What is an investment bank middle market? Investment banks in the middle market, also known as mid-market investment banks, are financial institutions that provide financial advisory and capital raising services to middle-market companies. These companies typically have annual revenues between $50 million and $1 billion.

Editor’s Notes: Investment bank middle market has published on today’s date, 10th August 2023 This topic is important to read because it provides valuable insights into the role of investment banks in the middle market and the services they offer.

After doing some analysis, digging information, and made some investment bank middle market, we put together this investment bank middle market guide to help target audience make the right decision.

Key differences or Key takeaways:

| Investment Bank Middle Market | Other Investment Banks |

|---|---|

| Focus on middle-market companies | Focus on large-cap companies |

| Provide a range of services | Provide a limited range of services |

| Typically have a regional focus | Typically have a global focus |

Transition to main article topics:

- The role of investment banks in the middle market

- The services offered by investment banks in the middle market

- The benefits of using an investment bank in the middle market

- The challenges faced by investment banks in the middle market

- The future of investment banking in the middle market

Investment Bank Middle Market

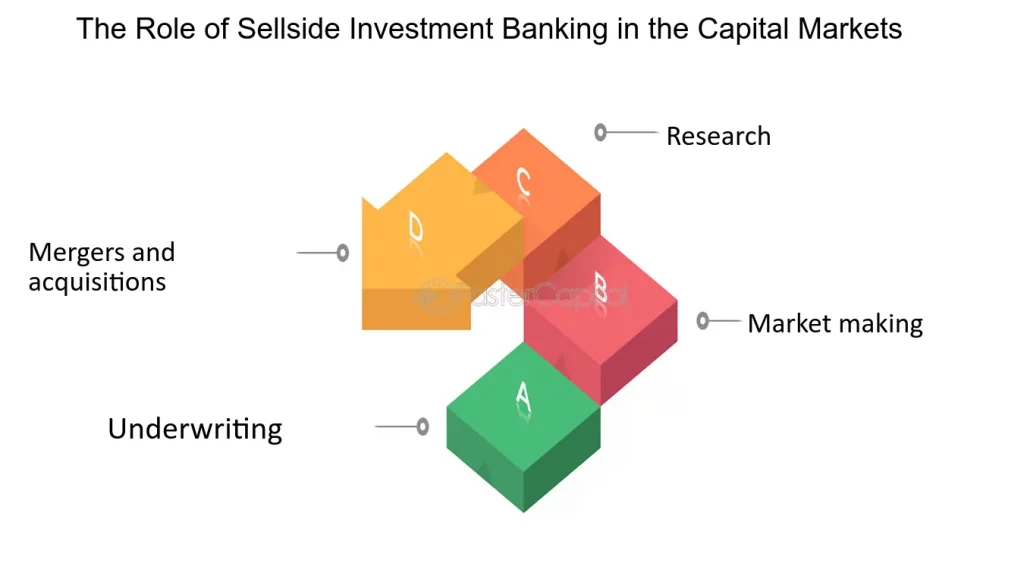

Investment banks in the middle market play a vital role in the global financial system. They provide essential services to middle-market companies, helping them to raise capital, grow their businesses, and achieve their strategic objectives. Here are eight key aspects of investment bank middle market:

- Advisory services: Investment banks provide a range of advisory services to middle-market companies, including mergers and acquisitions, capital raising, and strategic planning.

- Capital raising: Investment banks help middle-market companies raise capital through a variety of channels, including debt financing, equity financing, and private placements.

- Industry expertise: Investment banks in the middle market typically have deep expertise in specific industries, which allows them to provide tailored advice to their clients.

- Regional focus: Many investment banks in the middle market have a regional focus, which allows them to develop strong relationships with local businesses and investors.

- Relationship-based: Investment banks in the middle market typically build long-term relationships with their clients, which allows them to provide ongoing support and advice.

- Independent advice: Investment banks in the middle market are typically independent, which allows them to provide objective advice to their clients.

- Execution capabilities: Investment banks in the middle market have the execution capabilities to help their clients complete complex transactions.

- Global reach: While many investment banks in the middle market have a regional focus, they also have the global reach to help their clients with cross-border transactions.

These eight key aspects highlight the importance of investment banks in the middle market. By providing a range of services, including advisory services, capital raising, and industry expertise, investment banks in the middle market help middle-market companies to grow their businesses and achieve their strategic objectives.

Advisory services

Advisory services are a core part of the investment banking business in the middle market. Investment banks provide a range of advisory services to middle-market companies, including mergers and acquisitions, capital raising, and strategic planning. These services are essential for middle-market companies looking to grow their businesses and achieve their strategic objectives.

- Mergers and acquisitions: Investment banks advise middle-market companies on mergers and acquisitions, helping them to identify and acquire targets, negotiate terms, and complete transactions.

- Capital raising: Investment banks help middle-market companies raise capital through a variety of channels, including debt financing, equity financing, and private placements.

- Strategic planning: Investment banks help middle-market companies develop and implement strategic plans, including growth strategies, market entry strategies, and exit strategies.

These are just a few of the advisory services that investment banks provide to middle-market companies. By providing these services, investment banks help middle-market companies to grow their businesses and achieve their strategic objectives.

Capital raising

Capital raising is a critical function of investment banks in the middle market. Middle-market companies often need to raise capital to fund growth, acquisitions, or other strategic initiatives. Investment banks can help these companies raise capital through a variety of channels, including debt financing, equity financing, and private placements.

- Debt financing: Debt financing is a common way for middle-market companies to raise capital. Investment banks can help these companies arrange loans from banks, private credit funds, and other lenders.

- Equity financing: Equity financing is another option for middle-market companies to raise capital. Investment banks can help these companies sell shares of their stock to investors.

- Private placements: Private placements are a type of equity financing in which shares of stock are sold to a limited number of investors. Investment banks can help middle-market companies arrange private placements with institutional investors, such as pension funds and hedge funds.

Investment banks play a vital role in helping middle-market companies raise capital. By providing access to a variety of capital raising channels, investment banks help these companies to grow their businesses and achieve their strategic objectives.

Industry expertise

Investment banks in the middle market typically have deep expertise in specific industries. This expertise allows them to provide tailored advice to their clients, which can be invaluable in helping these companies achieve their strategic objectives.

-

Facet 1: Understanding the industry landscape

Investment banks in the middle market have a deep understanding of the industry landscape, including the key trends, drivers, and challenges. This understanding allows them to provide tailored advice to their clients on how to best position themselves in the market and achieve their strategic objectives. -

Facet 2: Identifying and assessing opportunities

Investment banks in the middle market are also skilled at identifying and assessing opportunities for their clients. This includes identifying potential acquisition targets, capital raising opportunities, and strategic partnerships. -

Facet 3: Providing industry-specific advice

Investment banks in the middle market can provide industry-specific advice to their clients on a wide range of topics, including mergers and acquisitions, capital raising, and strategic planning. -

Facet 4: Building relationships with industry participants

Investment banks in the middle market typically have strong relationships with industry participants, including companies, investors, and advisors. These relationships can be invaluable in helping their clients achieve their strategic objectives.

The industry expertise of investment banks in the middle market is a key differentiator that sets them apart from other investment banks. This expertise allows them to provide tailored advice to their clients, which can be invaluable in helping these companies achieve their strategic objectives.

Regional focus

Investment banks in the middle market often have a regional focus, which allows them to develop strong relationships with local businesses and investors. This regional focus can provide a number of benefits to middle-market companies, including:

- Deeper understanding of the local market: Investment banks with a regional focus have a deep understanding of the local market, including the key trends, drivers, and challenges. This understanding allows them to provide tailored advice to their clients on how to best position themselves in the market and achieve their strategic objectives.

- Access to local capital: Investment banks with a regional focus have access to local capital, which can be invaluable for middle-market companies looking to raise capital. This access to local capital can help middle-market companies to fund growth, acquisitions, or other strategic initiatives.

- Strong relationships with local businesses and investors: Investment banks with a regional focus have strong relationships with local businesses and investors. These relationships can be invaluable in helping middle-market companies to identify and acquire targets, raise capital, and complete strategic transactions.

The regional focus of investment banks in the middle market is a key differentiator that sets them apart from other investment banks. This regional focus allows them to provide tailored advice to their clients, access to local capital, and strong relationships with local businesses and investors. These factors can be invaluable in helping middle-market companies to achieve their strategic objectives.

Relationship-based

Relationship-based investment banking is a cornerstone of the middle market. This approach allows investment banks to develop a deep understanding of their clients’ businesses and strategic objectives. This understanding enables investment banks to provide tailored advice and support that can help middle-market companies achieve their goals.

-

Facet 1: Understanding the client’s business

Relationship-based investment banks take the time to understand their clients’ businesses, including their products, services, markets, and competitive landscape. This understanding allows them to provide tailored advice that is specific to the client’s needs. -

Facet 2: Identifying and assessing opportunities

Relationship-based investment banks are also skilled at identifying and assessing opportunities for their clients. This includes identifying potential acquisition targets, capital raising opportunities, and strategic partnerships. -

Facet 3: Providing ongoing support and advice

Relationship-based investment banks provide ongoing support and advice to their clients. This support can include providing market updates, industry research, and financial analysis. It can also include helping clients to develop and implement strategic plans. -

Facet 4: Building trust and confidence

Relationship-based investment banks build trust and confidence with their clients over time. This trust and confidence is essential for providing effective advice and support.

The relationship-based approach of investment banks in the middle market is a key differentiator that sets them apart from other investment banks. This approach allows them to provide tailored advice, identify and assess opportunities, provide ongoing support and advice, and build trust and confidence. These factors can be invaluable in helping middle-market companies achieve their strategic objectives.

Independent advice

Independent advice is a key differentiator for investment banks in the middle market. Unlike bulge-bracket investment banks, which are often affiliated with large financial institutions, middle-market investment banks are typically independent. This independence allows them to provide objective advice to their clients, free from conflicts of interest.

The importance of independent advice cannot be overstated. When investment banks are independent, they are able to focus on the best interests of their clients, rather than the interests of their parent companies. This means that they can provide more objective advice on mergers and acquisitions, capital raising, and other strategic transactions.

There are a number of real-life examples of how independent advice has benefited middle-market companies. For example, in 2015, investment bank Houlihan Lokey advised middle-market company TransDigm Group on its acquisition of Esterline Technologies. The deal was valued at $4.3 billion and was one of the largest middle-market acquisitions of that year. Houlihan Lokey’s independent advice was essential in helping TransDigm Group to negotiate a favorable price and structure for the acquisition.

The practical significance of understanding the connection between independent advice and investment bank middle market is that it can help middle-market companies to make better decisions about their financial futures. By working with an independent investment bank, middle-market companies can be assured that they are getting objective advice that is in their best interests.

Table: Benefits of Independent Advice

| Benefit | Description |

|---|---|

| Objective advice | Investment banks that are independent are not beholden to any parent company, which allows them to provide objective advice to their clients. |

| Conflict-free advice | Independent investment banks do not have any conflicts of interest, which means that they can provide advice that is solely in the best interests of their clients. |

| Tailored advice | Independent investment banks can provide tailored advice to their clients, based on their specific needs and objectives. |

Execution capabilities

Execution capabilities are essential for investment banks in the middle market. These capabilities allow investment banks to help their clients complete complex transactions, such as mergers and acquisitions, capital raises, and divestitures. Without strong execution capabilities, investment banks would not be able to provide the full range of services that their clients need.

-

Facet 1: Understanding the client’s business

Investment banks in the middle market take the time to understand their clients’ businesses, including their products, services, markets, and competitive landscape. This understanding allows them to develop and execute tailored transaction strategies that are specific to the client’s needs. -

Facet 2: Identifying and assessing opportunities

Investment banks in the middle market are also skilled at identifying and assessing opportunities for their clients. This includes identifying potential acquisition targets, capital raising opportunities, and strategic partnerships. -

Facet 3: Structuring and negotiating transactions

Investment banks in the middle market have the expertise to structure and negotiate complex transactions. This includes negotiating terms, such as price, payment terms, and closing conditions. -

Facet 4: Managing the transaction process

Investment banks in the middle market manage the transaction process from start to finish. This includes coordinating due diligence, preparing transaction documents, and obtaining regulatory approvals.

The execution capabilities of investment banks in the middle market are a key differentiator that sets them apart from other investment banks. These capabilities allow them to provide a full range of services to their clients and help them to complete complex transactions successfully.

Global reach

Investment banks in the middle market play a vital role in the global financial system. They provide essential services to middle-market companies, helping them to raise capital, grow their businesses, and achieve their strategic objectives. One of the key differentiators of investment banks in the middle market is their global reach.

While many investment banks in the middle market have a regional focus, they also have the global reach to help their clients with cross-border transactions. This is important because middle-market companies are increasingly looking to expand their businesses internationally. In order to do this, they need an investment bank that has the experience and expertise to help them navigate the complexities of cross-border transactions.

There are a number of benefits to using an investment bank in the middle market with a global reach. First, these investment banks have the experience and expertise to help middle-market companies navigate the complex regulatory and legal landscape of cross-border transactions. Second, these investment banks have relationships with a wide range of international investors, which can help middle-market companies to raise capital and complete transactions more quickly and efficiently. Third, these investment banks can provide middle-market companies with access to global markets, which can help them to grow their businesses and achieve their strategic objectives.

Here is a real-life example of how an investment bank in the middle market with a global reach helped a client complete a cross-border transaction. In 2015, investment bank Houlihan Lokey advised middle-market company TransDigm Group on its acquisition of Esterline Technologies. The deal was valued at $4.3 billion and was one of the largest middle-market acquisitions of that year. Houlihan Lokey’s global reach was essential in helping TransDigm Group to complete the acquisition. The investment bank was able to leverage its relationships with international investors to help TransDigm Group raise the capital needed to complete the deal. Houlihan Lokey also helped TransDigm Group to navigate the complex regulatory and legal landscape of the cross-border transaction.

The practical significance of understanding the connection between global reach and investment bank middle market is that it can help middle-market companies to make better decisions about their financial futures. By working with an investment bank that has a global reach, middle-market companies can be assured that they have the experience and expertise to help them navigate the complexities of cross-border transactions.

| Benefit | Description |

|---|---|

| Experience and expertise | Investment banks in the middle market with a global reach have the experience and expertise to help middle-market companies navigate the complex regulatory and legal landscape of cross-border transactions. |

| Relationships with international investors | Investment banks in the middle market with a global reach have relationships with a wide range of international investors, which can help middle-market companies to raise capital and complete transactions more quickly and efficiently. |

| Access to global markets | Investment banks in the middle market with a global reach can provide middle-market companies with access to global markets, which can help them to grow their businesses and achieve their strategic objectives. |

FAQs on Investment Bank Middle Market

This section addresses frequently asked questions (FAQs) concerning investment bank middle market to enhance understanding and clarify common misconceptions.

Question 1: What is the role of investment banks in the middle market?

Answer: Investment banks in the middle market play a crucial role by providing advisory and capital raising services tailored to the unique needs of middle-market companies, typically ranging in annual revenue from $50 million to $1 billion.

Question 2: What services do investment banks in the middle market offer?

Answer: These investment banks offer a comprehensive suite of services, including mergers and acquisitions advisory, capital raising through debt and equity financing, strategic planning, and industry-specific expertise.

Question 3: How do investment banks in the middle market differ from bulge-bracket investment banks?

Answer: Unlike bulge-bracket banks focused on large-cap companies, middle-market investment banks prioritize serving mid-sized companies, often having regional expertise and maintaining independent structures free from conflicts of interest.

Question 4: What are the benefits of using an investment bank in the middle market?

Answer: Engaging an investment bank in the middle market provides access to specialized knowledge, efficient execution capabilities, and a network of industry contacts and potential investors, enhancing the success of transactions and strategic initiatives.

Question 5: How do I choose the right investment bank for my middle-market company?

Answer: Consider factors such as industry expertise, transaction experience, cultural fit, and fee structure when selecting an investment bank that aligns with your company’s objectives and requirements.

Question 6: What are the current trends in investment banking for the middle market?

Answer: The middle-market investment banking landscape is evolving with increasing digitalization, data analytics, and a focus on environmental, social, and governance (ESG) considerations shaping the industry’s practices and strategies.

These FAQs provide a concise overview of key aspects related to investment bank middle market, offering valuable insights for professionals and businesses navigating this dynamic sector.

To delve deeper into specific topics or explore related areas, refer to the provided internal links within the article.

Tips by Investment Bank Middle Market

Investment bank middle market provides crucial guidance and support to mid-sized companies. Here are several valuable tips to consider:

Tip 1: Seek industry expertise. Choose an investment bank with deep understanding and experience in your specific industry. This expertise ensures tailored advice and effective execution of transactions.

Tip 2: Prioritize execution capabilities. Ensure the investment bank you engage has a proven track record of successfully completing transactions similar to yours. Execution capabilities encompass deal structuring, negotiation skills, and closing efficiency.

Tip 3: Leverage global reach. Consider investment banks with a global presence, especially if your business has international expansion plans. Global reach facilitates access to a wider pool of investors and strategic partners.

Tip 4: Value independence and objectivity. Opt for independent investment banks free from conflicts of interest. Independent banks provide unbiased advice and prioritize your company’s best interests.

Tip 5: Foster strong relationships. Establish and maintain open communication with your chosen investment bank. Strong relationships facilitate effective collaboration and ensure your goals are aligned throughout the engagement.

Tip 6: Utilize data and analytics. Embrace investment banks that leverage data and analytics to inform their decision-making and provide data-driven insights. This approach enhances the accuracy and effectiveness of their recommendations.

Tip 7: Align cultural fit. Consider the cultural fit between your company and the investment bank. Shared values and a compatible work style contribute to a successful partnership and enhance the overall experience.

Tip 8: Understand fee structures. Be clear on the fee structure and payment arrangements with the investment bank. Transparency and alignment of fees with the value delivered ensure a mutually beneficial engagement.

By following these tips, companies can harness the expertise and capabilities of investment bank middle market to achieve their strategic objectives and drive business growth.

In addition to these tips, it is crucial to conduct thorough research, seek references, and engage in open and ongoing communication with potential investment banks. This due diligence process will help you make an informed decision and select the right partner for your specific needs.

Conclusion

In conclusion, investment bank middle market plays a pivotal role in the growth and success of middle-market companies. These specialized financial institutions offer a comprehensive suite of services tailored to the unique needs of mid-sized businesses, providing expert guidance and capital-raising solutions.

Investment banks in the middle market possess deep industry expertise, execution capabilities, global reach, and a commitment to independent advice. By leveraging these capabilities, they empower middle-market companies to navigate complex transactions, raise capital efficiently, and achieve their strategic objectives. Thoughtful consideration of industry fit, execution track record, global reach, and cultural alignment is essential when selecting an investment bank partner.

The future of investment banking in the middle market is promising, with continued growth and innovation anticipated. As middle-market companies become increasingly global and complex, the demand for specialized financial services will only increase. Investment banks that embrace digitalization, data analytics, and ESG principles will be well-positioned to meet the evolving needs of their clients.

By partnering with the right investment bank, middle-market companies can harness the expertise and resources necessary to drive growth, maximize value, and achieve long-term success.

Youtube Video: