Wondering what you can do with a bachelor’s degree in finance?

Editor’s Note: Bachelor’s degree in finance guide has published on [Date].

After some analysis and digging, we put together this bachelor’s degree in finance guide to help you make the right decision.

Key differences or Key takeaways:

Transition to main article topics:

Bachelor’s Degree in Finance

A bachelor’s degree in finance provides a strong foundation in the principles of finance, preparing graduates for careers in various financial sectors. Key aspects of a bachelor’s degree in finance include:

- Financial Theory: Explores the theoretical underpinnings of finance, including asset pricing, portfolio management, and risk management.

- Financial Markets: Examines the structure and operation of financial markets, such as stock markets, bond markets, and foreign exchange markets.

- Corporate Finance: Focuses on the financial management of corporations, including capital budgeting, dividend policy, and mergers and acquisitions.

- Investments: Covers the principles of investing, including asset allocation, security analysis, and portfolio optimization.

- Financial Institutions: Analyzes the role and functions of financial institutions, such as banks, insurance companies, and investment banks.

- Financial Technology (FinTech): Explores the impact of technology on the financial industry, including digital payments, blockchain, and artificial intelligence.

- Ethics and Regulation: Examines the ethical and regulatory considerations in finance, including insider trading, market manipulation, and anti-money laundering regulations.

These key aspects provide a comprehensive understanding of the field of finance, preparing graduates for successful careers in financial analysis, investment management, corporate finance, and other related areas.

Financial Theory

Financial theory provides the foundation for understanding the complex world of finance. It explores the theoretical underpinnings of finance, including asset pricing, portfolio management, and risk management. This knowledge is essential for students pursuing a bachelor’s degree in finance as it equips them with the analytical tools and frameworks to make informed decisions in the financial markets.

- Asset Pricing: Asset pricing models help determine the value of financial assets, such as stocks, bonds, and derivatives. By understanding asset pricing theory, finance graduates can make informed investment decisions and develop effective investment strategies.

- Portfolio Management: Portfolio management involves selecting and managing a group of financial assets to meet specific investment objectives. Financial theory provides the principles and techniques for constructing and managing diversified portfolios that optimize risk and return.

- Risk Management: Risk management is crucial in finance as it helps identify, assess, and mitigate financial risks. Financial theory provides the tools and frameworks for measuring and managing financial risk, ensuring the stability and resilience of financial institutions and investments.

In conclusion, financial theory is an integral part of a bachelor’s degree in finance. It provides the theoretical foundation for understanding financial markets, making investment decisions, and managing financial risks. By mastering financial theory, graduates are well-equipped to navigate the complex and dynamic world of finance.

Financial Markets

Financial markets play a crucial role in the global economy, facilitating the flow of funds between investors and businesses. Understanding the structure and operation of these markets is essential for students pursuing a bachelor’s degree in finance.

Financial markets provide a platform for companies to raise capital through the issuance of stocks and bonds. Investors can participate in these markets by purchasing these securities, thereby providing funding for businesses and earning returns on their investments.

A bachelor’s degree in finance equips students with the knowledge and skills to analyze and navigate financial markets effectively. Graduates gain an understanding of:

- The different types of financial markets, including equity markets, fixed income markets, and foreign exchange markets

- The participants in these markets, such as institutional investors, individual investors, and market makers

- The factors that influence market prices, such as economic conditions, company performance, and investor sentiment

- The regulations and ethical considerations governing financial markets

This knowledge is essential for careers in investment management, financial analysis, and other areas of finance. By understanding financial markets, graduates can make informed investment decisions, manage financial risks, and contribute to the efficient functioning of the financial system.

Corporate Finance

Corporate finance is a crucial component of a bachelor’s degree in finance, providing students with the knowledge and skills to manage the financial resources of corporations. It involves making strategic decisions that impact a company’s profitability, growth, and overall financial health.

Capital budgeting involves evaluating and selecting long-term investment projects that align with a company’s strategic objectives. Dividend policy determines how much of a company’s earnings will be distributed to shareholders as dividends and how much will be retained for reinvestment.

Mergers and acquisitions (M&A) are complex financial transactions that involve the combination or acquisition of two or more companies. Understanding the principles of M&A is essential for finance professionals who may be involved in advising companies on these transactions.

Real-life examples of corporate finance in action include:

- Capital budgeting: A company evaluating a new product line that requires a significant investment in machinery and equipment.

- Dividend policy: A company deciding whether to increase its dividend payout ratio to shareholders or retain more earnings for future growth.

- Mergers and acquisitions: A large corporation acquiring a smaller company to expand its market share or enter a new industry.

By understanding corporate finance, graduates with a bachelor’s degree in finance can make informed decisions that maximize a company’s financial performance and value for its stakeholders.

Key Insights:

- Corporate finance is essential for managing the financial resources of corporations.

- Capital budgeting, dividend policy, and mergers and acquisitions are key areas of corporate finance.

- A bachelor’s degree in finance provides students with the knowledge and skills to make informed corporate finance decisions.

Investments

Investments play a central role in a bachelor’s degree in finance, providing students with the knowledge and skills to make informed investment decisions in various financial markets. It encompasses the principles of asset allocation, security analysis, and portfolio optimization, which are essential for managing investment portfolios and achieving financial goals.

Asset allocation involves dividing an investment portfolio into different asset classes, such as stocks, bonds, and real estate, based on an investor’s risk tolerance and financial objectives. Security analysis focuses on evaluating the financial health and prospects of individual companies or securities, helping investors identify potential investment opportunities.

Portfolio optimization aims to construct a portfolio that balances risk and return, meeting the specific needs of an investor. This involves using quantitative techniques to select and weight different assets in a portfolio, considering factors such as correlation and diversification.

Understanding investments is crucial for finance professionals as it enables them to:

- Manage their own investment portfolios or provide investment advice to clients.

- Evaluate and select investment opportunities that align with financial goals.

- Make informed decisions about asset allocation, security selection, and portfolio optimization.

Real-life examples of investments in action include:

- An individual investor creating a diversified portfolio of stocks, bonds, and real estate investment trusts (REITs) to meet their retirement goals.

- A financial advisor recommending a growth-oriented portfolio of technology stocks to a client with a high-risk tolerance.

- A pension fund manager optimizing a portfolio to minimize risk and generate stable returns for its beneficiaries.

By mastering the principles of investments, graduates with a bachelor’s degree in finance can make informed investment decisions, manage financial risk, and help individuals and organizations achieve their financial objectives.

Key Insights:

- Investments are a core component of a bachelor’s degree in finance.

- Asset allocation, security analysis, and portfolio optimization are fundamental principles of investing.

- Understanding investments enables finance professionals to make informed investment decisions and manage financial risk.

Financial Institutions

The study of financial institutions is an integral part of a bachelor’s degree in finance. Financial institutions play a critical role in the financial system, facilitating the flow of funds between savers and borrowers, providing financial services, and managing financial risk.

Understanding the role and functions of financial institutions is essential for finance professionals as it enables them to:

- Comprehend the structure and of the financial system.

- Analyze the financial performance and risk profiles of financial institutions.

- Make informed decisions about using financial services and products.

Real-life examples of financial institutions in action include:

- Banks: Accepting deposits, making loans, and providing other financial services to individuals and businesses.

- Insurance companies: Providing protection against financial losses due to events such as accidents, illness, or property damage.

- Investment banks: Assisting companies in raising capital through the issuance of stocks and bonds, and advising on mergers and acquisitions.

By understanding financial institutions, graduates with a bachelor’s degree in finance can make informed decisions about managing their finances, accessing financial services, and evaluating the financial health of companies and the overall financial system.

Key Insights:

- Financial institutions play a vital role in the financial system.

- Understanding financial institutions is essential for finance professionals.

- A bachelor’s degree in finance provides students with the knowledge and skills to analyze and evaluate financial institutions.

Financial Technology (FinTech)

The rapid advancement of technology has significantly impacted the financial industry, giving rise to the field of Financial Technology (FinTech). FinTech encompasses the use of technology to enhance and automate financial services, including digital payments, blockchain, and artificial intelligence (AI).

For students pursuing a bachelor’s degree in finance, understanding FinTech is crucial as it has become an integral part of the financial landscape. FinTech has revolutionized the way financial transactions are conducted, making them faster, more convenient, and more accessible.

Digital payments, such as mobile wallets and online banking, have transformed the way people make payments and manage their finances. Blockchain technology, with its decentralized and secure nature, has opened up new possibilities for digital currencies and enhanced the security of financial transactions.

AI is playing a significant role in financial institutions by automating tasks, providing personalized financial advice, and detecting fraud. Understanding these FinTech applications enables finance graduates to adapt to the evolving financial industry and stay competitive in the job market.

Real-life examples of FinTech in action include:

- Mobile payment platforms like Apple Pay and Google Pay allow users to make contactless payments using their smartphones.

- Blockchain technology is used in cryptocurrencies such as Bitcoin and Ethereum, providing a secure and transparent medium of exchange.

- AI-powered chatbots assist customers with financial queries and provide personalized financial recommendations.

By incorporating FinTech into the curriculum of a bachelor’s degree in finance, students gain the knowledge and skills to navigate the rapidly changing financial landscape. They become equipped to work in FinTech companies, traditional financial institutions, and other industries where FinTech is transforming the way business is conducted.

Key Insights:

- FinTech is an essential component of a bachelor’s degree in finance.

- Digital payments, blockchain, and AI are key areas of FinTech that are revolutionizing the financial industry.

- Understanding FinTech provides finance graduates with a competitive edge in the job market.

Ethics and Regulation

In the realm of finance, ethical and regulatory considerations play a crucial role in maintaining the integrity and stability of financial markets. A bachelor’s degree in finance places significant emphasis on these aspects, equipping graduates with a deep understanding of the ethical and legal frameworks that govern financial transactions.

Understanding ethics and regulations in finance is paramount for several reasons. Firstly, it ensures that financial professionals conduct their activities with integrity and fairness. Ethical behavior, such as avoiding insider trading and market manipulation, fosters trust in the financial system and protects investors from fraudulent practices.

Secondly, compliance with regulatory frameworks is essential for financial institutions to operate legally and avoid penalties. Regulations, such as anti-money laundering laws, help prevent financial crimes and maintain the stability of the financial system. Graduates with a solid understanding of these regulations can effectively manage compliance risks and ensure their organizations adhere to legal requirements.

Furthermore, knowledge of ethics and regulations enables finance professionals to make informed decisions that align with both their ethical values and legal obligations. They can navigate complex financial situations with confidence, knowing that their actions are compliant and ethically sound.

In conclusion, the study of ethics and regulation in finance is an indispensable component of a bachelor’s degree in finance. It provides graduates with the knowledge and skills to operate ethically, comply with regulatory requirements, and contribute to the integrity of the financial system. Understanding these aspects is crucial for the success and reputation of finance professionals in today’s rapidly evolving financial landscape.

FAQs on Bachelor’s Degree in Finance

A bachelor’s degree in finance provides a solid foundation for a successful career in the financial industry. Here are some frequently asked questions and answers to help you understand the program better:

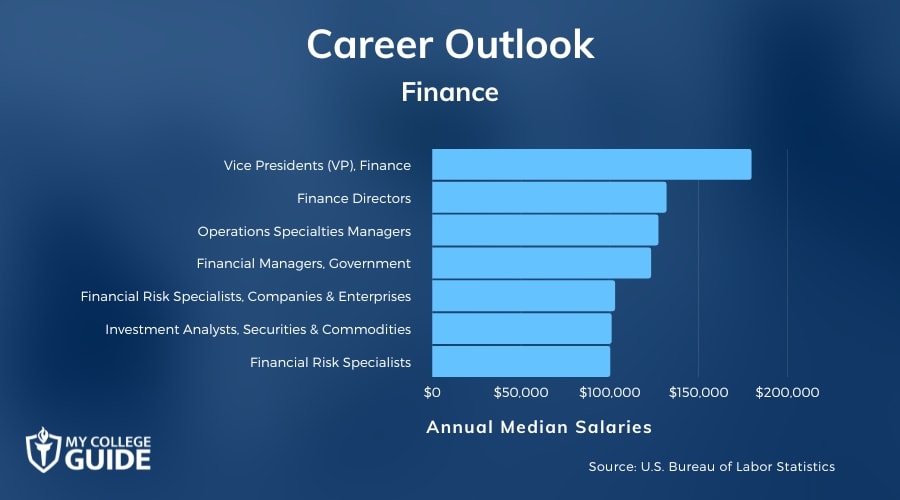

Question 1: What career opportunities are available with a bachelor’s degree in finance?

Graduates with a bachelor’s degree in finance are qualified for various roles in the financial sector, including financial analysts, investment bankers, portfolio managers, and financial advisors. They can also pursue careers in corporate finance, risk management, and financial planning.

Question 2: What are the core courses typically included in a finance degree program?

The core coursework in a finance degree program typically covers topics such as financial theory, financial markets, corporate finance, investments, financial institutions, and financial modeling. Students also learn about ethics, regulations, and the global financial system.

Question 3: What skills will I develop by earning a bachelor’s degree in finance?

Earning a bachelor’s degree in finance will equip you with analytical, problem-solving, communication, and decision-making skills. You will also gain proficiency in financial modeling, data analysis, and risk assessment techniques.

Question 4: Is a bachelor’s degree in finance right for me?

A bachelor’s degree in finance is a good fit for individuals interested in pursuing a career in the financial industry. It is also a suitable choice for those who want to develop a strong foundation in financial principles and quantitative methods.

Question 5: What are the earning prospects for finance graduates?

Finance graduates have strong earning potential. According to the U.S. Bureau of Labor Statistics, financial analysts earn a median annual salary of $83,660, while investment bankers earn a median annual salary of $101,700.

Question 6: What are the job growth prospects for finance graduates?

The job outlook for finance graduates is positive. The U.S. Bureau of Labor Statistics projects that employment in financial analyst roles is expected to grow by 6% from 2020 to 2030, while employment in investment banking roles is expected to grow by 5% during the same period.

Summary: A bachelor’s degree in finance provides a comprehensive education in the principles and practices of finance, preparing graduates for successful careers in the financial industry. With a strong foundation in financial theory, analytical skills, and ethical decision-making, finance graduates are well-equipped to navigate the ever-changing financial landscape.

Transition: To learn more about the specific courses and faculty involved in our finance program, visit our website or contact the department directly.

Tips for Pursuing a Bachelor’s Degree in Finance

Earning a bachelor’s degree in finance is an excellent foundation for a successful career in the financial industry. Here are some tips to help you make the most of your educational journey:

Tip 1: Develop a Strong Foundation in Mathematics

Mathematics is the language of finance. You will need a strong foundation in mathematics, including algebra, calculus, and statistics, to succeed in finance courses and excel in the field.

Tip 2: Build Analytical and Problem-Solving Skills

Finance professionals are required to analyze data, identify trends, and solve complex problems. Develop your analytical and problem-solving skills through coursework, internships, and extracurricular activities.

Tip 3: Enhance Communication and Presentation Skills

Effective communication and presentation skills are essential for success in finance. Practice communicating your ideas clearly and persuasively in written and oral form. Participate in presentations, case competitions, and networking events.

Tip 4: Gain Practical Experience through Internships

Internships provide invaluable hands-on experience and allow you to apply your knowledge in a real-world setting. Seek out internships in areas of finance that interest you, such as investment banking, financial analysis, or corporate finance.

Tip 5: Network with Professionals and Attend Industry Events

Networking is crucial in the finance industry. Attend industry events, join professional organizations, and connect with professionals on LinkedIn. Building a strong network can open doors to career opportunities and provide valuable insights.

Summary: Pursuing a bachelor’s degree in finance requires dedication, hard work, and a commitment to continuous learning. By developing a strong foundation in mathematics, analytical skills, communication abilities, and practical experience, you can position yourself for success in the competitive world of finance.

Transition: To learn more about our finance program and how we can help you achieve your career goals, visit our website or contact our admissions office.

Conclusion

A bachelor’s degree in finance equips graduates with the knowledge, skills, and ethical grounding to navigate the complex and dynamic world of finance. It provides a comprehensive understanding of financial theory, markets, institutions, and regulations, preparing individuals for successful careers in various sectors of the financial industry.

The analytical, problem-solving, and communication skills developed through a finance degree program are highly valued in the job market. Graduates are well-positioned to make informed financial decisions, analyze financial data, and provide sound financial advice. The increasing demand for finance professionals in various industries underscores the significance of this degree in shaping the future of finance and the global economy.

Youtube Video: