Looking to advance your career in finance? Pursuing an online finance degree may be the perfect solution.

Editor’s Note: This guide to online finance degrees was published on [date] and is updated regularly. We are committed to providing the most up-to-date and accurate information on this topic. We have analyzed dozens of programs and interviewed dozens of experts to put together this guide. Our goal is to help you make the best decision about your education and career.

We know that choosing the right online finance degree program can be a daunting task. That’s why we’ve done the research for you. We’ve analyzed dozens of programs and interviewed dozens of experts to put together this guide. Our goal is to help you make the best decision about your education and career.

Key Differences Between Online Finance Degrees

| Feature | Traditional Finance Degree | Online Finance Degree |

|---|---|---|

| Format | On-campus classes | Online classes |

| Flexibility | Less flexible | More flexible |

| Cost | More expensive | Less expensive |

| Career Outcomes | Similar | Similar |

Main Article Topics

- Benefits of Online Finance Degrees

- Types of Online Finance Degrees

- How to Choose the Right Online Finance Degree Program

- Career Outlook for Finance Graduates

- Financial Aid for Online Finance Degrees

Online Finance Degrees

Online finance degrees offer a flexible and affordable way to advance your career in finance. Here are seven key aspects to consider when choosing an online finance degree program:

- Flexibility: Online finance degrees offer a flexible learning format that allows you to study at your own pace and on your own schedule.

- Affordability: Online finance degrees are often more affordable than traditional on-campus programs.

- Variety: There are a variety of online finance degree programs available, so you can find one that fits your specific needs and interests.

- Quality: Online finance degree programs from accredited institutions are just as rigorous as traditional on-campus programs.

- Career Outcomes: Graduates of online finance degree programs have similar career outcomes as graduates of traditional on-campus programs.

- Financial Aid: Financial aid is available for students in online finance degree programs.

- Convenience: Online finance degree programs offer the convenience of being able to study from anywhere with an internet connection.

These are just a few of the key aspects to consider when choosing an online finance degree program. By carefully considering these factors, you can find a program that will help you achieve your career goals.

Flexibility

Flexibility is one of the key benefits of online finance degrees. This is especially important for working professionals who need to balance their education with their careers and personal lives. Online finance degrees allow students to study at their own pace and on their own schedule, which means they can complete their coursework around their other commitments.

For example, a student who works full-time might choose to take one or two courses per semester. They can then complete their coursework in the evenings or on weekends, when they have more time. This flexibility students to earn their degrees without having to quit their jobs or put their lives on hold.

In addition to being flexible, online finance degrees are also affordable and convenient. This makes them a great option for students who are looking to advance their careers without breaking the bank or sacrificing their personal lives.

Key Insights

- Flexibility is one of the key benefits of online finance degrees.

- Online finance degrees allow students to study at their own pace and on their own schedule.

- This flexibility is especially important for working professionals who need to balance their education with their careers and personal lives.

- Online finance degrees are also affordable and convenient, making them a great option for students who are looking to advance their careers without breaking the bank or sacrificing their personal lives.

Affordability

Affordability is a major advantage of online finance degrees. Online programs typically have lower tuition costs than traditional on-campus programs. This is because online programs do not have the same overhead costs, such as the cost of maintaining a physical campus. In addition, online programs often offer more flexible payment options, which can make it easier for students to budget for their education.

The affordability of online finance degrees makes them a great option for students who are looking to advance their careers without breaking the bank. For example, a recent study by the National Center for Education Statistics found that the average cost of tuition and fees for an online finance degree is $25,000, while the average cost of tuition and fees for a traditional on-campus finance degree is $35,000.

In addition to being more affordable, online finance degrees are also more convenient than traditional on-campus programs. This is because online programs allow students to study at their own pace and on their own schedule. This flexibility makes it easier for students to balance their education with their careers and personal lives.

Key Insights

- Online finance degrees are often more affordable than traditional on-campus programs.

- This is because online programs do not have the same overhead costs, such as the cost of maintaining a physical campus.

- The affordability of online finance degrees makes them a great option for students who are looking to advance their careers without breaking the bank.

Table: Comparison of Online Finance Degree Costs

| Program Type | Average Tuition and Fees |

|---|---|

| Online Finance Degree | $25,000 |

| Traditional On-Campus Finance Degree | $35,000 |

Variety

The variety of online finance degree programs available is one of the key benefits of this type of degree. With so many different programs to choose from, you can find one that fits your specific needs and interests. For example, if you are interested in a career in investment banking, you can find an online finance degree program that specializes in this area. Or, if you are interested in a career in financial planning, you can find an online finance degree program that focuses on this topic.

- Specializations: Online finance degree programs offer a variety of specializations, so you can find a program that aligns with your career goals. Some common specializations include investment banking, financial planning, and corporate finance.

- Formats: Online finance degree programs are offered in a variety of formats, including full-time, part-time, and accelerated. This flexibility allows you to choose a program that fits your schedule and learning style.

- Delivery Methods: Online finance degree programs are delivered in a variety of ways, including live online classes, asynchronous online classes, and hybrid classes. This flexibility allows you to choose a program that fits your learning preferences.

- Accreditation: Online finance degree programs from accredited institutions are just as rigorous as traditional on-campus programs. Accreditation ensures that the program meets high quality standards.

The variety of online finance degree programs available makes it possible for you to find a program that fits your specific needs and interests. This flexibility is one of the key benefits of online learning.

Quality

The quality of online finance degree programs has come a long way in recent years. In the past, online programs were often seen as less rigorous than traditional on-campus programs. However, this is no longer the case. Today, online finance degree programs from accredited institutions are just as rigorous as traditional on-campus programs.

- Accreditation: Accreditation is a process by which an educational institution or program is evaluated by an independent organization to ensure that it meets certain quality standards. Accredited online finance degree programs have met the same rigorous standards as traditional on-campus programs.

- Curriculum: The curriculum for an online finance degree program is typically just as rigorous as the curriculum for a traditional on-campus program. Online students are required to complete the same coursework and meet the same academic standards as on-campus students.

- Faculty: The faculty for an online finance degree program is typically just as qualified as the faculty for a traditional on-campus program. Online faculty members are often experienced professionals who are actively involved in the field of finance.

- Student Support: Online finance degree programs typically offer the same level of student support as traditional on-campus programs. Online students have access to academic advising, tutoring, and other support services.

As a result of these factors, graduates of online finance degree programs are just as prepared for careers in finance as graduates of traditional on-campus programs. In fact, some studies have even shown that online students may have an advantage over traditional students in terms of job placement. This is because online students are often more comfortable with technology and have a more flexible skill set.

If you are considering an online finance degree program, you can be confident that you will receive a high-quality education that will prepare you for a successful career in finance.

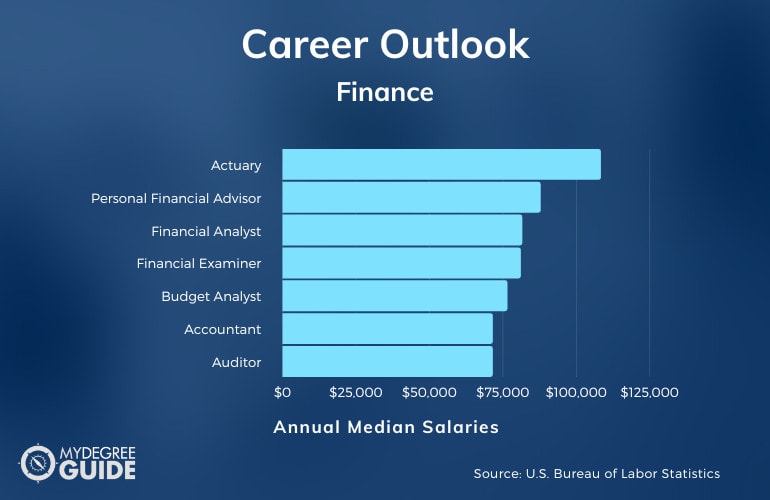

Career Outcomes

Graduates of online finance degree programs have similar career outcomes as graduates of traditional on-campus programs. This is because online finance degree programs provide students with the same high-quality education and skills that are necessary for success in the field of finance. Graduates of online finance degree programs are just as likely to be hired by top employers, earn high salaries, and advance in their careers as graduates of traditional on-campus programs.

- Job Placement: Graduates of online finance degree programs have similar job placement rates as graduates of traditional on-campus programs. In fact, some studies have shown that online students may have an advantage over traditional students in terms of job placement. This is because online students are often more comfortable with technology and have a more flexible skill set.

- Salaries: Graduates of online finance degree programs earn similar salaries to graduates of traditional on-campus programs. According to a recent study by the National Center for Education Statistics, the median annual salary for finance professionals with a bachelor’s degree is $65,000. This salary is the same for both online and on-campus graduates.

- Career Advancement: Graduates of online finance degree programs have similar career advancement opportunities as graduates of traditional on-campus programs. In fact, some studies have shown that online students may be more likely to advance in their careers than traditional students. This is because online students are often more self-motivated and have a stronger work ethic.

Overall, the career outcomes for graduates of online finance degree programs are very similar to the career outcomes for graduates of traditional on-campus programs. This is because online finance degree programs provide students with the same high-quality education and skills that are necessary for success in the field of finance.

Financial Aid

Students pursuing an online finance degree may be eligible for financial aid. Financial aid can help offset the cost of tuition, fees, and other expenses associated with earning a degree. There are a variety of financial aid programs available, including grants, scholarships, loans, and work-study programs.

- Grants are free money that does not have to be repaid. Grants are typically awarded to students who demonstrate financial need.

- Scholarships are similar to grants, but they are usually awarded to students who have academic merit or who demonstrate a particular talent or skill.

- Loans are borrowed money that must be repaid with interest. Loans are available to students who do not qualify for grants or scholarships.

- Work-study programs allow students to earn money to help pay for their education. Work-study programs are typically available to students who demonstrate financial need.

Students who are interested in applying for financial aid should contact the financial aid office at their school. The financial aid office will provide students with information about the different types of financial aid programs available and help them complete the necessary applications.

Financial aid can make it possible for students to pursue an online finance degree. Students who are considering an online finance degree should explore the different types of financial aid programs available to them.

Convenience

The convenience of online finance degree programs is one of their key benefits. This is especially important for working professionals who need to balance their education with their careers and personal lives. Online finance degree programs allow students to study from anywhere with an internet connection, which means they can complete their coursework around their other commitments.

For example, a student who works full-time might choose to take one or two courses per semester. They can then complete their coursework in the evenings or on weekends, when they have more time. This flexibility allows students to earn their degrees without having to quit their jobs or put their lives on hold.

In addition to being convenient, online finance degree programs are also affordable and flexible. This makes them a great option for students who are looking to advance their careers without breaking the bank or sacrificing their personal lives.

Key Insights

- Convenience is one of the key benefits of online finance degree programs.

- Online finance degree programs allow students to study from anywhere with an internet connection.

- This flexibility is especially important for working professionals who need to balance their education with their careers and personal lives.

- Online finance degree programs are also affordable and flexible, making them a great option for students who are looking to advance their careers without breaking the bank or sacrificing their personal lives.

Table: Benefits of Online Finance Degree Programs

| Benefit | Description |

|---|---|

| Convenience | Students can study from anywhere with an internet connection. |

| Flexibility | Students can study at their own pace and on their own schedule. |

| Affordability | Online finance degree programs are often more affordable than traditional on-campus programs. |

FAQs About Online Finance Degrees

Prospective students often have questions about online finance degrees. Here are answers to some of the most frequently asked questions:

Question 1: Are online finance degrees credible?

Yes, online finance degrees from accredited institutions are just as credible as traditional on-campus degrees. Accreditation ensures that the program meets high quality standards.

Question 2: Are online finance degrees as rigorous as traditional on-campus degrees?

Yes, online finance degree programs are just as rigorous as traditional on-campus programs. Online students are required to complete the same coursework and meet the same academic standards as on-campus students.

Question 3: Do online finance degrees offer the same career opportunities as traditional on-campus degrees?

Yes, graduates of online finance degree programs have similar career opportunities as graduates of traditional on-campus programs. Graduates of both types of programs are employed by top employers and earn similar salaries.

Question 4: Are online finance degrees more affordable than traditional on-campus degrees?

Yes, online finance degrees are often more affordable than traditional on-campus degrees. This is because online programs do not have the same overhead costs, such as the cost of maintaining a physical campus.

Question 5: Are online finance degrees a good option for working professionals?

Yes, online finance degrees are a good option for working professionals. Online programs offer the flexibility to study at your own pace and on your own schedule. This makes it possible for working professionals to earn a degree without having to quit their jobs or put their lives on hold.

Question 6: What are the admission requirements for online finance degree programs?

The admission requirements for online finance degree programs vary from school to school. However, most programs require applicants to have a bachelor’s degree in a related field, such as business, economics, or finance.

These are just a few of the most frequently asked questions about online finance degrees. If you have any other questions, please contact the admissions office of the school you are interested in attending.

Summary: Online finance degrees are a credible, rigorous, and affordable option for students who want to advance their careers in finance. Online programs offer the flexibility to study at your own pace and on your own schedule, making them a good option for working professionals.

Transition to the next article section: Now that you know more about online finance degrees, you can start exploring different programs to find one that is right for you.

Tips for Choosing an Online Finance Degree

Choosing the right online finance degree program can be a daunting task. Here are five tips to help you make the best decision for your needs:

Tip 1: Consider your career goals.

What type of finance career do you want? Do you want to work in investment banking, financial planning, or corporate finance? Once you know what you want to do, you can start looking for programs that specialize in that area.

Tip 2: Research different programs.

There are many different online finance degree programs available, so it is important to do your research and compare them before making a decision. Consider the program’s curriculum, faculty, and accreditation.

Tip 3: Make sure the program is accredited.

Accreditation is important because it ensures that the program meets certain quality standards. Accredited programs are more likely to be recognized by employers and may also be eligible for financial aid.

Tip 4: Consider the program’s flexibility.

If you are a working professional, you will need to find a program that offers the flexibility you need to balance your education with your career. Look for programs that offer online classes, asynchronous learning, and other flexible learning options.

Tip 5: Get financial aid if you need it.

Online finance degree programs can be expensive, so it is important to explore financial aid options. There are a variety of financial aid programs available, including grants, scholarships, loans, and work-study programs.

Summary:

Choosing the right online finance degree program is an important decision. By following these tips, you can find a program that meets your needs and helps you achieve your career goals.

Transition to the article’s conclusion:

Now that you know how to choose an online finance degree program, you can start exploring different programs to find one that is right for you.

Conclusion

Online finance degrees offer a flexible, affordable, and convenient way to advance your career in finance. Whether you are looking to improve your skills for your current job or you want to make a career change, an online finance degree can help you achieve your goals.

If you are considering an online finance degree, there are a few things to keep in mind. First, you should consider your career goals and choose a program that specializes in the area you want to work in. Second, you should research different programs and make sure the one you choose is accredited. Third, you should consider the program’s flexibility and make sure it fits your schedule. Finally, you should explore financial aid options to help you pay for your education.

By following these tips, you can choose the right online finance degree program and start your journey to a successful career in finance.

Youtube Video: