However, recent developments, particularly higher state and federal expenses, have canceled the irs garnishment of social security benefit. Under the automated federal payment levy program, the irs can garnish up to 15 percent of social security benefits.

Da Form 4856 Online

Thus, social security payments may be levied by the irs for up to 15% of the payment.

Irs tax levy on social security. When the taxpayer receives social security and owes federal taxes, irs typically uses a §6331(h) levy to collect the tax, and limits its collection to no more than 15%. The irs can garnish 15 percent of social security income for past due income taxes. For example, if your benefit is $1,000, the irs can take up to $150.

In fact, the protection the social security act provides for social security benefits against creditors does not extend to the government or the internal revenue service (irs). Traditionally, welfare benefits like social security had the privilege of being exempt from garnishment. Many taxpayers are not even aware that the irs can levy social security benefits.

Through a manual levy, the government does not take a set percentage. That 15 percent will be used to pay off your tax debt until it is paid in full. It is very uncommon for the irs to garnish pensions and other retirement income.

The irs leverages the federal payment levy program (fplp) to take 15 percent of your social security benefits payments to satisfy the tax debt, regardless of the amount of money you are left with. Generally speaking, the irs has an automatic levy of your social security at 15 percent. The irs will continue to garnish your benefits until you pay your back taxes in full.

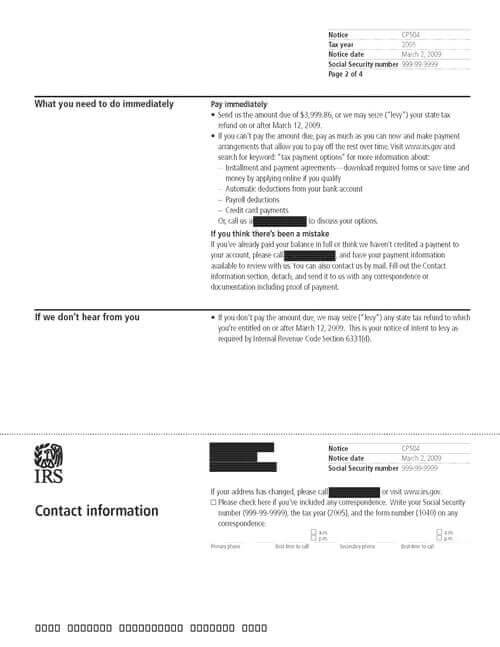

Rather, it allots you a minimum amount of living expenses and garnishes everything over. The irs just sent you notice cp91, final notice before levy on social security benefits. A widow came to tas for help because the irs was trying to levy against her social security payments and that would cause her a financial hardship.

407) protects social security benefits from garnishment, levy or other withholdings by the federal government, except: Under irc sec (6331 (h), the irs is permitted to levy 15 % to pay delinquent tax debts under the federal payment levy program. Fifteen percent of the social security benefit will be levied through the fplp regardless of.

The amount owed to the irs was due to payroll taxes from her deceased husband’s business which had closed. All personal details are removed to protect the taxpayer’s privacy. The irs, however has a manual levy program under irc sec 6331 (a), and the 15 % levy is a supplement to the manual levy power.

Instead, the irs seized his entire social security benefit—that is, his “fixed and determinable right to payment” of his social security benefit in monthly installments—immediately upon issuing the notice of levy in june 2013. Section 207 of the social security act (42 u.s.c. Though the irs has many different ways to collect a tax debt from you, there are some exceptions.

Garnishment of social security for federal tax debt will not happen wihtout notice. For example, social security payments, which are subject to levy under present law, would become subject to continuous levy. A common misconception is the irs is limited to levying 15 % of the social security received.

Because the fplp is used to satisfy tax debts, the irs may levy your social security benefits regardless of the amount. The irs can levy a taxpayer’s social security payments to pay unpaid taxes. If you owe the federal taxes, the irs will send you a notice before the offset occurs.

Section 6331(a) is a less frequently used manual levy by irs revenue officers and has no limit. But §6331(h) is not the only way irs can collect against social security. Social security levies, like wage levies, are “continuous” and apply until a taxpayer’s tax debt is paid.

The irs will apply this amount to your taxes owed. To enforce child support and alimony obligations under section 459 of the social security act (42 u.s.c. In 30 days, the irs can notify the social security administration that you have a tax debt, instruct them to deduct 15% of your benefit, and send the money to them.

With a notice of levy to collect overdue federal taxes under section. An levy on your social security is permitted by internal revenue code 6331. In fact, the revenue officer may take 100% of the social security payments.

Know the social security payments. Generally, if a taxpayer fails to pay any tax owed to the federal government within 10 days after notice and demand, the internal revenue. Such a levy will continue until all the back taxes along with penalties and interest are entirely paid.

As of february 2002, the irs can now levy social security for tax debt. Instead, the irs seized his entire social security benefit—that is, his “fixed and determinable right to payment” of his social security benefit in monthly installments—immediately upon issuing the notice of levy in june 2013. Although some wage garnishments can be avoided if you either file bankruptcy or start receiving disability benefits, irs tax levies are not stopped.

Having seized his entire benefit before. The amount that the irs is able to levy your social security is 15% of your monthly benefits. What is the federal payment levy program?

Irc 6331(h) is an automated levy that is limited to 15% of the social security payments. Under the fplp, the irs can garnish up to 15% of your social security benefits each time you receive your check.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Pin On Jerry Springer

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Releases Draft Form 1040 Heres Whats New For 2020 Tax Return Irs Forms Income Tax Return

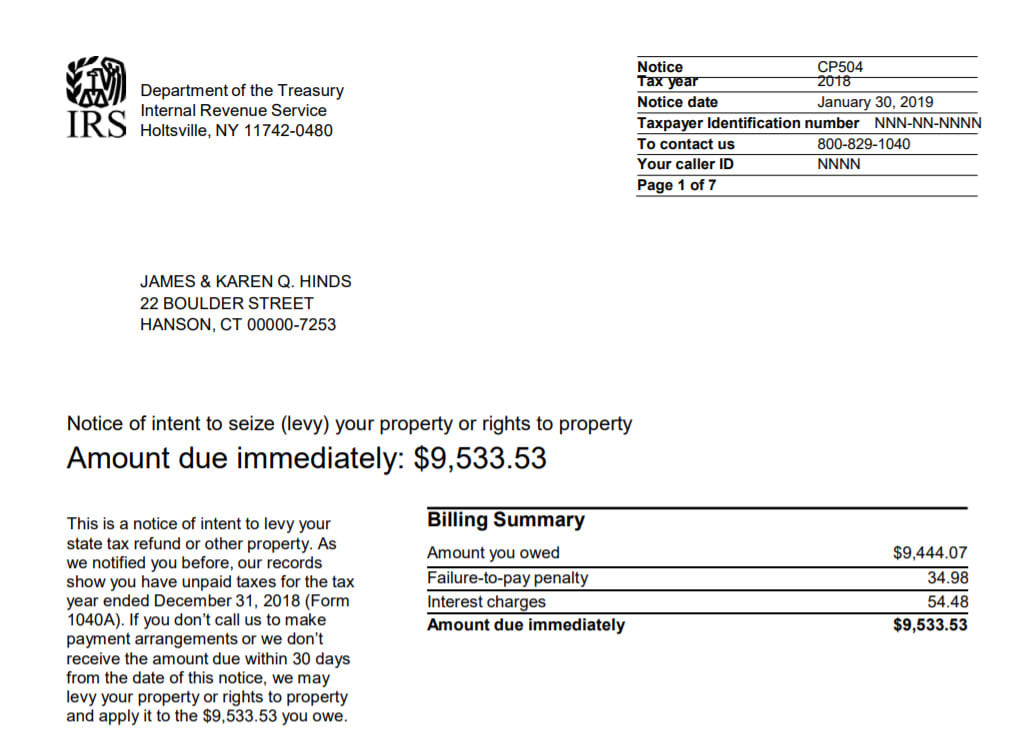

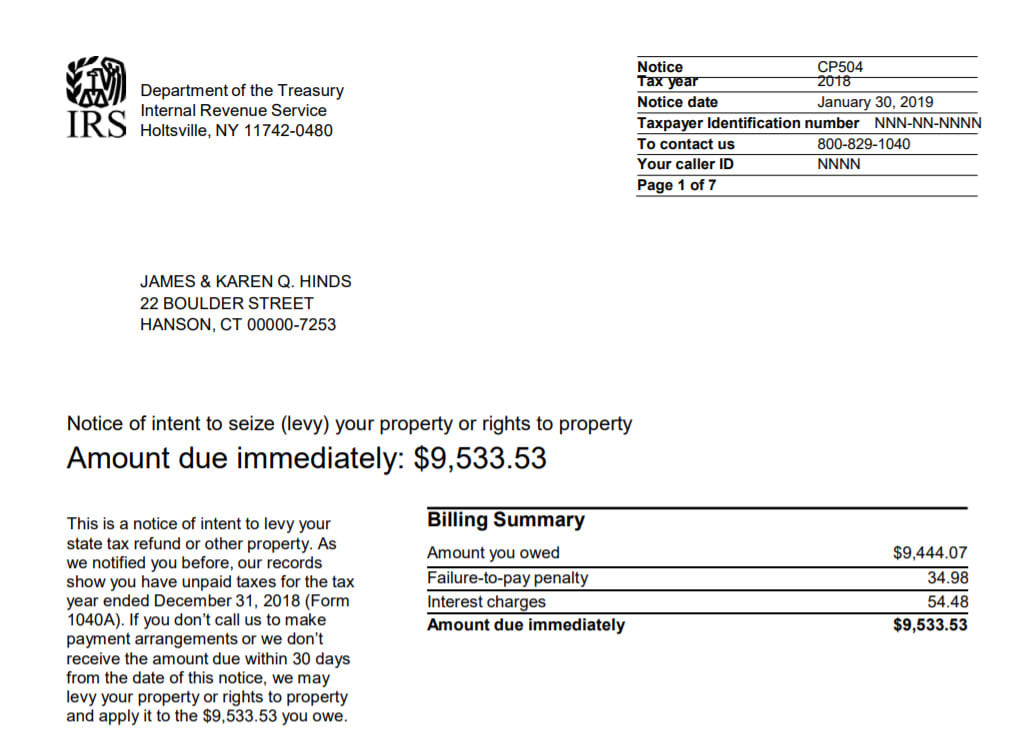

Irs Notice Cp91 – Intent To Seize Social Security Benefits Hr Block

Answer Your Questions To Irs Tax Notices And Letters By Kennethcwaters Fiverr

Irs Notice Cp503 – Second Reminder For Unpaid Taxes Hr Block

Irs Installment Agreement Maywood Il 60153 Wwwmmfinancialorg Tax Debt Debt Help Payroll Taxes

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Dependent Tax Debt Debt Debt Reduction

Pin On Startup

Can Social Security Disability Benefits Be Levied To Satisfy Unpaid Federal Income Tax Debts T Tax Debt Federal Income Tax Social Security Disability Benefits

A Simple Guide To Understanding Irs Penalties In 2021 Irs Taxes Tax Debt Tax Return

Flat Fee Irs Income Tax Relief – One Day Affordable Irs Levy Help Can I Have An Irs Levy Stopped And Released In 1 Irs Taxes Debt Relief Programs Debt Relief

Irs And State Bank Levy Information – Larson Tax Relief

The Irs May Levy Seize Assets Such As Wages Bank Accounts Social Security Benefits And Retirement Inco Tax Debt Social Security Benefits Retirement Income

Can The Irs Garnish Your Social Security Payments The W Tax Group

Pin By Brigham Calhoun Pc On Tax Tips Business Tips Calhoun Cpa

Irs Installment Agreement Georgetown Tn Mm Financial Consulting Inc Irs Taxes Payroll Taxes Internal Revenue Service

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien