Here’s another way of describing this idea: If you itemize your tax return, you can reduce your tax burden by giving a gift of cash to a charity (or charities) of your choice.

Craig On Federal Budget Budgeting Federal Income Tax

If you have a final salary scheme, you’ll also need to include any benefits you’ve built up in that.

How to reduce taxable income for high earners 2020. Here are 6 ways to accomplish your goal and reduce your tax bill: Any more than that and. And, you have until the april.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. The law allows you to give up to 60% of your adjusted gross income and deduct it on one tax return. This credit will reduce his tax bill to zero.

The good news is that with a combination of tax deductions, tax credits, and contribution strategies, you can reduce your tax bill by reducing your taxable income. 6 ways to reduce taxable income as a high earner. One of the tax reduction strategies for high income earners that i think a lot of people don’t fully understand is selling inherited real estate.

When you inherit real estate, particularly in the state of california with community property rules, you get a full step up in basis, making your property tax go up. As you know, a tax deduction shrinks your tax bill by shrinking your taxable income. For example, your parents bought a home for.

Max out your retirement contributions John’s retirement savings contributions credit will be $545. If, for example, you earn $70,000 and take a $5,000 deduction, your taxable income will shrink by $5,000.

For example, in 2020, we plan to deduct all of the following from our taxable income: To calculate your adjusted income, take your taxable income for the year, add employer pension contributions and subtract any reliefs that apply. Find out how to lower your tax bill for 2020.

This will help you reduce tax paid on the higher tax bracket and save more money. The retirement savings contributions credit, or saver’s credit, offers taxpayers a credit of 10%, 20% or 50% of contributions to retirement savings accounts such as a 401k or an ira. Fall to 17 per cent by 2020.

Another way to reduce your taxable income is to contribute to health savings account, or hsa.

4 Ways High-earners Can Reduce Taxable Income Best Local Financial Advisors In Salt Lake County Ut Truenorth Wealt

Pin On Article

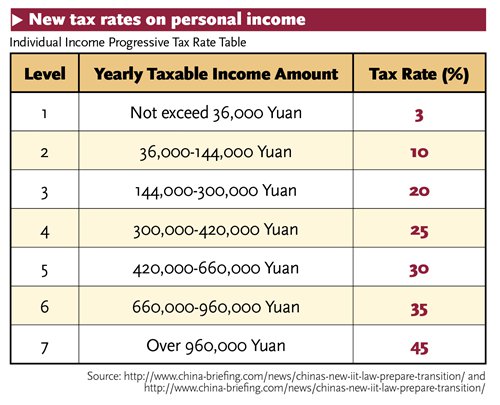

Expat Tax Guide 2019 – Global Times

Your Guide As To Whats In The 2019 Budget – Nexia Edwards Marshall Nt

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Individual Income Tax In Malaysia For Expatriates

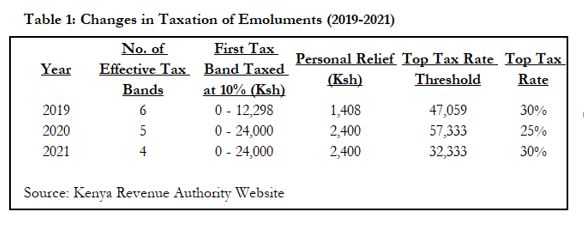

Evaluating Kenyas Tax Law Changes On Paye In January 2021 – Iea Kenya

How To Reduce Income Tax In India Income Tax Income Tax

How To Use Tax-loss Harvesting To Improve Your Returns Capital Gains Tax Income Tax Brackets Tax

Pdf Social Welfare Effects Of Progressive Income Taxation Under Increasing Inequality

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pay Highway Toll In Seconds With Fastag Free Travel Radio Frequency Identification Air Pollution

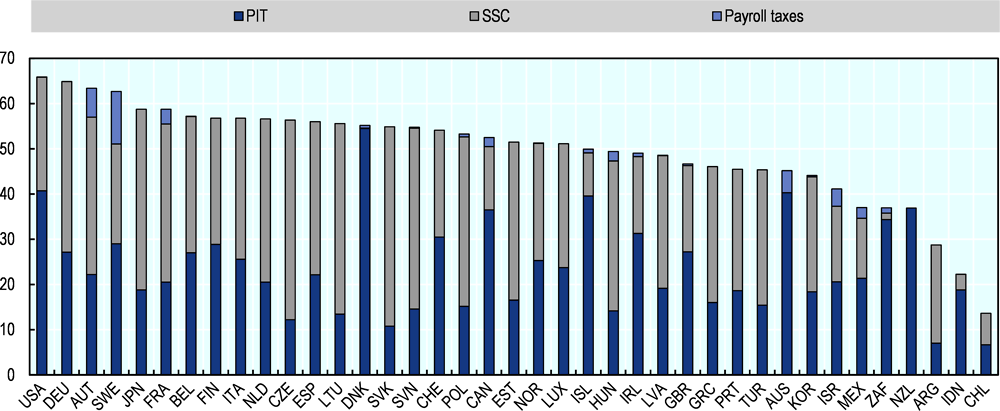

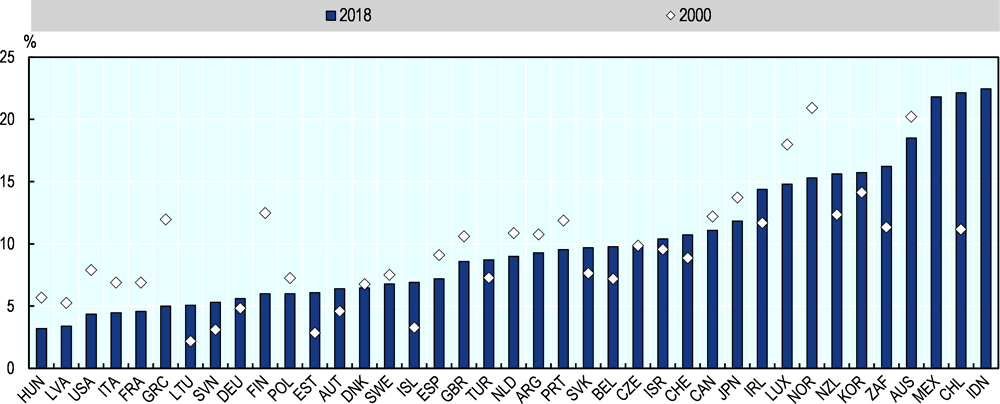

Tax Reforms Before The Covid-19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

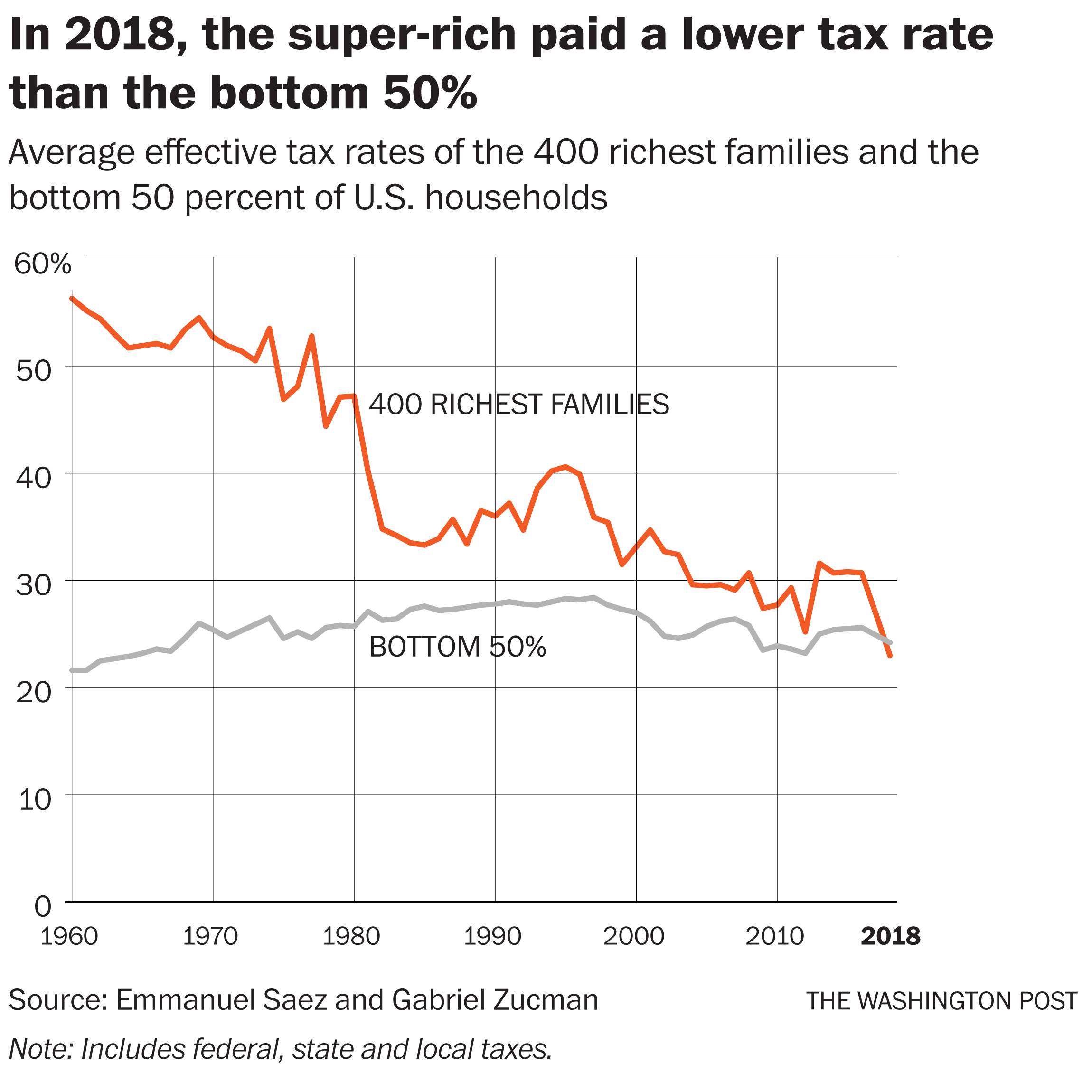

For The First Time In History Us Billionaires Paid A Lower Tax Rate Than The Working Class – The Washington Post

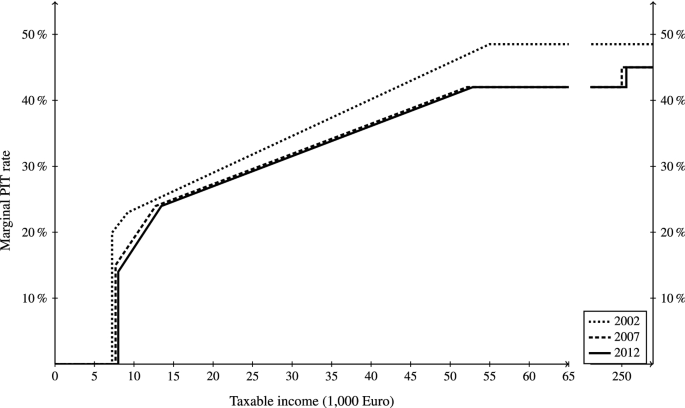

The Effects Of Income Taxation On Entrepreneurial Investment A Puzzle Springerlink

Tax Reforms Before The Covid-19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Saving Income Tax Saving For Fy 2020-2021

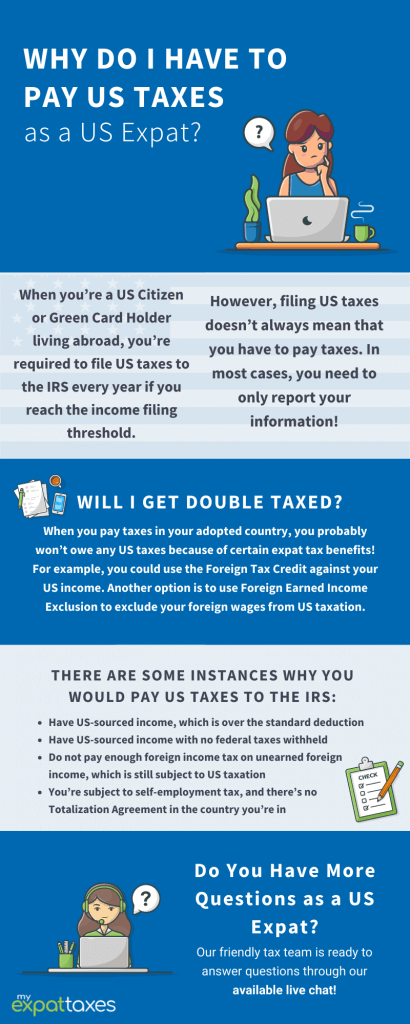

Paying Us Expat Taxes As An American Abroad Myexpattaxes

How Does The Deduction For State And Local Taxes Work Tax Policy Center