What is business financing? Business financing is the process of obtaining funds to start or operate a business. It can come from a variety of sources, including banks, investors, and government programs.

Editor’s Note: This article on business financing was published on [Date].

Our team of experts has analyzed and compared various business financing options to provide you with this comprehensive guide. This guide will help you understand the different types of financing available, the pros and cons of each, and how to choose the right option for your business.

Key Differences:

| Type of Financing | Pros | Cons |

|---|---|---|

| Debt Financing | – Lower interest rates than equity financing- Tax-deductible interest payments | – Requires collateral- Can be difficult to qualify for |

| Equity Financing | – No monthly payments- No risk of default | – Gives up ownership of the business- Can be difficult to find investors |

| Government Financing | – Low interest rates- Long repayment terms | – Can be difficult to qualify for- May have restrictions on how the funds can be used |

Main Article Topics:

- The Different Types of Business Financing

- The Pros and Cons of Each Type of Financing

- How to Choose the Right Financing Option for Your Business

- Tips for Getting Approved for Business Financing

Business Financing

Business financing is essential for any business, regardless of its size or industry. It can provide the funds needed to start a business, expand operations, or purchase new equipment. There are many different types of business financing available, each with its own advantages and disadvantages. It is important to understand the different options available in order to choose the right one for your business.

- Sources: Banks, investors, government programs

- Types: Debt financing, equity financing, government financing

- Advantages: Lower interest rates, tax-deductible interest payments, no monthly payments

- Disadvantages: Requires collateral, can be difficult to qualify for, gives up ownership of the business

- Considerations: Business plan, financial statements, credit score

- Alternatives: Crowdfunding, factoring, merchant cash advances

- Importance: Funds business operations, growth, and expansion

- Risks: Default, loss of ownership, personal liability

These are just a few of the key aspects of business financing. By understanding these aspects, you can make informed decisions about how to finance your business and achieve your business goals.

Sources

Business financing can come from a variety of sources, including banks, investors, and government programs. Each source has its own advantages and disadvantages, so it is important to understand the different options available before making a decision.

-

Banks

Banks are a traditional source of business financing. They offer a variety of loan products, including term loans, lines of credit, and equipment loans. Banks typically require collateral, such as real estate or inventory, and they may also require a personal guarantee from the business owner. The interest rates on bank loans can vary depending on the creditworthiness of the borrower. Although they can be a more expensive option, banks also offer some of the most flexible financing options.

-

Investors

Investors can provide financing to businesses in exchange for an equity stake in the company. This means that investors will share in the profits and losses of the business. There are many different types of investors, including angel investors, venture capitalists, and private equity firms. The terms of investment will vary depending on the type of investor and the stage of the business.

-

Government Programs

Government programs can provide financing to businesses that meet certain criteria. These programs typically offer low interest rates and long repayment terms. However, they can be difficult to qualify for and may have restrictions on how the funds can be used.

The choice of financing source will depend on the specific needs of the business. It is important to carefully consider the pros and cons of each option before making a decision.

Types

Debt financing, equity financing, and government financing are the three main types of business financing. Each type has its own advantages and disadvantages, and the best option for a particular business will depend on its specific needs.

Debt financing involves borrowing money from a bank or other lender. The loan must be repaid with interest over a period of time. Debt financing is a good option for businesses that have a strong credit history and can afford to make regular payments.

Equity financing involves selling a stake in the business to investors. In exchange for their investment, investors receive a share of the profits and losses of the business. Equity financing is a good option for businesses that need a large amount of funding and are willing to give up some ownership of the business.

Government financing involves obtaining funds from government programs. Government financing is typically available to businesses that meet certain criteria, such as being located in a low-income area or being engaged in a particular industry. Government financing is a good option for businesses that have difficulty obtaining financing from banks or investors.

The choice of financing type will depend on the specific needs of the business. It is important to carefully consider the pros and cons of each option before making a decision.

Table: Comparison of Business Financing Types

| Type of Financing | Advantages | Disadvantages |

|---|---|---|

| Debt Financing | – Lower interest rates than equity financing- Tax-deductible interest payments | – Requires collateral- Can be difficult to qualify for |

| Equity Financing | – No monthly payments- No risk of default | – Gives up ownership of the business- Can be difficult to find investors |

| Government Financing | – Low interest rates- Long repayment terms | – Can be difficult to qualify for- May have restrictions on how the funds can be used |

Advantages

When it comes to business financing, there are a number of advantages to consider, including lower interest rates, tax-deductible interest payments, and no monthly payments. These advantages can make business financing a valuable tool for businesses of all sizes.

-

Lower interest rates

Business loans typically have lower interest rates than personal loans. This is because businesses are considered to be less risky borrowers than individuals. As a result, businesses can save money on interest payments over the life of the loan.

-

Tax-deductible interest payments

Interest payments on business loans are tax-deductible, which can save businesses money on their taxes. This is a significant advantage, as it can reduce the overall cost of borrowing.

-

No monthly payments

Some types of business financing, such as lines of credit, do not require monthly payments. This can give businesses more flexibility in managing their cash flow.

These are just a few of the advantages of business financing. By understanding these advantages, businesses can make informed decisions about how to finance their operations and achieve their business goals.

Disadvantages

Business financing can be a valuable tool for businesses of all sizes, but it is important to be aware of the potential disadvantages. These disadvantages include the need for collateral, the difficulty in qualifying for financing, and the potential loss of ownership in the business.

-

Collateral

Collateral is an asset that a borrower pledges to a lender as security for a loan. If the borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Collateral can take many forms, such as real estate, inventory, or equipment. The need for collateral can make it difficult for businesses to obtain financing, especially if they do not have sufficient assets to pledge.

-

Qualifying for financing

Lenders typically have strict criteria for approving business loans. These criteria may include the business’s credit history, financial statements, and business plan. Businesses that do not meet the lender’s criteria may be denied financing or may only be offered financing at high interest rates.

-

Loss of ownership

Equity financing involves selling a stake in the business to investors. In exchange for their investment, investors receive a share of the profits and losses of the business. This means that the business owner gives up some control over the business and may have to share profits with the investors.

These are just a few of the disadvantages of business financing. It is important to carefully consider these disadvantages before making a decision about whether or not to pursue financing.

Considerations

When applying for business financing, lenders will consider a number of factors, including the business plan, financial statements, and credit score. These factors can have a significant impact on the amount of financing that a business is approved for, as well as the interest rate and terms of the loan.

-

Business plan

The business plan is a roadmap for the business. It outlines the business’s goals, strategies, and financial projections. A well-written business plan can demonstrate to lenders that the business is viable and has the potential to succeed. It can also help lenders to understand how the business will use the financing.

-

Financial statements

Financial statements provide a snapshot of the business’s financial health. They include the balance sheet, income statement, and cash flow statement. Lenders will use these statements to assess the business’s profitability, solvency, and liquidity. Strong financial statements can increase the likelihood of getting approved for financing and can also lead to lower interest rates.

-

Credit score

The credit score is a measure of the business’s creditworthiness. It is based on factors such as the business’s payment history, debt-to-income ratio, and length of credit history. A high credit score can indicate to lenders that the business is a low risk and can help to secure financing at favorable terms.

These are just a few of the factors that lenders will consider when evaluating a business loan application. By understanding these factors, businesses can improve their chances of getting approved for financing and securing the best possible terms.

Alternatives

Introduction

In addition to traditional business financing options such as bank loans and equity financing, there are a number of alternative financing options available to businesses. These alternatives can provide businesses with access to capital that may not be available through traditional channels.

-

Crowdfunding

Crowdfunding is a way for businesses to raise capital from a large number of individuals. This is typically done through online platforms that allow businesses to post their funding needs and attract investors. Crowdfunding can be a good option for businesses that are looking to raise small amounts of capital or that do not qualify for traditional financing.

-

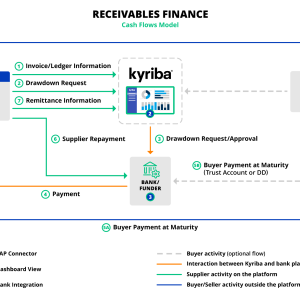

Factoring

Factoring is a way for businesses to sell their accounts receivable to a factoring company. This can provide businesses with immediate access to cash that they would otherwise have to wait for their customers to pay. Factoring can be a good option for businesses that have a large number of accounts receivable and that need to improve their cash flow.

-

Merchant cash advances

Merchant cash advances are a type of short-term financing that is available to businesses that accept credit cards. With a merchant cash advance, the business receives a lump sum of cash in exchange for a percentage of their future credit card sales. Merchant cash advances can be a good option for businesses that need to cover unexpected expenses or that are experiencing seasonal fluctuations in their cash flow.

Conclusion

These are just a few of the alternative financing options available to businesses. By understanding these alternatives, businesses can access the capital they need to grow and succeed.

Importance

Business financing plays a pivotal role in ensuring the smooth functioning, growth, and expansion of businesses. It provides the necessary capital to support various aspects of a business’s operations, enabling it to seize opportunities and achieve its goals.

-

Funding Day-to-Day Operations

Business financing helps cover essential expenses such as rent, utilities, salaries, and inventory. Without adequate financing, businesses may struggle to maintain their daily operations, leading to disruptions and potential closures.

-

Facilitating Growth and Expansion

Expansion often requires significant investments in new equipment, facilities, or markets. Business financing provides the capital needed to undertake these growth initiatives, allowing businesses to increase their production capacity, expand their customer base, and enter new markets.

-

Supporting Research and Development

Innovation and technological advancements are crucial for businesses to stay competitive. Business financing can fund research and development activities, enabling businesses to develop new products or processes that enhance their offerings and drive growth.

-

Managing Cash Flow

Businesses often experience fluctuations in cash flow. Business financing can provide a buffer during lean periods, ensuring that businesses can meet their obligations and avoid financial distress.

In conclusion, business financing is vital for businesses to maintain their operations, pursue growth opportunities, and adapt to changing circumstances. By providing access to capital, financing empowers businesses to invest in their future, create jobs, and contribute to the overall economy.

Risks

Business financing, while beneficial, carries inherent risks that entrepreneurs and business owners must carefully consider. These risks include the potential for default, loss of ownership, and personal liability.

Default occurs when a business is unable to repay its loan or meet its financial obligations. This can have severe consequences, including damage to the business’s credit rating, legal action from creditors, and even bankruptcy. The risk of default is particularly high for businesses that are heavily leveraged or that operate in volatile markets.

Loss of ownership is another potential risk of business financing. This can occur if a business takes on equity financing, which involves selling a portion of the business to investors. In exchange for their investment, investors receive a share of the business’s profits and losses, and they may also have a say in the business’s operations. This can lead to a loss of control for the original business owners.

Personal liability is a risk for business owners who have personally guaranteed their business’s loans. This means that if the business defaults on its loan, the creditors can pursue the business owner’s personal assets to satisfy the debt. This can put the business owner’s home, car, and other personal belongings at risk.

Understanding the risks of business financing is essential for entrepreneurs and business owners. By carefully considering these risks and taking steps to mitigate them, business owners can increase their chances of success and protect their personal assets.

Table: Risks of Business Financing

| Risk | Description | Potential Consequences |

|---|---|---|

| Default | Inability to repay loan or meet financial obligations | Damage to credit rating, legal action, bankruptcy |

| Loss of ownership | Selling a portion of the business to investors in exchange for financing | Reduced control for original business owners |

| Personal liability | Business owners personally guaranteeing business loans | Creditors can pursue personal assets to satisfy debt |

Business Financing FAQs

This section addresses frequently asked questions (FAQs) about business financing, providing clear and concise answers to common concerns and misconceptions.

Question 1: What are the different types of business financing available?

Answer: There are several types of business financing, including debt financing (loans), equity financing (selling a portion of the business to investors), and government financing (loans or grants from government agencies).

Question 2: What are the advantages of business financing?

Answer: Business financing can provide access to capital for starting or expanding a business, improve cash flow, and fund research and development.

Question 3: What are the risks of business financing?

Answer: Business financing can involve risks such as default (inability to repay the loan), loss of ownership (selling a portion of the business to investors), and personal liability (for business owners who personally guarantee the loan).

Question 4: How do I apply for business financing?

Answer: The application process for business financing typically involves submitting a business plan, financial statements, and other supporting documents to a lender or investor.

Question 5: What are the factors that lenders consider when evaluating a business loan application?

Answer: Lenders typically consider factors such as the business’s creditworthiness, financial history, and repayment capacity when evaluating a loan application.

Question 6: Are there alternative financing options available for businesses that do not qualify for traditional loans?

Answer: Yes, there are alternative financing options such as crowdfunding, factoring, and merchant cash advances that may be available to businesses that do not qualify for traditional loans.

Summary: Business financing can be a valuable tool for businesses, but it is important to understand the different types of financing available, the advantages and risks involved, and the application process. By carefully considering these factors, businesses can make informed decisions about financing their operations and achieving their goals.

Transition: For more in-depth information on business financing, please refer to our comprehensive guide on the topic.

Business Financing Tips

Business financing can be a valuable tool for businesses of all sizes, but it is important to approach the process strategically. Here are some tips to help you secure the best possible financing for your business:

Tip 1: Understand your financing needs

Before you start applying for financing, it is important to understand your business’s financing needs. This includes determining how much financing you need, what type of financing is best for your business, and what terms are acceptable to you.

Tip 2: Prepare a strong business plan

A well-written business plan is essential for securing business financing. Your business plan should outline your business’s goals, strategies, and financial projections. It should also demonstrate that you have a clear understanding of your market and that you have a solid plan for repaying your loan.

Tip 3: Shop around for the best interest rates and terms

Don’t just accept the first loan offer you receive. Take the time to shop around and compare interest rates and terms from multiple lenders. This will help you secure the best possible deal for your business.

Tip 4: Be prepared to provide collateral

Many lenders require collateral in order to approve a business loan. Collateral can include assets such as real estate, inventory, or equipment. Having collateral can help you secure a lower interest rate and better loan terms.

Tip 5: Be honest and transparent with lenders

When applying for business financing, it is important to be honest and transparent with lenders. This means providing accurate financial information and disclosing any potential risks to your business. Lenders are more likely to approve loans to businesses that they trust.

Summary: By following these tips, you can increase your chances of securing the best possible financing for your business. Remember to understand your financing needs, prepare a strong business plan, shop around for the best interest rates and terms, be prepared to provide collateral, and be honest and transparent with lenders.

Transition: For more in-depth information on business financing, please refer to our comprehensive guide on the topic.

Conclusion

Business financing is a critical aspect of starting and growing a successful business. By providing access to capital, financing enables entrepreneurs and business owners to invest in their operations, pursue growth opportunities, and adapt to changing circumstances.

Understanding the different types of financing available, the advantages and risks involved, and the application process is essential for making informed financing decisions. By carefully considering these factors, businesses can secure the financing they need to achieve their goals and contribute to the overall economy.

Youtube Video: