What is equipment finance insurance, and why is it important for businesses? Equipment finance insurance protects businesses from financial losses in the event that the equipment they have financed is damaged, lost, or stolen. This type of insurance can be a valuable asset for businesses of all sizes, as it can help to protect their investment and ensure that they can continue to operate in the event of an unexpected loss.

Editor’s Note: This equipment finance insurance guide was last published on [Date]. Due to the equipment finance insurance market’s constant evolution, it’s best to research the latest equipment finance insurance trends to make informed decisions.

To help you make the right decision about equipment finance insurance, we’ve put together this comprehensive guide. We’ll explain what equipment finance insurance is, how it works, and the benefits of having it. We’ll also provide some tips on how to choose the right equipment finance insurance policy for your business.

Key Differences or Key Takeaways:

| Feature | Equipment Finance Insurance | Traditional Insurance |

|---|---|---|

| Coverage | Covers specific equipment | May not cover all types of equipment |

| Cost | Typically less expensive than traditional insurance | Can be more expensive than equipment finance insurance |

| Flexibility | Can be customized to meet your specific needs | May not be as flexible as traditional insurance |

Transition to main article topics:

- What is equipment finance insurance?

- How does equipment finance insurance work?

- What are the benefits of equipment finance insurance?

- How to choose the right equipment finance insurance policy

- Conclusion

Equipment Finance Insurance

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. Here are 8 key aspects of equipment finance insurance that you should know:

- Coverage: Equipment finance insurance covers specific equipment, such as computers, machinery, and vehicles.

- Cost: Equipment finance insurance is typically less expensive than traditional insurance.

- Flexibility: Equipment finance insurance can be customized to meet your specific needs.

- Protection: Equipment finance insurance protects your business from financial losses in the event that your equipment is damaged, lost, or stolen.

- Peace of mind: Equipment finance insurance can give you peace of mind knowing that your business is protected.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in.

- Premium: The premium is the amount you pay for your insurance coverage.

- Term: The term is the length of time your insurance coverage lasts.

These are just a few of the key aspects of equipment finance insurance that you should know. By understanding these aspects, you can make an informed decision about whether or not equipment finance insurance is right for your business.

For example, if you have a business that relies on specialized equipment, then equipment finance insurance can be a valuable way to protect your investment. In the event that your equipment is damaged or stolen, equipment finance insurance can help you to replace it quickly and easily, so that you can continue to operate your business without interruption.

Equipment finance insurance is a complex topic, but it is important to understand the basics so that you can make an informed decision about whether or not it is right for your business.

Coverage

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. One of the key benefits of equipment finance insurance is that it provides coverage for specific equipment.

-

Facet 1: What types of equipment are covered?

Equipment finance insurance can cover a wide range of equipment, including computers, machinery, vehicles, and other business-related equipment.

-

Facet 2: How is the equipment valued?

The value of the equipment is typically determined by the purchase price or the depreciated value.

-

Facet 3: What are the coverage limits?

The coverage limits vary depending on the policy, but they typically range from $10,000 to $1 million.

-

Facet 4: What are the exclusions?

Some policies may exclude certain types of equipment, such as equipment that is used for illegal purposes or equipment that is not properly maintained.

By understanding the coverage provided by equipment finance insurance, you can make an informed decision about whether or not it is right for your business.

Cost

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. One of the key benefits of equipment finance insurance is that it is typically less expensive than traditional insurance.

-

Reason 1: Equipment finance insurance is more specific.

Traditional insurance policies often cover a wide range of risks, including equipment damage, loss, and theft. Equipment finance insurance, on the other hand, is more specific and only covers the equipment that is financed. This allows equipment finance insurance companies to offer lower premiums.

-

Reason 2: Equipment finance insurance companies have lower overhead costs.

Equipment finance insurance companies typically have lower overhead costs than traditional insurance companies. This is because they do not have to maintain a large network of agents and brokers.

-

Reason 3: Equipment finance insurance is a competitive market.

There are a number of equipment finance insurance companies in the market, which means that there is a lot of competition. This competition drives down prices.

By understanding the reasons why equipment finance insurance is typically less expensive than traditional insurance, you can make an informed decision about whether or not it is right for your business.

Flexibility

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. One of the key benefits of equipment finance insurance is that it can be customized to meet your specific needs.

-

Facet 1: Coverage options

Equipment finance insurance policies can be customized to cover a wide range of risks, including equipment damage, loss, and theft. You can also choose to add riders to your policy to cover specific risks, such as cyber attacks or natural disasters.

-

Facet 2: Deductible options

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. You can choose a higher deductible to lower your premium, or a lower deductible to increase your coverage.

-

Facet 3: Payment options

Equipment finance insurance premiums can be paid monthly, quarterly, or annually. You can choose the payment option that best fits your budget.

-

Facet 4: Term options

Equipment finance insurance policies can be written for terms of one year, three years, or five years. You can choose the term that best meets your needs.

By understanding the flexibility of equipment finance insurance, you can create a policy that meets your specific needs and budget.

Protection

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss.

-

Facet 1: Financial protection

Equipment finance insurance can provide financial protection in the event that your equipment is damaged, lost, or stolen. This can help you to avoid costly repairs or replacements, and it can also help you to stay in business if your equipment is essential to your operations.

-

Facet 2: Peace of mind

Equipment finance insurance can give you peace of mind knowing that your business is protected. This can allow you to focus on other aspects of your business, such as growth and profitability.

-

Facet 3: Coverage options

Equipment finance insurance policies can be customized to cover a wide range of risks, including equipment damage, loss, and theft. You can also choose to add riders to your policy to cover specific risks, such as cyber attacks or natural disasters.

-

Facet 4: Affordable premiums

Equipment finance insurance is typically less expensive than traditional insurance. This makes it an affordable option for businesses of all sizes.

By understanding the protection provided by equipment finance insurance, you can make an informed decision about whether or not it is right for your business.

Peace of mind

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. One of the key benefits of equipment finance insurance is that it can give you peace of mind.

-

Facet 1: Financial security

Equipment finance insurance can provide financial security in the event that your equipment is damaged, lost, or stolen. This can help you to avoid costly repairs or replacements, and it can also help you to stay in business if your equipment is essential to your operations.

-

Facet 2: Reduced stress

Equipment finance insurance can reduce stress by giving you peace of mind knowing that your business is protected. This can allow you to focus on other aspects of your business, such as growth and profitability.

-

Facet 3: Improved decision-making

Equipment finance insurance can improve decision-making by giving you the confidence to make informed decisions about your business. This can help you to avoid costly mistakes and make better decisions about your equipment.

-

Facet 4: Increased productivity

Equipment finance insurance can increase productivity by giving you peace of mind knowing that your business is protected. This can allow you to focus on your work and be more productive.

By understanding the connection between peace of mind and equipment finance insurance, you can make an informed decision about whether or not it is right for your business.

Deductible

A deductible is a common feature of insurance policies, including equipment finance insurance. It is the amount that you, the policyholder, are responsible for paying out of pocket before the insurance company begins to cover the costs of a claim.

The deductible is an important factor to consider when choosing an equipment finance insurance policy. A higher deductible will result in a lower premium, but it will also mean that you will have to pay more out of pocket in the event of a claim.

There are several factors to consider when choosing a deductible for your equipment finance insurance policy:

- Your financial situation: If you have a limited budget, you may want to choose a higher deductible to lower your premium. However, if you have a larger budget, you may want to choose a lower deductible to reduce your out-of-pocket costs in the event of a claim.

- The type of equipment you are financing: Some types of equipment are more likely to be damaged or lost than others. If you are financing high-risk equipment, you may want to choose a lower deductible.

- Your claims history: If you have a history of filing claims, you may want to choose a higher deductible to avoid paying higher premiums.

It is important to weigh all of these factors carefully when choosing a deductible for your equipment finance insurance policy. The right deductible will help you to protect your business from financial losses without breaking the bank.

| Deductible | Pros | Cons |

|---|---|---|

| High deductible | Lower premium | Higher out-of-pocket costs in the event of a claim |

| Low deductible | Lower out-of-pocket costs in the event of a claim | Higher premium |

Premium

The premium is a key component of equipment finance insurance. It is the amount that you pay to the insurance company in exchange for coverage. The premium is typically paid annually, but it can also be paid monthly or quarterly.

The premium for equipment finance insurance is determined by a number of factors, including:

- The type of equipment being financed

- The value of the equipment

- The term of the loan

- The deductible

- The insurance company’s claims history

It is important to compare quotes from multiple insurance companies before purchasing equipment finance insurance. This will help you to get the best possible rate on your coverage.

The premium for equipment finance insurance is tax deductible. This means that you can reduce your taxable income by the amount of the premium that you pay.

| Factor | Impact on premium |

|---|---|

| Type of equipment | Higher-risk equipment will have a higher premium. |

| Value of the equipment | More valuable equipment will have a higher premium. |

| Term of the loan | Longer loan terms will have a higher premium. |

| Deductible | Higher deductibles will result in a lower premium. |

| Insurance company’s claims history | Insurance companies with a higher claims history will have higher premiums. |

Term

The term of equipment finance insurance is the length of time that your coverage will last. It is important to choose a term that is long enough to protect your equipment for the entire duration of your loan. If you choose a term that is too short, you may find yourself without coverage in the event of a loss.

There are a few factors to consider when choosing the term of your equipment finance insurance policy:

- The length of your loan

- The age of your equipment

- Your budget

It is important to weigh all of these factors carefully when choosing the term of your equipment finance insurance policy. The right term will help you to protect your business from financial losses without breaking the bank.

| Term | Pros | Cons |

|---|---|---|

| Short term (1-3 years) | Lower premium | May not provide enough coverage |

| Medium term (3-5 years) | Moderate premium | Provides more coverage than a short-term policy |

| Long term (5+ years) | Higher premium | Provides the most coverage |

Equipment Finance Insurance FAQs

Equipment finance insurance can be a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. However, there are a lot of common questions about equipment finance insurance. In this FAQ, we will answer some of the most frequently asked questions about equipment finance insurance.

Question 1: What is equipment finance insurance?

Equipment finance insurance is a type of insurance that protects businesses from financial losses in the event that their financed equipment is damaged, lost, or stolen.

Question 2: What types of equipment are covered by equipment finance insurance?

Equipment finance insurance can cover a wide range of equipment, including computers, machinery, vehicles, and other business-related equipment.

Question 3: How much does equipment finance insurance cost?

The cost of equipment finance insurance varies depending on the type of equipment being financed, the value of the equipment, the term of the loan, and the deductible.

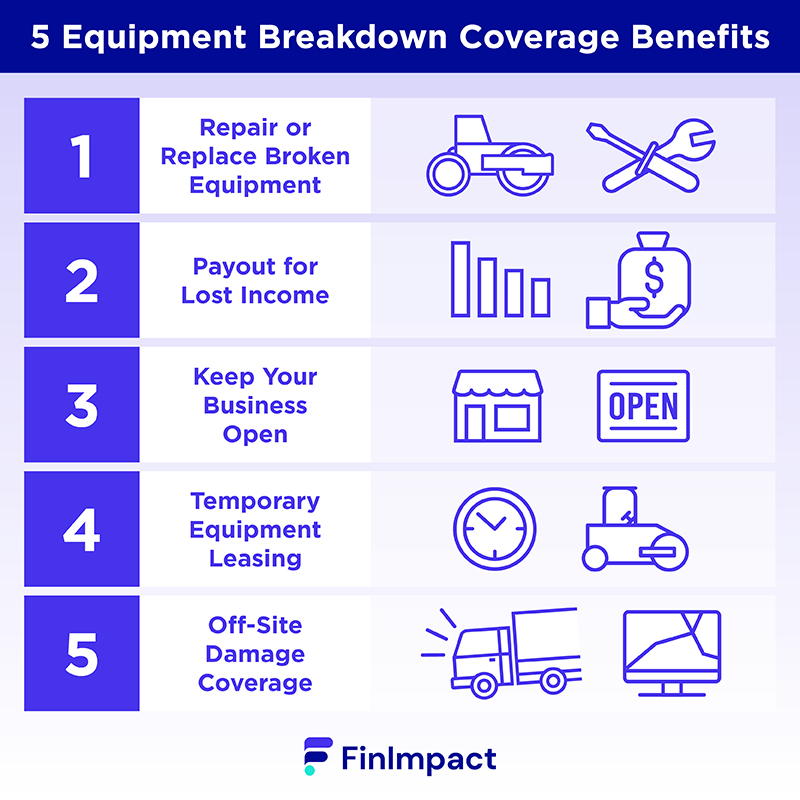

Question 4: What are the benefits of equipment finance insurance?

Equipment finance insurance offers a number of benefits, including financial protection, peace of mind, and reduced stress.

Question 5: What are the drawbacks of equipment finance insurance?

There are a few potential drawbacks to equipment finance insurance, including the cost and the fact that it may not cover all types of losses.

Question 6: Is equipment finance insurance right for my business?

Whether or not equipment finance insurance is right for your business depends on a number of factors, including the type of equipment you are financing, the value of the equipment, and your budget.

We hope this FAQ has answered some of your questions about equipment finance insurance. If you have any further questions, please contact your insurance agent or broker.

Summary of key takeaways:

- Equipment finance insurance can protect your business from financial losses in the event that your financed equipment is damaged, lost, or stolen.

- Equipment finance insurance can cover a wide range of equipment, including computers, machinery, vehicles, and other business-related equipment.

- The cost of equipment finance insurance varies depending on a number of factors, including the type of equipment being financed, the value of the equipment, and the deductible.

- Equipment finance insurance offers a number of benefits, including financial protection, peace of mind, and reduced stress.

- Whether or not equipment finance insurance is right for your business depends on a number of factors, including the type of equipment you are financing, the value of the equipment, and your budget.

Transition to the next article section:

Now that you have a better understanding of equipment finance insurance, you can make an informed decision about whether or not it is right for your business.

Equipment Finance Insurance Tips

Equipment finance insurance can be a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. However, there are a few things you should keep in mind to get the most out of your equipment finance insurance policy.

Tip 1: Understand your coverage.

Before you purchase an equipment finance insurance policy, it is important to understand what is and is not covered. This will help you to avoid any surprises down the road.

Tip 2: Choose the right deductible.

The deductible is the amount of money that you will have to pay out of pocket before your insurance coverage kicks in. A higher deductible will result in a lower premium, but it will also mean that you will have to pay more out of pocket in the event of a claim.

Tip 3: Keep your policy up to date.

Your equipment finance insurance policy should be updated whenever you make any changes to your equipment. This will ensure that you have adequate coverage in the event of a loss.

Tip 4: File claims promptly.

If you experience a loss, it is important to file a claim with your insurance company as soon as possible. This will help to ensure that your claim is processed quickly and efficiently.

Tip 5: Keep good records.

It is important to keep good records of your equipment, including its value, serial number, and purchase date. This will help you to file a claim in the event of a loss.

Summary of key takeaways:

- Understand your coverage.

- Choose the right deductible.

- Keep your policy up to date.

- File claims promptly.

- Keep good records.

Transition to the article’s conclusion:

By following these tips, you can get the most out of your equipment finance insurance policy and protect your business from financial losses.

Conclusion

Equipment finance insurance is a valuable tool for businesses of all sizes. It can protect your investment in equipment and ensure that you can continue to operate in the event of an unexpected loss. By understanding the basics of equipment finance insurance, you can make an informed decision about whether or not it is right for your business.

If you do decide to purchase equipment finance insurance, be sure to follow the tips outlined in this article. By doing so, you can get the most out of your policy and protect your business from financial losses.

Youtube Video: