Is cash flow a crucial element in your investment strategy? A company’s financial health can be determined by its cash flow. Positive cash flow indicates a company’s ability to generate cash from its operations, which can be used to fund growth, pay dividends, or reduce debt. Conversely, negative cash flow can be a sign of financial distress, as it may indicate that a company is unable to generate enough cash to meet its obligations.

Editor’s Notes: Cash flow of investment has been published today to provide valuable insights into how cash flow can impact investment decisions.

Our team has conducted extensive research and analysis to provide you with this comprehensive guide on cash flow of investment.

Key Differences:

| Positive Cash Flow | Negative Cash Flow | |

|---|---|---|

| Definition | A company generates more cash than it spends | A company spends more cash than it generates |

| Impact on Financial Health | Positive cash flow indicates financial strength | Negative cash flow can be a sign of financial distress |

| Uses of Cash | Fund growth, pay dividends, reduce debt | May require additional financing or asset sales |

Transition to main article topics:

- Importance of cash flow for investment decisions

- How to analyze a company’s cash flow

- Investment strategies based on cash flow

Cash Flow of Investment

Cash flow of investment is a crucial aspect of financial analysis and investment decision-making. It provides insights into a company’s financial health, stability, and growth potential.

- Cash Flow Generation: The ability of a company to generate positive cash flow from its operations.

- Cash Flow Analysis: Techniques used to evaluate a company’s cash flow patterns and trends.

- Investment Strategies: Investment approaches that consider a company’s cash flow characteristics.

- Dividend Payments: The distribution of cash to shareholders from a company’s profits.

- Debt Repayment: The use of cash flow to reduce or eliminate outstanding debt obligations.

- Capital Expenditures: The allocation of cash flow to fund investments in new assets or expansion projects.

- Financial Strength: Positive cash flow indicates financial strength and stability.

- Growth Potential: Strong cash flow can support growth initiatives and expansion plans.

In conclusion, the key aspects of cash flow of investment provide valuable insights into a company’s financial performance and investment potential. By analyzing cash flow patterns, investors can make informed decisions about which companies to invest in and how to manage their portfolios. Understanding these aspects is essential for successful investment strategies.

Cash Flow Generation

Cash flow generation is a fundamental aspect of cash flow of investment, as it provides the financial foundation for a company’s investment activities. A company with strong cash flow generation is better positioned to make strategic investments that can drive growth and profitability.

- Operating Cash Flow: Operating cash flow represents the cash generated from a company’s core business activities. It is calculated by taking the net income and adding back non-cash expenses, such as depreciation and amortization. Operating cash flow is a key indicator of a company’s ability to generate cash internally.

- Investing Cash Flow: Investing cash flow represents the cash used by a company to acquire or dispose of long-term assets, such as property, plant, and equipment. Positive investing cash flow indicates that a company is investing in its future growth.

- Financing Cash Flow: Financing cash flow represents the cash used by a company to raise capital from investors or lenders. Positive financing cash flow can be used to fund growth initiatives or reduce debt.

Overall, cash flow generation is a critical component of cash flow of investment. By analyzing a company’s cash flow statement, investors can gain insights into its financial health, stability, and growth potential.

Cash Flow Analysis

Cash flow analysis is a crucial aspect of cash flow of investment, as it provides investors with insights into a company’s financial health, stability, and growth potential. By analyzing a company’s cash flow statement, investors can identify trends and patterns that can inform their investment decisions.

- Trend Analysis: Trend analysis involves examining a company’s cash flow over time to identify patterns and trends. This analysis can help investors identify companies with consistent and growing cash flow, which is a positive sign for investment.

- Ratio Analysis: Ratio analysis involves using financial ratios to evaluate a company’s cash flow efficiency and performance. Common ratios include the cash flow to debt ratio, cash flow to equity ratio, and cash flow to sales ratio. These ratios can provide insights into a company’s ability to generate cash from its operations and meet its financial obligations.

- Cash Flow Forecasting: Cash flow forecasting involves using historical data and assumptions about future performance to predict a company’s future cash flows. This analysis can help investors assess a company’s liquidity and solvency, and make informed decisions about the timing of their investments.

- Scenario Analysis: Scenario analysis involves creating different scenarios to assess the impact of various factors on a company’s cash flow. This analysis can help investors understand how a company’s cash flow might be affected by changes in the economy, industry, or competitive landscape.

Overall, cash flow analysis is a valuable tool for investors seeking to make informed investment decisions. By analyzing a company’s cash flow patterns and trends, investors can gain insights into its financial health, stability, and growth potential.

Investment Strategies

Investment strategies that consider a company’s cash flow characteristics can be effective in identifying undervalued companies with strong growth potential. By analyzing cash flow patterns and trends, investors can gain insights into a company’s financial health, stability, and ability to generate returns.

- Value Investing: Value investors look for companies that are trading at a discount to their intrinsic value. Cash flow analysis is a key component of value investing, as it helps investors identify companies with strong cash flow generation and low valuations.

- Growth Investing: Growth investors look for companies with high growth potential. Cash flow analysis can help investors identify companies that are generating strong cash flow and reinvesting it in growth initiatives.

- Income Investing: Income investors look for companies that pay regular dividends. Cash flow analysis can help investors identify companies with a history of consistent and growing cash flow, which is essential for sustainable dividend payments.

- Contrarian Investing: Contrarian investors look for companies that are out of favor with the market. Cash flow analysis can help investors identify companies with strong cash flow but depressed valuations, which could represent a contrarian investment opportunity.

Overall, investment strategies that consider a company’s cash flow characteristics can be effective in identifying undervalued companies with strong growth potential. By analyzing cash flow patterns and trends, investors can gain insights into a company’s financial health, stability, and ability to generate returns.

Dividend Payments

Dividend payments are an important aspect of cash flow of investment, as they represent a distribution of a company’s profits to its shareholders. Companies with strong cash flow generation are more likely to be able to pay consistent and growing dividends, which can be an attractive feature for investors seeking income.

- Impact on Cash Flow: Dividend payments reduce a company’s cash on hand, as cash is distributed to shareholders. This can impact a company’s ability to invest in growth initiatives or reduce debt.

- Dividend Policy: A company’s dividend policy outlines its strategy for distributing dividends to shareholders. This policy is influenced by factors such as the company’s cash flow, earnings, and growth prospects.

- Dividend Yield: The dividend yield is a measure of the return on investment that a shareholder receives from dividends. It is calculated by dividing the annual dividend per share by the current market price of the stock.

- Tax Implications: Dividend payments are subject to taxation, which can impact the net return received by shareholders.

Overall, dividend payments are an important consideration for investors evaluating cash flow of investment. Companies with strong cash flow generation and a history of paying consistent dividends can be attractive investments for income-oriented investors.

Debt Repayment

Debt repayment is an essential component of cash flow of investment, as it directly impacts a company’s financial health and stability. Companies with strong cash flow generation are better positioned to repay their debts, which can lead to improved credit ratings, reduced interest expenses, and increased financial flexibility.

When a company uses its cash flow to repay debt, it reduces its outstanding debt obligations. This can have several positive effects:

- Improved Credit Ratings: Debt repayment can improve a company’s credit rating, as it demonstrates the company’s ability to meet its financial obligations. This can lead to lower interest rates on future borrowing, which can save the company money and improve its overall profitability.

- Reduced Interest Expenses: As a company repays its debt, its interest expenses will decrease. This can free up cash flow for other purposes, such as investing in growth initiatives or reducing operating costs.

- Increased Financial Flexibility: By reducing its debt obligations, a company increases its financial flexibility. This allows the company to take on new debt if needed, or to make other strategic investments without being constrained by high levels of debt.

In summary, debt repayment is an important aspect of cash flow of investment. Companies that prioritize debt repayment can improve their financial health, reduce their costs, and increase their financial flexibility. This can lead to improved investment opportunities and long-term growth.

Real-life Example:

Apple Inc. is a company that consistently generates strong cash flow. The company has used its cash flow to repay debt, which has improved its credit rating and reduced its interest expenses. As a result, Apple has been able to invest more in research and development, which has led to the development of new products and services that have driven its growth.

Capital Expenditures

Capital expenditures (CapEx) are an essential component of cash flow of investment, as they represent the investment of cash flow into long-term assets that will generate future returns. CapEx can include investments in new equipment, property, or infrastructure, as well as investments in research and development (R&D) and new product development.

Companies with strong cash flow generation are better positioned to make strategic CapEx investments that can drive growth and profitability. CapEx investments can increase a company’s production capacity, improve its efficiency, or expand its product offerings. This can lead to increased sales, improved margins, and ultimately higher returns for shareholders.

However, it is important to note that CapEx investments can also be risky. If a company invests in the wrong assets or if the market conditions change, the investment may not generate the expected returns. Therefore, companies must carefully evaluate their CapEx projects and ensure that they are aligned with their overall business strategy and financial goals.

Overall, capital expenditures are an important aspect of cash flow of investment. Companies that make strategic CapEx investments can improve their long-term growth prospects and profitability. However, it is important to carefully evaluate CapEx projects and ensure that they are aligned with the company’s overall business strategy and financial goals.

Real-life Example:

Amazon.com Inc. is a company that has consistently invested heavily in CapEx. The company has used its cash flow to build new warehouses, data centers, and fulfillment centers. These investments have helped Amazon to grow its e-commerce business and become one of the most valuable companies in the world.

| Benefits of CapEx Investments | Risks of CapEx Investments | |

|---|---|---|

| Increased Production Capacity | CapEx investments can increase a company’s production capacity, which can lead to increased sales and profits. | If demand for a company’s products or services decreases, the company may be left with excess production capacity. |

| Improved Efficiency | CapEx investments can improve a company’s efficiency, which can lead to reduced costs and improved profitability. | New equipment or technology may not perform as expected, or may require additional training or maintenance costs. |

| Expanded Product Offerings | CapEx investments can allow a company to expand its product offerings, which can attract new customers and increase sales. | New products or services may not be successful, or may cannibalize existing products or services. |

Financial Strength

Positive cash flow is a key indicator of a company’s financial strength and stability. A company with positive cash flow is able to generate enough cash from its operations to meet its financial obligations, such as paying its bills, investing in growth initiatives, and repaying debt. This financial strength and stability provides a solid foundation for long-term growth and profitability.

Positive cash flow is an important component of cash flow of investment, as it provides the financial resources necessary to make strategic investments. Companies with strong cash flow generation are better positioned to invest in new products and services, expand into new markets, and acquire other companies. These investments can drive growth and profitability, which can lead to increased shareholder value.

Here are some real-life examples of how positive cash flow has contributed to the financial strength and stability of companies:

- Apple Inc.: Apple has consistently generated strong cash flow from its iPhone, iPad, and Mac products. This cash flow has allowed Apple to invest in new products and services, such as the Apple Watch and Apple Music. These investments have helped Apple to maintain its leadership position in the technology industry.

- Amazon.com Inc.: Amazon has also generated strong cash flow from its e-commerce business. This cash flow has allowed Amazon to invest in new warehouses, data centers, and fulfillment centers. These investments have helped Amazon to grow its market share and become one of the most valuable companies in the world.

- Berkshire Hathaway Inc.: Berkshire Hathaway is a conglomerate that owns a diverse range of businesses, including insurance, energy, and manufacturing. Berkshire Hathaway has consistently generated strong cash flow from its insurance operations. This cash flow has allowed Berkshire Hathaway to invest in a variety of businesses, including stocks, bonds, and real estate. These investments have helped Berkshire Hathaway to become one of the most successful companies in the world.

Understanding the connection between positive cash flow and financial strength is essential for investors. Investors should look for companies with strong cash flow generation when making investment decisions. These companies are more likely to be financially stable and have the resources to invest in growth initiatives. This can lead to increased shareholder value over the long term.

Table: The Connection between Positive Cash Flow and Financial Strength

| Positive Cash Flow | Financial Strength and Stability | |

|---|---|---|

| Definition | A company generates more cash than it spends | A company’s ability to meet its financial obligations and withstand economic downturns |

| Impact on Investment Decisions | Indicates a company’s ability to invest in growth initiatives and return cash to shareholders | Provides a solid foundation for long-term growth and profitability |

| Real-Life Examples | Apple Inc., Amazon.com Inc., Berkshire Hathaway Inc. | Companies with a history of strong cash flow generation |

Growth Potential

In the realm of cash flow of investment, growth potential is a crucial aspect that hinges on a company’s ability to generate strong cash flow. Companies with robust cash flow are better equipped to fuel growth initiatives and expansion plans, laying the groundwork for long-term success and shareholder value creation.

-

Investment in Research and Development (R&D):

Strong cash flow allows companies to invest in R&D, which is essential for developing new products, services, and technologies. These investments can drive innovation, enhance competitiveness, and create new revenue streams.

-

Expansion into New Markets:

Companies can leverage their cash flow to expand into new markets, both domestically and internationally. This expansion can increase the company’s customer base, diversify revenue streams, and reduce reliance on a single market.

-

Acquisitions and Mergers:

Strong cash flow provides companies with the financial flexibility to pursue acquisitions and mergers. These strategic moves can enhance market share, expand product offerings, and create synergies that drive growth.

-

Organic Growth:

Cash flow can be used to fund organic growth initiatives, such as increasing production capacity, enhancing operational efficiency, and improving customer service. These investments can lead to increased sales, improved margins, and overall business growth.

Understanding the connection between strong cash flow and growth potential is paramount for investors. Companies with the ability to generate and effectively utilize cash flow are more likely to achieve long-term growth and profitability. Therefore, investors should prioritize companies with strong cash flow generation when making investment decisions.

In conclusion, growth potential is inextricably linked to cash flow of investment. Companies with strong cash flow have the financial resources to invest in growth initiatives, expand into new markets, and pursue strategic acquisitions. By leveraging their cash flow effectively, these companies can drive long-term growth and create value for shareholders.

FAQs on Cash Flow of Investment

This section addresses frequently asked questions (FAQs) about cash flow of investment, providing concise and informative answers to enhance your understanding of this crucial concept.

Question 1: What is cash flow of investment?

Cash flow of investment refers to the flow of cash generated and used by a company for investment purposes. It includes cash inflows from investment activities, such as the sale of assets or issuance of debt, and cash outflows for capital expenditures, acquisitions, and research and development.

Question 2: Why is cash flow of investment important?

Cash flow of investment is important because it provides insights into a company’s financial health, growth potential, and ability to generate returns for investors. A company with strong cash flow of investment is better positioned to invest in growth initiatives, reduce debt, and enhance shareholder value.

Question 3: How can I analyze a company’s cash flow of investment?

To analyze a company’s cash flow of investment, review its cash flow statement, which provides a detailed breakdown of cash flows from operating, investing, and financing activities. Key metrics to consider include cash flow from operations, capital expenditures, and free cash flow.

Question 4: What are the key factors that affect cash flow of investment?

The key factors that affect cash flow of investment include the company’s profitability, investment strategy, debt financing, and overall economic conditions. Companies with high profitability, a balanced investment strategy, and low debt levels tend to have stronger cash flow of investment.

Question 5: How can I use cash flow of investment to make investment decisions?

Cash flow of investment can be used to identify undervalued companies with strong growth potential. Companies with consistently positive cash flow from operations and a history of investing in high-return projects are more likely to generate long-term value for investors.

Question 6: What are some common misconceptions about cash flow of investment?

A common misconception is that cash flow of investment is only important for large, publicly traded companies. However, cash flow of investment is equally important for small businesses and private companies as it provides insights into their financial health and ability to grow.

In summary, cash flow of investment is a crucial aspect of financial analysis that can provide valuable insights into a company’s financial performance and investment potential. By understanding the key factors that affect cash flow of investment and how to analyze it, investors can make informed investment decisions and maximize their returns.

Transition to the next article section:

This concludes our FAQs on cash flow of investment. For further exploration, we recommend delving into our comprehensive articles on cash flow analysis, investment strategies, and dividend policies.

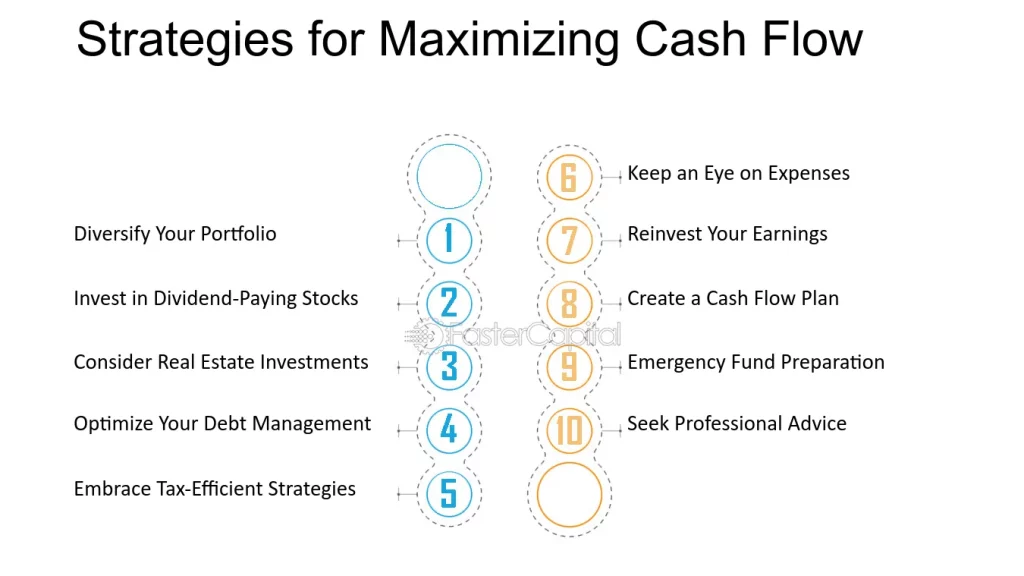

Tips on Cash Flow of Investment

Cash flow of investment is a crucial aspect of financial analysis and investment decision-making. By understanding the key factors that affect cash flow and how to analyze it, investors can make informed decisions and maximize returns.

Tip 1: Analyze the Cash Flow Statement

The cash flow statement provides a detailed breakdown of cash flows from operating, investing, and financing activities. Key metrics to consider include cash flow from operations, capital expenditures, and free cash flow.

Tip 2: Assess Cash Flow Generation

Evaluate a company’s ability to generate cash internally through its operations. Strong cash flow generation indicates financial strength and stability, reducing reliance on external financing.

Tip 3: Consider Capital Expenditures

Capital expenditures represent investments in long-term assets. Analyze how these investments align with the company’s growth strategy and potential return on investment.

Tip 4: Evaluate Dividend Policies

Dividend payments can impact a company’s cash flow and financial flexibility. Understand the company’s dividend policy and its implications for future cash flow.

Tip 5: Monitor Debt Repayment

Debt repayment affects cash flow and financial leverage. Analyze a company’s debt structure, interest coverage ratio, and plans for debt repayment.

Tip 6: Identify Growth Potential

Strong cash flow can support growth initiatives and expansion plans. Assess the company’s investment strategy and its potential to generate long-term growth and profitability.

Tip 7: Compare to Industry Benchmarks

Benchmark the company’s cash flow metrics against industry peers to identify strengths, weaknesses, and areas for improvement.

Tip 8: Seek Professional Advice

Consider consulting with a financial advisor or investment professional for personalized guidance on cash flow of investment analysis and investment strategies.

By incorporating these tips into your investment analysis, you can gain valuable insights into a company’s financial health, growth potential, and investment opportunities.

Summary of Key Takeaways

- Analyze the cash flow statement for insights into cash inflows and outflows.

- Assess a company’s ability to generate cash internally through its operations.

- Evaluate capital expenditures, dividend policies, and debt repayment plans.

- Identify growth potential supported by strong cash flow.

- Compare to industry benchmarks to identify areas for improvement.

- Seek professional advice for personalized guidance on cash flow analysis and investment strategies.

Understanding cash flow of investment is essential for making informed investment decisions that align with your financial goals and risk tolerance.

Conclusion

Cash flow of investment is a fundamental aspect of financial analysis and investment decision-making. By analyzing a company’s cash flow statement and considering key factors such as cash flow generation, capital expenditures, and debt repayment, investors can gain valuable insights into a company’s financial health, growth potential, and investment opportunities.

Companies with strong cash flow of investment are better positioned to invest in growth initiatives, reduce debt, and enhance shareholder value. Understanding cash flow of investment empowers investors to make informed decisions and maximize returns. It is an essential component of financial literacy and a cornerstone of successful investment strategies.

Youtube Video: