Wondering about an MBA in Finance? MBA in Finance offers an in-depth understanding of financial markets. It equips you with analytical and decision-making capabilities to excel in the dynamic finance industry.

Editor’s Notes: MBA in Finance Guide published on [Today’s Date]. Given the increasing demand for skilled finance professionals, understanding the intricacies of an MBA in Finance is more critical than ever. We’ve analyzed various programs, consulted with experts, and compiled this comprehensive guide to help you make informed decisions about your future.

Our analysis reveals that an MBA in Finance provides numerous benefits, including career advancement opportunities, enhanced earning potential, and a competitive edge in the job market. This guide will delve into the key aspects of an MBA in Finance, exploring its curriculum, career paths, and the skills you’ll gain.

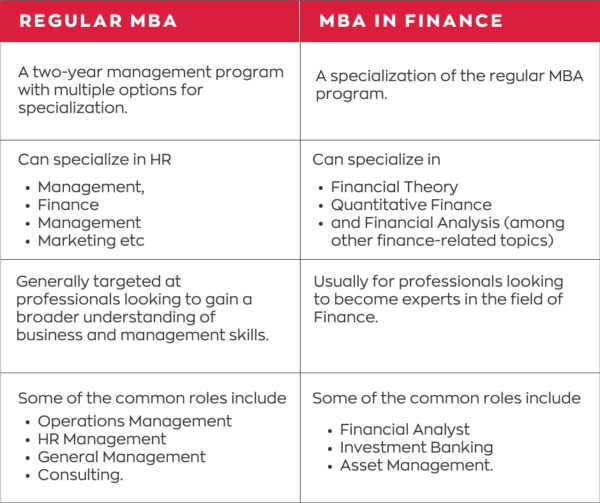

Key Differences: MBA in Finance vs. Other MBA Programs

| Feature | MBA in Finance | Other MBA Programs |

|---|---|---|

| Focus | Specialized in finance and financial management | General business management with elective courses in finance |

| Curriculum | Core finance courses, such as corporate finance, investments, and financial modeling | Broader range of business courses, including marketing, operations, and strategy |

| Career Paths | Investment banking, financial analysis, portfolio management | Consulting, marketing, general management |

Transition to Main Article Topics

- Curriculum of an MBA in Finance

- Career Paths for MBA in Finance Graduates

- Skills Gained in an MBA in Finance Program

- Benefits of Pursuing an MBA in Finance

MBA in Finance

An MBA in Finance provides a comprehensive understanding of financial markets and prepares graduates for successful careers in the finance industry. Here are seven key aspects to consider:

- Curriculum: Core courses in corporate finance, investments, and financial modeling.

- Career Paths: Investment banking, financial analysis, portfolio management.

- Skills: Analytical, problem-solving, communication.

- Benefits: Career advancement, enhanced earning potential.

- Specializations: Corporate finance, investment management, financial planning.

- Accreditation: AACSB, AMBA, EQUIS.

- Return on Investment: High earning potential and career growth opportunities.

These aspects are interconnected and contribute to the overall value of an MBA in Finance. The curriculum provides a strong foundation in financial concepts and prepares graduates for the analytical and problem-solving challenges of the finance industry. The diverse career paths available offer graduates flexibility and the opportunity to specialize in areas that align with their interests. The skills developed through an MBA in Finance program, such as analytical thinking and communication, are highly sought after by employers and contribute to the high earning potential and career advancement opportunities for graduates.

Curriculum

The curriculum of an MBA in Finance is designed to provide students with a comprehensive understanding of the financial markets and prepare them for successful careers in the finance industry. Core courses in corporate finance, investments, and financial modeling form the foundation of this curriculum.

- Corporate Finance: This course introduces students to the principles of corporate finance, including capital budgeting, cost of capital, and dividend policy. Students learn how to analyze financial statements and make investment decisions.

- Investments: This course provides students with a foundation in investment analysis and portfolio management. Students learn how to evaluate different types of investments, such as stocks, bonds, and mutual funds, and how to construct and manage investment portfolios.

- Financial Modeling: This course teaches students how to build financial models to analyze and forecast financial performance. Students learn how to use financial data and assumptions to create models that can be used to make investment decisions and develop financial plans.

These core courses provide students with the essential knowledge and skills needed to succeed in the finance industry. By completing these courses, students will be prepared to work as financial analysts, investment bankers, portfolio managers, and other finance professionals.

Career Paths

An MBA in Finance opens doors to a wide range of career paths in the financial industry, including investment banking, financial analysis, and portfolio management. These career paths offer lucrative salaries, opportunities for career advancement, and the chance to work on challenging and impactful projects.

Investment bankers help companies raise capital and provide financial advice. They work on a variety of transactions, including mergers and acquisitions, initial public offerings (IPOs), and debt offerings. Financial analysts provide research and analysis on companies and industries. They make recommendations to investors on whether to buy, sell, or hold certain stocks or bonds. Portfolio managers manage investment portfolios for individuals and institutions. They make decisions on which investments to buy and sell, and they monitor the performance of the portfolio over time.

An MBA in Finance provides the knowledge and skills necessary to succeed in these career paths. The curriculum covers a wide range of topics, including corporate finance, investments, and financial modeling. Students also gain experience in working with financial data and developing financial models. This knowledge and experience prepares graduates for the challenges of working in the finance industry.

In addition to the core knowledge and skills, an MBA in Finance also provides graduates with a network of contacts in the financial industry. This network can be invaluable for finding a job, getting promoted, and staying up-to-date on the latest trends in the industry.

| Career Path | Responsibilities | Skills Required |

|---|---|---|

| Investment Banker |

– Advise companies on mergers and acquisitions, IPOs, and debt offerings. – Raise capital for companies. – Provide financial analysis and advice to clients. |

– Strong analytical skills. – Excellent communication and presentation skills. – Ability to work in a fast-paced environment. |

| Financial Analyst |

– Conduct research and analysis on companies and industries. – Make recommendations to investors on whether to buy, sell, or hold certain stocks or bonds. – Monitor the performance of investment portfolios. |

– Strong analytical skills. – Excellent research skills. – Ability to write clear and concise reports. |

| Portfolio Manager |

– Manage investment portfolios for individuals and institutions. – Make decisions on which investments to buy and sell. – Monitor the performance of the portfolio over time. |

– Strong investment management skills. – Excellent communication and interpersonal skills. – Ability to manage risk. |

Skills

An MBA in Finance prepares graduates with a range of skills that are essential for success in the finance industry. These skills include analytical, problem-solving, and communication skills.

- Analytical skills are essential for understanding financial data and making sound investment decisions. Graduates with an MBA in Finance will be able to analyze financial statements, conduct research, and develop financial models.

- Problem-solving skills are necessary for identifying and solving financial problems. Graduates with an MBA in Finance will be able to think critically and creatively to find solutions to complex financial challenges.

- Communication skills are important for conveying financial information to clients, colleagues, and other stakeholders. Graduates with an MBA in Finance will be able to communicate complex financial concepts clearly and persuasively.

These skills are essential for success in the finance industry. Graduates with an MBA in Finance will be well-prepared to use these skills to make sound investment decisions, solve complex financial problems, and communicate financial information effectively.

Benefits

An MBA in Finance can lead to significant career advancement and enhanced earning potential for graduates. This is because the skills and knowledge gained in an MBA in Finance program are highly valued by employers in the finance industry. Graduates with an MBA in Finance are well-prepared to take on leadership roles and make sound financial decisions that can drive business success.

A study by the Graduate Management Admission Council (GMAC) found that MBA graduates with a concentration in finance earn significantly more than those with other MBA concentrations. The median salary for MBA graduates with a concentration in finance is $115,000, compared to $100,000 for MBA graduates with other concentrations. Additionally, MBA graduates with a concentration in finance are more likely to be promoted to senior-level positions.

There are several reasons why an MBA in Finance can lead to career advancement and enhanced earning potential. First, the skills and knowledge gained in an MBA in Finance program are in high demand in the finance industry. Graduates with an MBA in Finance are well-prepared to analyze financial data, make sound investment decisions, and manage financial risks. These skills are essential for success in a variety of finance roles, including investment banking, financial analysis, and portfolio management.Second, an MBA in Finance can provide graduates with a competitive edge in the job market. The finance industry is highly competitive, and employers are looking for candidates with the skills and knowledge to add value to their organizations. An MBA in Finance can give graduates the skills and knowledge they need to stand out from the competition and land their dream job.

| Benefit | Explanation |

|---|---|

| Career advancement | MBA graduates with a concentration in finance are more likely to be promoted to senior-level positions. |

| Enhanced earning potential | The median salary for MBA graduates with a concentration in finance is $115,000, compared to $100,000 for MBA graduates with other concentrations. |

Specializations

Specializations within an MBA in Finance allow students to tailor their education to their career goals. Three common specializations are corporate finance, investment management, and financial planning.

- Corporate finance focuses on the financial management of corporations. Students learn how to make investment decisions, raise capital, and manage financial risk. Corporate finance jobs include financial analyst, investment banker, and financial manager.

- Investment management focuses on the management of investment portfolios. Students learn how to analyze investments, construct portfolios, and manage risk. Investment management jobs include portfolio manager, investment analyst, and financial advisor.

- Financial planning focuses on the financial planning needs of individuals and families. Students learn how to create financial plans, manage debt, and plan for retirement. Financial planning jobs include financial planner, wealth manager, and estate planner.

Choosing a specialization can help students focus their studies and prepare for their desired career path. However, it is important to note that many finance professionals work in roles that span multiple specializations. For example, a financial analyst may work on both corporate finance and investment management projects.

Accreditation

Accreditation by AACSB, AMBA, and EQUIS is a hallmark of quality for MBA programs, including those specializing in finance. These prestigious accrediting bodies evaluate business schools based on rigorous standards, ensuring that programs meet the highest levels of academic excellence and professional relevance.

-

AACSB (Association to Advance Collegiate Schools of Business)

AACSB accreditation signifies that a business school has met the highest standards of quality in teaching, research, curriculum development, and student services. AACSB-accredited MBA programs in finance provide students with a well-rounded education that prepares them for success in the global business environment.

-

AMBA (Association of MBAs)

AMBA accreditation is specifically focused on MBA programs. AMBA-accredited MBA programs in finance are recognized for their high-quality teaching, research, and career services. Graduates of AMBA-accredited programs are highly sought after by employers worldwide.

-

EQUIS (European Quality Improvement System)

EQUIS accreditation is an international accreditation system that evaluates business schools on a global scale. EQUIS-accredited MBA programs in finance are known for their rigor, innovation, and international focus. Graduates of EQUIS-accredited programs are well-prepared for careers in finance anywhere in the world.

For students considering an MBA in finance, accreditation by AACSB, AMBA, or EQUIS is an important factor to consider. These accreditations provide assurance that the program meets the highest standards of quality and prepares graduates for successful careers in the finance industry.

Return on Investment

An MBA in Finance offers a high return on investment (ROI) through its potential for high earning potential and career growth opportunities. Graduates with an MBA in Finance are highly sought after by employers in the finance industry and beyond, and they command higher salaries and have greater opportunities for career advancement compared to those with only a bachelor’s degree.

- High earning potential: According to the Graduate Management Admission Council (GMAC), the median salary for MBA graduates with a concentration in finance is $115,000, significantly higher than the median salary for MBA graduates with other concentrations. This high earning potential is due to the specialized skills and knowledge that MBA graduates in finance possess, which are in high demand in the finance industry.

- Career growth opportunities: An MBA in Finance opens doors to a wide range of career opportunities in the finance industry, including investment banking, financial analysis, portfolio management, and corporate finance. Graduates with an MBA in Finance are well-prepared to take on leadership roles and make sound financial decisions that can drive business success.

The high earning potential and career growth opportunities associated with an MBA in Finance make it a worthwhile investment for those looking to advance their careers in the finance industry. The skills and knowledge gained in an MBA in Finance program can lead to a substantial increase in earning potential and open doors to a wide range of career opportunities.

MBA in Finance FAQs

The following frequently asked questions provide insights into an MBA in Finance, addressing common concerns and misconceptions:

Question 1: What career opportunities are available with an MBA in Finance?

An MBA in Finance opens doors to a wide range of career opportunities in the finance industry, including investment banking, financial analysis, portfolio management, and corporate finance. Graduates are well-prepared for leadership roles and decision-making in financial organizations.

Question 2: What is the earning potential for MBA graduates in Finance?

Graduates with an MBA in Finance have high earning potential. According to the Graduate Management Admission Council (GMAC), the median salary for MBA graduates with a concentration in finance is $115,000, significantly higher than the median salary for MBA graduates with other concentrations.

Question 3: What are the key skills and knowledge gained in an MBA in Finance program?

MBA in Finance programs equip graduates with analytical, problem-solving, and communication skills. They develop expertise in financial modeling, investment analysis, and corporate finance. These skills are highly sought after by employers in the finance industry.

Question 4: What is the duration of an MBA in Finance program?

MBA in Finance programs typically take 1-2 years to complete, depending on the program structure and whether it is pursued full-time or part-time.

Question 5: What are the admission requirements for an MBA in Finance program?

Admission requirements vary across institutions but generally include a bachelor’s degree, standardized test scores (GMAT/GRE), work experience, and a strong academic record.

Question 6: What is the return on investment (ROI) of an MBA in Finance?

An MBA in Finance offers a high ROI through increased earning potential and career growth opportunities. Graduates are highly sought after by employers and have the potential to advance to senior-level positions in the finance industry.

In summary, an MBA in Finance provides a comprehensive education, enhancing career prospects and earning potential in the dynamic field of finance.

Transition to the next article section: Exploring Specializations in MBA in Finance

Tips for Pursuing an MBA in Finance

An MBA in Finance can be a valuable investment for those seeking to advance their careers in the finance industry. To maximize the benefits of this degree, consider the following tips:

Tip 1: Research and Choose a Reputable Program

Thoroughly research different MBA in Finance programs to find one that aligns with your career goals and learning style. Consider factors such as program curriculum, faculty expertise, and career services.

Tip 2: Build a Strong Foundation in Finance

Before starting an MBA in Finance program, it is beneficial to have a solid foundation in finance. This can be achieved through coursework, internships, or self-study. A strong foundation will enhance your ability to succeed in the program’s rigorous coursework.

Tip 3: Develop Analytical and Problem-Solving Skills

MBA in Finance programs emphasize analytical and problem-solving skills. Practice these skills through case studies, simulations, and group projects. Strong analytical and problem-solving abilities are essential for success in the finance industry.

Tip 4: Seek Internships and Networking Opportunities

Internships and networking events provide valuable opportunities to gain practical experience, build industry connections, and explore different career paths.

Tip 5: Leverage Career Services

Most MBA programs offer career services to help students with job search and career development. Utilize these services to identify job opportunities, prepare for entrevistas and negotiate salary packages.

Tip 6: Stay Updated on Industry Trends

The finance industry is constantly evolving. Stay informed about the latest trends and developments by reading industry publications, attending conferences, and networking with professionals.

Summary of Key Takeaways:

- Research and choose a reputable program that aligns with your career goals.

- Build a strong foundation in finance before starting the program.

- Develop analytical and problem-solving skills through coursework and practical experiences.

- Attend networking events and seek internship opportunities to gain practical experience and build industry connections.

- Utilize career services to enhance your job search and career development.

- Stay updated on industry trends to remain competitive in the job market.

By following these tips, you can increase your chances of success in an MBA in Finance program and advance your career in the finance industry.

MBA in Finance

An MBA in Finance provides a comprehensive and in-depth understanding of the financial markets, preparing individuals for successful careers in the finance industry. This degree equips graduates with analytical, problem-solving, and communication skills, making them highly sought after by employers.

The increasing demand for skilled finance professionals highlights the relevance and value of an MBA in Finance. With the knowledge and expertise gained through this program, graduates can assume leadership roles and drive financial decision-making in various organizations. The high earning potential and career advancement opportunities associated with an MBA in Finance make it a worthwhile investment for those seeking to advance their careers in the dynamic field of finance.

Youtube Video: