Small business financing options can help you operate and grow your business. Learn about different ways to finance your small business.

Editor’s Note: We have published this guide to help business owners understand small business financing and make the right financing decisions for their business.

We analyzed different financing options and put together this guide to help you make the right decision for your business.

Key differences or Key takeaways:

| Financing Type | Loan Amount | Interest Rate | Loan Term |

|---|---|---|---|

| SBA loan | Up to $5 million | As low as 2.75% | Up to 25 years |

| Term loan | Up to $500,000 | 5% to 10% | 1 to 5 years |

| Line of credit | Up to $100,000 | Prime rate plus 1% to 3% | 1 year (revolving) |

| Invoice factoring | Up to 85% of invoice amount | 1% to 5% of invoice amount | Varies |

| Merchant cash advance | Up to $250,000 | Factor rate of 1.2 to 1.5 | 6 to 18 months |

Main article topics:

- Types of small business financing

- How to choose the right small business financing

- Pros and cons of small business financing

Small Business Financing

Small business financing is crucial for entrepreneurs and startups looking to launch and grow their businesses. It can provide access to capital for various purposes, such as purchasing equipment, hiring staff, or expanding operations.

- Funding options: Loans, grants, equity financing, crowdfunding

- Loan terms: Interest rates, repayment periods, collateral requirements

- Eligibility criteria: Business plans, financial statements, credit scores

- Government support: SBA loans, grants, tax incentives

- Alternative financing: Invoice factoring, merchant cash advances, peer-to-peer lending

- Business plan: Outlining financial needs and how funds will be used

- Financial projections: Demonstrating the ability to repay the loan

- Creditworthiness: Establishing a strong credit history and score

These key aspects are interconnected and play a vital role in securing small business financing. For instance, understanding the different funding options and loan terms available can help businesses make informed decisions based on their specific needs and financial situation. Additionally, preparing a comprehensive business plan and financial projections can increase the chances of loan approval and favorable terms. Furthermore, maintaining a strong creditworthiness is essential for accessing traditional financing options and securing lower interest rates.

Funding options

Funding options play a critical role in small business financing. Loans, grants, equity financing, and crowdfunding provide diverse avenues for entrepreneurs to access capital and fuel their business growth. Each of these options has its own unique characteristics, advantages, and considerations.

Loans, a common form of small business financing, involve borrowing money from a bank or other lender and repaying it over time with interest. Grants, on the other hand, provide non-repayable funds to businesses that meet specific criteria, often related to innovation, research, or community development. Equity financing involves selling a portion of the business to investors in exchange for capital. Crowdfunding platforms allow businesses to raise funds from a large number of individuals, typically through online platforms.

Understanding the different funding options available and their suitability for specific business needs is crucial for successful small business financing. Loans offer a structured approach to borrowing, while grants provide non-repayable funding but may have specific eligibility criteria. Equity financing can provide substantial capital but involves giving up ownership in the business. Crowdfunding can be a viable option for businesses seeking smaller amounts of capital and community support.

By carefully evaluating the various funding options and their implications, small businesses can make informed decisions about the best way to finance their operations and growth.

| Funding Option | Description | Advantages | Disadvantages |

|---|---|---|---|

| Loans | Borrowing money from a bank or other lender that must be repaid with interest | Structured and predictable repayment plan, established credit history | Interest charges, collateral requirements, personal liability |

| Grants | Non-repayable funds provided by government agencies or non-profit organizations | No repayment obligation, potential for significant funding | Specific eligibility criteria, competitive application process |

| Equity financing | Selling a portion of the business to investors in exchange for capital | Large potential for funding, expertise from investors | Giving up ownership in the business, potential loss of control |

| Crowdfunding | Raising funds from a large number of individuals, typically through online platforms | Access to smaller amounts of capital, community support | Time-consuming, competitive, may not reach funding goals |

Loan terms

Loan terms are a critical component of small business financing, as they determine the cost and accessibility of borrowed funds. Interest rates, repayment periods, and collateral requirements are key elements of loan terms that directly impact the financial viability and sustainability of a small business.

Interest rates represent the cost of borrowing money and are typically expressed as an annual percentage. Higher interest rates increase the total cost of the loan, while lower interest rates reduce the burden on the business. Small businesses with strong credit histories and financial performance can often qualify for lower interest rates.

Repayment periods define the duration over which the loan must be repaid. Shorter repayment periods result in higher monthly payments but lower overall interest costs. Conversely, longer repayment periods lead to lower monthly payments but higher total interest paid. The choice of repayment period depends on the business’s cash flow and ability to service the debt.

Collateral requirements refer to the assets that a business pledges as security for the loan. Collateral can include property, equipment, or inventory. Lenders require collateral to reduce their risk in case the business defaults on the loan. Providing collateral can increase the chances of loan approval and may also lead to more favorable loan terms.

Understanding the between loan terms and small business financing is crucial for entrepreneurs and business owners. By carefully considering interest rates, repayment periods, and collateral requirements, businesses can make informed decisions about borrowing money and avoid potential financial pitfalls. Lenders evaluate various factors, including the business’s financial health, industry, and market conditions, when determining loan terms. It is important for businesses to present a strong case and negotiate favorable terms that align with their financial goals and long-term sustainability.

| Loan Term | Description | Impact on Small Business Financing |

|---|---|---|

| Interest rates | The cost of borrowing money, expressed as an annual percentage | Higher interest rates increase the cost of the loan, while lower interest rates reduce the burden on the business. |

| Repayment periods | The duration over which the loan must be repaid | Shorter repayment periods result in higher monthly payments but lower overall interest costs, while longer repayment periods lead to lower monthly payments but higher total interest paid. |

| Collateral requirements | The assets that a business pledges as security for the loan | Providing collateral can increase the chances of loan approval and may also lead to more favorable loan terms. |

Eligibility criteria

Eligibility criteria play a significant role in determining access to small business financing. Lenders and investors carefully evaluate a business’s eligibility based on various factors, including business plans, financial statements, and credit scores.

- Business plans: A well-crafted business plan outlines the business’s goals, strategies, and financial projections. It demonstrates the business’s viability and potential for growth. Lenders and investors use business plans to assess the business’s management team, market opportunity, and financial sustainability.

- Financial statements: Financial statements provide a comprehensive view of a business’s financial performance and health. Lenders and investors analyze financial statements to evaluate the business’s profitability, liquidity, and solvency. Strong financial statements increase the likelihood of loan approval and favorable loan terms.

- Credit scores: Credit scores are numerical representations of a business’s creditworthiness. Lenders and investors use credit scores to assess the business’s ability to repay debt. Higher credit scores indicate a lower risk of default, which can lead to better loan terms and interest rates.

- Other factors: In addition to business plans, financial statements, and credit scores, lenders and investors may also consider other factors when evaluating eligibility for small business financing. These factors may include industry experience, collateral, and personal guarantees.

By meeting the eligibility criteria, small businesses can increase their chances of securing financing and accessing the capital they need to grow and succeed. It is important for business owners to carefully prepare their business plans, financial statements, and credit scores to present a strong case to lenders and investors.

Government support

Government support plays a crucial role in fostering small business financing, providing access to capital and encouraging entrepreneurship. Through various initiatives, governments aim to stimulate economic growth, create jobs, and support innovation within the small business sector.

-

SBA loans:

The Small Business Administration (SBA) offers a range of loan programs designed to meet the specific needs of small businesses. These loans are typically characterized by favorable interest rates, long repayment terms, and flexible collateral requirements. SBA loans can be used for various purposes, such as purchasing equipment, expanding operations, or financing working capital.

-

Grants:

Government grants provide non-repayable funds to small businesses for specific purposes, such as research and development, job creation, or community development. Grants are highly competitive and require businesses to meet specific eligibility criteria. However, they can be a valuable source of funding for businesses that qualify.

-

Tax incentives:

Governments may offer tax incentives to encourage investment in small businesses. These incentives can include tax deductions for expenses related to starting or operating a business, tax credits for hiring new employees, or exemptions from certain taxes.

These government support mechanisms can significantly impact small business financing by providing access to capital, reducing the cost of borrowing, and creating a more favorable environment for entrepreneurship. By understanding and utilizing these resources, small businesses can increase their chances of success and contribute to the overall economic growth and prosperity.

Alternative financing

Alternative financing options, such as invoice factoring, merchant cash advances, and peer-to-peer lending, play a vital role in the landscape of small business financing. These alternative sources of capital provide small businesses with access to funding that may not be available through traditional lending institutions.

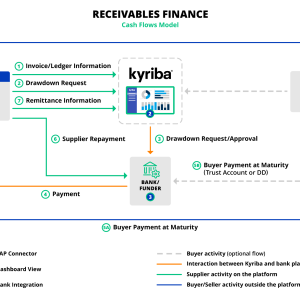

Invoice factoring involves selling unpaid invoices to a factoring company at a discount. This allows businesses to receive immediate cash flow, rather than waiting for customers to pay their invoices. Merchant cash advances provide businesses with a lump sum of cash in exchange for a percentage of future sales. Peer-to-peer lending platforms connect small businesses with individual investors who are willing to lend money at competitive interest rates.

These alternative financing options can be particularly beneficial for small businesses that have difficulty qualifying for traditional loans. They can also be useful for businesses that need quick access to capital to cover unexpected expenses or to seize growth opportunities.

It is important for small businesses to understand the different alternative financing options available and to choose the one that best meets their specific needs. Invoice factoring can be a good option for businesses that have a high volume of unpaid invoices. Merchant cash advances can be helpful for businesses that need quick access to cash to cover expenses or to invest in growth. Peer-to-peer lending can be a good option for businesses that have good credit and are looking for a competitive interest rate.

By understanding the connection between alternative financing and small business financing, small businesses can increase their chances of obtaining the capital they need to grow and succeed.

| Financing Option | Description | Advantages | Disadvantages |

|---|---|---|---|

| Invoice factoring | Selling unpaid invoices to a factoring company at a discount | Immediate cash flow, no personal guarantee required | Can be expensive, may require high volume of invoices |

| Merchant cash advances | Receiving a lump sum of cash in exchange for a percentage of future sales | Quick access to cash, no collateral required | High cost, can be difficult to qualify for |

| Peer-to-peer lending | Connecting with individual investors who are willing to lend money at competitive interest rates | Competitive interest rates, no collateral required | Can be time-consuming, may not be able to borrow large amounts |

Business plan

A business plan is a crucial document for small business financing, as it outlines the financial needs of the business and how the funds will be used. This information is essential for lenders and investors to assess the viability of the business and its potential for success.

-

Financial needs:

The business plan should clearly outline the financial needs of the business. This includes the amount of funding required, as well as the purpose of the funds. For example, the funds may be used to purchase equipment, hire staff, or expand operations.

-

Use of funds:

The business plan should also explain how the funds will be used. This should include a detailed budget that outlines the specific expenses that the funds will cover. For example, the budget may include expenses for equipment, salaries, and marketing.

-

Financial projections:

In addition to outlining the financial needs and use of funds, the business plan should also include financial projections. These projections should demonstrate the expected financial performance of the business over a period of time, typically three to five years. The financial projections should be based on realistic assumptions and should be supported by historical data and market research.

-

Exit strategy:

The business plan should also include an exit strategy. This section should outline the plans for the future of the business, such as selling the business, passing it on to family members, or taking the business public. The exit strategy should be aligned with the goals of the business owners and should be realistic given the nature of the business.

By providing a clear and concise business plan, small business owners can increase their chances of securing financing and achieving their business goals.

Financial projections

Financial projections are a crucial aspect of small business financing, as they demonstrate the business’s ability to repay the loan. Lenders and investors rely on financial projections to assess the risk of lending money to a business. Well-prepared financial projections can increase a business’s chances of securing financing and obtaining favorable loan terms.

-

Revenue projections:

Revenue projections outline the expected revenue that the business will generate over a period of time, typically three to five years. Lenders and investors will want to see realistic revenue projections that are supported by market research and historical data. Strong revenue projections indicate that the business has the potential to generate enough cash flow to repay the loan.

-

Expense projections:

Expense projections outline the expected expenses that the business will incur over a period of time, typically three to five years. Lenders and investors will want to see detailed expense projections that include all major categories of expenses, such as salaries, rent, and marketing. Realistic expense projections demonstrate that the business has a clear understanding of its costs and that it has a plan to manage its expenses effectively.

-

Profit projections:

Profit projections outline the expected profit that the business will generate over a period of time, typically three to five years. Lenders and investors will want to see realistic profit projections that are supported by the revenue and expense projections. Strong profit projections indicate that the business has the potential to be profitable and that it has a plan to generate sufficient cash flow to repay the loan.

-

Cash flow projections:

Cash flow projections outline the expected cash flow of the business over a period of time, typically three to five years. Lenders and investors will want to see detailed cash flow projections that show how the business will generate and use cash. Strong cash flow projections demonstrate that the business has a clear understanding of its cash flow needs and that it has a plan to manage its cash flow effectively.

By providing accurate and well-prepared financial projections, small businesses can increase their chances of securing financing and obtaining favorable loan terms. Financial projections demonstrate the business’s ability to repay the loan and its potential for success.

Creditworthiness

Creditworthiness, often measured through credit history and credit scores, plays a pivotal role in small business financing. It directly influences a business’s ability to secure loans, qualify for favorable interest rates, and build strong relationships with lenders.

-

Payment history:

A consistent record of on-time payments on existing debts, including loans, credit cards, and utility bills, is crucial for building a strong credit history. Late payments or missed payments can negatively impact credit scores and make it more difficult to obtain financing.

-

Credit utilization:

Maintaining a low credit utilization ratio, which measures the amount of available credit being used, is another important factor in establishing creditworthiness. High credit utilization can indicate a higher risk of default and may lead to lower credit scores.

-

Length of credit history:

Lenders prefer borrowers with a long and established credit history. A longer history provides more data points for lenders to assess creditworthiness and make informed decisions.

-

Credit mix:

Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, demonstrates responsible credit management and can positively impact credit scores.

By understanding the connection between creditworthiness and small business financing, business owners can take proactive steps to build and maintain a strong credit profile. This will increase their chances of securing financing on favorable terms, which can support business growth and success.

FAQs on Small Business Financing

Small business financing can be a complex topic, but it doesn’t have to be. Here are answers to some of the most frequently asked questions about small business financing:

Question 1: What are the different types of small business financing?

There are many different types of small business financing available, including loans, grants, equity financing, and crowdfunding. Each type of financing has its own unique advantages and disadvantages, so it’s important to choose the one that’s right for your business.

Question 2: How do I qualify for small business financing?

The qualifications for small business financing vary depending on the type of financing you’re seeking. However, there are some general factors that lenders and investors will consider, such as your business plan, financial statements, and credit score.

Question 3: What are the interest rates on small business loans?

The interest rates on small business loans vary depending on the type of loan, the lender, and your business’s creditworthiness. However, you can expect to pay an interest rate that is higher than the prime rate.

Question 4: What are the repayment terms for small business loans?

The repayment terms for small business loans vary depending on the type of loan and the lender. However, you can expect to repay the loan over a period of several years.

Question 5: What are the advantages of small business financing?

Small business financing can provide a number of advantages, including access to capital, the ability to expand your business, and the opportunity to improve your cash flow.

Question 6: What are the disadvantages of small business financing?

Small business financing can also have some disadvantages, such as the cost of borrowing, the risk of default, and the potential for personal liability.

Summary: Small business financing can be a valuable tool for entrepreneurs and small business owners. However, it’s important to understand the different types of financing available, the qualifications for each type of financing, and the advantages and disadvantages of each type of financing before making a decision.

Next steps: If you’re considering small business financing, the next step is to talk to a lender or financial advisor to learn more about your options. They can help you assess your needs and choose the right financing option for your business.

Tips for Securing Small Business Financing

Small business financing can be a valuable tool for entrepreneurs and small business owners. However, it is important to understand the different types of financing available, the qualifications for each type of financing, and the advantages and disadvantages of each type of financing before making a decision.

Tip 1: Determine your financing needs

- Consider the purpose of the financing, such as purchasing equipment, hiring staff, or expanding operations.

- Estimate the amount of financing you need and the repayment period that is feasible for your business.

Tip 2: Research different financing options

- Explore traditional bank loans, government-backed loans, and alternative financing options such as crowdfunding and peer-to-peer lending.

- Compare interest rates, repayment terms, and eligibility criteria for each option.

Tip 3: Prepare a strong business plan

- Outline your business goals, strategies, and financial projections.

- Demonstrate the viability of your business and its ability to repay the loan.

Tip 4: Build a strong credit history

- Pay bills on time and keep credit utilization low.

- Establish a track record of responsible financial management.

Tip 5: Seek professional advice

- Consult with a financial advisor or loan officer to assess your options and prepare a strong loan application.

- They can provide guidance and support throughout the financing process.

Summary

By following these tips, small business owners can increase their chances of securing the financing they need to grow and succeed.

Next steps

If you are considering small business financing, the next step is to talk to a lender or financial advisor to learn more about your options.

Conclusion

Small business financing is essential for entrepreneurs and small business owners looking to start, grow, and succeed. By understanding the different types of financing available, the qualifications for each type of financing, and the advantages and disadvantages of each type of financing, small business owners can make informed decisions about how to finance their businesses.

Small business financing can be a powerful tool for small business owners. It can provide access to capital, allowing businesses to purchase equipment, hire staff, and expand operations. Small business financing can also help businesses improve their cash flow and manage their finances more effectively.

If you are a small business owner considering financing, it is important to do your research and understand the different options available to you. By following the tips outlined in this article, you can increase your chances of securing the financing you need to grow your business and achieve your goals.

Youtube Video: