Want to automate your investments? Consider Fidelity recurring investment.

Editor’s Note: Fidelity recurring investment published on [Date]. We recognized that many people often miss out on long-term investment opportunities due to a lack of time or financial resources. That’s why we’ve put together this guide to help you make the right decision.

Our team has done the research and analysis, and we’ve put together this guide to help you make the right decision.

Key Differences:

| Feature | Fidelity Recurring Investment |

|---|---|

| Minimum investment | $1 |

| Frequency | Daily, weekly, bi-weekly, or monthly |

| Investment options | Stocks, bonds, mutual funds, and ETFs |

Transition to main article topics:

- Benefits of Fidelity recurring investment

- How to set up a Fidelity recurring investment

- Tips for getting the most out of Fidelity recurring investment

Fidelity Recurring Investment

Fidelity recurring investment is a powerful tool that can help you automate your savings and investments. Here are 8 key aspects to consider:

- Minimum investment: $1

- Frequency: Daily, weekly, bi-weekly, or monthly

- Investment options: Stocks, bonds, mutual funds, and ETFs

- Convenience: Set it up once and forget about it

- Flexibility: Change your investment amount or frequency at any time

- Tax efficiency: Potential tax savings when investing in a retirement account

- Long-term growth: The power of compound interest

- Peace of mind: Knowing that you’re investing for your future

Fidelity recurring investment is a great way to reach your financial goals. By automating your savings and investments, you can make sure that you’re on track to reach your goals, even when you’re busy or don’t have a lot of money to invest. For example, you could set up a recurring investment of $25 per week into a mutual fund that tracks the S&P 500 index. Over time, this investment could grow significantly, thanks to the power of compound interest. Fidelity recurring investment is a simple and effective way to save and invest for your future.

Minimum investment

One of the key benefits of Fidelity recurring investment is that it allows you to get started with just $1. This makes it a great option for people who are new to investing or who have a limited budget. With Fidelity recurring investment, you can start investing small amounts of money on a regular basis, and over time, your investment can grow significantly. For example, if you invest $1 per day into a mutual fund that tracks the S&P 500 index, your investment could grow to over $10,000 in 30 years, thanks to the power of compound interest.

Fidelity recurring investment is a great way to reach your financial goals, even if you don’t have a lot of money to invest. By starting small and investing regularly, you can make a big difference in your financial future.

Here are some additional benefits of Fidelity recurring investment:

- It’s convenient. Once you set up a recurring investment, you can forget about it and your investments will be made automatically.

- It’s flexible. You can change your investment amount or frequency at any time.

- It’s tax-efficient. You can save on taxes when you invest in a retirement account.

If you’re looking for a simple and effective way to save and invest for your future, Fidelity recurring investment is a great option.

Frequency

The frequency of your Fidelity recurring investment is an important factor to consider. The frequency you choose will depend on your financial goals and your cash flow. If you have a long-term investment horizon and you’re comfortable with investing smaller amounts of money more frequently, then you may want to consider investing daily or weekly. This will allow you to take advantage of dollar-cost averaging, which can help to reduce your investment risk. If you have a shorter-term investment horizon or you’re not comfortable with investing smaller amounts of money more frequently, then you may want to consider investing bi-weekly or monthly. This will allow you to invest larger amounts of money less frequently, which can help to reduce your transaction costs.

Here is a table that summarizes the pros and cons of each investment frequency:

| Frequency | Pros | Cons |

|---|---|---|

| Daily | Dollar-cost averaging | Higher transaction costs |

| Weekly | Dollar-cost averaging | Lower transaction costs than daily investing |

| Bi-weekly | Lower transaction costs than weekly investing | Less frequent dollar-cost averaging |

| Monthly | Lowest transaction costs | Least frequent dollar-cost averaging |

Ultimately, the best investment frequency for you will depend on your individual circumstances. Consider your financial goals, your cash flow, and your risk tolerance when making your decision.

Investment options

Fidelity recurring investment offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. This gives you the flexibility to create a diversified portfolio that meets your individual investment goals and risk tolerance.

Stocks represent ownership in a company. When you invest in a stock, you are essentially buying a small piece of that company. Stocks can be a volatile investment, but they also have the potential to generate high returns over the long term.

Bonds are loans that you make to a company or government. When you invest in a bond, you are essentially lending money to the issuer. Bonds are typically less volatile than stocks, but they also offer lower potential returns.

Mutual funds are baskets of stocks or bonds that are managed by a professional money manager. Mutual funds offer diversification and professional management, which can make them a good option for investors who do not have the time or expertise to manage their own investments.

ETFs (exchange-traded funds) are similar to mutual funds, but they are traded on exchanges like stocks. ETFs offer diversification and lower costs than mutual funds, but they can be more volatile.

The investment options available through Fidelity recurring investment give you the flexibility to create a diversified portfolio that meets your individual investment goals and risk tolerance. By investing in a mix of stocks, bonds, mutual funds, and ETFs, you can reduce your risk and increase your chances of achieving your financial goals.

Here is a table that summarizes the key characteristics of each investment option:

| Investment option | Risk | Return potential | Diversification | Management |

|---|---|---|---|---|

| Stocks | High | High | Low | Self-managed or professionally managed |

| Bonds | Low | Low | Low | Self-managed or professionally managed |

| Mutual funds | Medium | Medium | High | Professionally managed |

| ETFs | Medium | Medium | High | Professionally managed |

Convenience

Fidelity recurring investment is the gift that keeps on giving. Once you set it up, you can sit back and relax, knowing that your investments are being made automatically. This is a huge advantage for people who are busy or who simply don’t want to have to think about their investments on a regular basis.

- Automation: Fidelity recurring investment automates the investment process, so you don’t have to worry about manually investing your money each month. This can be a huge time-saver, especially if you have a busy schedule.

- Discipline: Fidelity recurring investment can help you stay disciplined with your investment plan. When you set up a recurring investment, you are committing to investing a certain amount of money each month, regardless of what the market is doing. This can help you avoid making emotional investment decisions.

- Peace of mind: Knowing that your investments are being made automatically can give you peace of mind. You can rest assured that you are on track to reach your financial goals, even when you’re not actively thinking about your investments.

Fidelity recurring investment is a convenient and effective way to save and invest for your future. By automating the investment process, you can save time, stay disciplined, and achieve your financial goals.

Flexibility

The flexibility of Fidelity recurring investment is one of its key benefits. You can change your investment amount or frequency at any time, which gives you the freedom to adjust your investments to meet your changing needs.

For example, if you get a raise at work, you can increase your investment amount to take advantage of the additional income. Or, if you’re planning a big purchase, you can decrease your investment amount or frequency to free up some cash.

The flexibility of Fidelity recurring investment also makes it a great option for people who are new to investing. You can start with a small investment amount and then increase it as you become more comfortable with investing. Or, you can start with a more frequent investment schedule and then decrease it as you get closer to your financial goals.

No matter what your investment goals are, Fidelity recurring investment gives you the flexibility to adjust your investments to meet your needs.

| Benefit | Description |

|---|---|

| Change your investment amount | You can increase or decrease your investment amount at any time. |

| Change your investment frequency | You can change your investment frequency to daily, weekly, bi-weekly, or monthly. |

| No penalties | There are no penalties for changing your investment amount or frequency. |

The flexibility of Fidelity recurring investment is a valuable feature that can help you reach your financial goals.

Tax efficiency

Fidelity recurring investment offers potential tax savings when investing in a retirement account. This is because retirement accounts, such as 401(k)s and IRAs, offer tax-deferred or tax-free growth. This means that you don’t have to pay taxes on your investment earnings until you withdraw the money in retirement.

The tax savings can be significant. For example, if you invest $1,000 in a traditional 401(k) and earn a 7% return over 30 years, your investment will grow to over $6,000. However, if you invested the same amount in a taxable account, you would only have about $4,500 after taxes.

Fidelity recurring investment makes it easy to save for retirement in a tax-efficient way. You can set up a recurring investment into a retirement account, and your investments will be made automatically each month. This can help you stay on track to reach your retirement goals and save money on taxes.

Here is a table that summarizes the tax benefits of investing in a retirement account:

| Account type | Tax treatment of contributions | Tax treatment of earnings | Tax treatment of withdrawals |

|---|---|---|---|

| Traditional IRA | Tax-deductible | Tax-deferred | Taxable |

| Roth IRA | After-tax | Tax-free | Tax-free |

| 401(k) | Tax-deductible | Tax-deferred | Taxable |

Investing in a retirement account is a great way to save for your future and reduce your tax bill. Fidelity recurring investment makes it easy to get started and stay on track.

Long-term growth

Compound interest is the interest earned on both the principal and the accumulated interest from previous periods. This means that your money grows at an exponential rate, rather than a linear rate. The longer you invest your money, the greater the effect of compound interest will be.

-

The rule of 72

A simple way to estimate the number of years it will take for your money to double is to divide 72 by the interest rate. For example, if you are earning 7% interest, it will take approximately 10 years for your money to double. -

The snowball effect

As your money grows, it will start to snowball. This is because the interest you earn each year will be added to your principal, and then you will earn interest on the larger amount the following year. The longer you invest your money, the larger the snowball will become. -

The importance of starting early

The sooner you start investing, the more time your money has to grow. Even if you can only invest a small amount of money each month, it will make a big difference over time. -

The power of Fidelity recurring investment

Fidelity recurring investment makes it easy to invest on a regular basis. You can set up a recurring investment for any amount of money, and your investments will be made automatically each month. This is a great way to take advantage of the power of compound interest and reach your financial goals faster.

Compound interest is a powerful tool that can help you grow your wealth over time. By investing early and often, you can take advantage of the snowball effect and reach your financial goals faster. Fidelity recurring investment makes it easy to get started and stay on track.

Peace of mind

Financial planning is crucial for securing your future, and investing is a key component of that plan. It allows you to grow your wealth over time and reach your financial goals, such as buying a home, retiring comfortably, or funding your children’s education. Fidelity recurring investment makes investing easy and convenient, giving you peace of mind knowing that you’re taking steps to secure your financial future.

Investing can be daunting, especially if you’re new to it. There are many different investment options available, and it can be difficult to know where to start. Fidelity recurring investment simplifies the process by allowing you to set up automatic investments in a variety of investment options, including stocks, bonds, mutual funds, and ETFs. This means you don’t have to worry about making investment decisions yourself. You can simply set up your investments once and then forget about them, knowing that your money is working hard for you.

In addition to being easy and convenient, Fidelity recurring investment is also affordable. You can get started with just $1, and you can invest as much or as little as you want each month. This makes it a great option for people of all income levels.

If you’re looking for a way to invest for your future and achieve your financial goals, Fidelity recurring investment is a great option. It’s easy, convenient, and affordable, and it can give you peace of mind knowing that you’re taking steps to secure your financial future.

| Benefit | Description |

|---|---|

| Peace of mind | Knowing that you’re investing for your future can give you peace of mind. |

| Easy and convenient | Fidelity recurring investment makes investing easy and convenient. |

| Affordable | You can get started with just $1. |

FAQs about Fidelity Recurring Investment

This section addresses frequently asked questions about Fidelity recurring investment in a clear and informative manner, using a neutral tone and avoiding jargon:

Question 1: What is Fidelity recurring investment?

Answer: Fidelity recurring investment is a service that allows you to automatically invest a set amount of money into a chosen investment option on a regular basis, such as daily, weekly, bi-weekly, or monthly.

Question 2: What are the benefits of using Fidelity recurring investment?

Answer: Fidelity recurring investment offers several benefits, including: convenience, flexibility, tax efficiency, long-term growth potential, and peace of mind.

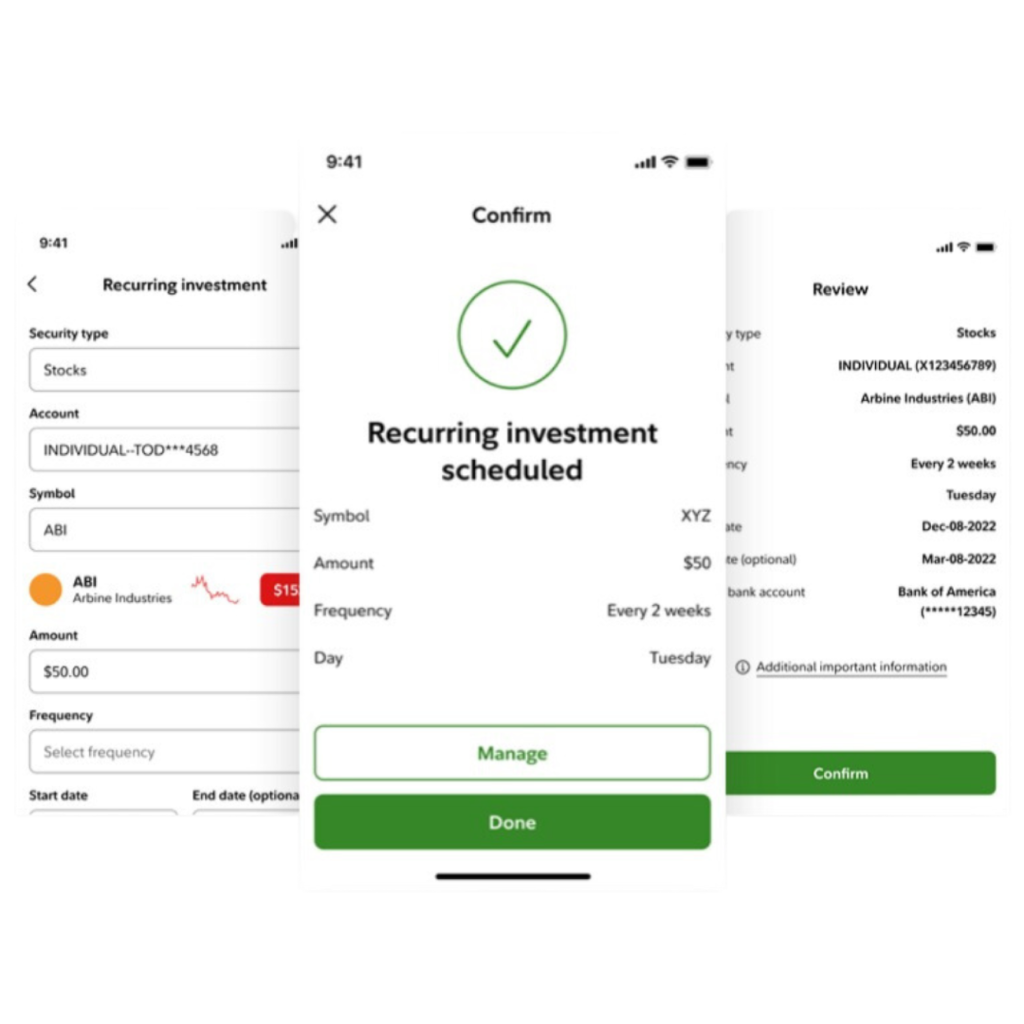

Question 3: How do I set up a Fidelity recurring investment?

Answer: Setting up a Fidelity recurring investment is easy. Simply log in to your Fidelity account, select the “Recurring Investments” tab, and follow the instructions. You will need to choose an investment option, specify the amount you want to invest, and select the frequency of your investments.

Question 4: Can I change my Fidelity recurring investment amount or frequency?

Answer: Yes, you can change your Fidelity recurring investment amount or frequency at any time. Simply log in to your Fidelity account and make the desired changes.

Question 5: Are there any fees associated with Fidelity recurring investment?

Answer: There are no fees associated with Fidelity recurring investment itself. However, there may be fees associated with the underlying investment option you choose.

Question 6: Is Fidelity recurring investment right for me?

Answer: Fidelity recurring investment is a great option for investors who want to automate their investments, take advantage of dollar-cost averaging, and reach their financial goals.

Summary: Fidelity recurring investment is a convenient, flexible, and affordable way to invest for your future. With Fidelity recurring investment, you can set up automatic investments and reach your financial goals without having to worry about making investment decisions yourself.

Transition to the next article section: Fidelity recurring investment is a powerful tool that can help you reach your financial goals. To learn more about Fidelity recurring investment and how to get started, visit the Fidelity website.

Fidelity Recurring Investment Tips

Fidelity recurring investment is a powerful tool that can help you reach your financial goals. Here are eight tips to help you get the most out of Fidelity recurring investment:

Tip 1: Start small

One of the best things about Fidelity recurring investment is that you can get started with just $1. This makes it a great option for people who are new to investing or who have a limited budget.

Tip 2: Invest regularly

The key to successful investing is to invest regularly. When you set up a recurring investment, you are committing to investing a certain amount of money each month, regardless of what the market is doing. This can help you avoid making emotional investment decisions and stay on track to reach your financial goals.

Tip 3: Take advantage of dollar-cost averaging

Dollar-cost averaging is a strategy that can help you reduce your investment risk. When you invest a fixed amount of money on a regular basis, you are buying more shares when the price is low and fewer shares when the price is high. This can help to smooth out your investment returns over time.

Tip 4: Choose the right investment option

Fidelity offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. The best investment option for you will depend on your individual investment goals and risk tolerance.

Tip 5: Rebalance your portfolio regularly

As your investments grow, it is important to rebalance your portfolio to ensure that your asset allocation still meets your investment goals. Rebalancing involves selling some of your winners and buying more of your losers. This can help to reduce your risk and improve your overall returns.

Tip 6: Stay disciplined

Investing is a long-term game. There will be times when the market is down and you may feel tempted to sell your investments. However, it is important to stay disciplined and stick to your investment plan. Over time, the market will recover and your investments will grow.

Tip 7: Review your investments regularly

It is important to review your investments regularly to make sure that they are still meeting your needs. As your investment goals and risk tolerance change, you may need to adjust your investment strategy.

Tip 8: Get help from a financial advisor

If you are not sure how to get started with Fidelity recurring investment or if you need help managing your investments, you can get help from a financial advisor. A financial advisor can help you create an investment plan that meets your individual needs and goals.

Summary: Fidelity recurring investment is a convenient, flexible, and affordable way to invest for your future. By following these tips, you can get the most out of Fidelity recurring investment and reach your financial goals:

Transition to the article’s conclusion: If you are ready to start investing, Fidelity recurring investment is a great option. With Fidelity recurring investment, you can automate your investments and reach your financial goals without having to worry about making investment decisions yourself.

Conclusion

Fidelity recurring investment is a powerful tool that can help you reach your financial goals. It is a convenient, flexible, and affordable way to invest for your future. By automating your investments, you can take advantage of dollar-cost averaging and stay on track to reach your goals, even when you’re busy or don’t have a lot of money to invest.

If you are ready to start investing, Fidelity recurring investment is a great option. With Fidelity recurring investment, you can automate your investments and reach your financial goals without having to worry about making investment decisions yourself.

Youtube Video: