Indiana income tax on military retired pay: 55255 certification of purchase price:

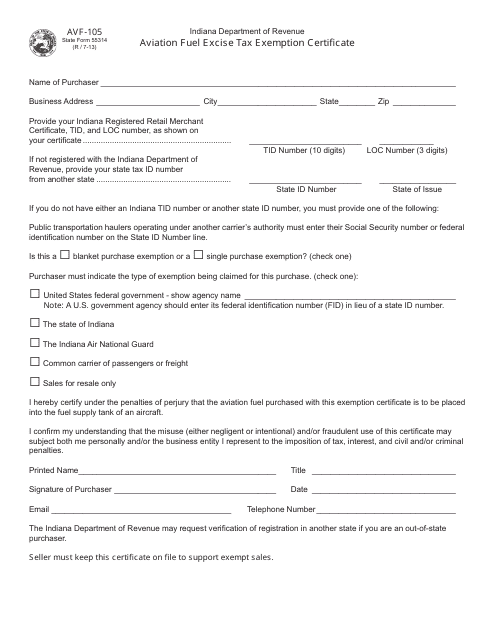

Form Avf-105 State Form 55314 Download Fillable Pdf Or Fill Online Aviation Fuel Excise Tax Exemption Certificate Indiana Templateroller

File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident.

Indiana excise tax exemption military. Military exemption from vehicle excise tax city of portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the armed forces and who are permanently stationed at a military or naval post, station or base outside of the state of maine or who are deployed for military service for more than 180 days. The spouse may be eligible to claim a deduction if: Oregon a disabled veteran or surviving spouse in oregon may receive a property tax exemption on his/her primary residence if the veteran is 40.

The motor vehicle excise tax is for the privilege of using the roadways and for registering a motor vehicle. Please see all dc dmv locations under about dmv in the menu. Base outside this state or deployed for military service for a period of more than 180 days and who desires to register that resident’s vehicle(s) in this state are hereby exempted from the annual excise tax imposed pursuant to 36 m.r.s.a.

Military id or equivalent) must be submitted to be eligible for an excise tax credit. Indiana is in the process of exempting taxes on all military retired pay. Military vehicles vehicles registered as military vehicles are charged a flat rate vehicle excise tax of $8.00.

If you can't renew online you may need to print a military extension letter. Have more time to file my taxes and i think i will owe the department. Visit the indiana bmv website to renew your driver's license online.

Proof of military status (i.e. Houses (5 days ago) disabled veterans living in indiana can benefit from a property tax deduction if they served at least 90 days of honorable military service and are totally disabled or are at least 62 years old and 10 percent or more disabled. The paper forms with instructions shown below are available so customers can visualize what is required.

If the owner is a member of the military on active duty or a member of their immediate family and has not been a maryland resident for more than one year, an excise tax credit is allowed with proof of active military status. Hp0252, ld 338, item 1, an act to exempt certain disabled veterans from the motor vehicle excise tax. 54085 annual report of exempt aircraft usage:

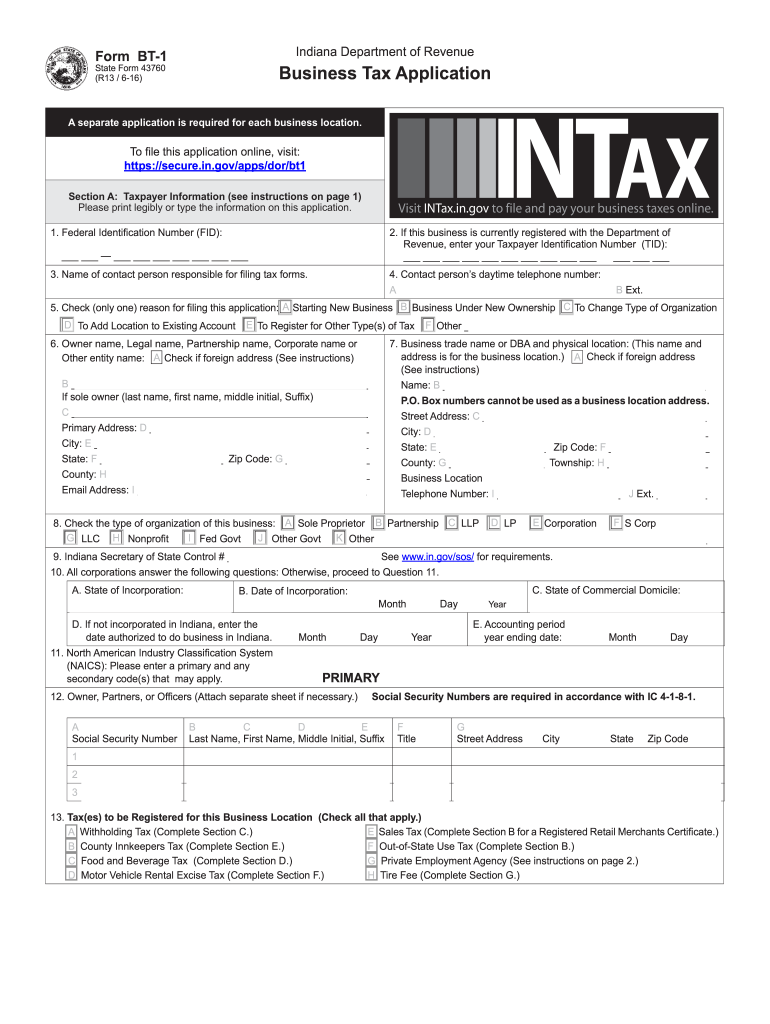

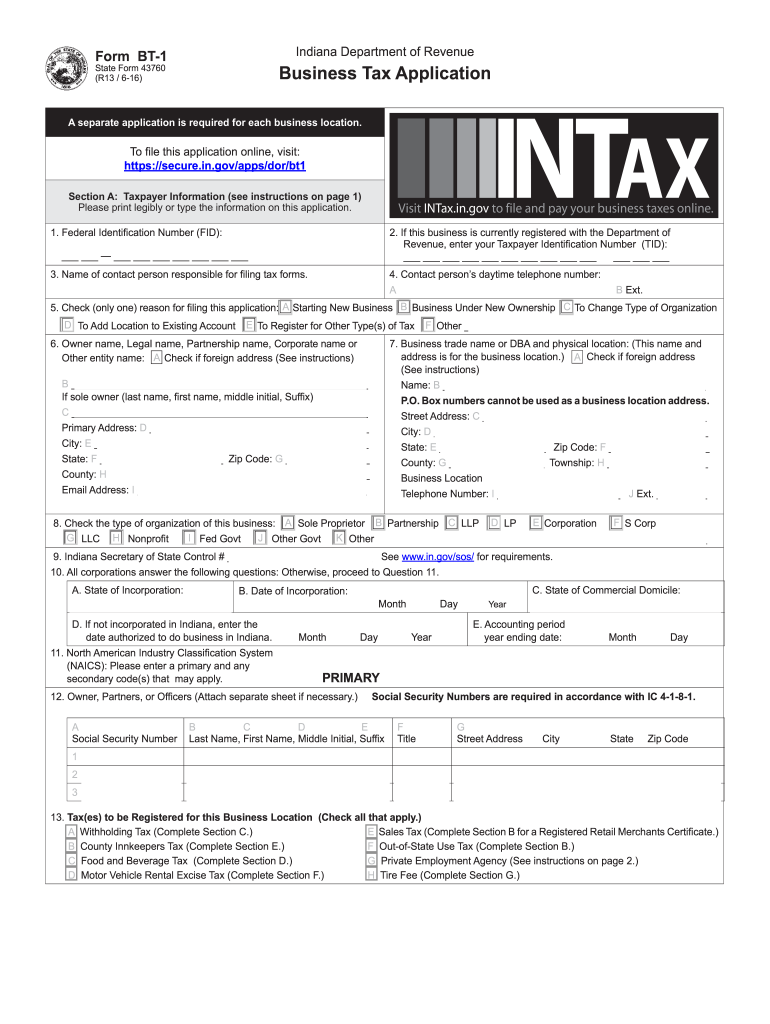

Online application to register with indiana for sales tax, withholding tax, food & beverage tax, county innkeeper tax, motor vehicle rental excise tax, and gasoline use tax (gut). To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov. Additionally, under the servicemembers civil relief act, the excise tax exemption is available to.

54086 annual report of exempt aircraft used in public transportation: Know when i will receive my tax refund. Indiana aviation fuel tax in indiana, aviation fuel is subject to a state excise tax of $0.18 +$0.01 oil inspection fee + $0.10 aviation fuel excise tax

To qualify for this exemption, the resident must present to the municipal excise tax collector The oklahoma 100 percent veteran disability tax exemption applies to sales tax, excise tax and ad valorem tax. For motor vehicles, the unused portion of the veteran deduction reduces the annual excise tax in the amount of two dollars ($2.00) on each one

Certificate of exemption from registration/excise tax on aircraft owned by an indiana resident and based out of state: The primary excise taxes on fuel in indiana are on gasoline, though most states also tax other types of fuel. A spouse of a nonresident military servicemember may not owe tax to indiana on earned income from indiana sources.

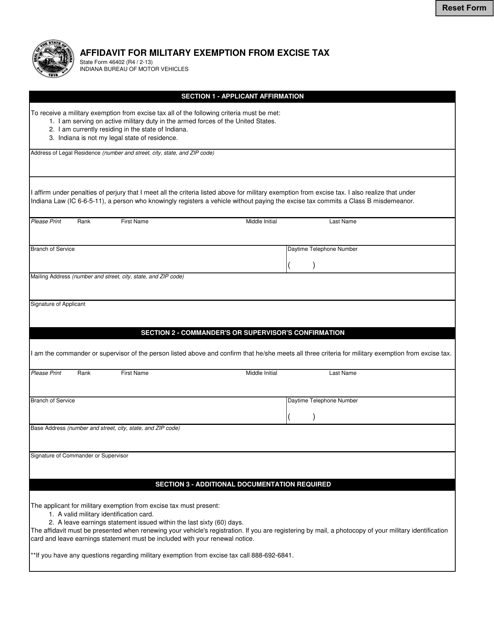

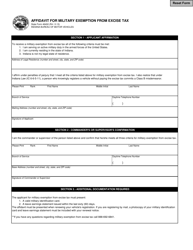

Claim a gambling loss on my indiana return. These veterans can claim a $12,480 annual deduction as long as their homes are not valued at. On the other hand, if you are just temporarily residing in the state due to military service, in order for you to not be liable for any sort of excise tax during vehicle registration, you will need to fill out an affidavit for military exemption from excise tax (46402).

Property tax deductions for senior citizens in indiana. Monthly excise tax return for alcoholic beverage wholesalers. Pay my tax bill in installments.

Please visit the electronic filing for alcohol taxpayers webpage for electronic filing information. Model year 1980 or older passenger vehicles, trucks with a declared gross weight of not more than 11,000 pounds and motorcycles are charged a flat rate vehicle excise tax of $12.00. Claim a gambling loss on my indiana return.

Have more time to file my taxes and i think i will owe the department. Pay my tax bill in installments. Know when i will receive my tax refund.

To get started, click on the appropriate link: For taxable year 2020 indiana resident veterans are eligible for a deduction of. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident.

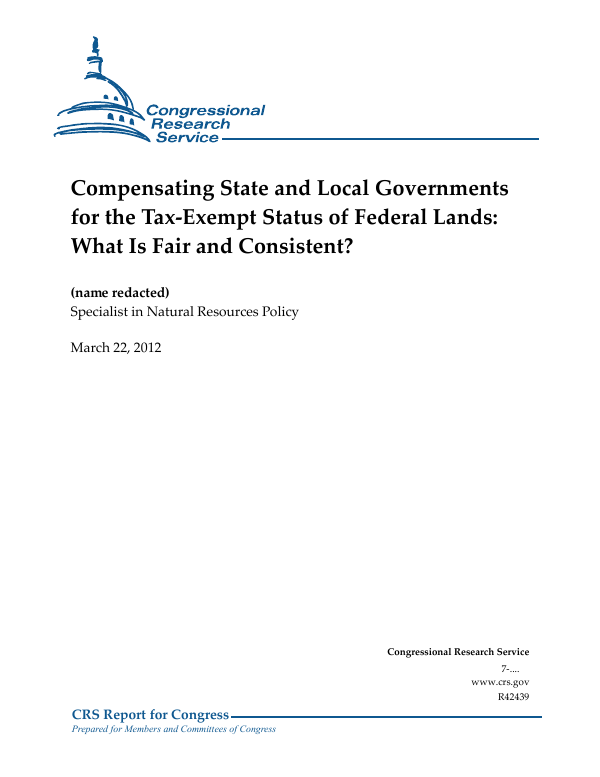

Compensating State And Local Governments For The Tax-exempt Status Of Federal Lands What Is Fair And Consistent – Everycrsreportcom

State Form 46402 Download Fillable Pdf Or Fill Online Affidavit For Military Exemption From Excise Tax Indiana Templateroller

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

2

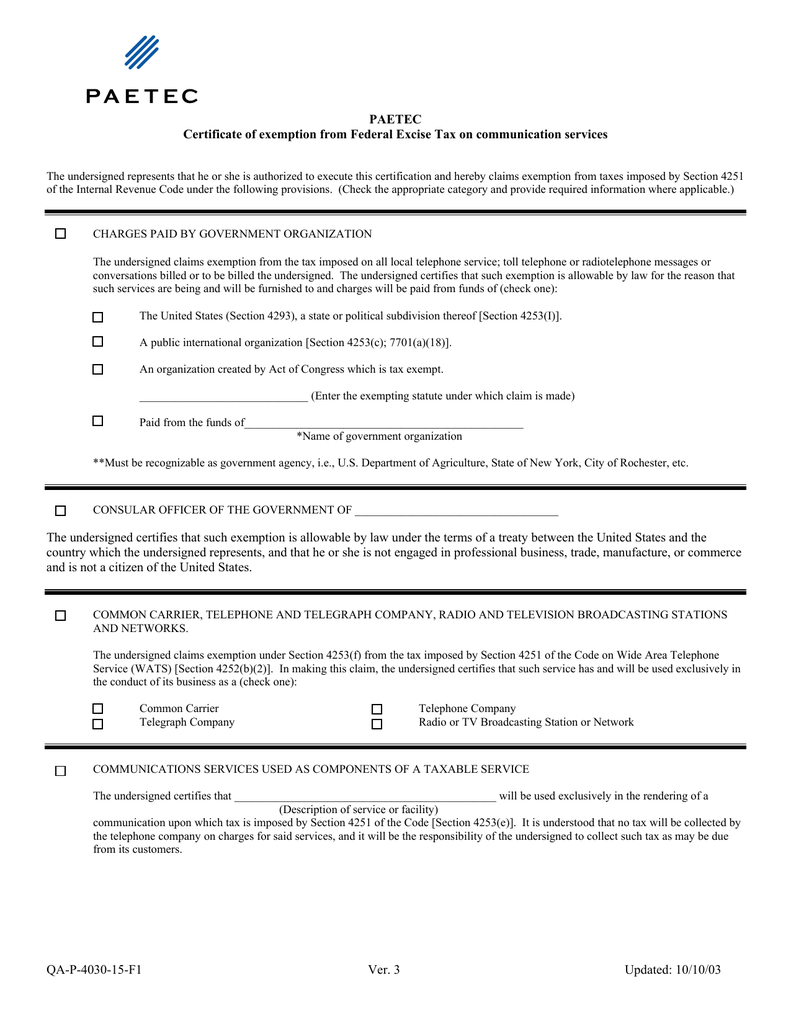

Federal Excise Tax Exemption Form Manualzz

Indiana Military And Veterans Benefits The Official Army Benefits Website

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Dor Stages Of Collection

Indiana Military And Veterans Benefits The Official Army Benefits Website

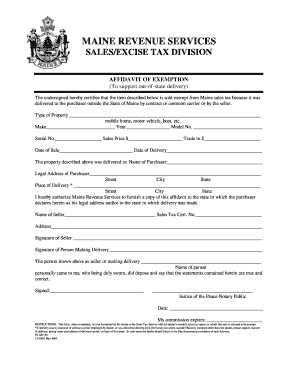

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates – Fillable Printable Samples For Pdf Word Pdffiller

Wa Mt Or Nd Id Mn Nv Wi

All Veteran Property Tax Exemptions By State And Disability Rating

In Form Bt-1 2016 – Fill Out Tax Template Online Us Legal Forms

Form Avf-105 State Form 55314 Download Fillable Pdf Or Fill Online Aviation Fuel Excise Tax Exemption Certificate Indiana Templateroller

Fillable Online Forms In Affidavit For Military Exemption From Excise Tax Fax Email Print – Pdffiller

State Form 46402 Download Fillable Pdf Or Fill Online Affidavit For Military Exemption From Excise Tax Indiana Templateroller

Pdf Mobilizing Public Opinion For The Tobacco Industry The Consumer Tax Alliance And Excise Taxes

Disabled Veterans Property Tax Exemptions By State

2