There are laws regarding how estates are taxes, how estates are passed down, and even. November 2019 (3) october 2019 (2) september 2019 (3) august 2019 (4) july 2019 (2)

2

On june 16, 2021, the governor signed sf 619 which, among other tax law changes, reduces the inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024 and results in the repeal of the inheritance tax as of january 1, 2025.

South carolina inheritance tax 2019. There is no inheritance tax in south carolina. Make sure to check local laws if you’re inheriting something from someone who lives out of state. South carolina does not tax inheritance gains and eliminated its estate tax in 2005.

It is one of the 38 states that does not have either inheritance or estate tax. Does south carolina have an inheritance tax or estate tax? Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024.

As of 2019, iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania have their own inheritance tax. There are no inheritance or estate taxes in south carolina. South carolina has no estate tax for decedents dying on or after january 1, 2005.

Does south carolina have an inheritance tax or estate tax? No estate tax or inheritance tax There is no federal inheritance tax.

Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15% and 19%. Iowa has an inheritance tax, but in 2021, the state decided it would repeal this tax by 2025. It is one of the 38 states that does not.

There are no inheritance or estate taxes in south carolina. Data were drawn from mcguire woods llp, “state death tax chart” and indicate the presence of an estate or inheritance tax as. Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes.

Currently, south carolina does not impose an estate tax, but other states do. A nonresident individual receiving south carolina income from wages, rental property, businesses, or other investments in south carolina, must file an sc1040 south carolina individual income tax return and schedule nr nonresident schedule. You should also keep in mind that.

South carolina imposes income taxes on income earned during the course of estate administration, and there may be income and/or estate or death taxes imposed by other states or nations. This act takes effect upon approval by the governor and applies for property tax years beginning after 2019. Washington state’s 20 percent rate is the highest estate tax rate in the nation, although hawaii is set to increase its top rate to 20 percent effective january 1, 2020.

Every state has its own unique set of laws that go into inheriting estates and south carolina is no exception. Eight states and the district of columbia are next with a top rate of 16 percent. There is no inheritance tax in south carolina.

This publication provides forest owners, foresters, loggers, and timber businesses a guide of the applicable federal income tax laws, including the. Because the state follows federal rules regarding the taxation of estates, the phaseout of the federal credit means that the. Maryland is the only state to impose both.

The effective state and local tax rate for south carolina residents in 2019 was 8.9 percent, the 11th lowest percentage among the 50 states, according to a new ranking published by the tax foundation. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island: The top estate tax rate is 16 percent (exemption threshold:

Large estates may be subject to the federal estate tax, and you may need to pay inheritance if you inherit property from someone who lived in another state. However, the federal government still collects these taxes, and you must pay them if you are liable. Inheritance tax is only applied if the amount is above each state’s threshold and is assessed on the amount that exceeds that threshold.

There are no inheritance or estate taxes in south carolina. The top estate tax rate is 16 percent (exemption threshold: No estate tax or inheritance tax.

This variable assesses if a state levies an estate or inheritance tax. Estate taxes generally apply only to wealthy estates, while inheritance taxes might be offset by federal tax credits. South carolina does not levy an estate or inheritance tax.

South Carolina Income Tax Brackets 2020

What You May Have Missed – The Pros And Cons Of Living In South Carolina

Sc Earned Income Tax Credit Increases In 2020

South Carolina Income Tax Calculator – Smartasset

South Carolina Vs North Carolina – Which Is The Better State Of The Carolinas

South Carolina Retirement Tax Friendliness – Smartasset

Relocating To Sc Best Cities To Live In South Carolina

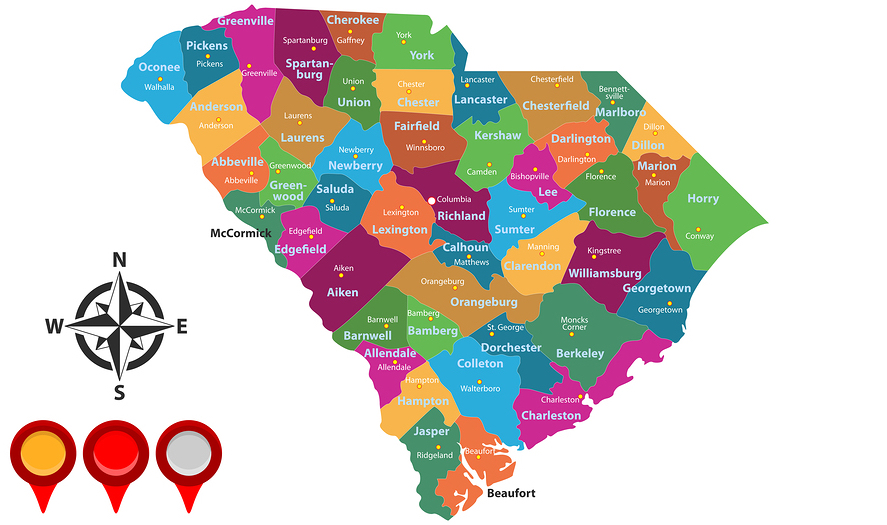

See How South Carolinas Counties Are Growing And Shrinking – Gem Mcdowell Law 843-284-1021 Estate-business-law-local

2021 Best Places To Raise A Family In South Carolina – Niche

Complete E-file Your 2021 2022 South Carolina State Return

See This Home On Redfin 221 Gilliam St Oxford Nc 27565 Mls 2247827 Foundonredfin Mansions Historic Homes Mansions For Sale

South Carolina Sales Tax – Taxjar

South Carolina Inheritance Laws – King Law

The Best Places To Live In South Carolina Real Estate Us News

Ebay Will Collect Sales Tax In 5 More States Sales Tax Marketing Communication States

Use Tax

Revealed Living In South Carolina Vs North Carolina This May Surprise You – Youtube

The Ultimate Guide To South Carolina Real Estate Taxes

South Carolina Retirement – Taxes And Economic Factors To Consider