Will be used to review and determine your eligibility for exemption for real property taxes under article 8, section 2(c) of the pennsylvania constitution and 51 pa.c.s. This section cited in 43 pa.

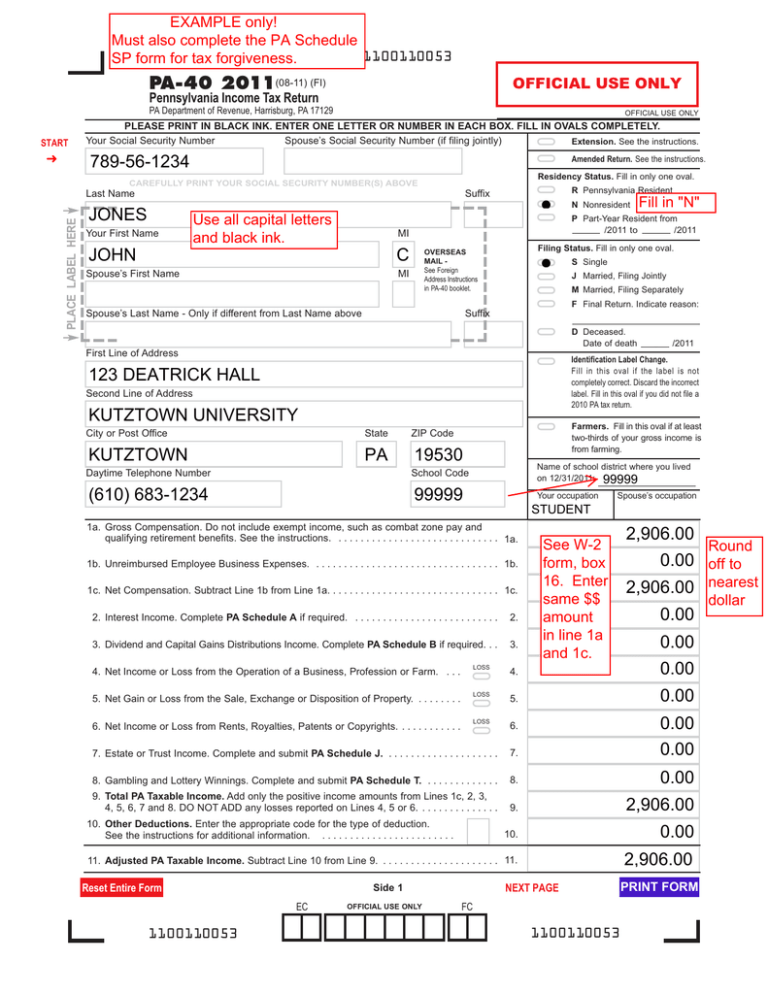

Pa-40 2011

What isn’t so obvious is the staggering financial impact.

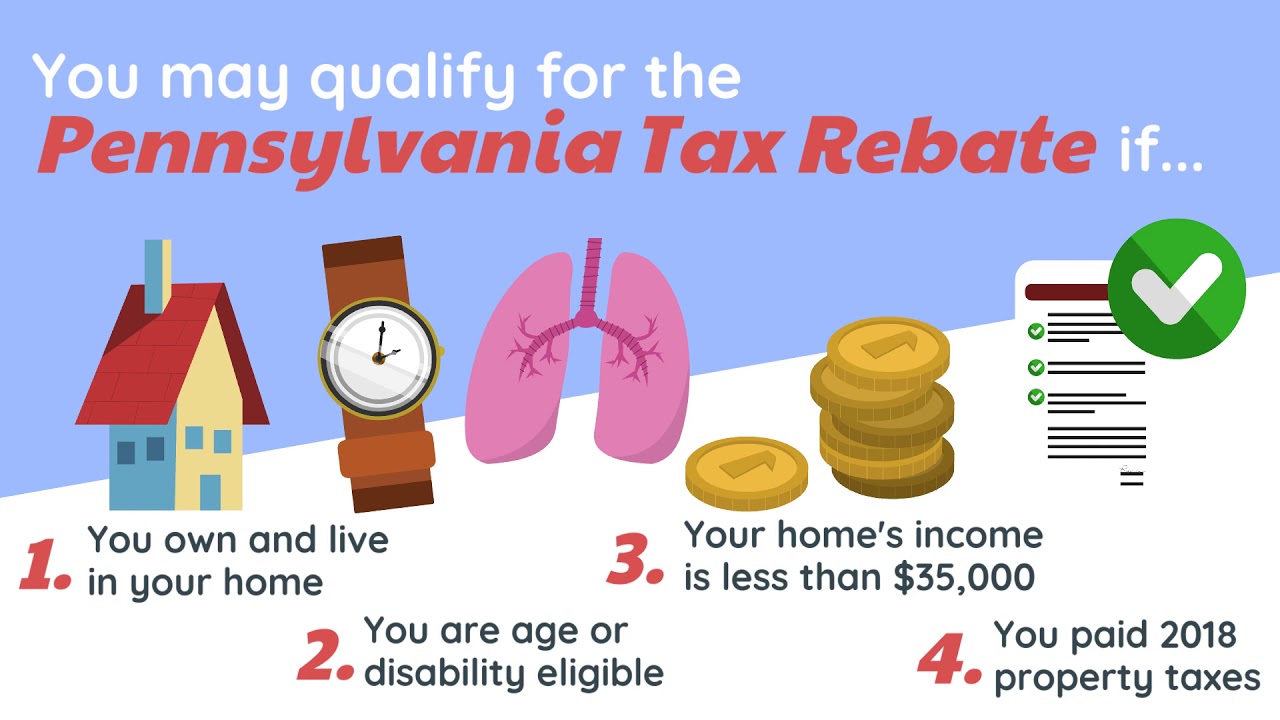

Property tax forgiveness pa. That means the owner of a home valued at $200,000 currently would pay. The average effective property tax rate in pennsylvania is 1.58%, compared to the national average of 1.08%. This can be done in the form of tax credits or exemptions.

The penalty for real estate taxes was forgiven through november 30, 2020. Taxes paid in december will now be assessed the penalty amount, and those taxes must be. The property tax and rent rebate program would be expanded.

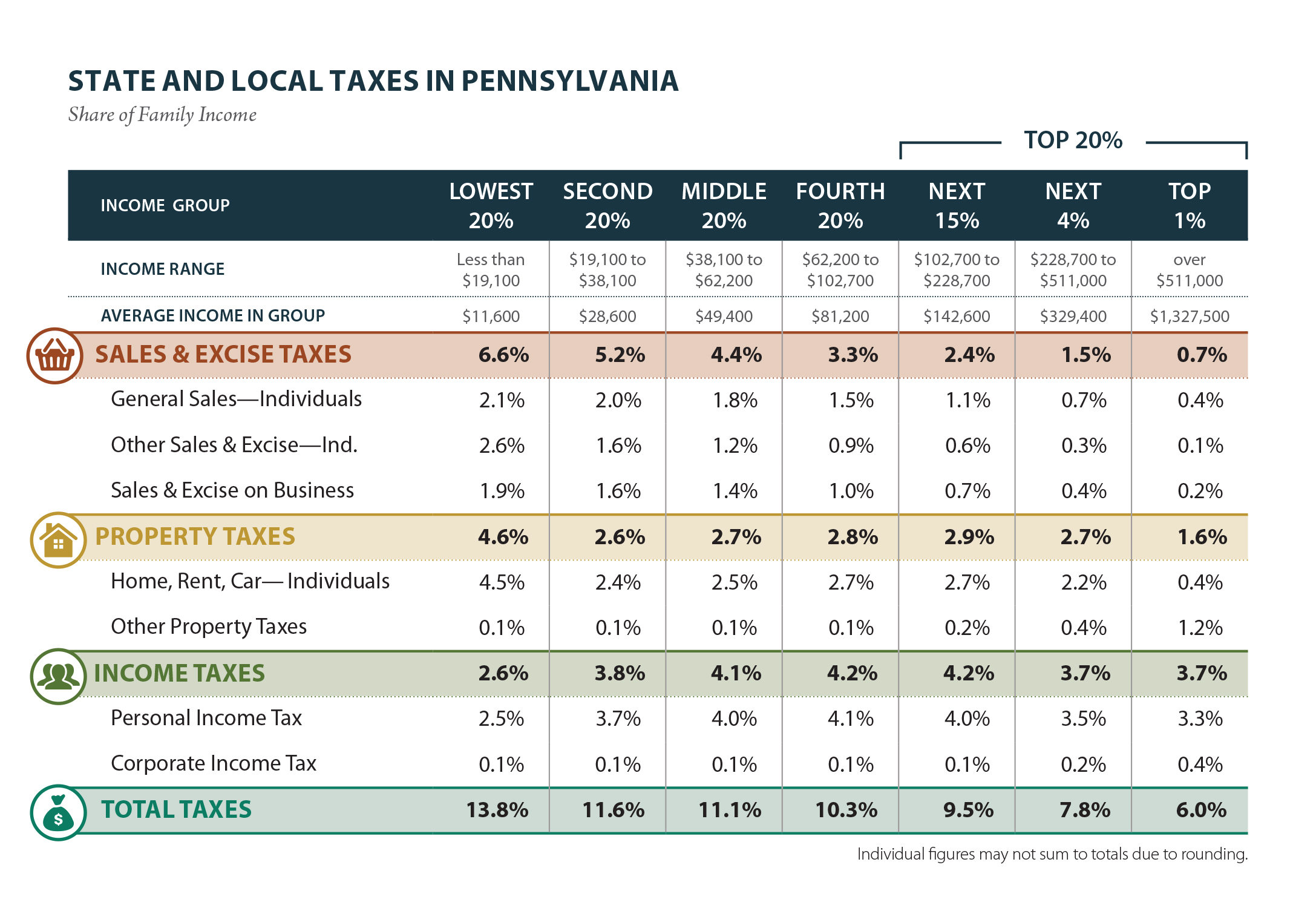

Wolf and legislative leaders are currently negotiating over the terms of a plan to cut property taxes which would be financed by an increase in the state sales tax rate from 6% to 7.25%. These standards vary from state to state. The taxpayer relief act, act 1 of special session 1 of 2006, was signed into law on june 27, 2006.

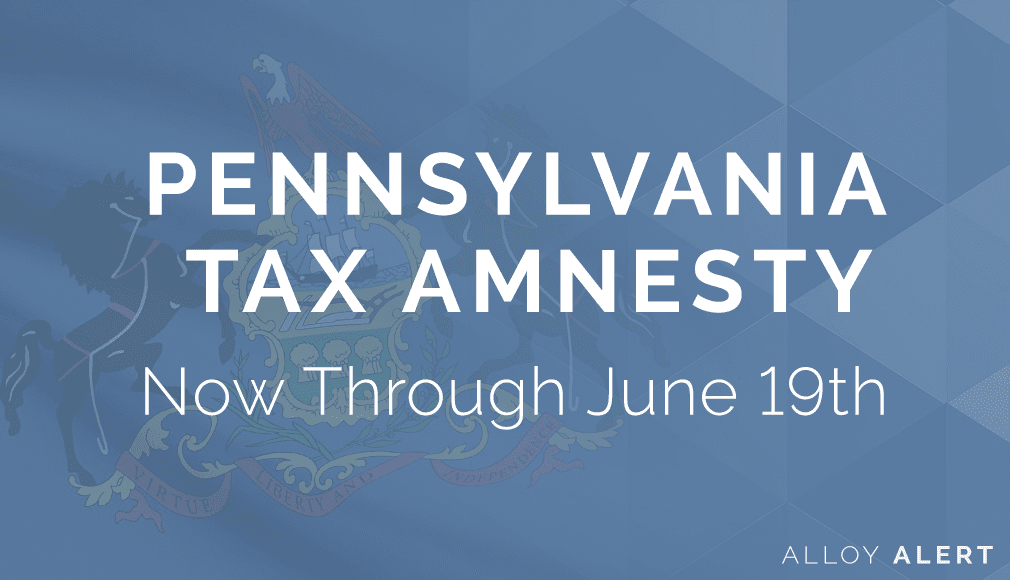

For example, in pennsylvania, a single person who makes less than $6,500 per year may qualify to have 100 percent of their state back taxes forgiven. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability. Hubert minnis, prime minister & minister of finance, announced the government’s immediate implementation of the “real property tax forgiveness program” (the “program’), as outlined in the real property tax (amnesty) order, 2021 (“the order”), and which came into effect on 1 march 2021.

Provides a reduction in tax liability, and. Voted for property tax relief: Application forms for the property tax/rent rebate program are now available for eligible pennsylvanians to begin claiming rebates on property taxes or.

Overall, pennsylvania has property tax rate that exceeds the national average. Several exemptions are available in the state of pennsylvania, like homestead exclusion or property tax/rent rebate program, which may lower the property's tax bill. The taxpayer relief act provides for property tax reduction allocations to be distributed by the commonwealth to each school district.

The pa property tax rates vary from county to county. What do i do next? In their 2013 study, allegheny county’s three cogs determined the direct and indirect costs of blight to the 41 communities in the study area:

School districts would have to levy a local earned income of at least 1%. Then move across the row to find your eligibility income. Stroll along the streets of wilkinsburg, and blight is pretty obvious.

Reduce school property taxes by $8.62 billion, increase the personal income tax from 3.07% to 4.07%, and raise the sales tax from 6% to 7% to provide money for homestead exclusions. If your eligibility income from pa schedule sp,. Do you qualify for 30% discount on your county taxes?

At the bottom of that column is the percentage of tax forgiveness for which you qualify. The direct cost to municipal services is $10,720,302. On 1 march 2021, during the fiscal strategy debate, the most honourable dr.

More than 30% of all tax filers received tax forgiveness in six pennsylvania counties: What it means, how it works, what's next. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes.

If you think you may have trouble meeting your tax obligations, there are several programs in pa that can reduce the amount of property tax you owe or offer you a rebate on property tax paid. Tax forgiveness utilization is highest in pennsylvania’s rural counties. Table 1 lists the percentage of tax returns receiving tax forgiveness by county in pennsylvania in tax year 2006.

(a) the commission will review cases that have been granted real property tax relief under the pa. This brief analyzes the size of the sales tax rate increase by income. This property might benefit from homestead exclusions but unfortunately, no data regarding the exact exemption was provided to us.

Although you’re going to see a considerable difference in the property tax rate based on where you purchase a home, the average property tax rate for pennsylvania was 2.02% in 2017. Local governments within the state use various methods to calculate your real property tax base. Forest, cameron, tioga, fayette, venango, and philadelphia.

The information may be provided to federal, state and local agencies, including your local taxing authorities, in. (b) on the second anniversary of the granting of real property tax relief under the pa. Forgives some taxpayers of their liabilities even if they have not paid their pennsylvania personal income tax.

States also offer tax forgiveness based on personal income standards. Code § 5.24 (relating to processing applications).

Think You Cant Afford A Home Actually You Might Be Pleasantly Surprised There Are So Many Loan Programs And Options Ou In 2021 Income Current Mortgage Rates States

I Turn Coffee Into Tax Returns Tax Return Turn Ons Tax Season

Pennsylvania Department Of Revenue – Posts Facebook

2

Pennsylvania Tax Rebate Are You Eligible For 975video Palawhelporg – Your Online Guide To Legal Information And Legal Services In Pennsylvania

Are You Eligible For The Pa Tax Amnesty Program – Alloy Silverstein

Akuntansi Keuangan Manajemen Keuangan Finance Management Business Advice Investing Savings Advice

2

Mike Wolf Is A Seasoned Real Estate Investor International Speaker Coach In Turnkey Properties Pa Real Estate Quotes Motivational Cards Strong Women Quotes

Httpdebtreliefdigimktscom I Need This Support Specialist 866-232-9476 Debt Relief Debt Relief Programs Credit Card Debt Relief Tax Debt Relief

Pennsylvania Sales Tax – Small Business Guide Truic

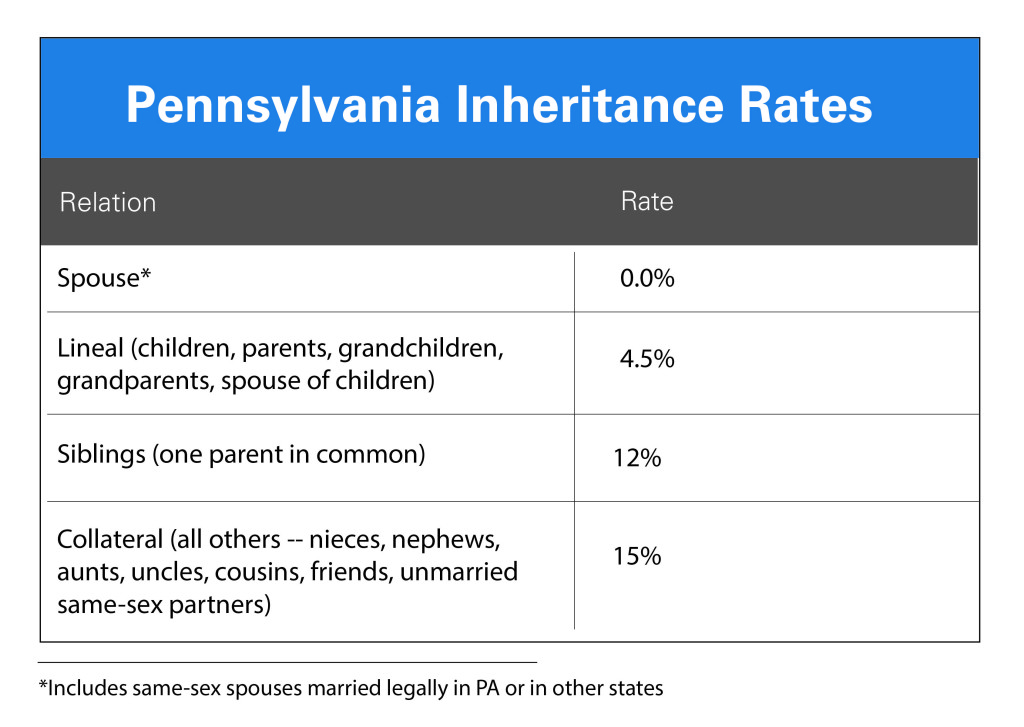

Estate Gift Tax Considerations

News Release

This Pa City Wont Make You Pay Back Taxes On Vacant Homes If Youre Willing To Fix One Up – Pennlivecom

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Pennsylvania Who Pays 6th Edition Itep

Pin On Educational

Pennsylvanians Can Now File Property Taxrent Rebate Program Applications Online Pennsylvania Legal Aid Network

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center