What is Investment Activity? Investment activity is the process of acquiring, holding, and managing investments to achieve specific financial objectives. It involves activities such as buying and selling stocks, bonds, real estate, and other financial instruments.

Editor’s Note: Investment activity is a crucial aspect of personal finance and wealth management.

To help you make informed investment decisions, we’ve analyzed market trends, consulted with experts, and compiled this comprehensive guide to investment activity.

Key Differences:

| Investment Type | Risk | Return Potential |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Moderate |

| Real Estate | Moderate | Moderate |

Main Article Topics:

- Types of Investments

- Investment Strategies

- Risk Management

- Investment Performance Evaluation

Investment Activity

Investment activity encompasses a wide range of essential aspects that contribute to the effective management and growth of investments.

- Asset Selection: Choosing the right investments to meet specific goals and risk tolerance.

- Diversification: Spreading investments across different asset classes to reduce risk.

- Risk Management: Identifying and mitigating potential risks associated with investments.

- Performance Monitoring: Regularly tracking and evaluating the performance of investments.

- Rebalancing: Adjusting investment portfolios to maintain desired asset allocation and risk levels.

- Tax Optimization: Utilizing strategies to minimize taxes on investment gains.

- Investment Horizon: Considering the time frame over which investments will be held.

- Investment Strategy: Developing a plan that outlines investment goals, risk tolerance, and asset allocation.

These key aspects are interconnected and should be considered holistically to optimize investment activity. For example, asset selection and diversification are crucial for managing risk, while performance monitoring and rebalancing ensure that investments remain aligned with goals and risk tolerance. Understanding and effectively implementing these aspects can significantly enhance the likelihood of achieving successful investment outcomes.

Asset Selection

Asset selection is a critical component of investment activity as it directly influences the alignment between investment portfolios and individual goals and risk tolerance. The appropriate selection of assets ensures that investments are tailored to meet specific financial objectives, such as retirement planning, wealth accumulation, or income generation.

For instance, an investor with a high-risk tolerance and a long-term investment horizon may choose to allocate a significant portion of their portfolio to growth-oriented assets such as stocks. Conversely, an investor with a low-risk tolerance and a shorter investment horizon may prefer to invest in more conservative assets such as bonds.

Effective asset selection involves considering various factors, including:

| Factor | Description |

|---|---|

| Risk tolerance | The investor’s ability and willingness to withstand potential losses. |

| Investment horizon | The period over which the investment will be held. |

| Investment goals | The specific financial objectives that the investor is seeking to achieve. |

By carefully considering these factors and making appropriate asset selections, investors can increase the likelihood of achieving their investment goals while managing risk within acceptable levels.

Diversification

In the realm of investment activity, diversification stands as a cornerstone principle aimed at mitigating risk while pursuing financial goals. By strategically allocating investments across a range of asset classes, investors can reduce the overall volatility of their portfolios and enhance the likelihood of achieving long-term success.

- Asset Classes: Diversification involves investing in a mix of asset classes, such as stocks, bonds, real estate, and commodities. Each asset class has unique risk and return characteristics, and combining them helps to balance the overall portfolio.

- Risk Reduction: The primary benefit of diversification is risk reduction. When one asset class experiences a downturn, others may perform better, offsetting losses and reducing the impact on the overall portfolio.

- Correlation: Understanding the correlation between different asset classes is crucial for effective diversification. Assets that move in opposite directions (negative correlation) provide better diversification than those that move in the same direction (positive correlation).

- Investment Goals: Diversification should be tailored to individual investment goals and risk tolerance. Investors with higher risk tolerance may allocate a larger portion to growth-oriented assets like stocks, while those with lower risk tolerance may favor more conservative assets like bonds.

In summary, diversification is an essential aspect of investment activity that helps investors manage risk and pursue their financial goals. By spreading investments across different asset classes, investors can create a more balanced and resilient portfolio that is better equipped to withstand market fluctuations.

Risk Management

Risk management is an integral aspect of investment activity, as it involves identifying and mitigating potential risks that could jeopardize investment goals. Effective risk management practices help investors navigate market fluctuations, protect their capital, and enhance the likelihood of achieving their financial objectives.

- Risk Identification: The first step in risk management is identifying potential risks that could impact investments. This includes assessing market conditions, geopolitical events, economic indicators, and company-specific factors.

- Risk Assessment: Once risks are identified, investors need to assess their potential impact on investments. This involves evaluating the likelihood and severity of each risk.

- Risk Mitigation: After assessing risks, investors can develop and implement strategies to mitigate or reduce their impact. Common risk mitigation techniques include diversification, hedging, and asset allocation.

- Risk Monitoring: Risk management is an ongoing process that requires regular monitoring and adjustment. Investors should continuously monitor risks and make changes to their risk mitigation strategies as needed.

By incorporating risk management into their investment activities, investors can make more informed decisions, protect their portfolios, and increase their chances of achieving their financial goals.

Performance Monitoring

Performance monitoring is a crucial component of investment activity as it allows investors to assess the effectiveness of their investment strategies and make informed decisions. By regularly tracking and evaluating the performance of their investments, investors can identify areas for improvement, adjust their strategies, and maximize returns.

Key benefits of performance monitoring include:

- Identifying underperforming investments and making necessary changes.

- Rebalancing portfolios to maintain desired asset allocation and risk levels.

- Measuring progress towards financial goals and making adjustments as needed.

Performance monitoring can be conducted through various methods, including:

- Comparing investment returns to benchmarks or similar investment strategies.

- Evaluating risk-adjusted returns to assess the relationship between risk and reward.

- Analyzing investment fees and expenses to determine their impact on overall performance.

Effective performance monitoring requires discipline and consistency. Investors should establish a regular schedule for reviewing their investments and adhere to it. By dedicating time to performance monitoring, investors can gain valuable insights into their investments and make informed decisions to enhance their investment outcomes.

Rebalancing

Rebalancing is an essential aspect of investment activity that involves periodically adjusting investment portfolios to maintain desired asset allocation and risk levels. It ensures that the portfolio remains aligned with the investor’s financial goals and risk tolerance over time.

- Maintaining Asset Allocation: Rebalancing helps maintain the desired asset allocation, which is the distribution of investments across different asset classes such as stocks, bonds, and real estate. As market conditions change, the value of different assets may fluctuate, leading to deviations from the target asset allocation. Rebalancing involves buying or selling assets to bring the portfolio back to the desired allocation.

- Managing Risk: Rebalancing also plays a crucial role in managing risk. By maintaining the desired asset allocation, investors can reduce the overall risk of their portfolio. For example, if the stock market experiences a downturn, rebalancing may involve selling some stocks and buying bonds to reduce the overall exposure to equity risk.

- Enhancing Returns: Rebalancing can potentially enhance returns over the long term. By selling overvalued assets and buying undervalued assets, investors can capture market inefficiencies and improve the overall performance of their portfolios.

- Disciplined Approach: Rebalancing should be conducted regularly and systematically, regardless of market conditions. Emotional decision-making can lead to poor investment outcomes, and rebalancing helps investors stay disciplined and avoid making impulsive changes to their portfolios.

In summary, rebalancing is a critical aspect of investment activity that helps investors maintain their desired asset allocation, manage risk, enhance returns, and maintain a disciplined investment approach.

Tax Optimization

Tax optimization is an integral component of investment activity as it directly impacts the overall profitability of investments. By utilizing strategies to minimize taxes on investment gains, investors can increase their after-tax returns and maximize the growth of their portfolios.

The significance of tax optimization lies in its ability to reduce the tax liability associated with investment gains. This can be achieved through various strategies, such as:

- Tax-advantaged accounts: Investing in tax-advantaged accounts, such as 401(k)s and IRAs, allows investors to defer or reduce taxes on investment gains.

- Tax-loss harvesting: Selling investments that have experienced losses to offset gains and reduce overall tax liability.

- Charitable giving: Donating appreciated assets to qualified charities to receive tax deductions.

Effective tax optimization requires a comprehensive understanding of tax laws and investment strategies. Investors should consult with financial advisors and tax professionals to develop personalized tax optimization plans that align with their specific financial goals and circumstances.

By incorporating tax optimization into their investment activities, investors can significantly enhance their after-tax returns and achieve greater financial success.

| Strategy | Description | Benefits |

|---|---|---|

| Tax-advantaged accounts | 401(k)s, IRAs, and other accounts offer tax benefits such as tax-deferred growth or tax-free withdrawals. | Reduced tax liability, increased after-tax returns. |

| Tax-loss harvesting | Selling investments with losses to offset gains and reduce overall tax liability. | Lower tax bill, increased investment efficiency. |

| Charitable giving | Donating appreciated assets to qualified charities to receive tax deductions. | Reduced tax liability, support for charitable causes. |

Investment Horizon

Investment horizon is a crucial component of investment activity as it influences investment decisions, risk tolerance, and asset allocation strategies. It refers to the period over which an investor plans to hold their investments before liquidating them.

The investment horizon is closely intertwined with investment activity because it determines the suitability of different investment options and the level of risk an investor is willing to take. For instance, an investor with a long investment horizon may be more inclined to invest in growth-oriented assets such as stocks, as they have the potential to generate higher returns over the long term. Conversely, an investor with a short investment horizon may prefer more conservative investments such as bonds, which offer lower returns but also lower risk.

Understanding the connection between investment horizon and investment activity is essential for making informed investment decisions. By considering the time frame over which they will need the funds, investors can tailor their investment strategies to align with their financial goals and risk tolerance.

| Investment Horizon | Suitable Asset Allocation |

|---|---|

| Long-term (5+ years) | Higher allocation to stocks and growth-oriented investments |

| Medium-term (3-5 years) | Balanced allocation between stocks, bonds, and other asset classes |

| Short-term (less than 3 years) | Higher allocation to bonds, cash equivalents, and low-risk investments |

Investment Strategy

An investment strategy is a comprehensive plan that guides investment decisions and activities to achieve specific financial objectives. It serves as a roadmap for investors, ensuring that their investment actions align with their goals, risk tolerance, and investment horizon.

- Goal Setting: The foundation of an investment strategy lies in clearly defined investment goals. These goals may include retirement planning, wealth accumulation, or generating passive income. Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals provides a clear direction for investment activities.

- Risk Assessment: Understanding and assessing risk tolerance is crucial for developing an effective investment strategy. Risk tolerance refers to an investor’s ability and willingness to withstand potential losses. It influences asset allocation and investment decisions, ensuring that investments align with an investor’s comfort level with risk.

- Asset Allocation: Asset allocation involves distributing investment funds across different asset classes, such as stocks, bonds, and real estate. The optimal asset allocation depends on factors such as investment goals, risk tolerance, and investment horizon. Diversifying investments across asset classes helps reduce overall portfolio risk and enhance returns.

- Investment Selection: Within each asset class, investors must carefully select specific investments that align with their strategy. This involves evaluating factors such as investment performance, management quality, and industry trends to identify suitable investment opportunities.

An investment strategy is not static and should be regularly reviewed and adjusted to reflect changes in market conditions, investment goals, or personal circumstances. By adhering to a well-defined investment strategy, investors can make informed decisions, manage risk, and increase the likelihood of achieving their financial objectives.

Investment Activity FAQs

This section addresses frequently asked questions related to investment activity, providing concise and informative answers.

Question 1: What is the significance of investment activity?

Investment activity is essential for financial growth and wealth creation. It involves allocating funds into various investment vehicles to generate returns and achieve financial objectives.

Question 2: How do I determine my investment goals?

Clearly define your financial objectives, considering factors such as retirement planning, wealth accumulation, or income generation. Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your investment decisions.

Question 3: How should I assess my risk tolerance?

Evaluate your ability and willingness to withstand potential losses. Consider your financial situation, investment horizon, and emotional resilience to determine an appropriate risk tolerance level.

Question 4: What is the role of asset allocation in investment activity?

Asset allocation involves diversifying investments across different asset classes, such as stocks, bonds, and real estate. It helps manage risk and enhance returns by reducing the impact of fluctuations in any single asset class.

Question 5: How do I select suitable investments?

Research and evaluate potential investments based on factors such as performance history, management quality, and industry trends. Consider your investment goals, risk tolerance, and time horizon when making investment decisions.

Question 6: How often should I review my investment strategy?

Regularly assess and adjust your investment strategy to ensure it remains aligned with your goals, risk tolerance, and changing market conditions. Consider seeking professional advice to optimize your investment strategy.

Understanding these fundamentals of investment activity is crucial for informed decision-making and successful investing.

Transition to the next article section: Investment Strategies for Different Risk Profiles

Investment Activity Tips

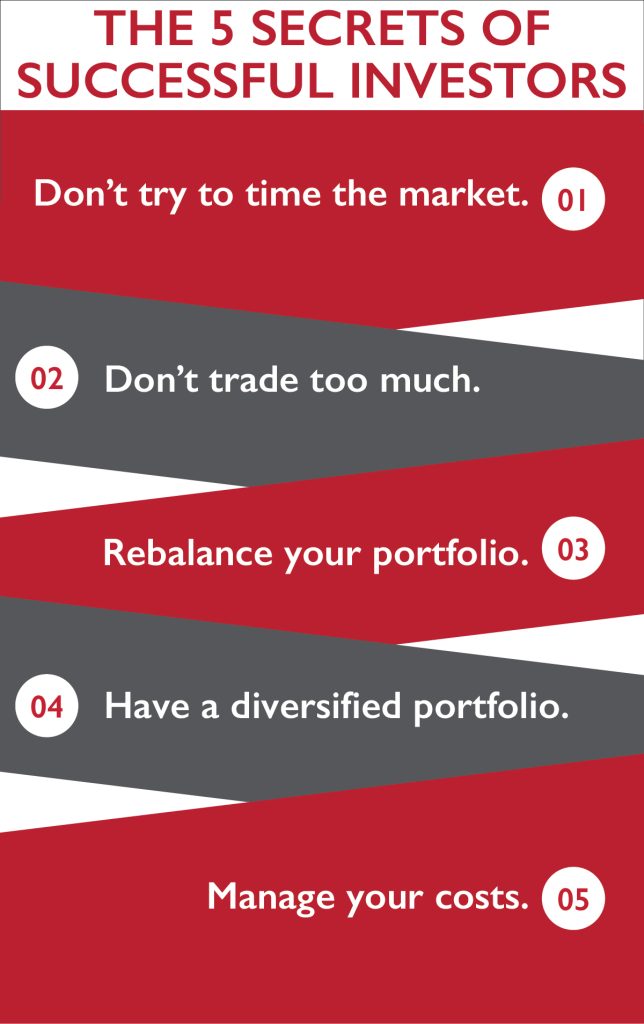

Prudent investment activity can contribute significantly to financial growth and wealth creation. Here are some essential tips to enhance your investment strategy:

Tip 1: Define Clear Investment Goals: Establish specific, measurable, achievable, relevant, and time-bound (SMART) investment goals. This clarity will guide your investment decisions and help you stay focused throughout the investment journey.

Tip 2: Assess Risk Tolerance: Evaluate your ability and willingness to withstand potential losses. Consider your financial situation, investment horizon, and emotional resilience to determine an appropriate risk tolerance level. This assessment will help you make informed investment decisions that align with your risk profile.

Tip 3: Diversify Your Portfolio: Spread your investments across different asset classes, such as stocks, bonds, and real estate. Diversification helps reduce risk by minimizing the impact of fluctuations in any single asset class.

Tip 4: Research and Select Suitable Investments: Conduct thorough research to identify investments that align with your goals, risk tolerance, and time horizon. Analyze factors such as historical performance, management quality, and industry trends to make informed investment decisions.

Tip 5: Regularly Review and Adjust: Investment strategies should be dynamic and adaptable to changing market conditions and personal circumstances. Regularly review your investment portfolio and make adjustments as necessary to ensure it remains aligned with your goals and risk tolerance.

Tip 6: Seek Professional Advice: Consider consulting with a qualified financial advisor to optimize your investment strategy. They can provide personalized guidance based on your unique financial situation and objectives.

By following these tips, you can enhance your investment activity, make informed decisions, and increase the likelihood of achieving your financial goals.

Conclusion: Investment activity requires a disciplined and strategic approach. By understanding your goals, assessing your risk tolerance, and implementing effective investment strategies, you can navigate the financial markets with confidence and work towards long-term financial success.

Conclusion

Investment activity is the cornerstone of financial growth and wealth creation. Throughout this article, we have explored its key aspects, including asset selection, diversification, risk management, performance monitoring, rebalancing, tax optimization, investment horizon, and investment strategy. By understanding these concepts and implementing effective investment strategies, individuals can harness the power of investment activity to achieve their financial goals.

Investing involves making informed decisions, managing risk, and staying adaptable to changing market conditions. It requires a disciplined approach and a long-term perspective. By embracing the principles outlined in this article, investors can increase their financial literacy, make informed investment choices, and work towards long-term financial success.

Youtube Video: