If it no longer meets these criteria, you can reassess it. The 421a tax exemption program was started in 1971 to encourage the development of underutilized or vacant property by dramatically reducing property taxes for a set amount of time.

421a Tax Abatement Archives Nestapple

More details can be found in hcr fact sheet #41:

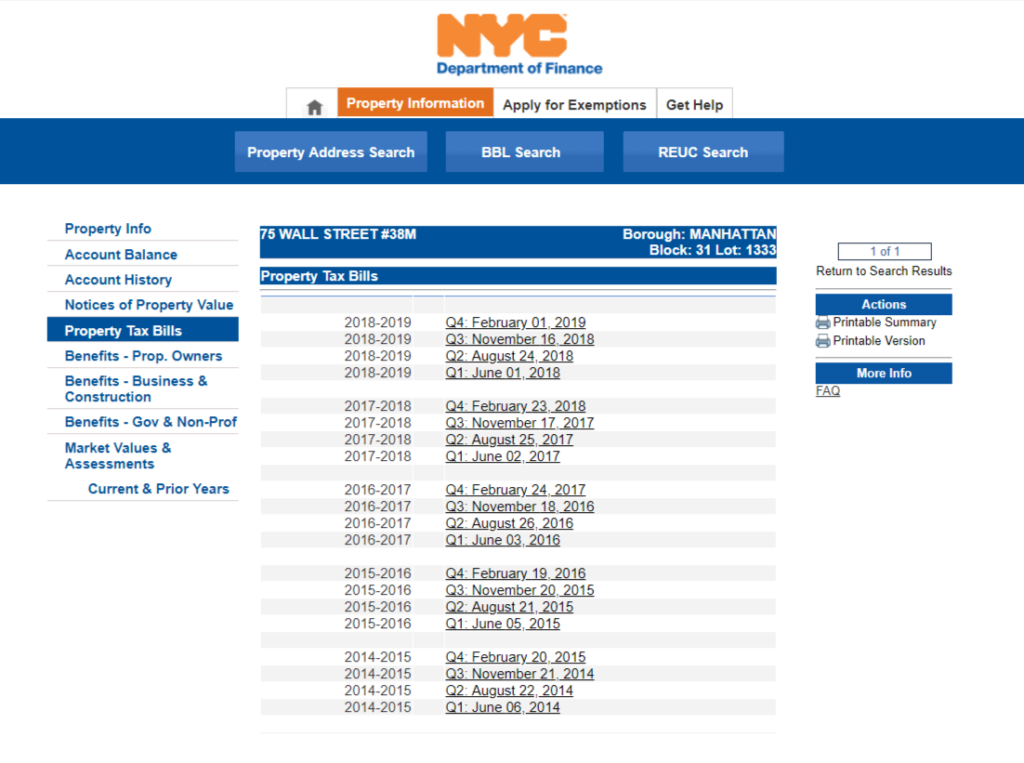

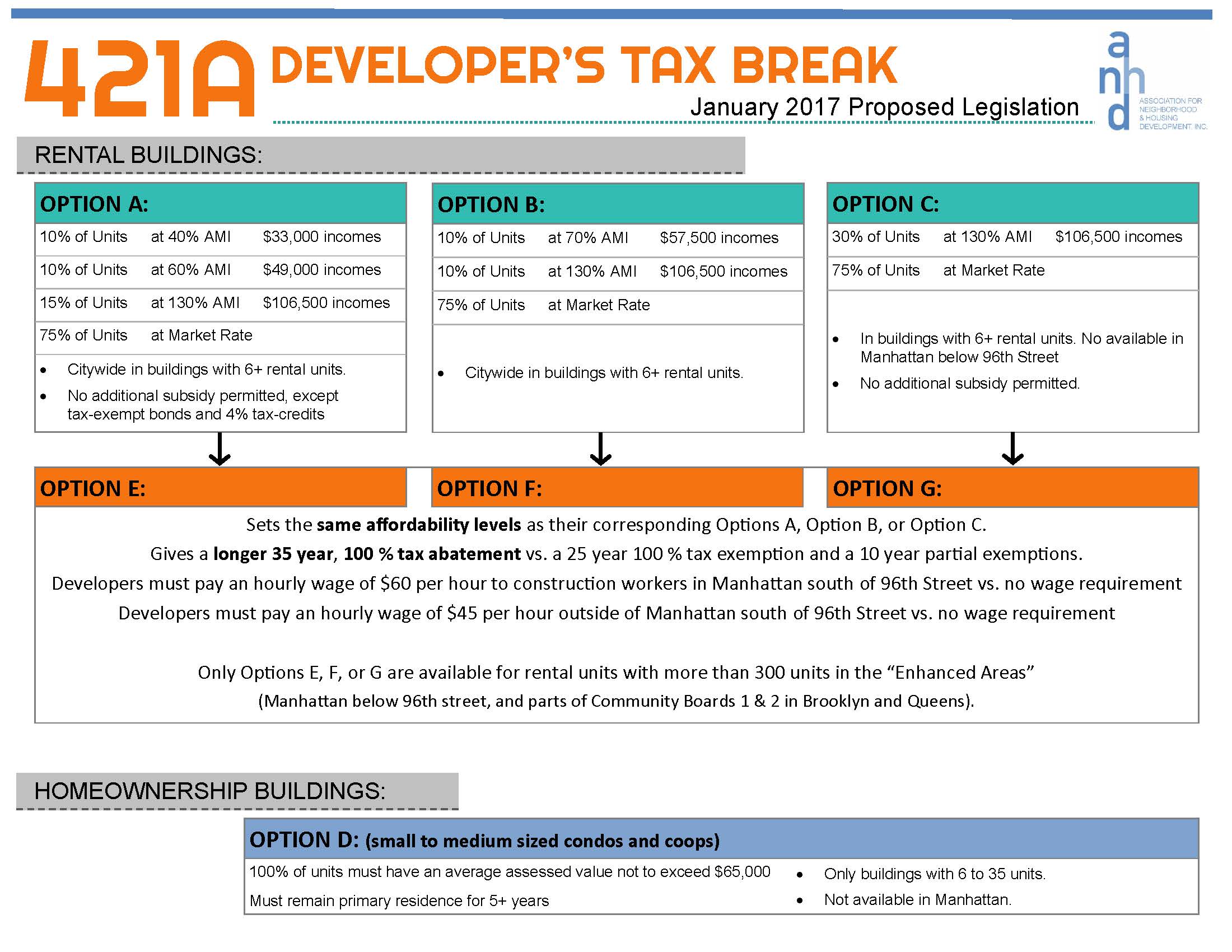

421a tax abatement meaning. You must then submit finance’s 421a application along with the certificate of eligibility you received from hpd. Multiply that by the assessment rate of 45 percent, and you get $61,875, allowing the unit to qualify for 421a. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of new york.

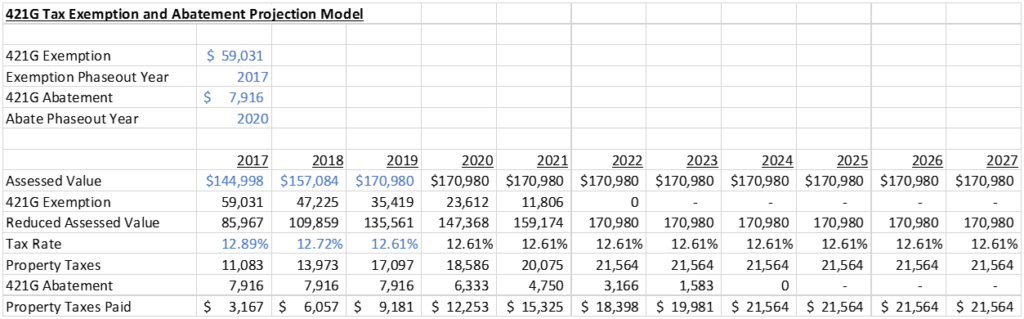

Condos built under the 421a tax abatement program, on the other hand, are starting to fade away to a point where there will eventually not be any more. In essence, it’s a tax exemption program given to building developers that typically lowers the. These tax abatement agreements also include a prescribed start and end period lasting usually for 5, 10, 15, and 25 years.

Once deregulated, the landlord may negotiate a market rate lease. Created in 1971, the 421a tax abatement program was originally created as a way to support and encourage property developers to build new residential buildings on unused or underused land in nyc. From these assumptions, we have again determined both a high preservation estimate (421a abatement and heavy rehab costs) and a low preservation estimate (420c abatement and moderate rehab costs).

Once you are approved by hpd, you will receive a certificate of eligibility. This client alert is meant to provide an overview of the The exemption also applies to buildings that add new residential units.

Homebuyers can understand the true meaning of the abatement by knowing when it will expire. One of those perplexing terms is 421a tax abatement. During the time period, thousands of new yorkers were moving upstate or to the suburbs, and city officials feared a decline in residential development.

Tax benefits expire means that the apartment will. As currently written, the program also focuses on promoting affordable housing in the most densely populated areas of new york city. The agreement details how the local government will reduce property taxes for an improvement an individual performs to a home or development a company contributes to the local economy.

Curious about what that all means? If you are in a rental building where the owner has a 421a abatement that means all apartments are stabalized and they are able to only increase by the 1 to 2 year percentages as set by the rent stabalization board. What is 421a tax abatement?

This is because these properties failed to comply with requirements to obtain the final. There are multiple variations of the 421a tax abatement, ranging from terms of 10 to 25 years. If you can improve it further, please do so.

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements – What Are They And How To Verify – Yoreevo Yoreevo

New York City 421a Partial Tax Exemption For New Multiple Dwellings Application Download Printable Pdf Templateroller

Nyc 421a Tax Abatements – What Are They And How To Verify – Yoreevo Yoreevo

Tax Abatement Nyc Guide 421a J-51 And More

421a Tax Abatement Archives Nestapple

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc Real Estate Taxes Blooming Sky

421a Tax Abatement Archives Nestapple

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

Everything You Need To Know About Nycs 421-a Tax Program By Hauseit Medium

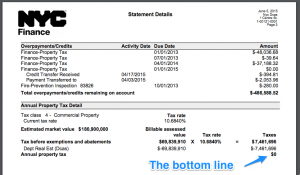

Nyc 421a Tax Abatements – What Are They And How To Verify – Yoreevo Yoreevo

What Is A 421a Tax Abatement In Nyc Streeteasy

Tax Abatement Nyc Guide 421a J-51 And More

The 421a Tax Abatement In Nyc Explained Hauseit

Nyc 421a Tax Abatements – What Are They And How To Verify – Yoreevo Yoreevo

Understanding Rebnys New 421-a Tax Exemption Proposal Association For Neighborhood And Housing Development

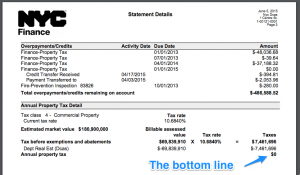

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax