Irs to begin issuing refunds this week on $10,200 unemployment benefits millions of americans are due money if they received unemployment benefits last year and filed their 2020 taxes before the. So we are now officially about to enter into the third wave of the unemployment tax refund payments.

Turbotax Hr Block Update Software For 10200 Unemployment Tax Break

New exclusion of up to $10,200 of unemployment compensation.

10200 unemployment tax break refund update. 12 may 2021 00:19 edt How to know if i will get it if you claimed unemployment compensation in 2020 and are owed a refund, you’ll want to keep an eye out with. Outline 0:00 intro and key notes 1:07 who’s received it so far?

Only those who are awaiting a secondary refund due to the 10200 unemployment tax break. 3:34 who’s receiving it next this week? I filed my 2020 returns on 03/12 and received my fed refund and paid my state balance within a week.

Approximately 10million taxpayers are waiting for a $10,200 payout from the irs credit: There have been unconfirmed reports of people receiving their refund filing simple returns no dependents. What are the unemployment tax refunds?

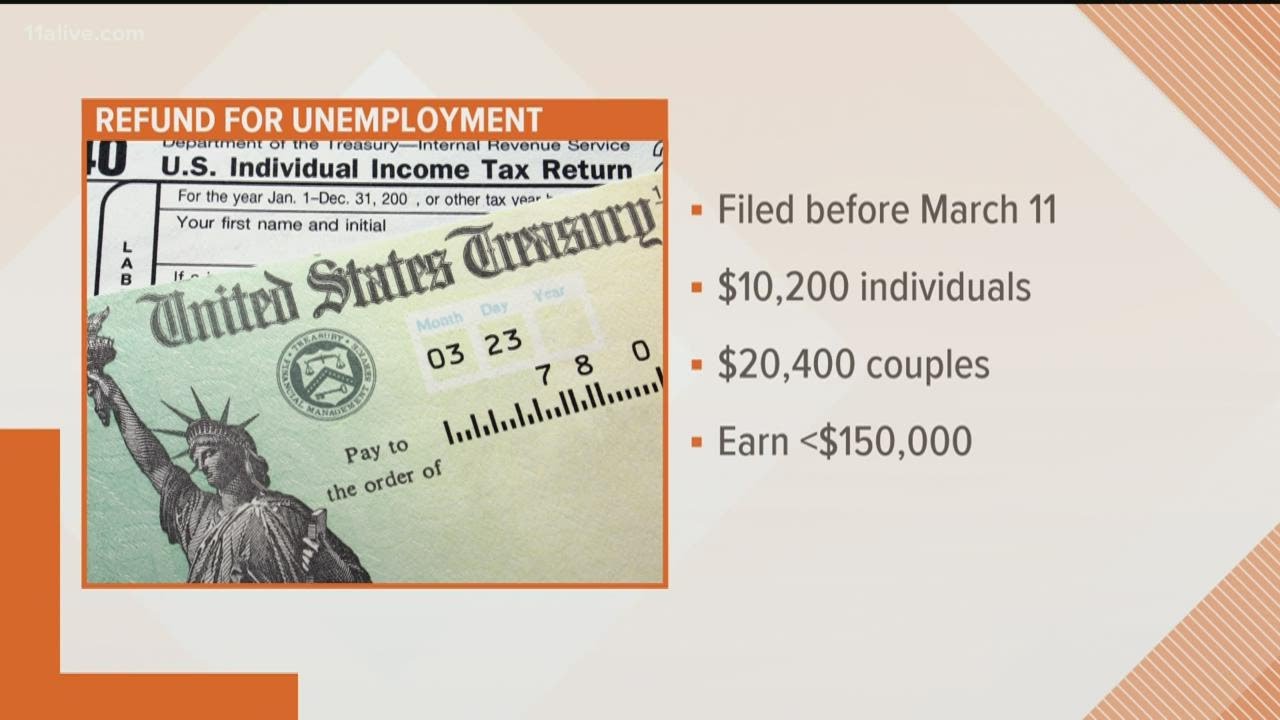

Turbotax and h&r block updated their online software to account for a new tax break on unemployment benefits received last year, according to company officials. The exemption, which applied to federal taxes, meant that unemployment checks sent during the pandemic weren't counted as earned income. The american rescue plan act signed on march 11 included a $10,200 tax exemption for 2020 unemployment benefits.

Most taxpayers don’t need to file an amended return to claim the exemption. It forgives $20,400 for couples filing jointly. An h&r block office in san francisco, calif.

The tax break is only for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during the pandemic in 2020. Refunds set to start in may those who filed 2020 tax returns before congress passed an exclusion on the first $10,200 in unemployment benefits could be getting a. The $10,200 is the amount of income exclusion for single filers, not the amount of the refund.

With the latest batch, uncle sam has now sent tax refunds to over 11 million americans for the $10,200 unemployment compensation tax exemption. As it stands the american rescue plan act of 2021, which sets out to provide relief to individuals who received unemployment compensation in 2020, there is an exclusion cap up to 10,200 dollars of. The exemption meant that checks sent during the pandemic weren't counted as earned income.

Update for taxpayers who qualified for the $10,200 exclusion on unemployment benefits but filed too early to get it by schwartz & schwartz, cpas | jun 1, 2021 | 2021 june news | 0 comments taxpayers who received unemployment benefits during 2020 could exclude the first $10,200 of benefits received from their taxable income as long as their total income. The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund. Current refund estimates are indicating that for single taxpayers who are eligible for the $10,200 tax break and fit into the 22 percent tax bracket.

Turbotax, h&r block update software for $10,200 unemployment tax break. $10,200 unemployment tax refund benefits extension update taxes return credit break pua peuc. $10,200 unemployment tax break refund:

A last minute addition to the $1.9 trillion stimulus package exempted the first $10,200 of 2020 unemployment compensation from federal income tax for households. 4:59 how many refunds you’ll receive? Rocky mengle , marc a.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund (taxpayers who are married and. The $10,200 is the amount of income exclusion for single filers, not the amount of the refund. Since may, the irs has been making adjustments on 2020 tax returns and issuing refunds averaging around $1,600 to those who can claim an unemployment tax break.

The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. The irs said friday it has since identified 10 million taxpayers who had already filed their returns by then, which included taxes on those jobless benefits. 2020 unemployment $10200 credit update.

The bill forgives taxes on the first $10,200 for individuals, including those who are married but file taxes separately. Starting in may and into summer, the irs will begin to send tax refunds to those who benefited from the $10,200 unemployment tax break for claims in 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The first $10,200 of 2020 jobless benefits ($20,400 for married couples filing jointly) was made nontaxable income by the american rescue plan in march. 6:20 the amount you’ll receive clarified 7:50 how many have been sent? The american rescue plan act, which was signed on march 11, included a $10,200 tax exemption for 2020 unemployment benefits.

Irs slow to rollout unemployment tax refund. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. If your modified adjusted gross income (agi) is less than $150,000, the american rescue plan enacted on march 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you don’t have to pay tax on unemployment compensation of up to $10,200.

To date, the irs has identified more than 16 million taxpayers who are eligible and has issued. Arp provided a tax break of up to $10,200 to those who received unemployment compensation in 2020.

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

2020 Unemployment Tax Break Hr Block

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Irs Refunds Will Start In May For 10200 Unemployment Tax Break

Letter By Mail Will Be Confirmation That Irs Sent You A Refund Under 10200 In Unemployment Tax Exemption – The Saxon

Irs No Tax Return To Get 10200 Unemployment Exemption Under Biden Plan – The Saxon

Dont Forget To Pay Taxes On Unemployment Benefits

Still Waiting On Your 10200 Unemployment Tax Break Refund How To Check The Status

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

If You Got Unemployment Benefits In 2020 Heres How Much Could Be Tax Exempt – Abc News

Unemployment 10200 Tax Break Some States Require Amended Returns

Interesting Update On The Unemployment Refund Rirs

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours – Mlivecom

Tax Refunds On 10200 Of Unemployment Benefits Start In May Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Refunds Irs Payment Schedule Tax Certificates And More

Who Gets Paid First When Refunds On 10200 Unemployment Benefits Get Sent Out – Youtube

Over 7 Million Americans Could Receive Refund For 10200 Unemployment Tax Break

How To Claim Your Unemployment Tax Break On 2020 Benefits