To receive the federal tax credit for installing an ev charger in your home, you must purchase and install the charger by december 31, 2021. However, the answer as to whether or not the ev tax credit will be retroactive may not be as straightforward as you think.

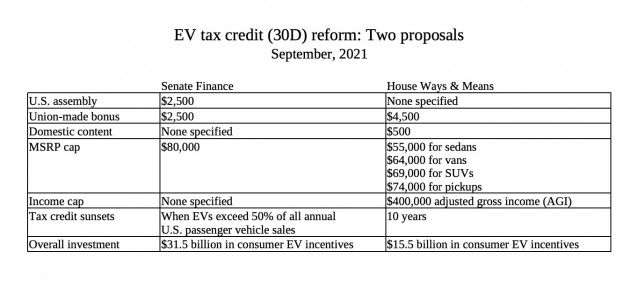

Ev Tax Credit Boost At Up To 12500 Heres How The Two Versions Compare

(whichever happens last) verbiage of credits for used evs also included in bill, 2 & 3 wheeled vehicles, charging station credits, commercial usage, etc.

2021 ev tax credit retroactive. My 2021 gtpe comes in at $69,840 with rapid red, pano, camera and protection kit. It is unclear how tesla and gm will address this retroactive credit availability for leased evs. December 31, 2021 or when the bill takes effect.

Read the potential new law on ev tax credits sponsored by michigan senators and it currently looks like the “suv” category has a top end of $69,000. Look like the new $7,000 tax credit is going to be retroactive. $500 if at least 50% of components and battery cells are manufactured in the us.

Current ev tax credits top out at $7,500. In fact, if you live in the united states, retroactive tax credits of 30% of the cost of purchasing and installing an ev charging station—up to $30,000 for commercial. Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022.

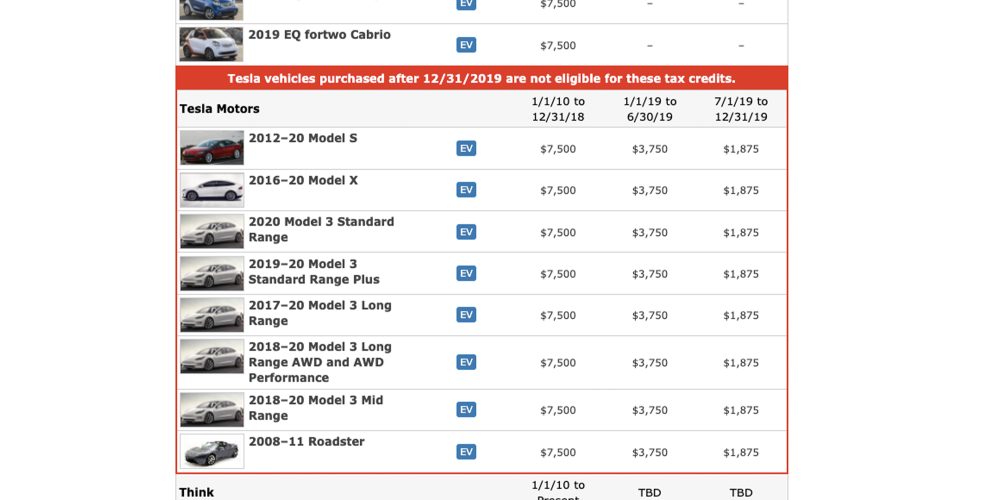

And the oem phaseout is retroactive to may 24, 2021 so buyers of tesla and gm evs purchased after may 24, 2021 could apply the credit on their 2021 tax return. Us senate puts $40,000 cap on price of electric cars that qualify for ev tax credit ahead of reform. 11th 2021 10:12 am pt.

Energy secretary defends tax credits for evs made by unionized automakers. Let's say you owed the federal government $10,000. The ev tax credit is currently a nonrefundable credit, so the government does not cut you a check for the balance.

11th 2021 6:22 am pt. It’s possible that, if passed, the feds could apply the credit retroactively to a date certain (eg: Therefore, the tax credit isn’t retroactive.

This credit is retroactive, meaning that if you bought and installed a charging station in either 2018 or 2019, you will be able to claim the credit on your 2019 returns by filling out form 8911. Other environmentally focused tax credits (such as evse installation credit) have included retroactive provisions. Us with new proposed reform of the federal ev incentive program.

Hypothetically, if you were to buy an ev in 2021 before a 2022 increase in credit amount, you would. The credit is now refundable, and can be remitted to the dealer at the point of sale. The us senate has voted to.

$4,500 if the final assembly occurs at a domestic, unionized plant. Congress recently passed a retroactive (now includes 2018, 2019, 2020, and through 2021) federal tax credit for those who purchase(d) ev charging infrastructure. The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles.

One the bill goes into affect, the next 400,000 ev’s tesla sell will be included in the tax credit. New ev credit that is the sum of: The tax credit is retroactive, so you can apply for this credit for ev chargers installed as far back as 2017.

The ev tax credit must be claimed on the tax forms for the year during which the taxpayer purchased a qualifying electric vehicle. No, it’s not retroactive as it’s currently written. Published fri, oct 29 2021 10:08 am edt updated fri, oct 29 2021 8:19.

Based on how the federal ev tax credit currently works, it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your ev. Federal tax credit for evse purchase and installation extended! $3,500 if the ev has a battery of at least 40kwh.

The proposed bill extends the ev credit system for another 10 years and eliminates the 200,000 vehicle restriction. Here’s how you would qualify for the maximum credit: Federal tax credit for evs jumps from $7,500 to $12,500 keep the $7,500 incentive for new electric cars for five years add an additional $4,500 for evs assembled in the us using union labor

Also, the value of the credit increase if the the car is manufactured in the united states, and even more so if. First, it would place a limit on the total price of the cars eligible to $80,000. The ev charging credit will be available for installations performed through 2020.

Receive a federal tax credit of 30% of the cost of purchasing and installing an ev charging station.

Vubfurm5yoxywm

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Ev Charging Tax Credit Returns

New Brunswick Launches Ev Incentive Program With Up To 5000 – The Car Guide

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557-4215

Ev Tax Credit Boost At Up To 12500 Heres How The Two Versions Compare

Tax Credit For Electric Vehicle Chargers Enel X

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Vubfurm5yoxywm

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Tesla To Get Access To 7000 Tax Credit On 400000 More Electric Cars In The Us With New Incentive Reform – Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

Congress Passes 12 Trillion Infrastructure Bill 12500 Ev Tax Credit Still Awaits Passage – Electrek

Vubfurm5yoxywm

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Proposed Changes To Federal Ev Tax Credit Part 2 End Of The Manufacturer Sales Phaseout Evadoption

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Federal Tax Credit For Ev Charging Stations Installation Extended –