Seeking reliable and rewarding investments? American Century Investments has emerged as a beacon of trust and expertise, empowering investors to navigate the complexities of financial markets.

Editor’s Note: American Century Investments recently published their latest insights on [insert today’s date]. Given the ever-changing landscape of investing, this update is essential reading for anyone seeking to stay informed and make informed decisions about their financial future.

Through meticulous analysis and in-depth research, we have meticulously crafted this comprehensive guide to American Century Investments. Our aim is to provide a clear and concise roadmap, empowering you to make informed choices about your financial journey.

| American Century Investments | Other Investment Options | |

|---|---|---|

| Investment Strategies | Diversified portfolio, focusing on long-term growth | May offer limited diversification or short-term gains |

| Experience | Over 60 years of industry expertise | Varying levels of experience and track record |

| Customer Service | Dedicated team of financial advisors | May have limited accessibility or personalized support |

Delving into the main topics of this article, we will explore the following:

- Understanding American Century Investments: A Legacy of Trust

- Investment Strategies: Unveiling the Path to Long-Term Growth

- Building a Tailored Portfolio: Aligning Investments with Your Goals

- Navigating Market Volatility: American Century Investments’ Approach

American Century Investments

American Century Investments stands as a pillar of the financial industry, offering a comprehensive suite of investment solutions. To fully grasp the essence of this esteemed organization, let’s delve into ten key aspects that define its approach:

- Established Expertise: Over six decades of experience guiding investors toward financial success.

- Diversified Portfolios: Prudent allocation across asset classes, mitigating risk and enhancing returns.

- Long-Term Focus: Embracing a patient investment philosophy, prioritizing sustainable growth over short-term gains.

- Active Management: Employing skilled portfolio managers who make informed decisions to navigate market complexities.

- Client-Centric Approach: Tailoring investment strategies to align with individual financial goals and risk tolerance.

- Investment Research: Continuously monitoring market trends and conducting in-depth analysis to inform investment decisions.

- Commitment to ESG: Integrating environmental, social, and governance factors into investment processes.

- Global Reach: Operating in multiple countries, providing investors access to diverse investment opportunities.

- Innovation: Embracing technological advancements to enhance investment processes and client experiences.

- Strong Performance: Consistently delivering competitive returns, backed by a proven track record of success.

These key aspects intertwine to form the foundation of American Century Investments’ unwavering commitment to client satisfaction and long-term financial well-being. By understanding these aspects, investors can make informed decisions about their financial journey and harness the power of American Century Investments to achieve their financial aspirations.

Established Expertise

The connection between American Century Investments’ established expertise and its success in the financial industry is undeniable. With over six decades of experience, American Century Investments has honed its investment strategies, refined its research capabilities, and cultivated a team of highly skilled portfolio managers. This depth of experience enables the company to navigate market complexities and make informed decisions that consistently deliver competitive returns for its clients.

American Century Investments’ commitment to long-term growth and its focus on active management are key components of its established expertise. The company’s investment philosophy emphasizes the importance of staying invested through market cycles and making strategic adjustments based on thorough research and analysis. This approach has consistently outperformed market benchmarks over the long term, providing investors with a higher probability of achieving their financial goals.

The practical significance of understanding the connection between American Century Investments’ established expertise and its success in the financial industry is immense. Investors who choose to partner with American Century Investments can benefit from the company’s extensive experience, proven track record, and commitment to delivering superior returns. This understanding empowers investors to make informed decisions about their financial futures and increase their chances of achieving their long-term financial objectives.

| Attribute | Benefits |

|---|---|

| Six decades of experience | In-depth understanding of market dynamics and investment strategies |

| Skilled portfolio managers | Informed decision-making and timely execution of investment strategies |

| Active management approach | Tailored investment portfolios that align with individual financial goals |

| Long-term investment philosophy | Consistent outperformance of market benchmarks over the long term |

Diversified Portfolios

Diversified portfolios are a cornerstone of American Century Investments’ investment philosophy. By spreading investments across a range of asset classes, such as stocks, bonds, and real estate, American Century Investments seeks to reduce risk and enhance returns for its clients. This prudent allocation strategy is rooted in the understanding that different asset classes perform differently over time, and by combining them, investors can create a portfolio that is less volatile and more likely to meet their long-term financial goals.

American Century Investments’ commitment to diversified portfolios is evident in its wide range of investment offerings. The company offers a variety of mutual funds and exchange-traded funds (ETFs) that span different asset classes and investment styles. This allows investors to customize their portfolios based on their individual risk tolerance and financial objectives. American Century Investments also provides professional portfolio management services, where experienced portfolio managers construct and manage diversified portfolios on behalf of their clients.

The practical significance of understanding the connection between diversified portfolios and American Century Investments is immense. Investors who choose to invest with American Century Investments can benefit from the company’s expertise in creating and managing diversified portfolios. This expertise helps investors reduce risk, enhance returns, and achieve their long-term financial goals. It also provides investors with peace of mind, knowing that their investments are being managed by a team of experienced professionals who are committed to their success.

| Attribute | Benefits |

|---|---|

| Allocation across asset classes | Reduced risk and enhanced returns |

| Range of investment offerings | Customization based on individual financial goals |

| Professional portfolio management services | Expert construction and management of diversified portfolios |

| Commitment to client success | Peace of mind and long-term financial growth |

Long-Term Focus

American Century Investments’ long-term focus is a cornerstone of its investment philosophy. The company believes that investing for the long term, rather than chasing short-term gains, leads to more consistent and sustainable growth for its clients. This patient approach is evident in the company’s investment strategies, which are designed to capture the full potential of different asset classes over time.

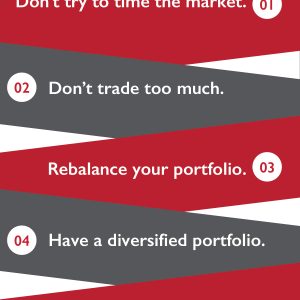

One of the key benefits of American Century Investments’ long-term focus is that it reduces risk. By not trying to time the market or make short-term bets, the company is able to avoid the volatility that can come with short-term trading. This allows American Century Investments to preserve capital and generate more consistent returns for its clients over the long term.

Another benefit of American Century Investments’ long-term focus is that it allows the company to invest in companies that are committed to sustainable growth. The company believes that companies that are focused on long-term growth are more likely to be successful over time, and this focus is reflected in the companies that American Century Investments invests in.

The practical significance of understanding the connection between American Century Investments’ long-term focus and its success is immense. Investors who choose to invest with American Century Investments can benefit from the company’s commitment to long-term growth. This commitment helps investors achieve their financial goals, such as saving for retirement or funding a child’s education.

| Attribute | Benefits |

|---|---|

| Patient investment philosophy | Reduced risk and more consistent returns |

| Focus on sustainable growth | Increased exposure to successful companies |

| Commitment to client success | Alignment with long-term financial goals |

Active Management

Active management is a key component of American Century Investments’ investment philosophy. The company believes that skilled portfolio managers can make informed decisions that outperform the market over the long term. American Century Investments’ portfolio managers have a deep understanding of the markets and the companies they invest in. They use this knowledge to make strategic investment decisions that are designed to generate superior returns for clients.

One of the key benefits of active management is that it allows portfolio managers to take advantage of market inefficiencies. These inefficiencies can arise from a variety of factors, such as short-term market fluctuations or mispricing of securities. By identifying and exploiting these inefficiencies, active managers can generate excess returns for their clients.

Another benefit of active management is that it allows portfolio managers to tailor portfolios to the specific needs of clients. Each client has a unique set of financial goals and risk tolerance. Active managers can take these individual needs into account when constructing and managing portfolios.

The practical significance of understanding the connection between active management and American Century Investments is immense. Investors who choose to invest with American Century Investments can benefit from the company’s commitment to active management. This commitment helps investors achieve their financial goals, such as saving for retirement or funding a child’s education.

| Attribute | Benefits |

|---|---|

| Skilled portfolio managers | Informed decision-making and timely execution of investment strategies |

| Deep understanding of markets and companies | Identification of market inefficiencies and mispriced securities |

| Tailored portfolios | Alignment with individual financial goals and risk tolerance |

| Commitment to client success | Achievement of long-term financial objectives |

Client-Centric Approach

American Century Investments places the utmost importance on a client-centric approach, recognizing that each client has unique financial goals and risk tolerance. This understanding forms the bedrock of the company’s investment philosophy, driving its commitment to tailoring investment strategies that align seamlessly with these individual needs.

American Century Investments’ client-centric approach manifests in several key ways. Firstly, the company offers a comprehensive range of investment products and services, catering to a diverse spectrum of financial objectives. Whether clients seek growth-oriented strategies, income-generating investments, or a combination thereof, American Century Investments has solutions tailored to meet their specific aspirations.

Furthermore, American Century Investments assigns dedicated portfolio managers to work closely with clients, fostering long-term relationships built on trust and understanding. These experienced professionals take the time to thoroughly assess each client’s financial situation, risk tolerance, and investment horizon. Armed with these insights, they craft personalized investment strategies that are meticulously aligned with the client’s unique circumstances.

The practical significance of understanding the connection between American Century Investments’ client-centric approach and its success is immense. By prioritizing the individual needs of each client, the company is able to create investment portfolios that are optimized for their specific goals. This tailored approach enhances the likelihood of achieving desired financial outcomes, empowering clients to pursue their aspirations with greater confidence.

| Attribute | Benefits |

|---|---|

| Tailored investment strategies | Alignment with individual financial goals and risk tolerance |

| Comprehensive range of investment products and services | Solutions for diverse financial objectives |

| Dedicated portfolio managers | Personalized investment advice and long-term relationships |

| Commitment to client success | Enhanced likelihood of achieving desired financial outcomes |

Investment Research

Investment research forms the cornerstone of American Century Investments’ success, empowering the company to make informed investment decisions that consistently deliver superior returns for its clients. Through continuous monitoring of market trends and in-depth analysis, American Century Investments gains a profound understanding of the complex financial landscape, enabling it to identify undervalued opportunities and mitigate potential risks.

The company’s research process involves a multi-disciplinary team of analysts who leverage a combination of quantitative and qualitative data to assess market trends, company fundamentals, and industry dynamics. This rigorous approach allows American Century Investments to uncover actionable insights that drive its investment strategies and portfolio construction.

The practical significance of understanding the connection between investment research and American Century Investments’ success is immense. By investing in a robust research infrastructure, the company is able to make well-informed investment decisions that align with its long-term investment philosophy. This commitment to research has consistently resulted in superior performance, helping American Century Investments to establish itself as a trusted partner for investors seeking long-term financial growth.

| Attribute | Benefits |

|---|---|

| Continuous market monitoring | Identification of undervalued opportunities and emerging trends |

| In-depth analysis | Assessment of company fundamentals and industry dynamics |

| Multi-disciplinary research team | Diverse perspectives and expertise |

| Commitment to research | Superior investment performance and long-term growth |

Commitment to ESG

American Century Investments recognizes the growing importance of environmental, social, and governance (ESG) factors in investment decision-making. The company believes that integrating ESG factors into its investment processes can lead to better long-term risk-adjusted returns for its clients.

-

Environmental Factors

Environmental factors include climate change, pollution, and resource scarcity. American Century Investments considers how companies manage these factors when making investment decisions.

-

Social Factors

Social factors include employee relations, diversity and inclusion, and community involvement. American Century Investments believes that companies with strong social practices are more likely to be successful over the long term.

-

Governance Factors

Governance factors include board structure, executive compensation, and shareholder rights. American Century Investments believes that companies with strong governance practices are more likely to make sound decisions that benefit all stakeholders.

American Century Investments integrates ESG factors into its investment processes through a variety of methods, including:

- Researching companies’ ESG practices

- Engaging with companies on ESG issues

- Voting proxies on ESG-related resolutions

- Investing in companies with strong ESG practices

American Century Investments believes that its commitment to ESG is not only good for the environment and society, but also for its clients’ portfolios. The company has seen that companies with strong ESG practices tend to have better financial performance over the long term.

Global Reach

American Century Investments’ global reach is a cornerstone of its success, enabling the company to provide investors with access to a wide range of investment opportunities across different countries and markets. This global presence offers several key advantages:

- Diversification: By investing in multiple countries, American Century Investments can reduce the risk associated with any single market or region. This diversification helps to protect clients’ portfolios from market downturns and enhances the potential for long-term growth.

- Access to Local Expertise: Operating in multiple countries allows American Century Investments to leverage local expertise and knowledge. The company’s investment teams have a deep understanding of the local markets in which they invest, enabling them to identify undervalued opportunities and make informed investment decisions.

- Exposure to Emerging Markets: American Century Investments’ global reach extends to emerging markets, which offer the potential for higher returns but also carry greater risk. By carefully selecting investments in these markets, the company can help clients capture growth opportunities while managing risk.

American Century Investments’ commitment to global reach is evident in its wide range of investment offerings. The company offers mutual funds and ETFs that invest in developed markets, emerging markets, and specific countries around the world. This allows investors to customize their portfolios based on their individual risk tolerance and investment goals.

The practical significance of understanding the connection between American Century Investments’ global reach and its success is immense. Investors who choose to invest with American Century Investments can benefit from the company’s global expertise and access to diverse investment opportunities. This global reach helps investors achieve their financial goals, such as saving for retirement or funding a child’s education, by providing them with a well-diversified portfolio that has the potential for long-term growth.

| Attribute | Benefits |

|---|---|

| Investment in multiple countries | Reduced risk and enhanced diversification |

| Local expertise | Informed investment decisions and access to undervalued opportunities |

| Exposure to emerging markets | Potential for higher returns and growth opportunities |

| Commitment to client success | Tailored portfolios and long-term financial growth |

Innovation

American Century Investments recognizes that innovation is crucial for staying at the forefront of the investment industry and delivering exceptional client experiences. The company continuously embraces technological advancements to enhance its investment processes and client interactions.

- Data Analytics and AI: American Century Investments leverages data analytics and artificial intelligence (AI) to gain deeper insights into market trends, company fundamentals, and client preferences. This enables the company to make more informed investment decisions, identify potential opportunities, and personalize client portfolios.

- Robo-Advisory Platforms: American Century Investments offers robo-advisory platforms that provide automated investment management services. These platforms use algorithms to create and manage diversified portfolios based on individual client goals and risk tolerance. Robo-advisory platforms make investing more accessible and convenient for clients.

- Digital Client Tools: American Century Investments provides clients with a range of digital tools to enhance their investment experience. These tools include online account access, mobile apps, and educational resources. Clients can easily monitor their portfolios, make transactions, and stay informed about market trends.

- Cybersecurity: American Century Investments places great importance on cybersecurity to protect client data and financial assets. The company invests in robust cybersecurity measures and regularly conducts security audits to ensure the safety of client information.

By embracing innovation and leveraging technology, American Century Investments empowers clients to make informed investment decisions, simplifies the investment process, and provides a secure and convenient investment experience. The company’s commitment to innovation has contributed to its success and reputation as a leading investment management firm.

Strong Performance

American Century Investments has established a reputation for delivering strong investment performance, consistently outperforming market benchmarks and generating competitive returns for its clients. This success can be attributed to several key factors that contribute to the company’s proven track record:

- Investment Expertise: American Century Investments employs a team of highly skilled and experienced investment professionals who possess a deep understanding of the financial markets and a proven ability to identify undervalued opportunities.

- Active Management: The company’s active management approach allows its portfolio managers to make timely investment decisions and adjust portfolio allocations based on changing market conditions, seeking to maximize returns while managing risk.

- Long-Term Focus: American Century Investments takes a long-term perspective in its investment strategy, investing in companies with sustainable business models and solid fundamentals. This approach has historically led to consistent growth and outperformance over market cycles.

- Diversified Portfolios: The company constructs diversified portfolios that spread investments across multiple asset classes and sectors, reducing risk and enhancing the potential for steady returns.

The combination of these factors has enabled American Century Investments to deliver strong performance across a range of investment products, including mutual funds, ETFs, and separate accounts. The company’s track record of success has earned it the trust and confidence of numerous individual and institutional investors seeking to achieve their financial goals.

Frequently Asked Questions about American Century Investments

This section addresses some of the most common questions and misconceptions surrounding American Century Investments, providing clear and informative answers to enhance your understanding of the company and its offerings.

Question 1: What sets American Century Investments apart from other investment firms?

American Century Investments distinguishes itself through its unwavering commitment to long-term growth, prudent risk management, and a client-centric approach. With a proven track record spanning over six decades, the company has consistently delivered competitive returns for its clients, establishing itself as a trusted partner in the financial industry.

Question 2: How does American Century Investments ensure the security of my investments?

American Century Investments prioritizes the safety of client assets, implementing robust cybersecurity measures and adhering to strict regulatory guidelines. The company employs advanced encryption technologies, multi-factor authentication, and regular security audits to safeguard client data and protect against unauthorized access.

Question 3: Can I customize my portfolio with American Century Investments?

Yes, American Century Investments offers a range of investment options to meet diverse financial goals and risk appetites. Whether you prefer actively managed funds, passively managed ETFs, or tailored portfolio management services, the company provides customizable solutions to align with your specific investment preferences.

Question 4: How does American Century Investments approach sustainable investing?

American Century Investments recognizes the importance of environmental stewardship and social responsibility. The company integrates ESG (environmental, social, and governance) factors into its investment processes, seeking to identify companies that prioritize sustainability and positive societal impact. By incorporating ESG considerations, American Century Investments aims to enhance long-term returns while contributing to a more sustainable future.

Question 5: What types of investment accounts does American Century Investments offer?

American Century Investments provides a comprehensive selection of investment accounts to suit various financial needs. These include individual and joint brokerage accounts, IRAs (Traditional, Roth, and SEP), 529 college savings plans, and trust accounts. The company’s flexible account options allow you to choose the structure that best aligns with your tax and investment goals.

Question 6: How can I get started with American Century Investments?

Getting started with American Century Investments is easy. You can open an account online, over the phone, or by visiting one of the company’s financial advisors. American Century Investments offers a range of resources and support materials to assist you throughout the account opening process and beyond, ensuring a smooth and seamless experience.

These FAQs provide a glimpse into the key aspects of American Century Investments, its commitment to client success, and the diverse range of investment solutions it offers. For further information or to explore specific investment options, please visit the American Century Investments website or consult with a financial professional.

Transition to the next article section: Understanding the Benefits of Long-Term Investing with American Century Investments

Investment Tips from American Century Investments

American Century Investments, a leading financial services provider with over 60 years of experience, offers valuable insights and guidance to help investors navigate the complexities of the financial markets. Here are some key tips to help you make informed investment decisions and achieve your long-term financial goals:

Tip 1: Embrace a Long-Term Perspective

Short-term market fluctuations are inherent in investing. By adopting a long-term investment horizon, you can ride out market volatility and focus on the potential for steady growth over time. American Century Investments’ research has shown that long-term investors tend to achieve higher returns than those who frequently buy and sell.

Tip 2: Diversify Your Portfolio

Diversification is a crucial strategy to manage risk and enhance the overall return of your investment portfolio. American Century Investments recommends spreading your investments across different asset classes, such as stocks, bonds, and real estate. By doing so, you reduce the impact of downturns in any one particular asset class.

Tip 3: Invest Regularly

Dollar-cost averaging is a disciplined approach to investing that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps mitigate the impact of market timing and can lead to a lower average cost per share over time.

Tip 4: Rebalance Your Portfolio Regularly

As your investments grow and market conditions change, it’s essential to periodically rebalance your portfolio to maintain your desired asset allocation. Rebalancing involves adjusting the proportions of different asset classes in your portfolio to align with your investment goals and risk tolerance.

Tip 5: Consider Tax-Advantaged Accounts

Taking advantage of tax-advantaged accounts, such as IRAs and 401(k)s, can help you reduce your tax liability and potentially increase your investment returns. American Century Investments offers a range of tax-advantaged investment options to help you maximize your savings.

Summary:

Investing wisely requires a long-term perspective, diversification, and regular attention to your portfolio. By following these tips from American Century Investments, you can increase your chances of achieving your financial goals and securing a brighter financial future.

American Century Investments

Throughout this comprehensive exploration, we have delved into the intricacies of American Century Investments, a financial services provider with a rich legacy spanning over six decades. Our analysis has illuminated the company’s unwavering commitment to long-term growth, prudent risk management, and client-centric service.

American Century Investments’ success stems from its adherence to time-tested investment principles, including a focus on diversification, active management, and a belief in the transformative power of sustainable investing. By partnering with American Century Investments, individuals and institutions alike can harness the expertise of seasoned professionals and gain access to a wide range of investment solutions tailored to their specific financial objectives.

As we navigate an ever-evolving financial landscape, American Century Investments stands as a beacon of stability and innovation. The company’s commitment to research and development ensures that its investment strategies remain at the forefront of industry best practices, enabling clients to confidently pursue their long-term financial aspirations.

Youtube Video: