You seem to be lost on the internet. We use cookies to give you the best possible experience on our website.

Taxes On Cares Act Ira Withdrawals – Form 8915-e – Youtube

And it helps to know the 8915 has nothing to do with stimulus funds.

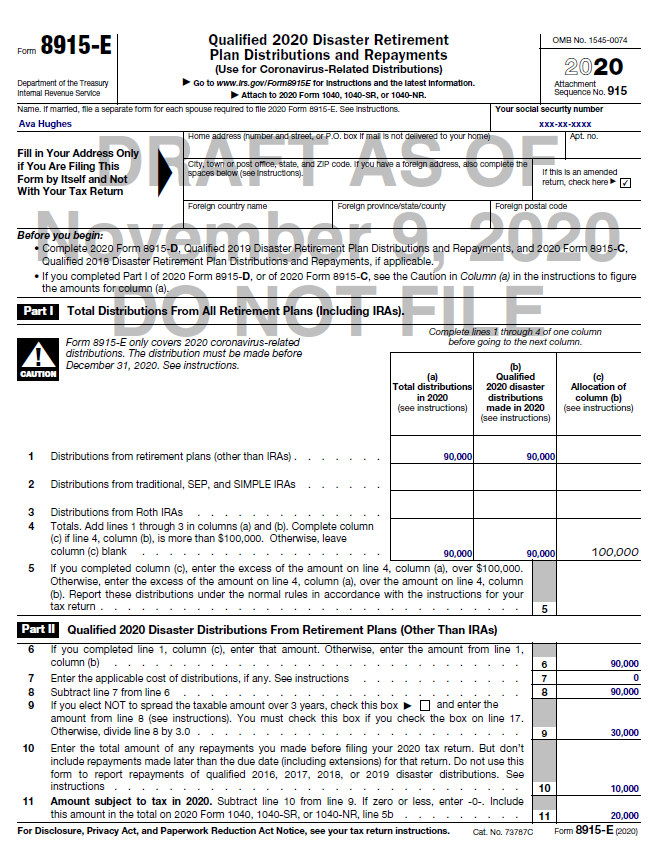

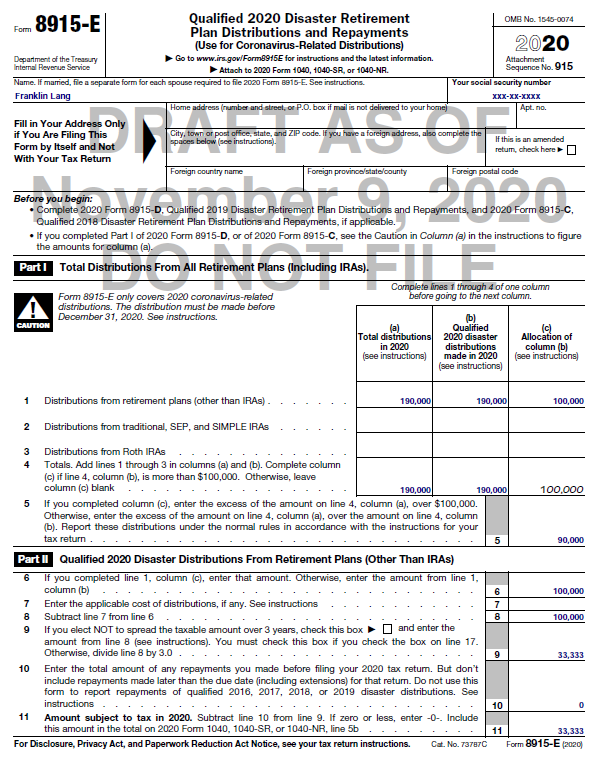

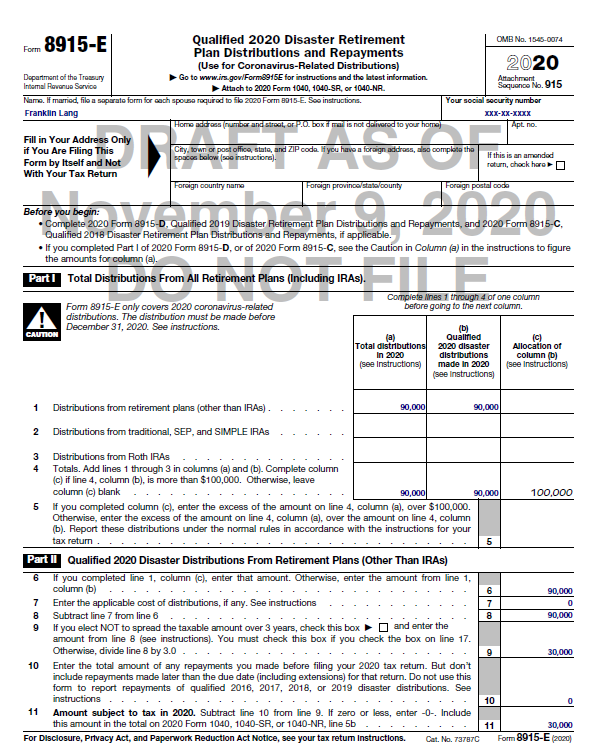

8915 e form tax act. On the form itself, it asks what. Report of a sale or exchange of certain partnership interests. The distribution, whether an actual distribution or a plan loan offset, can be made from a variety of retirement plans:

If you need links for stimulus funds, i have these resources to offer: We don't know who is holding up release of your forms. Screens for these forms can be accessed in the program by clicking the available link on screen 1099 , or by clicking the following screen links from the adjustments tab of the data entry menu :

Application for automatic extension of time to file certain business income tax, information, and other returns. Create this form in 5 minutes! Partnership declaration for an irs efile return.

Click retirement plan income in the federal quick q&a topics menu; The irs has not communicated when the form will be available for including in the 2020 federal tax return. To take your distribution in three equal amounts over three years and waive the 10% penalty for the early.

So, if you, your spouse, your dependent, or a member of your household was impacted by the coronavirus and you withdrew from your retirement accounts in 2020 before the age of 59 ½, you may not have to pay the 10% early withdrawal penalty (or the 25% additional tax for simple. The form includes information about the 10% early withdrawal waiver, your ability to spread taxable amounts over three years, and the option to repay prior cares act withdrawals. This is not a place for tax guidance.

From within your taxact return (online or desktop), click federal. How to create an esignature for the instructions 8915 form. Once the form and instructions have been finalized it will be included in the turbotax program.

The info here is for using specific income tax preparation programs. Get access to thousands of forms. For instructions and the latest information.

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

National Association Of Tax Professionals Blog

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions – Dont Mess With Taxes

Form 8915-e – Basics Beyond

National Association Of Tax Professionals Blog

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

Form 8915-e For Retirement Plans Hr Block

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915-e Explained – Youtube

National Association Of Tax Professionals Blog

8915 E Form – Fill Online Printable Fillable Blank Pdffiller

2

Re When Will Form 8915-e 2020 Be Available In Tur – Page 19

Solved Re Form 8915-e Is Available Today From Irs When – Page 2

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions – Dont Mess With Taxes

8915 E – Fill Online Printable Fillable Blank Pdffiller

![]()

Tax Newsletter December 2020 – Basics Beyond

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

A Guide To The New 2020 Form 8915-e

2