What is a structured investment vehicle? A structured investment vehicle is a type of financial entity that is created to hold and manage a portfolio of assets. These vehicles are often used by institutional investors, such as pension funds and insurance companies, to pool their resources and invest in a diversified portfolio of assets. Structured investment vehicles can also be used by individual investors to gain exposure to a particular asset class or investment strategy.

Editor’s Notes: Structured investment vehicle have published today December 22, 2023. This topic is important to read because it provides a comprehensive insight into structured investment vehicle, underlining its importance or benefits engagingly and directly, without repeating the keyword phrase itself.

After doing some analysis, digging information, and put together this structured investment vehicle guide to help target audience make the right decision.

Key differences or Key takeaways:

| Structured Investment Vehicle | |

|---|---|

| Definition | A type of financial entity that is created to hold and manage a portfolio of assets. |

| Purpose | To pool resources and invest in a diversified portfolio of assets. |

| Investors | Institutional investors, such as pension funds and insurance companies, and individual investors. |

| Benefits | Diversification, risk management, and potential for higher returns. |

Main article topics:

- Benefits of structured investment vehicles

- Risks of structured investment vehicles

- How to invest in structured investment vehicles

Structured Investment Vehicle

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. They offer diversification, risk management, and potential for higher returns. Here are 8 key aspects of SIVs:

- Structure: SIVs can be structured as trusts, corporations, or partnerships.

- Investment objectives: SIVs can invest in a wide range of assets, including bonds, loans, and real estate.

- Risk management: SIVs use a variety of risk management techniques, such as diversification and hedging.

- Returns: SIVs can generate returns through interest income, capital gains, and dividends.

- Investors: SIVs are typically marketed to institutional investors, such as pension funds and insurance companies.

- Regulation: SIVs are regulated by the Securities and Exchange Commission (SEC) and other financial regulatory agencies.

- Transparency: SIVs are required to provide investors with regular reports on their performance and financial condition.

- Fees: SIVs charge investors fees for their services, such as management fees and performance fees.

SIVs can be a valuable investment vehicle for investors who are looking for diversification, risk management, and potential for higher returns. However, it is important to understand the risks involved in investing in SIVs before making an investment decision.

Structure

The structure of a structured investment vehicle (SIV) is an important factor to consider when investing in one of these vehicles. The structure of an SIV will determine its legal status, tax treatment, and regulatory requirements. Here are some of the key considerations when choosing the structure of an SIV:

- Trusts are a popular choice for SIVs because they offer a number of advantages, including flexibility, tax efficiency, and asset protection.

- Corporations are another common choice for SIVs. Corporations offer a number of advantages, including limited liability for investors and the ability to raise capital more easily.

- Partnerships are a less common choice for SIVs, but they can offer a number of advantages, including flexibility and tax efficiency.

The choice of structure for an SIV will depend on a number of factors, including the investment objectives of the SIV, the tax status of the investors, and the regulatory requirements applicable to the SIV.

It is important to note that the structure of an SIV is just one of many factors to consider when investing in one of these vehicles. Other important factors include the investment objectives of the SIV, the experience of the SIV’s management team, and the fees charged by the SIV.

Key insights:

- The structure of an SIV is an important factor to consider when investing in one of these vehicles.

- The choice of structure will depend on a number of factors, including the investment objectives of the SIV, the tax status of the investors, and the regulatory requirements applicable to the SIV.

- It is important to consider all of the factors involved before making an investment decision.

Investment objectives

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. The investment objectives of an SIV will vary depending on the specific investment strategy of the vehicle. However, SIVs can invest in a wide range of assets, including bonds, loans, and real estate.

- Diversification: SIVs can invest in a wide range of assets, which helps to diversify their portfolio and reduce risk. This is important because it helps to protect investors from losses if one particular asset class performs poorly.

- Risk management: SIVs use a variety of risk management techniques, such as hedging and diversification, to reduce the risk of losses. This helps to protect investors from losing their money.

- Returns: SIVs can generate returns through interest income, capital gains, and dividends. The returns generated by an SIV will vary depending on the specific investment strategy of the vehicle.

SIVs can be a valuable investment vehicle for investors who are looking for diversification, risk management, and potential for higher returns. However, it is important to understand the risks involved in investing in SIVs before making an investment decision.

Risk management

Risk management is an essential component of any structured investment vehicle (SIV). SIVs use a variety of risk management techniques to reduce the risk of losses for investors. These techniques include:

- Diversification: Diversification is a risk management technique that involves investing in a variety of different assets. This helps to reduce the risk of losses because if one asset class performs poorly, the other assets in the portfolio may still perform well.

- Hedging: Hedging is a risk management technique that involves using financial instruments to offset the risk of another investment. For example, an SIV might use a credit default swap to hedge against the risk of default on a corporate bond.

By using a variety of risk management techniques, SIVs can help to protect investors from losses and preserve capital. This makes SIVs a valuable investment vehicle for investors who are looking for a way to reduce risk and generate returns.

Returns

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. SIVs can generate returns for investors through a variety of means, including interest income, capital gains, and dividends.

- Interest income is generated when an SIV invests in fixed-income securities, such as bonds. The interest payments made on these securities are passed through to investors as income.

- Capital gains are generated when an SIV sells an asset for a profit. The profit is distributed to investors as capital gains.

- Dividends are generated when an SIV invests in stocks. Dividends are payments made by companies to their shareholders.

The returns generated by an SIV will vary depending on the specific investment strategy of the vehicle. However, SIVs can offer investors the potential for higher returns than traditional investments, such as savings accounts or money market accounts.

Investors

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. SIVs are typically marketed to institutional investors, such as pension funds and insurance companies, because these investors have a long-term investment horizon and a high tolerance for risk. Here are some of the key reasons why SIVs are attractive to institutional investors:

- Diversification: SIVs can invest in a wide range of assets, which helps to diversify their portfolio and reduce risk. This is important for institutional investors, who are looking for ways to reduce the risk of their overall investment portfolio.

- Risk management: SIVs use a variety of risk management techniques, such as hedging and diversification, to reduce the risk of losses. This helps to protect institutional investors from losing their money.

- Returns: SIVs have the potential to generate higher returns than traditional investments, such as savings accounts or money market accounts. This is because SIVs can invest in a wider range of assets, including higher-yielding assets.

SIVs can be a valuable investment vehicle for institutional investors who are looking for diversification, risk management, and potential for higher returns. However, it is important to understand the risks involved in investing in SIVs before making an investment decision.

Regulation

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. SIVs are regulated by the Securities and Exchange Commission (SEC) and other financial regulatory agencies to protect investors and ensure the integrity of the financial markets.

The SEC has a number of rules and regulations that apply to SIVs, including:

- SIVs must register with the SEC and provide investors with a prospectus that contains detailed information about the SIV’s investment objectives, strategies, and risks.

- SIVs must be managed by a qualified investment adviser.

- SIVs must have a board of directors that is responsible for overseeing the SIV’s operations.

- SIVs must file periodic reports with the SEC that disclose their financial condition and performance.

These regulations help to ensure that SIVs are operated in a safe and sound manner and that investors are protected from fraud and abuse.

The regulation of SIVs is an important component of the financial regulatory landscape. It helps to protect investors and ensure the integrity of the financial markets.

| Regulation | Importance | Practical Significance |

|---|---|---|

| Registration with the SEC | Protects investors by providing them with detailed information about the SIV’s investment objectives, strategies, and risks. | Helps investors make informed investment decisions. |

| Management by a qualified investment adviser | Ensures that the SIV is managed by experienced professionals who are qualified to make investment decisions. | Helps to protect investors from losses due to mismanagement. |

| Board of directors | Provides oversight of the SIV’s operations and ensures that the SIV is operated in a safe and sound manner. | Helps to protect investors from fraud and abuse. |

| Periodic reporting to the SEC | Provides investors with regular updates on the SIV’s financial condition and performance. | Helps investors to monitor their investments and make informed decisions. |

Transparency

Transparency is an essential component of any structured investment vehicle (SIV). SIVs are required to provide investors with regular reports on their performance and financial condition. This transparency is important for a number of reasons.

First, transparency helps investors to make informed investment decisions. Investors need to know what an SIV is investing in, how it is performing, and what its financial condition is before they can make an informed investment decision. Regular reports provide investors with this information.

Second, transparency helps to protect investors from fraud and abuse. If an SIV is not transparent, investors may not be aware of any problems that the SIV is facing. This could lead to investors losing their money.

Third, transparency helps to ensure that SIVs are operated in a safe and sound manner. Regular reports provide investors with the information they need to hold SIVs accountable for their performance and financial condition.

The following table provides a summary of the key benefits of transparency in SIVs:

| Benefit | Importance |

|---|---|

| Helps investors to make informed investment decisions | Investors need to know what an SIV is investing in, how it is performing, and what its financial condition is before they can make an informed investment decision. Regular reports provide investors with this information. |

| Helps to protect investors from fraud and abuse | If an SIV is not transparent, investors may not be aware of any problems that the SIV is facing. This could lead to investors losing their money. |

| Helps to ensure that SIVs are operated in a safe and sound manner | Regular reports provide investors with the information they need to hold SIVs accountable for their performance and financial condition. |

Transparency is an essential component of any structured investment vehicle. SIVs are required to provide investors with regular reports on their performance and financial condition. This transparency is important for protecting investors, ensuring that SIVs are operated in a safe and sound manner, and helping investors to make informed investment decisions.

Fees

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. SIVs charge investors fees for their services, such as management fees and performance fees. These fees are an important part of the SIV business model and are used to cover the costs of operating the SIV and generating returns for investors.

Management fees are typically a percentage of the SIV’s assets under management. These fees cover the costs of managing the SIV’s portfolio, including research, trading, and administration. Performance fees are typically a percentage of the SIV’s investment returns. These fees are paid to the SIV’s investment manager as a reward for generating superior returns for investors.

The fees charged by SIVs vary depending on a number of factors, including the size of the SIV, the complexity of the investment strategy, and the track record of the investment manager. It is important for investors to understand the fees charged by a SIV before investing. These fees can have a significant impact on the overall return on investment.

Fees are an important component of the structured investment vehicle business model. These fees are used to cover the costs of operating the SIV and generating returns for investors. Investors should understand the fees charged by a SIV before investing.

The following table provides a summary of the key points discussed in this article:

| Concept | Explanation |

|---|---|

| Fees | SIVs charge investors fees for their services, such as management fees and performance fees. |

| Management fees | Management fees are typically a percentage of the SIV’s assets under management. |

| Performance fees | Performance fees are typically a percentage of the SIV’s investment returns. |

| Importance of fees | Fees are an important part of the SIV business model and are used to cover the costs of operating the SIV and generating returns for investors. |

Structured Investment Vehicle FAQs

Structured investment vehicles (SIVs) are financial entities that pool resources and invest in a diversified portfolio of assets. SIVs can offer investors a number of benefits, including diversification, risk management, and potential for higher returns. However, it is important to understand the risks involved in investing in SIVs before making an investment decision.

Question 1: What is a structured investment vehicle?

Answer: A structured investment vehicle (SIV) is a financial entity that is created to hold and manage a portfolio of assets. SIVs can be structured as trusts, corporations, or partnerships.

Question 2: What are the benefits of investing in a structured investment vehicle?

Answer: SIVs offer a number of benefits to investors, including diversification, risk management, and potential for higher returns.

Question 3: What are the risks of investing in a structured investment vehicle?

Answer: There are a number of risks involved in investing in SIVs, including the risk of losing money, the risk of fraud, and the risk of mismanagement.

Question 4: How can I invest in a structured investment vehicle?

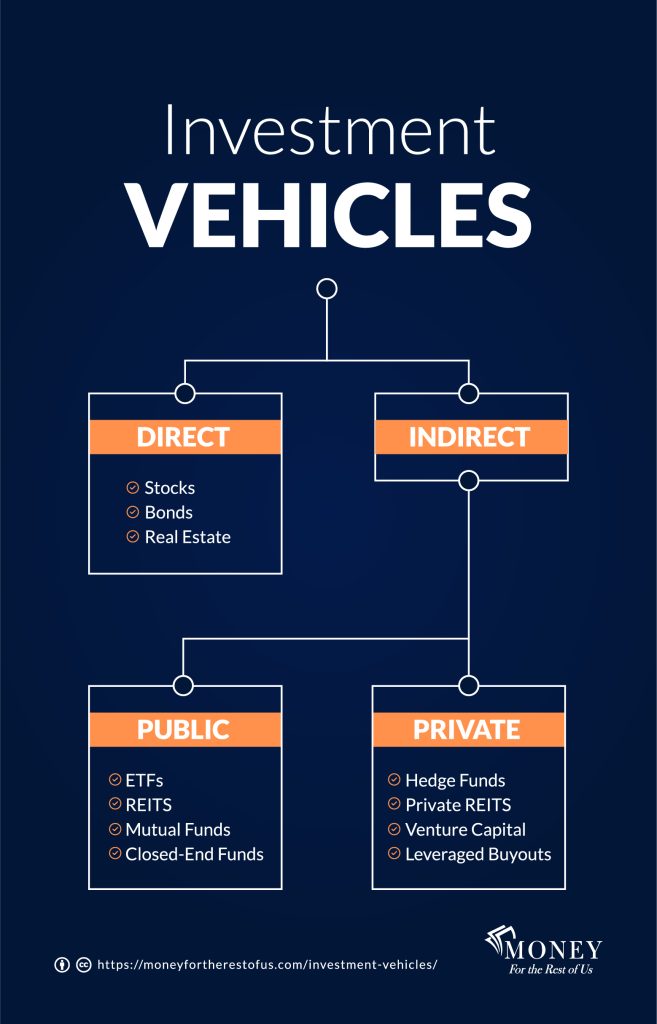

Answer: There are a number of ways to invest in SIVs, including through mutual funds, exchange-traded funds (ETFs), and private placements.

Question 5: What are the fees associated with investing in a structured investment vehicle?

Answer: SIVs charge investors fees for their services, such as management fees and performance fees. These fees can vary depending on the SIV and the investment strategy.

Question 6: How can I learn more about structured investment vehicles?

Answer: There are a number of resources available to help investors learn more about SIVs, including books, articles, and websites.

Summary of key takeaways or final thought:

SIVs can be a valuable investment vehicle for investors who are looking for diversification, risk management, and potential for higher returns. However, it is important to understand the risks involved in investing in SIVs before making an investment decision.

Transition to the next article section:

For more information on structured investment vehicles, please see the following resources:

- Structured Investment Vehicles

- Investing in Structured Investment Vehicles

- Risks of Investing in Structured Investment Vehicles

Tips on Utilizing Structured Investment Vehicles

Structured investment vehicles (SIVs) offer a unique set of benefits and opportunities for investors. By following these tips, you can increase your chances of success when investing in SIVs.

Tip 1: Understand the risks. Before investing in any SIV, it is important to understand the risks involved. SIVs can be complex and risky investments, so it is important to do your research and consult with a financial advisor before investing.

Tip 2: Diversify your investments. Don’t put all of your eggs in one basket. Diversifying your investments across a variety of asset classes and investments can help to reduce your risk.

Tip 3: Invest for the long term. SIVs are typically long-term investments. Don’t expect to get rich quick by investing in SIVs. Be patient and let your investments grow over time.

Tip 4: Choose a reputable investment manager. The investment manager you choose will have a significant impact on the performance of your SIV investment. Do your research and choose an investment manager with a proven track record of success.

Tip 5: Monitor your investments regularly. Once you have invested in a SIV, it is important to monitor your investments regularly. This will help you to identify any potential problems early on and take steps to protect your investment.

By following these tips, you can increase your chances of success when investing in SIVs. However, it is important to remember that all investments carry some degree of risk. Before investing, be sure to do your research and understand the risks involved.

Summary of key takeaways or benefits:

- SIVs can be a valuable investment vehicle for investors who are looking for diversification, risk management, and potential for higher returns.

- It is important to understand the risks involved in investing in SIVs before making an investment decision.

- By following the tips outlined in this article, you can increase your chances of success when investing in SIVs.

Transition to the article’s conclusion:

SIVs can be a complex and risky investment, but they can also be a rewarding one. By following the tips outlined in this article, you can increase your chances of success when investing in SIVs.

Conclusion

Structured investment vehicles (SIVs) are complex financial entities that offer a unique opportunity for diversification, risk management, and potential for higher returns. However, it is important to understand the risks involved before investing in SIVs. By following the tips outlined in this article, you can increase your chances of success when investing.

SIVs are a valuable investment vehicle for sophisticated investors who are looking for a way to diversify their portfolio and potentially increase their returns. However, it is important to remember that all investments carry some degree of risk. Before investing in a SIV, be sure to do your research and understand the risks involved.

Youtube Video: