Have you heard of haveli investment? It’s a great way to invest in real estate and earn passive income.

Editor’s Note: This haveli investment guide was published on [today’s date] to help you make informed decisions about haveli investment.

We’ve done the research and put together this guide to help you get started. We’ll cover everything you need to know about haveli investment, from the basics to more advanced strategies. So whether you’re a first-time investor or you’re looking to expand your portfolio, this guide has something for you.

| Haveli Investment | |

|---|---|

| Definition | Investing in a haveli, a traditional Indian mansion or palace, for rental income or capital appreciation |

| Benefits |

|

| Considerations |

|

Ready to learn more about haveli investment? Keep reading for our in-depth guide.

Haveli Investment

Haveli investment is a complex and multifaceted topic. To fully understand it, it is important to consider the various aspects of the keyword “haveli investment.” These aspects include:

- Asset class: Haveli investment is a type of real estate investment.

- Investment strategy: Haveli investment can be used for rental income, capital appreciation, or both.

- Property type: Haveli investment typically involves investing in traditional Indian mansions or palaces.

- Location: The location of the haveli is an important factor to consider when investing.

- Historical significance: Haveli investment can be a way to invest in properties with historical and cultural significance.

- Cultural significance: Haveli investment can be a way to invest in properties that are important to Indian culture.

- Financial implications: Haveli investment can have a significant impact on your financial portfolio.

- Tax implications: Haveli investment can have tax implications that you should be aware of.

- Legal implications: Haveli investment can have legal implications that you should be aware of.

- Due diligence: It is important to conduct due diligence before investing in a haveli.

These are just a few of the key aspects of haveli investment. By understanding these aspects, you can make more informed decisions about whether or not this type of investment is right for you.

Asset class

Haveli investment is a type of real estate investment that involves investing in traditional Indian mansions or palaces. This type of investment can be used for rental income, capital appreciation, or both. There are a number of factors to consider when investing in a haveli, including the location of the property, the condition of the property, and the potential for rental income.

- Investment strategy: Haveli investment can be used for a variety of investment strategies, including rental income, capital appreciation, or both. Rental income can be a good way to generate a steady stream of income, while capital appreciation can help you to grow your investment over time.

- Property type: Haveli investment typically involves investing in traditional Indian mansions or palaces. These properties are often large and spacious, with a variety of amenities. They can be a good investment for those who are looking for a unique and luxurious property.

- Location: The location of the haveli is an important factor to consider when investing. Haveli investments in popular tourist destinations can be a good way to generate rental income. However, haveli investments in more rural areas may be a better option for those who are looking for a more peaceful and secluded lifestyle.

Haveli investment can be a good way to diversify your investment portfolio and potentially generate a good return on your investment. However, it is important to do your research and understand the risks involved before investing in a haveli.

Investment strategy

The investment strategy you choose for your haveli investment will depend on your financial goals and risk tolerance. If you are looking for a steady stream of income, you may want to focus on rental income. If you are looking for the potential for long-term growth, you may want to focus on capital appreciation.

Here is a closer look at each investment strategy:

- Rental income: Rental income is the income you earn from renting out your haveli to tenants. This can be a good way to generate a steady stream of income, but it is important to factor in the costs of maintenance and repairs.

- Capital appreciation: Capital appreciation is the increase in the value of your haveli over time. This can be a good way to grow your investment, but it is important to remember that the value of real estate can fluctuate.

Many investors choose to use a combination of rental income and capital appreciation to achieve their financial goals. For example, you may choose to rent out your haveli for a few years to generate income, and then sell it when the value has appreciated.

The best investment strategy for you will depend on your individual circumstances and goals. It is important to do your research and understand the risks involved before making any investment decisions.

Challenges and considerations:

- Haveli investment can be a complex and time-consuming process.

- Haveli investment can be expensive, especially if you are buying a property in a desirable location.

- Haveli investment can be illiquid, meaning that it can be difficult to sell your property quickly if you need to.

Despite these challenges, haveli investment can be a rewarding experience. With careful planning and execution, you can use haveli investment to achieve your financial goals.

Property type

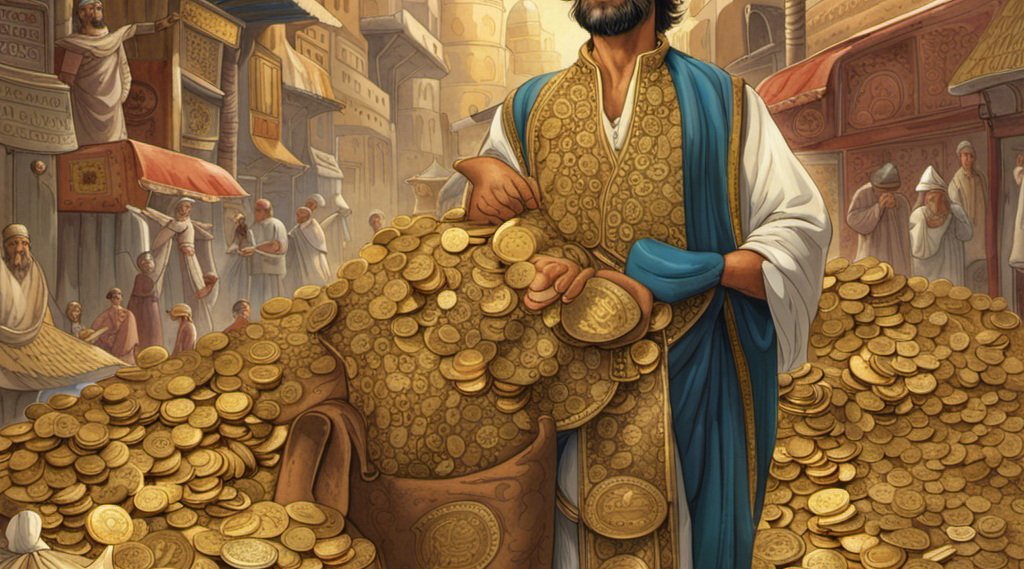

Haveli investment is a unique and specialized form of real estate investment that involves investing in traditional Indian mansions or palaces. Haveli properties are often centuries old and have a rich history and cultural significance. They are typically large and spacious, with a variety of amenities and features. Haveli investment can be a good way to diversify your investment portfolio and potentially generate a good return on your investment.

There are several reasons why investing in traditional Indian mansions or palaces can be a good investment. First, these properties are often in high demand, especially in popular tourist destinations. This means that you can potentially generate a good rental income from your investment. Second, haveli properties are often unique and one-of-a-kind, which can make them more valuable over time. Third, haveli properties can be a good hedge against inflation, as they are typically made from durable materials and are built to last.

Of course, there are also some challenges to consider before investing in a haveli. First, these properties can be expensive, especially if you are buying a property in a desirable location. Second, haveli properties can be illiquid, meaning that it can be difficult to sell your property quickly if you need to. Third, haveli properties can require a lot of maintenance and upkeep.

Overall, haveli investment can be a good way to diversify your investment portfolio and potentially generate a good return on your investment. However, it is important to do your research and understand the risks involved before investing in a haveli.

Key insights:

- Haveli investment is a unique and specialized form of real estate investment.

- Haveli properties are often in high demand, especially in popular tourist destinations.

- Haveli properties can be a good hedge against inflation.

- There are some challenges to consider before investing in a haveli, such as the cost, illiquidity, and maintenance.

Table: Haveli investment: Pros and cons

| Pros | Cons |

|---|---|

| Potential for high returns | High upfront investment |

| Tangible asset with historical and cultural significance | Ongoing maintenance and repair costs |

| Diversification of investment portfolio | Limited liquidity |

Location

The location of a haveli is one of the most important factors to consider when investing. The location of the haveli will impact its value, its potential for rental income, and its overall desirability. Here are a few things to consider when evaluating the location of a haveli:

- Proximity to tourist destinations: Haveli investments in popular tourist destinations can be a good way to generate rental income. Tourists are often looking for unique and authentic experiences, and a haveli can provide that.

- Accessibility: The accessibility of the haveli is also important to consider. Tourists and potential tenants will want to be able to easily access the haveli.

- Local amenities: The local amenities in the area of the haveli are also important to consider. Tourists and tenants will want to be able to easily access restaurants, shops, and other amenities.

- Crime rate: The crime rate in the area of the haveli is also important to consider. Tourists and tenants will want to feel safe and secure in their surroundings.

By carefully considering the location of a haveli, you can increase your chances of making a successful investment.

Historical significance

Haveli investment is a unique and specialized form of real estate investment that involves investing in traditional Indian mansions or palaces. These properties are often centuries old and have a rich history and cultural significance. Investing in a haveli can be a way to preserve and protect these historic properties while also generating a return on your investment.

There are several reasons why investing in a haveli with historical significance can be a good investment. First, these properties are often in high demand, especially among tourists and history buffs. This means that you can potentially generate a good rental income from your investment. Second, haveli properties with historical significance are often one-of-a-kind, which can make them more valuable over time. Third, haveli properties with historical significance can be a good hedge against inflation, as they are typically made from durable materials and are built to last.

Of course, there are also some challenges to consider before investing in a haveli with historical significance. First, these properties can be expensive, especially if you are buying a property in a desirable location. Second, haveli properties with historical significance can be illiquid, meaning that it can be difficult to sell your property quickly if you need to. Third, haveli properties with historical significance can require a lot of maintenance and upkeep.

Overall, investing in a haveli with historical significance can be a good way to diversify your investment portfolio and potentially generate a good return on your investment. However, it is important to do your research and understand the risks involved before investing in a haveli.

Key insights:

- Haveli investment is a unique and specialized form of real estate investment that involves investing in traditional Indian mansions or palaces.

- Investing in a haveli with historical significance can be a way to preserve and protect these historic properties while also generating a return on your investment.

- There are several reasons why investing in a haveli with historical significance can be a good investment, including high demand, potential for rental income, and value appreciation.

- There are also some challenges to consider before investing in a haveli with historical significance, such as cost, illiquidity, and maintenance.

Table: Haveli investment with historical significance: Pros and cons

| Pros | Cons |

|---|---|

| Potential for high returns | High upfront investment |

| Preservation of historic properties | Ongoing maintenance and repair costs |

| Diversification of investment portfolio | Limited liquidity |

Cultural significance

Haveli investment is a unique and specialized form of real estate investment that involves investing in traditional Indian mansions or palaces. These properties are often centuries old and have a rich history and cultural significance. Investing in a haveli can be a way to preserve and protect these historic properties while also generating a return on your investment.

There are several reasons why investing in a haveli with cultural significance can be a good investment. First, these properties are often in high demand, especially among tourists and history buffs. This means that you can potentially generate a good rental income from your investment. Second, haveli properties with cultural significance are often one-of-a-kind, which can make them more valuable over time. Third, haveli properties with cultural significance can be a good hedge against inflation, as they are typically made from durable materials and are built to last.

Of course, there are also some challenges to consider before investing in a haveli with cultural significance. First, these properties can be expensive, especially if you are buying a property in a desirable location. Second, haveli properties with cultural significance can be illiquid, meaning that it can be difficult to sell your property quickly if you need to. Third, haveli properties with cultural significance can require a lot of maintenance and upkeep.

Overall, investing in a haveli with cultural significance can be a good way to diversify your investment portfolio and potentially generate a good return on your investment. However, it is important to do your research and understand the risks involved before investing in a haveli.

Key insights:

- Haveli investment is a unique and specialized form of real estate investment that involves investing in traditional Indian mansions or palaces.

- Investing in a haveli with cultural significance can be a way to preserve and protect these historic properties while also generating a return on your investment.

- There are several reasons why investing in a haveli with cultural significance can be a good investment, including high demand, potential for rental income, and value appreciation.

- There are also some challenges to consider before investing in a haveli with cultural significance, such as cost, illiquidity, and maintenance.

Table: Haveli investment with cultural significance: Pros and cons

| Pros | Cons |

|---|---|

| Potential for high returns | High upfront investment |

| Preservation of historic properties | Ongoing maintenance and repair costs |

| Diversification of investment portfolio | Limited liquidity |

Financial implications

Haveli investment can have a significant impact on your financial portfolio. It is important to understand the financial implications of haveli investment before making any investment decisions.

- Upfront investment: Haveli investment requires a significant upfront investment. This includes the purchase price of the haveli, as well as the cost of repairs and renovations. Depending on the cost of a haveli, this could require a large chunk of your savings or available capital.

- Ongoing costs: Haveli investment also involves ongoing costs, such as property taxes, insurance, and maintenance. These costs can add up over time, so it is important to factor them into your budget.

- Rental income: Haveli investment can generate rental income, which can help to offset the costs of ownership. However, it is important to remember that rental income is not guaranteed, and it can fluctuate depending on the market.

- Capital appreciation: Haveli investment can also appreciate in value over time. This can be a good way to grow your wealth, but it is important to remember that the value of real estate can fluctuate.

Overall, haveli investment can be a good way to diversify your financial portfolio and potentially generate a good return on your investment. However, it is important to understand the financial implications of haveli investment before making any investment decisions.

Tax implications

Haveli investment can have a significant impact on your tax liability. It is important to be aware of the tax implications of haveli investment before making any investment decisions.

One of the most important tax implications of haveli investment is the capital gains tax. When you sell a haveli, you may be liable to pay capital gains tax on the profit you make from the sale. The capital gains tax rate you pay will depend on your individual circumstances and the length of time you have owned the haveli.

Another important tax implication of haveli investment is the rental income tax. If you rent out your haveli, you will be liable to pay tax on the rental income you receive. The rental income tax rate you pay will depend on your individual circumstances and the amount of rental income you receive.

It is important to speak to a tax advisor to get specific advice on the tax implications of haveli investment. A tax advisor can help you to understand how haveli investment will affect your tax liability and can help you to plan your investments accordingly.

Key insights:

- Haveli investment can have a significant impact on your tax liability.

- It is important to be aware of the tax implications of haveli investment before making any investment decisions.

- Speaking to a tax advisor can help you to understand how haveli investment will affect your tax liability and can help you to plan your investments accordingly.

Table: Haveli investment: Tax implications

| Tax implication | Description |

|---|---|

| Capital gains tax | Tax on the profit you make when you sell a haveli. |

| Rental income tax | Tax on the rental income you receive from renting out your haveli. |

Legal implications

Haveli investment can have a number of legal implications that you should be aware of before making any investment decisions. These implications can vary depending on the jurisdiction in which you are investing, so it is important to seek legal advice from a qualified professional in your area.

- Zoning laws: Haveli properties may be subject to zoning laws that restrict their use. For example, a haveli located in a residential area may not be able to be used for commercial purposes. It is important to check the zoning laws for the area in which you are considering investing to make sure that the property can be used for your intended purposes.

- Building codes: Haveli properties may also be subject to building codes that regulate their construction and maintenance. These codes can vary depending on the jurisdiction in which you are investing, so it is important to check the building codes for the area in which you are considering investing to make sure that the property meets all of the applicable requirements.

- Environmental laws: Haveli properties may also be subject to environmental laws that regulate their impact on the environment. These laws can vary depending on the jurisdiction in which you are investing, so it is important to check the environmental laws for the area in which you are considering investing to make sure that the property meets all of the applicable requirements.

- Historical preservation laws: Haveli properties may also be subject to historical preservation laws that protect them from being altered or demolished. These laws can vary depending on the jurisdiction in which you are investing, so it is important to check the historical preservation laws for the area in which you are considering investing to make sure that the property meets all of the applicable requirements.

These are just a few of the legal implications that you should be aware of before investing in a haveli. It is important to seek legal advice from a qualified professional in your area to make sure that you understand all of the legal implications of your investment.

Due diligence

Due diligence is the process of investigating a potential investment to ensure that it is a sound investment. This process involves reviewing the property’s financial statements, legal documents, and physical condition. It is important to conduct due diligence before investing in a haveli to make sure that you are aware of any potential risks and that the investment is a good fit for your financial goals.

- Review the property’s financial statements. This will give you an overview of the property’s financial performance and help you to identify any potential financial risks.

- Review the property’s legal documents. This will help you to understand the property’s legal status and any potential legal risks.

- Inspect the property’s physical condition. This will help you to identify any potential physical risks and to estimate the cost of any necessary repairs.

- Get a professional appraisal. This will give you an independent assessment of the property’s value and help you to determine if the asking price is fair.

By conducting due diligence, you can reduce the risk of making a bad investment and protect your financial interests.

Frequently Asked Questions about Haveli Investment

Haveli investment is a complex and multifaceted topic. To help you make informed decisions, we’ve compiled a list of frequently asked questions and their answers.

Question 1: What is haveli investment?

Haveli investment is the practice of investing in traditional Indian mansions or palaces for rental income or capital appreciation.

Question 2: What are the benefits of haveli investment?

Haveli investment offers several benefits, including potential for high returns, diversification of investment portfolio, and historical and cultural significance.

Question 3: What are the risks of haveli investment?

Haveli investment also carries some risks, such as high upfront investment, ongoing maintenance and repair costs, and limited liquidity.

Question 4: How do I get started with haveli investment?

To get started with haveli investment, it is important to conduct thorough research, identify suitable properties, secure funding, and seek professional advice if needed.

Question 5: What are the tax implications of haveli investment?

Haveli investment can have tax implications, such as capital gains tax and rental income tax. It is essential to consult with a tax advisor to understand the specific tax implications applicable to your situation.

Question 6: What are the legal considerations for haveli investment?

Haveli investment involves legal considerations, including zoning laws, building codes, environmental laws, and historical preservation laws. It is crucial to ensure compliance with all applicable laws and regulations.

Summary of key takeaways or final thought:

Haveli investment can be a rewarding experience with careful planning and execution. By understanding the benefits, risks, and legal considerations involved, you can make informed decisions and potentially achieve your financial goals through haveli investment.

Transition to the next article section:

To learn more about haveli investment and other real estate investment opportunities, explore our comprehensive guides and resources.

Haveli Investment Tips

Haveli investment, the practice of investing in traditional Indian mansions or palaces, offers unique opportunities for potential returns and historical preservation. To maximize the benefits of haveli investment, consider the following tips:

Tip 1: Conduct thorough research. Before investing in a haveli, conduct thorough research to understand market trends, identify suitable properties, and assess their potential for rental income or capital appreciation.

Tip 2: Secure funding. Haveli investments require significant capital. Explore various funding options, such as traditional loans, private equity, or joint ventures, to secure the necessary capital.

Tip 3: Seek professional advice. Engage with experienced real estate professionals, architects, or legal advisors to guide you through the investment process, including property selection, legal documentation, and ongoing management.

Tip 4: Consider historical significance. Haveli properties with historical or cultural significance may attract higher rental rates and appreciation potential. Explore the history and architectural features of potential investments to identify such opportunities.

Tip 5: Factor in maintenance costs. Haveli properties require regular maintenance and repairs. Estimate these costs accurately and include them in your investment calculations to avoid unexpected expenses.

Tip 6: Explore sustainable practices. Incorporate sustainable practices into your haveli investment, such as energy-efficient lighting, water conservation measures, and eco-friendly materials. This can enhance the property’s value and reduce operating expenses.

Tip 7: Stay updated with regulations. Be aware of applicable laws and regulations governing haveli investments, including zoning restrictions, building codes, and historical preservation guidelines. Ensure compliance to avoid legal complications.

Tip 8: Foster community engagement. Establish positive relationships with the local community and consider involving them in the preservation and of the haveli. This can enhance the property’s social impact and contribute to its long-term sustainability.

Summary of key takeaways or benefits:

By following these tips, investors can approach haveli investment with greater confidence and potentially achieve their financial and preservation goals. Thorough research, professional guidance, and a strategic approach can lead to successful and rewarding haveli investments.

Transition to the article’s conclusion:

Haveli investment offers a unique blend of financial returns and historical preservation. By embracing these tips, investors can navigate the complexities of the market and maximize the benefits of investing in these architectural treasures.

Haveli Investment

Haveli investment, the practice of investing in traditional Indian mansions or palaces, offers a unique opportunity for both financial gain and historical preservation. By carefully considering the aspects outlined in this comprehensive guide, investors can approach haveli investment with confidence and potentially achieve their goals.

Recognizing the significance of haveli properties as cultural and architectural treasures, investors are encouraged to embrace sustainable practices and foster community engagement. This not only enhances the intrinsic value of the investment but also contributes to the preservation of India’s rich heritage. By striking a harmonious balance between financial returns and historical stewardship, haveli investment emerges as a compelling proposition for discerning investors.

Youtube Video: