Cleveland (wjw/ap) — we’re days away from the sixth and final advance child tax credit payment in 2021. Extending it has been part of budget negotiations in.

How Do I Get My Child Tax Credit Payments In 2022 – Fingerlakes1com

In the meantime, some lawmakers are working to repeat it in 2022.

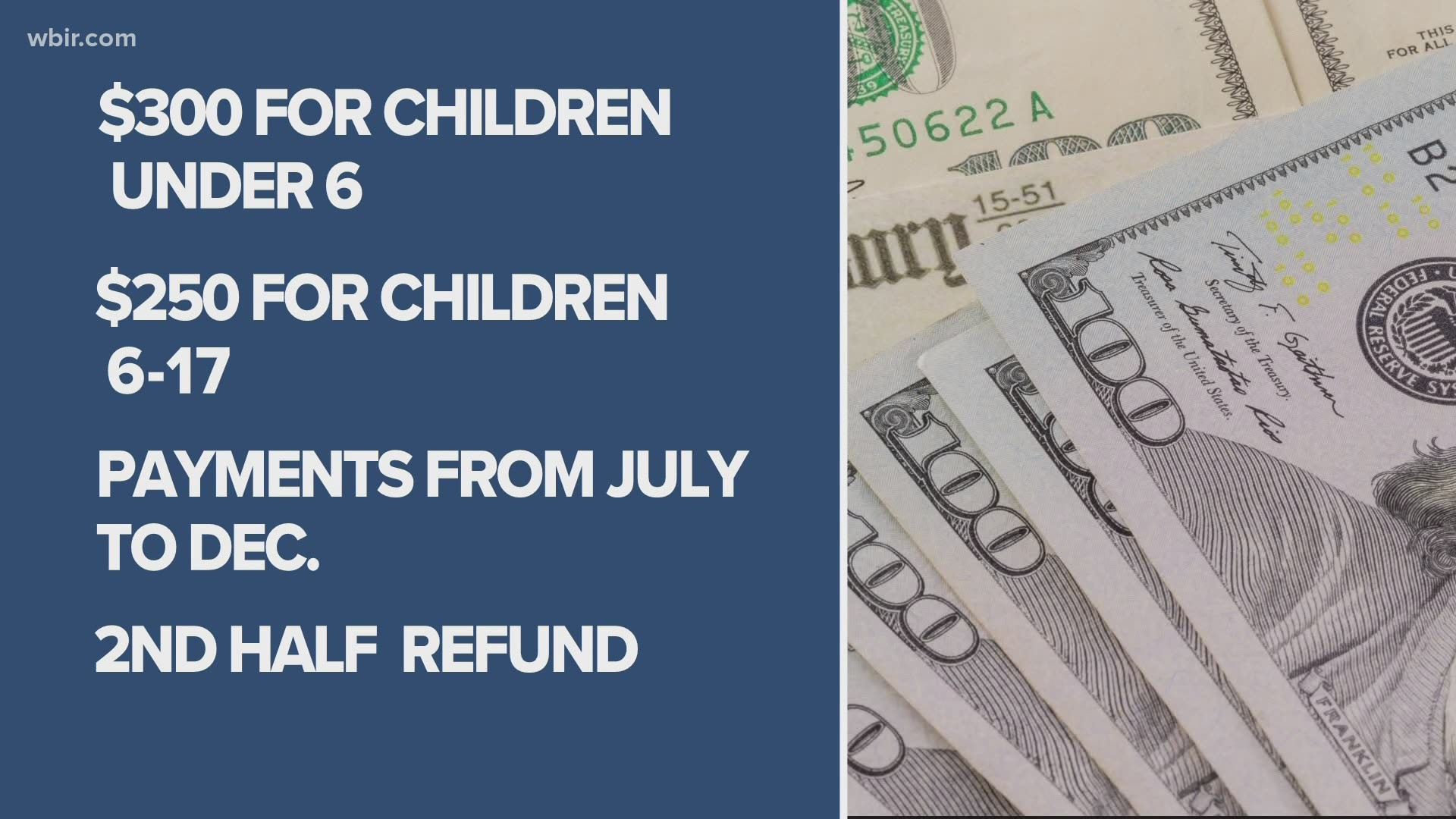

Will advance child tax credit payments continue in 2022. In january 2022, the irs will send families that received child tax credit payments a letter with the total amount of money they got in 2021. The enhanced value of the child tax credit would be extended for another year, through 2022. That means monthly payments would be provided to parents of nearly 90 percent of american children for 2022, which is $300 per month per child under six and $250 per month per child ages 6 to 17.

Parents would get up to $3,000 per child under age 18,. Only two child tax credit checks are remaining for 2021, with the second half of the payments arriving during tax season next year. Democrats are still hammering out details of the framework.

The advance child tax credit payments are set to expire at the end of the year. Expanded advanced monthly child tax credit extended into 2022. The enhanced child tax credit, including advance monthly payments, will continue through 2022, according to a framework democrats released thursday.

The advance child tax credit payments are set to expire at the end of the year. Currently, the expanded child tax credit provides $3,600 for each. By the end of this year, families will have received.

Will monthly child tax credit payments continue into 2022? 2022 changes to child tax credit in 2022, the monthly payments would continue, but this time would stretch throughout the full calendar year with 12 monthly payments, with maximums remaining the. Of course, families would be able to claim the remaining half of their payments on their tax returns.

The advance child tax credit payments are set to expire at the end of the year. Will monthly child tax credit payments continue into 2022? Under the build back better act, you generally won't receive monthly child tax credit payments in 2022 if your 2021 modified agi is too high.

Now, even before those monthly child tax credit advances run out (the final two payments come on nov. Under biden’s build back better spending plan the current expanded child tax credit will be extended for another year, bringing the total amount paid over 2 years to a maximum of $7,200. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

In 2021 and 2022, the average family will receive $5,086 in coronavirus stimulus money thanks to the expanded child tax credit. For each qualifying child age 5 and younger, up. Those payments, however, are set to end in december, though, if some lawmakers have the way, the money will keep flowing in 2022.

In the past, joe biden has called to. Extending it has been part of budget negotiations in congress. Will monthly child tax credit payments continue into 2022?

This money was authorized by the american rescue plan act, which. The latest on the enhanced child tax credit getting extended past 2022 given the popularity of the program with millions of families, there's a chance the credit could be extended. 15), democratic leaders in congress are working to extend the benefit into 2022.

“the build back better framework will provide monthly payments to the parents of nearly 90 percent of american children for 2022 — $300 per month per child under 6 and $250 per month per child. Extending it has been part of budget negotiations in congress. The next step is for democrats to vote on the framework and then write the actual legislation, which will need to pass congress.

Two more child tax credit checks are on the schedule for this year, with the second half of the payments arriving during tax season in 2022. The thresholds for monthly payment ineligibility are. At the very least, the current advance payments will likely remain in effect in 2022.

Enhanced Child Tax Credit To Continue For 1 More Year Per Democrats Plan

Child Tax Credit Deadline To Enroll Is November 15 Deadline To Opt-out November 11 Pix11

Child Tax Credit Boost Saved My Family After Landlord Increased Rent We Cant Afford To Lose Checks In 2022

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor – Fingerlakes1com

Child Tax Credit 2022 Who Will Be Eligible For Ctc Extension Payments Marca

Child Tax Credit 2022 How Next Years Credit Could Be Different Kiplinger

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

How The Child Tax Credit Originated And The Future Of The Child Tax Credit Forbes Advisor

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 – Alcom

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know – Cnet

O9aujiadyqv53m

Child Tax Credit 2022 Extension Update Is It In The Biden Plan 10tvcom

Child Tax Credit 2022 Extension Update Is It In The Biden Plan Kagstvcom

Monthly Advance Child Tax Credit Payments To Start This Week King5com

Child Tax Credit You Can Opt-out Of Monthly Payment Soon Abc10com

What Does The New Child Tax Credit Mean For Your 2022 Taxes Heres What We Know

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know – Cnet

Child Tax Credit 2021 Update – Surprise 8000 Stimulus Can Be Claimed As 3600 December Check To Be Sent In Days