Read Provia Windows Reviews: Are They Worth It?

Assessments of Provia windows reflect customer and professional opinions regarding the quality, performance, and value of window products manufactured by Provia. These evaluations frequently encompass aspects like energy…

Pro High Rise Window Cleaning | Sparkling Windows

The maintenance of exterior surfaces on tall buildings, specifically glass facades, is a specialized service. This service ensures aesthetic appeal and structural integrity. For example, routine attention to…

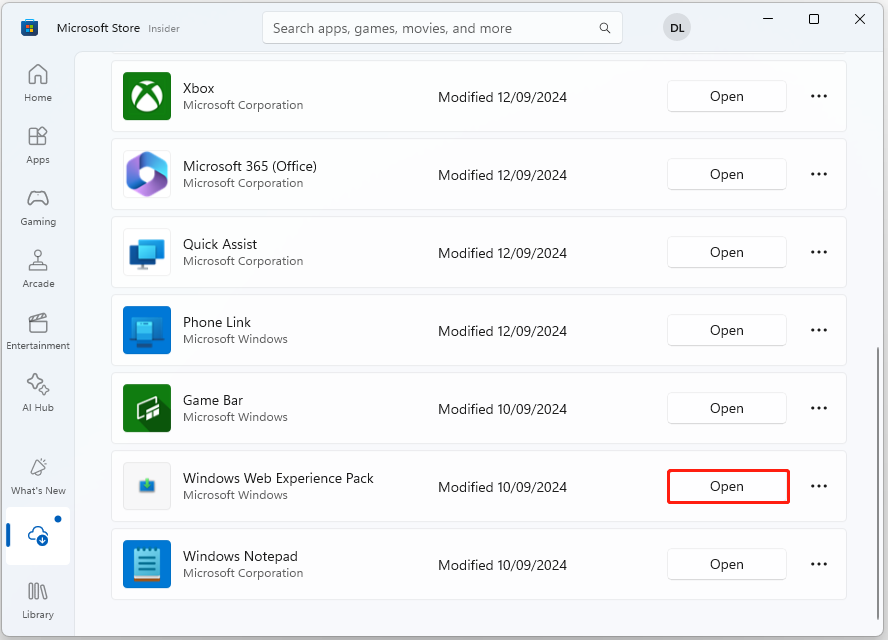

Boost Windows with the Web Experience Pack Download

This Windows component delivers evolving web-based content and experiences directly to the operating system’s user interface. A prominent example is the dynamic content displayed on the Windows lock…

RV Windows: Replacement, Repair & More!

Glazed apertures designed for recreational vehicles provide natural light, ventilation, and exterior views. These components are integral to the livability and functionality of the mobile dwelling. For example,…

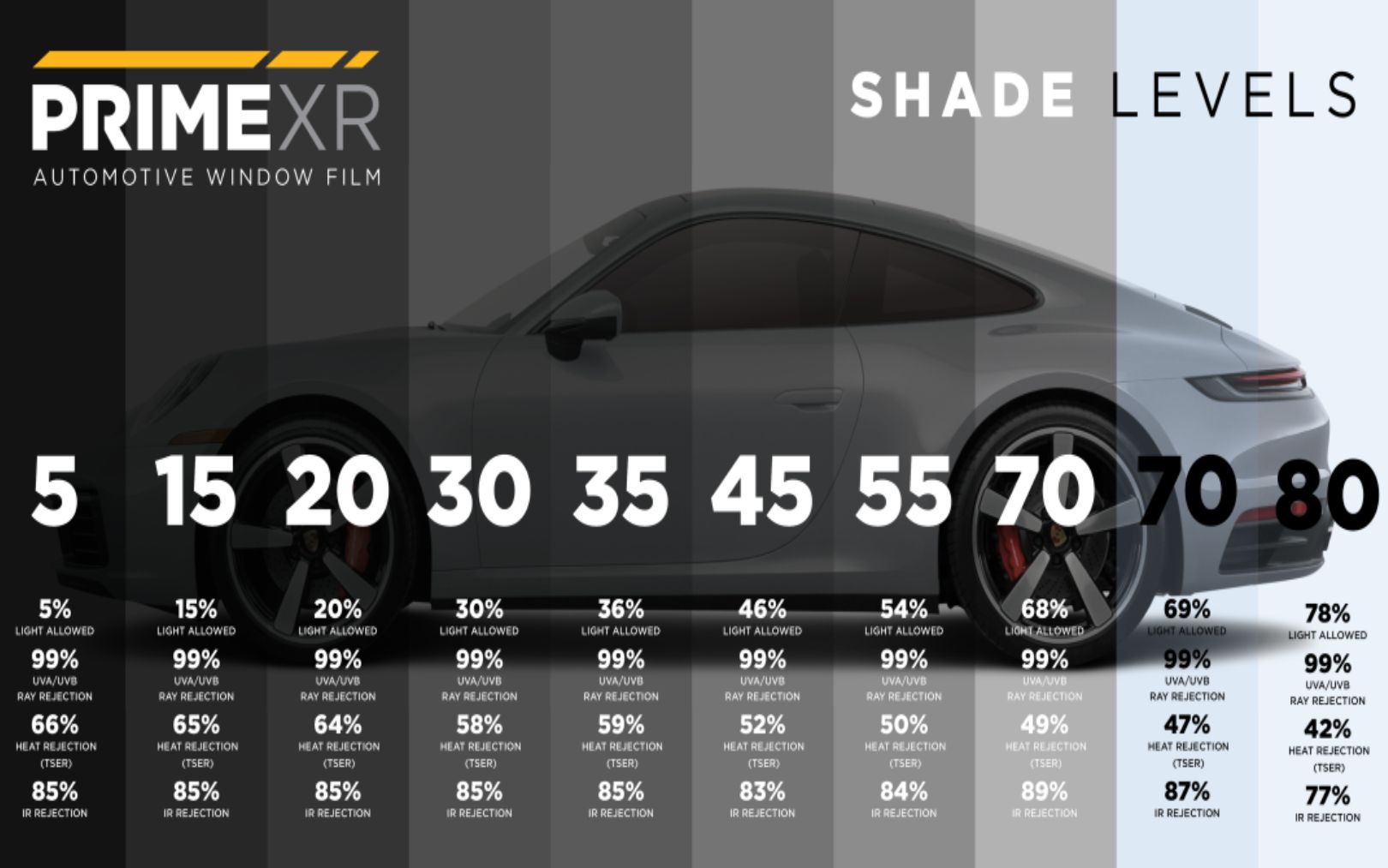

Professional Window Tinting Service – Quality Windows

The application of a thin laminate film to a vehicle’s or building’s glass is a process designed to modify the properties of that glass. This process involves carefully…

![Download Toki Pona Language Pack for Windows - [Updated] 16 download toki pona language pack for windows updated](https://superagc.com/wp-content/uploads/2025/10/download-toki-pona-language-pack-for-windows-updated.webp)

Download Toki Pona Language Pack for Windows – [Updated]

A method for enabling the use of the constructed language Toki Pona within the Windows operating system involves acquiring and installing a language pack. This typically allows for…

Protect: Window Well Liners – Easy Install!

Protective structures designed to safeguard the areas surrounding basement windows are constructed from durable materials, often plastic or metal. These units are installed within the excavated space outside…

Easy Cleaning Tinted Windows: Pro Tips & Tricks

The process of maintaining the clarity and integrity of coated automotive or architectural glass surfaces involves specific techniques and products. This specialized care ensures optimal visibility and prolongs…

Pro Tint: Window Tint Prices & Cost Near You

The cost associated with darkening vehicle or building panes constitutes a significant consideration for consumers. This figure is determined by several factors, including the type of film used,…

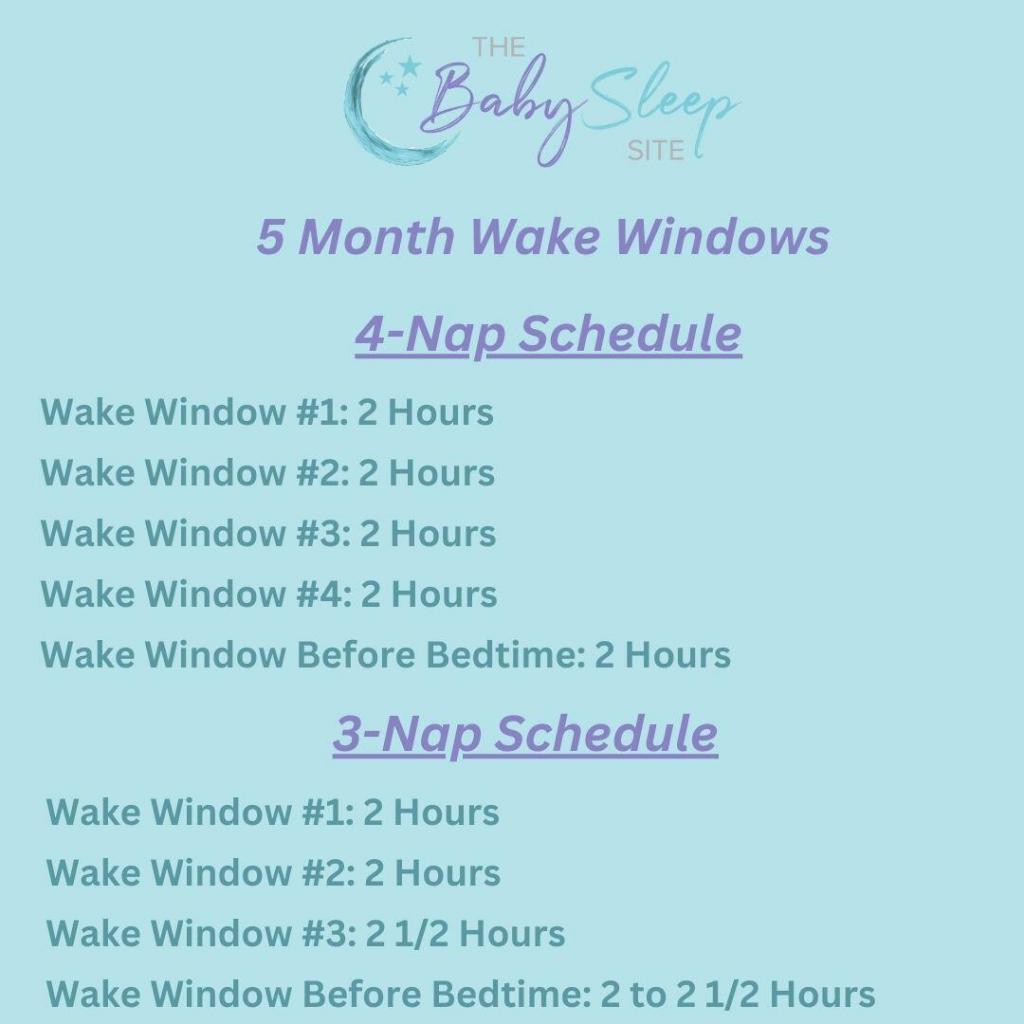

Baby's Best 4-5 Month Old Wake Window: Tips & Guide

The period of time a baby, specifically one between four and five months of age, is awake between naps is a key element in establishing healthy sleep patterns….