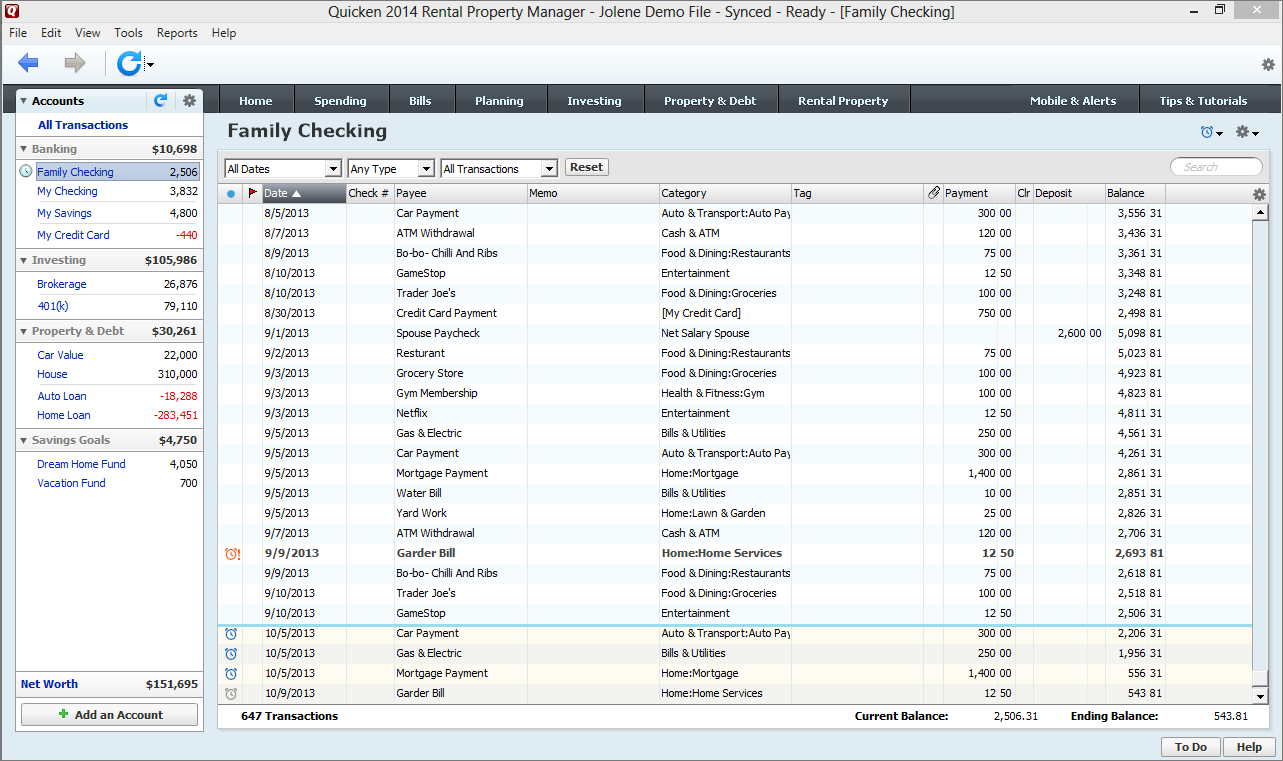

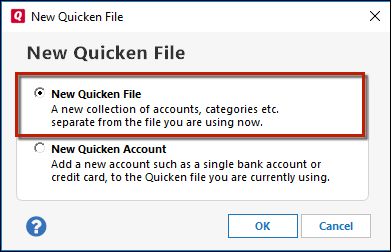

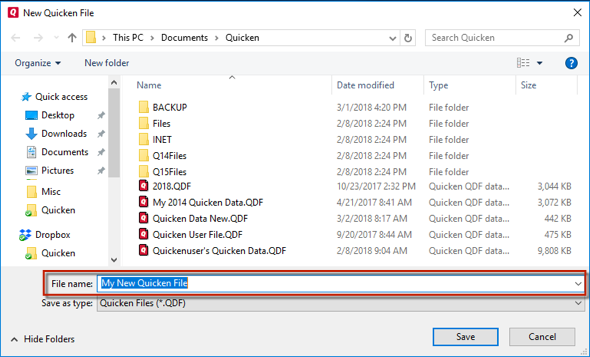

In the file name field, enter a name for the file, and click save. An issue in tax planner where scheduled state tax quarterly estimated payments made in the following year were included in this 2.) when you look at the details in the tax planner, i think you'll see the scheduled gross salary items listed first, followed by all the transfers.

Click ok to reset all scenario values to zero. Refer to the manufacturer's instructions for your tax software for information about how to import the.txf file that was created. As discussed above quicken online is easier to use and is an easy choice.

Any tax planner data fields for which no quicken data is available are reset to zero. Quicken is not set up correctly for managing 401k payroll deductions. Check with your tax advisor.

I am happy that the quicken planner takes in our current net worth, investment allocations, etc. The tax planner can use your quicken data to help you anticipate the current year’s tax liability. As quicken online is free and for using quicken on desktop you need to pay a fee.

Click the tax tools button. Choose export data > to tax export file. And then provides a ton of assumptions to calculate in current dollars and future dollars (applying my assumed 3% average inflation rate) each year (until my and dw death) and shows each.

Quicken desktop vs quicken online which one to choose? For example, the subscription release of quicken is currently in 2021, so its tax planner supports calculations for tax years 2021 and 2020. Planner can really be touchy sometimes so closing and reopening quicken sometimes help.

Yet, you should read the excuses from the quicken community users forum. After you categorize your transactions, you can use the tax planner to import data from tax. I dug into the budgeting tool with quicken.

In the save in field, select a location for the file. The tax planner helps you make a precise estimate of the taxes that you’ll owe. Dw retires in 20 months at 65 when she can start on medicare.

They will show you the impact your life choices will have on your. Horrific programming on quicken's part. No tax planner, no retirement planner, no zillow integration.

The average rate is the percentage of your income that you. The marginal rate is the percentage of tax you'd pay on the next $1,000 of income you earned. Turbotax online no longer supports quicken import.

Use the tax withholding estimator to see if you should be withholding more or less from your paycheck. Tax code changes constantly, the quicken tax planner supports two years of tax calculations: The current year and the year prior.

Quicken displays the data source and transaction details for each tax planner data item and each tax form. I'm using the paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom. They both complete all the needs of the users.

Also check the link in the upper right of the details box to confirm the tax line items are correct for how you are booking it. The quicken 2012 tax planner. If you've set up scenario 1, 2, or 3 in the tax planner and that scenario is selected, select reset scenario.

In the item list, select the appropriate data item. If you’re not satisfied, return this product to quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less. And of course you don't get any of the bells and whistles as you do with the quicken windows product.

Remember that the purpose of the tax planner is to help you get a realistic view of your tax liability for the year.

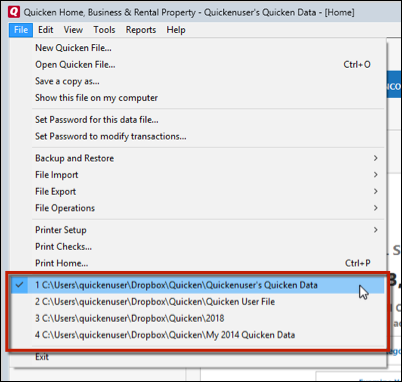

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

The Biggest Hurdle In Buying A House Is Laying Down A Deposit Heres Our Guide To Changing Your Spending Habits Money Lessons Tax Free Savings Money Plan

888-846-6939-instant Quicken Help To Fix Quicken 2018 Issues

Akuntansi Keuangan Pengertian Akuntansi Definisi Akuntansi Financial Accounting Accounting Financial

Turbotax Business 2015 Federal Fed Efile Tax Preparation Software Pc Disc With Quicken Rental Property Manage Tax Preparation Turbotax Accounting And Finance

Golden Rules Of Accounting – World Of Accounts Accounting Finance Class Accounting Notes

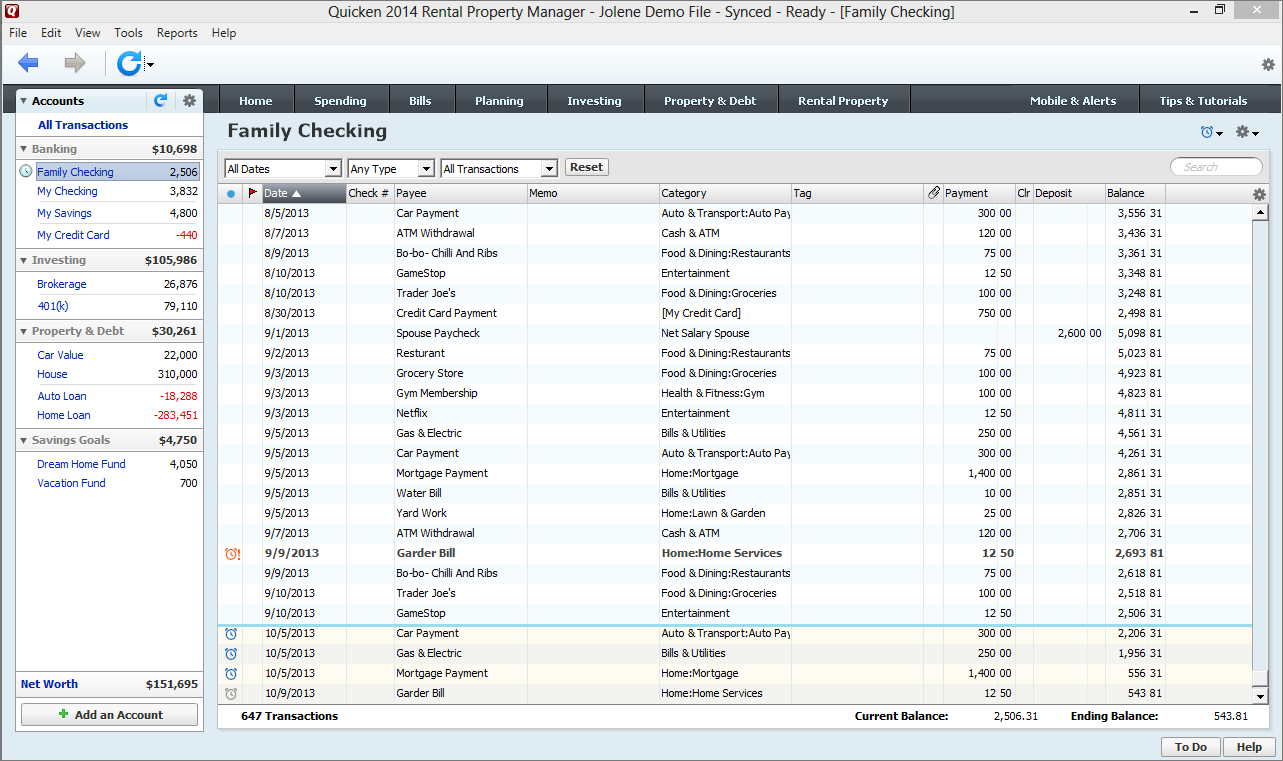

How I Learned To Love Quicken Deluxe And Give Up On The Past – Tidbits

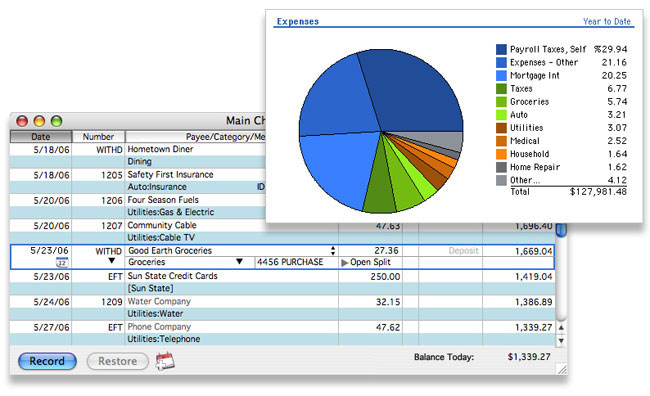

Quicken – Wikiwand

How I Learned To Love Quicken Deluxe And Give Up On The Past – Tidbits

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Information – Debt Collection Garnishment Repossession – Consumer Taxes Welcome To Oregonlawhelporg A Guide To Fre Debt Collection Debt Debt Repayment

Tax Planner And Import Data From Turbotax Quicken

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Helpful Support Services

Tax Planner And Import Data From Turbotax Quicken

Warehouse Management Software In 2021 Inventory Management Software Online Accounting Software Warehouse Management

Quicken 2019 For Mac Review – Robert Breen

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Ir Report Template 1 – Templates Example Templates Example Report Template Templates Electrical Engineering Projects