Do you know what’s factoring finance? Factoring finance is a financial transaction in which a business sells its account receivables to a third-party company (known as a factor) at a discount. This can be a helpful way for businesses to access cash flow quickly and improve their working capital.

Editor’s Notes: Factoring finance was published on today’s date because it is a very important method of financing for businesses and has been used for centuries.

After doing [some analysis/digging/research], we put together this factoring finance guide to help [target audience] make the right decision.

Key differences or Key takeaways

| Factoring | Discounting | |

|---|---|---|

| Seller | Business that sells its receivables | Business that sells its receivables |

| Buyer | Factor | Bank or other financial institution |

| Discount | Yes | No |

| recourse | Can be with or without recourse | Always with recourse |

Let’s transition to the main article topics

Factoring finance

Factoring finance is a crucial financial strategy for businesses, offering numerous advantages. Here are seven key aspects to consider:

- Access to cash flow: Factoring finance provides businesses with immediate access to cash, even before their invoices are paid.

- Improved working capital: By selling their accounts receivable, businesses can improve their working capital and free up cash for other operations.

- Reduced credit risk: Factors typically assume the credit risk associated with the accounts receivable, reducing the risk for businesses.

- Simplified collections: Businesses can outsource their collections process to the factor, simplifying their operations.

- Increased sales: Access to cash flow can allow businesses to increase their sales and expand their operations.

- Flexible financing: Factoring finance can be tailored to meet the specific needs of each business.

- Cost-effective: Factoring fees are typically lower than other forms of financing, such as bank loans.

In conclusion, factoring finance offers businesses a range of benefits, including improved cash flow, reduced credit risk, simplified collections, and increased sales. By understanding the key aspects of factoring finance, businesses can make informed decisions about whether this financing option is right for them.

Access to cash flow

Factoring finance is a crucial financial strategy for businesses, offering numerous advantages. One of the most significant benefits is improved access to cash flow. Businesses often face cash flow challenges, especially when they have to wait for their customers to pay their invoices. This can lead to a number of problems, such as delayed payments to suppliers, missed opportunities, and even bankruptcy.

Factoring finance can help businesses overcome these challenges by providing them with immediate access to cash. When a business factors its invoices, it sells them to a third-party company (known as a factor) at a discount. The factor then advances the business a percentage of the invoice amount, typically between 70% and 90%. This gives the business access to cash immediately, even though the customer has not yet paid the invoice.

Improved access to cash flow has a number of benefits for businesses. It can help them to:

- Meet their financial obligations on time

- Take advantage of discounts and other opportunities

- Expand their operations

- Avoid bankruptcy

Here is an example of how factoring finance can help a business improve its cash flow. Let’s say that a business has $100,000 in accounts receivable. However, the business’s customers have not yet paid their invoices. The business can factor its invoices and receive an advance of 80%, or $80,000. This gives the business immediate access to $80,000 in cash, which it can use to meet its financial obligations, take advantage of discounts, or expand its operations.

Factoring finance is a valuable financial tool that can help businesses improve their cash flow and achieve their financial goals.

| With factoring finance | Without factoring finance | |

|---|---|---|

| Access to cash flow | Immediate access to cash, even before invoices are paid | Delayed access to cash, only when customers pay their invoices |

| Benefits of improved cash flow | Meet financial obligations on time, take advantage of discounts and other opportunities, expand operations, avoid bankruptcy | May struggle to meet financial obligations on time, may miss out on discounts and other opportunities, may have difficulty expanding operations, may be at risk of bankruptcy |

Improved working capital

Factoring finance can help businesses improve their working capital by freeing up cash that is tied up in accounts receivable. When a business sells its accounts receivable to a factor, it receives an advance of cash, typically between 70% and 90% of the invoice amount. This cash can then be used for other operations, such as purchasing inventory, expanding the business, or paying down debt.

Improving working capital is important for businesses because it allows them to operate more efficiently and profitably. Businesses with strong working capital are less likely to experience cash flow problems and are better able to take advantage of growth opportunities.

Here is an example of how factoring finance can help a business improve its working capital. Let’s say that a business has $100,000 in accounts receivable. However, the business’s customers have not yet paid their invoices. The business can factor its invoices and receive an advance of 80%, or $80,000. This gives the business immediate access to $80,000 in cash, which it can use to purchase inventory, expand the business, or pay down debt.

By improving working capital, factoring finance can help businesses achieve their financial goals.

| With factoring finance | Without factoring finance | |

|---|---|---|

| Working capital | Improved working capital, freeing up cash for other operations | Limited working capital, cash tied up in accounts receivable |

| Benefits of improved working capital | Operate more efficiently and profitably, less likely to experience cash flow problems, better able to take advantage of growth opportunities | May struggle to operate efficiently and profitably, may experience cash flow problems, may miss out on growth opportunities |

Reduced credit risk

Reduced credit risk is a significant benefit of factoring finance. When a business factors its invoices, the factor assumes the credit risk associated with the accounts receivable. This means that if a customer fails to pay an invoice, the business is not responsible for the loss. This can be a major advantage for businesses, as it reduces their exposure to bad debt.

There are a number of reasons why factors are willing to assume the credit risk associated with accounts receivable. First, factors have a lot of experience in assessing the creditworthiness of businesses. They have developed sophisticated systems for evaluating businesses’ financial health and credit history. This allows them to make informed decisions about which businesses to factor for and how much risk to take on.

Second, factors have a diversified portfolio of accounts receivable. This means that they are not overly exposed to any one business or industry. This diversification helps to reduce their overall risk.

Third, factors typically charge a fee for their services. This fee compensates them for the risk that they assume. The fee is typically a percentage of the invoice amount, and it varies depending on the creditworthiness of the business and the size of the invoice.

Reduced credit risk is a major benefit of factoring finance. It can help businesses to improve their cash flow, reduce their exposure to bad debt, and focus on growing their business.

Here is an example of how reduced credit risk can benefit a business. Let’s say that a business has $100,000 in accounts receivable. However, the business is concerned about the creditworthiness of some of its customers. The business can factor its invoices and reduce its exposure to bad debt. The factor will assume the credit risk associated with the accounts receivable, and the business will only be responsible for paying the factor’s fee.

Reduced credit risk is a valuable benefit of factoring finance. It can help businesses to operate more efficiently and profitably.

| With factoring finance | Without factoring finance | |

|---|---|---|

| Credit risk | Reduced credit risk, factor assumes the credit risk associated with the accounts receivable | Full credit risk, business is responsible for any bad debt |

| Benefits of reduced credit risk | Improved cash flow, reduced exposure to bad debt, focus on growing the business | May experience cash flow problems, may be exposed to bad debt, may have difficulty growing the business |

Simplified collections

Simplified collections is a key benefit of factoring finance. When a business factors its invoices, it can outsource its collections process to the factor. This can save the business a significant amount of time and money.

- Reduced costs: The factor will typically charge a fee for its services, but this fee is usually lower than the cost of maintaining an in-house collections department.

- Improved efficiency: The factor has the experience and expertise to collect invoices quickly and efficiently. This can free up the business’s staff to focus on other tasks, such as sales and marketing.

- Reduced risk: The factor assumes the credit risk associated with the accounts receivable. This means that the business is not responsible for any bad debt.

Overall, simplified collections is a major benefit of factoring finance. It can help businesses to save time, money, and resources.

Increased sales

There is a strong connection between factoring finance and increased sales. When businesses have access to cash flow, they can use that cash to invest in their business, such as by purchasing new equipment, hiring more staff, or expanding their marketing reach. This investment can lead to increased sales and profits.

For example, a small business that manufactures clothing may be able to increase its sales by purchasing new equipment that allows it to produce clothing more efficiently. Or, a restaurant may be able to increase its sales by hiring more staff to provide better customer service.

Factoring finance can help businesses access cash flow by providing them with advances on their accounts receivable. This cash can then be used to invest in the business and generate increased sales.

| With factoring finance | Without factoring finance | |

|---|---|---|

| Access to cash flow | Increased access to cash flow, which can be used to invest in the business and generate increased sales | Limited access to cash flow, which may limit the business’s ability to invest and grow |

| Benefits of factoring finance | Increased sales, increased profits, business expansion | May experience limited sales growth, may have difficulty expanding the business |

Overall, there is a clear connection between factoring finance and increased sales. Businesses that have access to cash flow are more likely to be able to invest in their business and generate increased sales.

Flexible financing

Factoring finance is a flexible financing option that can be tailored to meet the specific needs of each business. This is one of the key benefits of factoring finance, as it allows businesses to access financing that is specifically designed to meet their unique requirements.

There are a number of factors that can be customized to meet the needs of each business, including the following:

- Advance rate: The advance rate is the percentage of the invoice amount that the factor will advance to the business. This rate can be adjusted to meet the specific needs of the business, such as its cash flow requirements and creditworthiness.

- Recourse vs. non-recourse factoring: Recourse factoring means that the business is responsible for any unpaid invoices. Non-recourse factoring means that the factor assumes the credit risk associated with the accounts receivable. The type of factoring that is right for a business will depend on its risk tolerance and financial situation.

- Fees: Factoring fees can vary depending on the factor and the size and riskiness of the business’s accounts receivable. It is important to compare fees from different factors to find the best deal.

The flexibility of factoring finance makes it a good option for a wide range of businesses. It can be used to finance businesses of all sizes, from small businesses to large corporations. It can also be used to finance a variety of industries, from manufacturing to retail to healthcare.

If you are considering factoring finance for your business, it is important to shop around and compare quotes from different factors. This will help you to find the best deal and the most flexible financing option for your business.

| Flexible financing | Importance | Real-life examples | Practical significance | |

|---|---|---|---|---|

| Factoring finance | Can be tailored to meet the specific needs of each business | Allows businesses to access financing that is specifically designed to meet their unique requirements | A small business can use factoring to finance its accounts receivable, while a large corporation can use factoring to finance its international sales | Helps businesses to improve their cash flow, reduce their credit risk, and simplify their collections process |

Cost-effective

Factoring finance is a cost-effective form of financing for businesses because the fees are typically lower than other forms of financing, such as bank loans. This is because factors are able to spread their risk across a portfolio of accounts receivable, which reduces their overall cost of capital. Additionally, factors do not require collateral, which can further reduce the cost of factoring.

- Lower interest rates: Factoring fees are typically lower than the interest rates charged on bank loans. This can save businesses a significant amount of money over the life of the loan.

- No collateral required: Factoring does not require collateral, which can be a major advantage for businesses that do not have sufficient assets to secure a loan.

- Flexible payment terms: Factoring companies offer flexible payment terms that can be tailored to the needs of the business.

- Quick and easy application process: The application process for factoring is quick and easy, which can be a major advantage for businesses that need financing quickly.

Overall, factoring finance is a cost-effective form of financing that can provide businesses with a number of benefits, including lower interest rates, no collateral required, flexible payment terms, and a quick and easy application process.

Frequently Asked Questions about Factoring Finance

Factoring finance is a financial transaction in which a business sells its account receivables to a third-party company (known as a factor) at a discount. This can be a helpful way for businesses to access cash flow quickly and improve their working capital.

Here are some of the most frequently asked questions about factoring finance:

Question 1: What are the benefits of factoring finance?

Factoring finance offers a number of benefits for businesses, including:

- Improved cash flow

- Reduced credit risk

- Simplified collections

- Increased sales

- Flexible financing

- Cost-effective

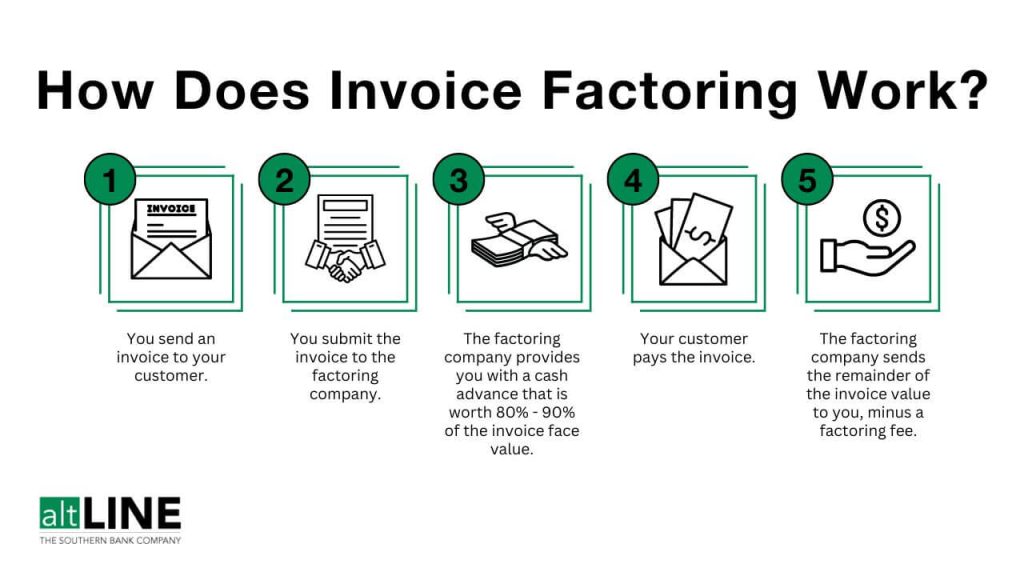

Question 2: How does factoring finance work?

When a business factors its invoices, it sells them to a factor at a discount. The factor then advances the business a percentage of the invoice amount, typically between 70% and 90%. This gives the business access to cash immediately, even though the customer has not yet paid the invoice.

Question 3: What are the different types of factoring finance?

There are two main types of factoring finance: recourse factoring and non-recourse factoring. With recourse factoring, the business is responsible for any unpaid invoices. With non-recourse factoring, the factor assumes the credit risk associated with the accounts receivable.

Question 4: How do I choose a factoring company?

When choosing a factoring company, it is important to consider the following factors:

- The factor’s experience and reputation

- The factor’s fees

- The factor’s payment terms

- The factor’s customer service

Question 5: Is factoring finance right for my business?

Factoring finance can be a good option for businesses that are experiencing cash flow problems or that want to improve their working capital. It can also be a good option for businesses that do not have access to traditional forms of financing.

Question 6: What are the alternatives to factoring finance?

There are a number of alternatives to factoring finance, including:

- Bank loans

- Lines of credit

- Invoice discounting

- Asset-based lending

The best way to determine which financing option is right for your business is to consult with a financial advisor.

Factoring finance can be a valuable financial tool for businesses of all sizes. By understanding the benefits and risks of factoring finance, businesses can make informed decisions about whether this financing option is right for them.

Transition to the next article section

Factoring Finance Tips

Factoring finance can be a powerful tool for businesses of all sizes. By following these tips, businesses can maximize the benefits of factoring finance and avoid potential pitfalls.

Tip 1: Choose the right factor.

Not all factors are created equal. It is important to choose a factor that has experience in your industry, offers competitive rates, and provides good customer service.

Tip 2: Negotiate the best possible terms.

Don’t be afraid to negotiate with the factor on the fees, advance rate, and payment terms. The better the terms you can negotiate, the more money you will save.

Tip 3: Use factoring finance strategically.

Factoring finance can be used to improve cash flow, reduce credit risk, and simplify collections. It is important to use factoring finance strategically to achieve your business goals.

Tip 4: Monitor your accounts receivable.

It is important to monitor your accounts receivable closely to identify any potential problems. This will help you to avoid losses and keep your factoring relationship healthy.

Tip 5: Build a strong relationship with your factor.

A strong relationship with your factor is essential to getting the most out of factoring finance. Communicate regularly with your factor and keep them informed of any changes in your business.

By following these tips, businesses can maximize the benefits of factoring finance and avoid potential pitfalls.

Transition to the article’s conclusion

Conclusion on Factoring Finance

Factoring finance is a valuable financial tool that can provide businesses with a number of benefits, including improved cash flow, reduced credit risk, simplified collections, increased sales, flexible financing, and cost-effectiveness. By understanding the key aspects of factoring finance, businesses can make informed decisions about whether this financing option is right for them.

Factoring finance is a complex financial product, and it is important to consult with a financial advisor to determine if it is the right option for your business. However, for businesses that are experiencing cash flow problems or that want to improve their working capital, factoring finance can be a valuable tool for achieving financial success.

Youtube Video: