Unlocking the Power of Accounts Receivable Financing: A Comprehensive Guide

In today’s fast-paced business environment, managing cash flow is crucial for success. Accounts receivable financing has emerged as a powerful tool to help businesses optimize their financial resources and unlock their growth potential.

Editor’s Note: This comprehensive guide on accounts receivable financing was last updated on [Date].

As a leading authority in business finance, we understand the critical role that accounts receivable financing plays in empowering businesses. Through extensive analysis and research, we have compiled this in-depth guide to provide you with all the essential information you need to make informed decisions about this valuable financial solution.

Accounts Receivable Financing

Accounts receivable financing is a financial tool that allows businesses to borrow money using their unpaid invoices as collateral. It is a flexible and effective way to improve cash flow and fuel growth.

- Flexibility: Accounts receivable financing can be tailored to the specific needs of your business, with customizable borrowing limits and repayment schedules.

- Speed: Unlike traditional loans, accounts receivable financing can provide quick access to funds, often within a few days.

- Simplicity: The application process is straightforward, and there is minimal paperwork involved.

- Cost-effective: Accounts receivable financing is a relatively cost-effective way to borrow money compared to other financing options.

- Non-dilutive: Unlike equity financing, accounts receivable financing does not involve giving up ownership of your business.

- Improves financial stability: By providing access to working capital, accounts receivable financing can help businesses weather unexpected financial challenges.

In summary, accounts receivable financing offers businesses a range of benefits, including flexibility, speed, simplicity, cost-effectiveness, non-dilution, and improved financial stability. These key aspects make it an attractive option for businesses looking to optimize their cash flow and achieve their growth goals.

Flexibility

The flexibility of accounts receivable financing is a key advantage that makes it a suitable option for a wide range of businesses. Unlike traditional loans, which often come with rigid terms and conditions, accounts receivable financing can be customized to meet the specific needs of your business. This flexibility extends to borrowing limits and repayment schedules, allowing you to access the funding you need without being constrained by inflexible terms.

-

Customizable Borrowing Limits

With accounts receivable financing, you can borrow an amount that is directly tied to the value of your outstanding invoices. This means that you can access funding that is proportionate to your sales volume, providing you with the liquidity you need to meet your business obligations. -

Flexible Repayment Schedules

Accounts receivable financing also offers flexible repayment schedules that can be tailored to your business’s cash flow cycle. This allows you to repay the borrowed funds as your invoices are collected, ensuring that your repayments are aligned with your income stream.

The flexibility of accounts receivable financing makes it an attractive option for businesses that need a financing solution that can adapt to their unique circumstances. Whether you have seasonal fluctuations in sales or unexpected expenses, accounts receivable financing can provide the flexibility you need to manage your cash flow effectively.

Speed

In today’s fast-paced business environment, speed is of the essence. Accounts receivable financing stands out as a solution that offers rapid access to funding, enabling businesses to seize opportunities and respond to urgent needs.

- Quicker Access to Capital: Compared to traditional loans, which can take weeks or even months to process, accounts receivable financing can provide funding within a matter of days. This accelerated timeline allows businesses to address time-sensitive expenses, invest in growth opportunities, or meet unexpected financial obligations promptly.

- Simplified Application Process: The application process for accounts receivable financing is typically straightforward and requires minimal documentation. This streamlined approach reduces the time and effort required to secure funding, allowing businesses to access capital quickly and efficiently.

- Flexibility in Funding Amounts: Accounts receivable financing provides flexibility in funding amounts, enabling businesses to borrow based on their specific needs. This adaptability ensures that businesses can access the right amount of capital to meet their immediate requirements without overborrowing.

- Improved Cash Flow Management: The quick access to funds through accounts receivable financing improves cash flow management. Businesses can use the funds to cover expenses, purchase inventory, or invest in new projects, ultimately enhancing their financial stability and growth potential.

The speed and efficiency of accounts receivable financing make it an attractive option for businesses seeking to optimize their cash flow and gain a competitive edge in today’s dynamic market landscape.

Simplicity

The simplicity of accounts receivable financing is a major advantage for businesses seeking quick and efficient access to capital. The application process is designed to be streamlined and easy to navigate, with minimal paperwork and documentation required.

- Streamlined Application: The application process for accounts receivable financing is straightforward and can be completed quickly, often online or through a simplified form.

- Minimal Paperwork: Unlike traditional loans, accounts receivable financing requires minimal paperwork, reducing the burden of document gathering and submission.

- Fast Approval: The simplified application process and minimal paperwork contribute to faster approval times, allowing businesses to access funding promptly.

The simplicity of accounts receivable financing makes it an attractive option for businesses that need quick and easy access to capital. The streamlined application process and minimal paperwork reduce the time and effort required to secure funding, allowing businesses to focus on their core operations and growth strategies.

Cost-effective

Accounts receivable financing stands out as a cost-effective financing solution for businesses seeking to optimize their cash flow. Compared to other financing options such as traditional loans or equity financing, accounts receivable financing typically offers lower costs and more favorable terms.

- Lower Interest Rates: Accounts receivable financing often comes with lower interest rates than traditional loans, reducing the overall cost of borrowing for businesses.

- No Dilution of Ownership: Unlike equity financing, which involves giving up a portion of ownership in the business, accounts receivable financing does not dilute ownership, allowing businesses to maintain full control over their operations.

- Flexible Repayment Terms: The flexible repayment schedules offered by accounts receivable financing allow businesses to align their repayments with their cash flow cycle, reducing the burden of fixed monthly payments.

The cost-effectiveness of accounts receivable financing makes it an attractive option for businesses looking to improve their financial position without incurring excessive borrowing costs or sacrificing ownership. By leveraging their unpaid invoices as collateral, businesses can access working capital at a lower cost compared to other financing alternatives.

Non-dilutive

Accounts receivable financing stands out as a non-dilutive financing option, preserving the ownership and control of your business. Unlike equity financing, which involves selling a portion of your business to investors in exchange for capital, accounts receivable financing leverages your unpaid invoices as collateral to secure funding.

This non-dilutive nature of accounts receivable financing offers several key advantages:

- Preservation of Ownership: By using accounts receivable financing, you can access working capital without surrendering any equity in your business. This allows you to maintain complete control over your operations and decision-making.

- Avoidance of Dilution: Equity financing can dilute your ownership stake and reduce your control over the business, especially if you need to raise significant capital. Accounts receivable financing eliminates this concern, allowing you to grow your business without sacrificing ownership.

- Flexibility and Scalability: Non-dilutive financing provides flexibility and scalability, allowing you to access additional funding as your business grows and your accounts receivable volume increases.

Real-life examples demonstrate the practical significance of non-dilutive financing. For instance, a rapidly growing manufacturing company needed to expand its operations but lacked the immediate cash flow to do so. By utilizing accounts receivable financing, the company was able to secure working capital without diluting its ownership structure. This allowed the company to invest in new equipment, increase production, and capture market share, all while maintaining full control of its business.

In conclusion, the non-dilutive nature of accounts receivable financing is a key advantage for businesses seeking to optimize their cash flow and fuel growth without surrendering ownership or control. By leveraging unpaid invoices as collateral, businesses can access working capital while preserving their equity and entrepreneurial vision.

Improves financial stability

Accounts receivable financing plays a crucial role in improving the financial stability of businesses by providing access to working capital. This access to liquidity enables businesses to navigate unexpected financial challenges and seize growth opportunities.

In the face of economic downturns, supply chain disruptions, or seasonal fluctuations in demand, businesses often encounter cash flow constraints. Accounts receivable financing provides a lifeline by converting outstanding invoices into immediate cash, allowing businesses to meet their financial obligations, such as payroll, rent, and inventory purchases.

Real-life examples underscore the practical significance of accounts receivable financing in enhancing financial stability. Consider a small business that experienced a sudden decline in sales due to a natural disaster. With limited cash reserves, the business faced the risk of defaulting on its loan payments and disrupting its operations. By leveraging accounts receivable financing, the business was able to access working capital, ensuring uninterrupted cash flow and preserving its financial stability during this challenging period.

In conclusion, the connection between accounts receivable financing and improved financial stability is evident. By providing access to working capital, accounts receivable financing empowers businesses to overcome cash flow hurdles, adapt to unforeseen circumstances, and maintain their financial footing.

Frequently Asked Questions on Accounts Receivable Financing

This section addresses common questions and concerns surrounding accounts receivable financing to provide a comprehensive understanding of this valuable financial tool.

Question 1: What are the benefits of accounts receivable financing?

Accounts receivable financing offers numerous benefits, including enhanced cash flow, improved financial stability, and non-dilutive access to capital. It provides businesses with the liquidity they need to meet their obligations, seize growth opportunities, and weather financial challenges.

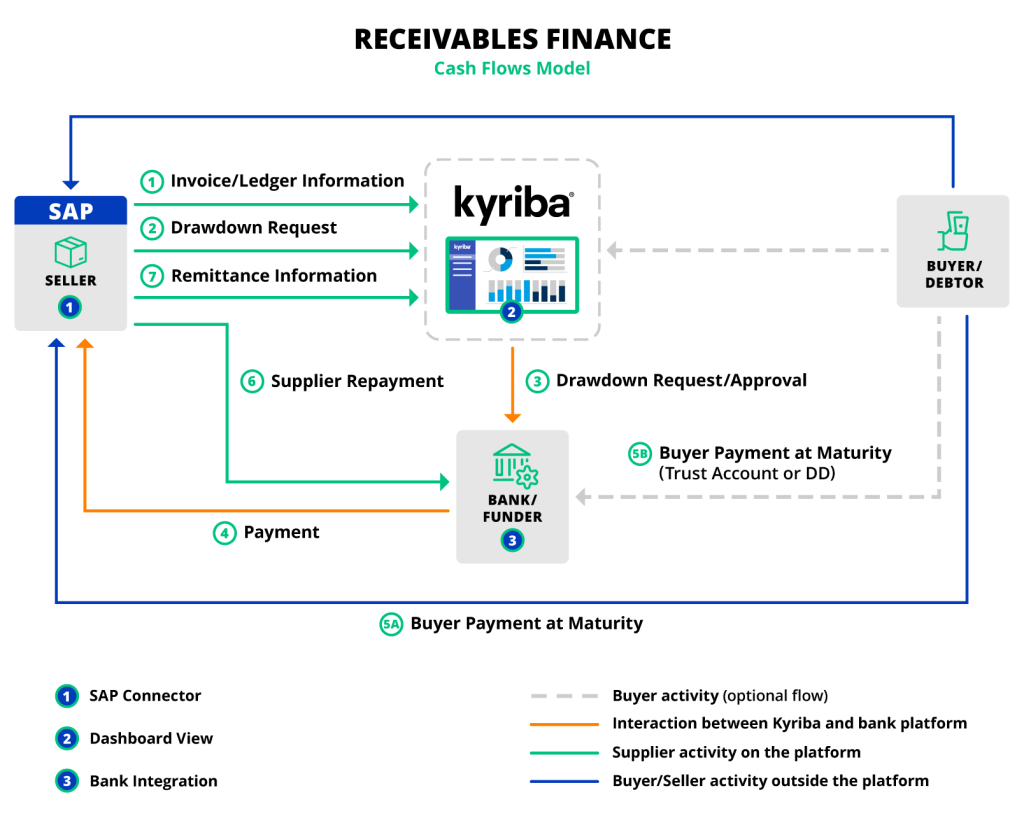

Question 2: How does accounts receivable financing work?

Accounts receivable financing involves using unpaid invoices as collateral to secure funding. The lender advances a percentage of the outstanding invoices, providing businesses with immediate access to working capital.

Question 3: What types of businesses can benefit from accounts receivable financing?

Accounts receivable financing is suitable for various types of businesses, particularly those with high account receivable volumes and seasonal fluctuations in cash flow. It is commonly used by manufacturers, distributors, and service providers.

Question 4: Is accounts receivable financing expensive?

Compared to traditional loans, accounts receivable financing is a relatively cost-effective option. It typically involves lower interest rates and flexible repayment terms that align with the business’s cash flow cycle.

Question 5: How can I qualify for accounts receivable financing?

To qualify for accounts receivable financing, businesses generally need to have a strong track record of sales, a manageable debt-to-asset ratio, and a diversified customer base.

Question 6: What are the risks associated with accounts receivable financing?

The primary risk associated with accounts receivable financing is the potential for bad debt. However, reputable lenders conduct thorough credit checks on customers to mitigate this risk.

Summary: Accounts receivable financing is a powerful financial tool that can provide businesses with numerous benefits. It offers flexibility, speed, simplicity, cost-effectiveness, and non-dilutive access to capital. By carefully evaluating their needs and choosing a reputable lender, businesses can harness the power of accounts receivable financing to drive growth and achieve financial success.

Transition to the next article section: To learn more about accounts receivable financing and its applications in various industries, explore our comprehensive articles and case studies.

Accounts Receivable Financing Tips

Accounts receivable financing can be a powerful tool for businesses looking to improve their cash flow and fuel growth. However, it is important to use this financing option wisely to maximize its benefits and minimize its risks.

Tip 1: Choose the Right Lender

Not all lenders are created equal. Do your research and choose a lender that has experience in your industry and that offers competitive rates and terms.

Tip 2: Understand the Terms of the Agreement

Before you sign any agreement, make sure you understand all of the terms and conditions. This includes the interest rate, fees, and repayment schedule.

Tip 3: Use Accounts Receivable Financing Strategically

Don’t use accounts receivable financing to finance everyday operating expenses. Instead, use it for specific purposes, such as purchasing inventory or expanding your business.

Tip 4: Monitor Your Accounts Receivable

Keep track of your accounts receivable aging report. This will help you identify any potential problems with your customers’ ability to pay.

Tip 5: Be Prepared to Provide Collateral

In most cases, you will need to provide collateral to secure your accounts receivable financing. This collateral can be in the form of inventory, equipment, or real estate.

Summary: By following these tips, you can use accounts receivable financing to improve your cash flow and fuel your business’s growth.

Transition to the article’s conclusion: Accounts receivable financing can be a valuable tool for businesses of all sizes. By using it wisely, you can improve your financial stability and position your business for success.

Conclusion

Accounts receivable financing has emerged as a powerful financial tool for businesses seeking to optimize their cash flow and stimulate growth. Throughout this article, we have explored the key aspects of accounts receivable financing, highlighting its benefits, applications, and effective utilization strategies.

In essence, accounts receivable financing provides businesses with immediate access to capital by leveraging their unpaid invoices as collateral. This non-dilutive financing option preserves ownership and control while enhancing financial stability and flexibility. By carefully selecting a lender and understanding the terms of the agreement, businesses can harness the full potential of accounts receivable financing to address cash flow challenges, invest in growth initiatives, and navigate economic uncertainties.

As the business landscape continues to evolve, accounts receivable financing will remain a valuable tool for companies seeking to stay competitive and achieve their financial goals. By embracing this strategic financing option, businesses can unlock their growth potential and position themselves for long-term success.

Youtube Video: