What is a Chief Investment Officer?

Editor’s Note: “What is a Chief Investment Officer” has been published today to address the increasing need for clarification surrounding this critical role within the financial industry.

To help you make informed decisions, we’ve done the analysis, dug into the data, and compiled this comprehensive guide outlining the key aspects of a Chief Investment Officer’s responsibilities.

Key Takeaways:

| Responsibility | Description |

|---|---|

| Investment Strategy | Develops and executes investment strategies aligned with organizational objectives. |

| Portfolio Management | Manages investment portfolios, including asset allocation, risk assessment, and performance monitoring. |

| Research and Analysis | Conducts thorough research and analysis to identify investment opportunities and assess market trends. |

| Risk Management | Implements risk management strategies to mitigate potential losses and protect investments. |

| Team Leadership | Leads and mentors a team of investment professionals. |

Main Article Topics:

- The Role of a Chief Investment Officer

- Responsibilities of a Chief Investment Officer

- Qualifications and Skills Required to Become a Chief Investment Officer

- The Importance of a Chief Investment Officer

- Conclusion

What is a Chief Investment Officer

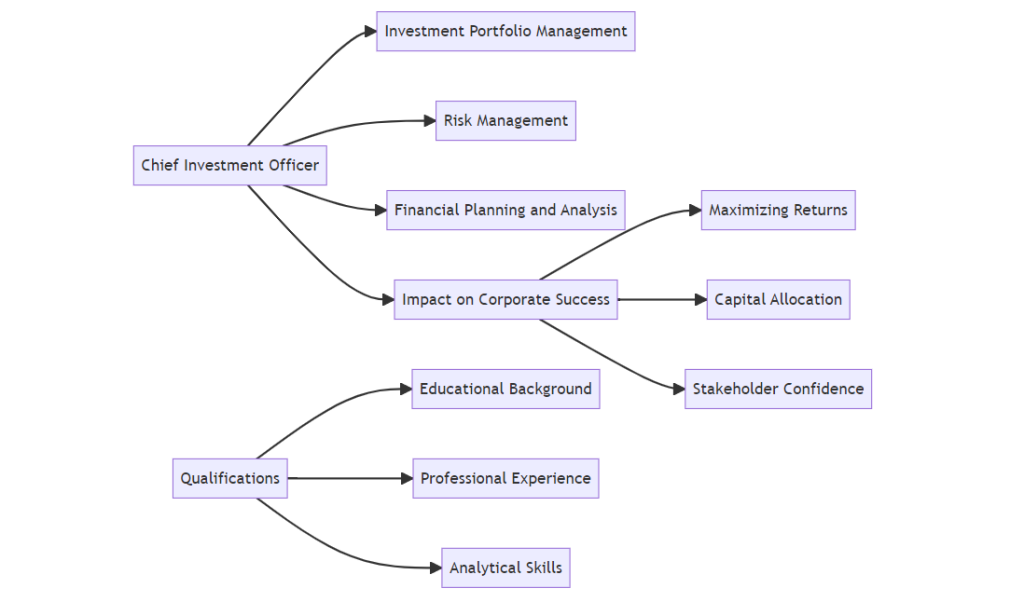

A Chief Investment Officer (CIO) plays a critical role in managing investments and driving financial performance for organizations. Here are 10 key aspects that define the role and responsibilities of a CIO:

- Investment Strategy: Develops and executes investment strategies aligned with organizational objectives.

- Portfolio Management: Manages investment portfolios, including asset allocation, risk assessment, and performance monitoring.

- Research and Analysis: Conducts thorough research and analysis to identify investment opportunities and assess market trends.

- Risk Management: Implements risk management strategies to mitigate potential losses and protect investments.

- Team Leadership: Leads and mentors a team of investment professionals.

- Stakeholder Management: Maintains relationships with investors, clients, and other stakeholders.

- Performance Evaluation: Evaluates investment performance and makes adjustments as needed.

- Compliance and Regulation: Ensures compliance with industry regulations and ethical standards.

- Continuing Education: Stays abreast of industry trends and best practices through ongoing professional development.

- Decision-Making: Makes critical investment decisions based on data analysis, market insights, and risk assessment.

These key aspects highlight the multifaceted nature of a CIO’s role. They are responsible for developing and executing investment strategies that align with the organization’s financial goals, while also managing risk and ensuring compliance. CIOs lead teams of investment professionals, evaluate performance, and make critical decisions that impact the organization’s financial success.

Investment Strategy

This facet of a Chief Investment Officer’s (CIO) role is crucial as it sets the foundation for the organization’s financial success. The CIO is responsible for developing and executing investment strategies that align with the organization’s overall objectives, risk tolerance, and investment horizon. This involves:

- Asset Allocation: Determining the optimal mix of asset classes (e.g., stocks, bonds, real estate) to achieve the desired risk-return profile.

- Diversification: Spreading investments across different asset classes, industries, and geographic regions to reduce risk.

- Risk Management: Identifying and mitigating potential risks that could impact investment performance.

- Performance Monitoring: Regularly tracking and evaluating investment performance against benchmarks and objectives.

By developing and executing sound investment strategies, CIOs play a critical role in achieving the organization’s long-term financial goals and creating value for stakeholders.

Portfolio Management

Portfolio management is a critical component of a Chief Investment Officer’s (CIO) role. It involves overseeing and managing investment portfolios to achieve specific financial objectives. This includes determining the optimal mix of assets (asset allocation), assessing and managing risk, and monitoring performance to ensure alignment with investment goals.

Effective portfolio management requires a deep understanding of financial markets, investment strategies, and risk management techniques. CIOs must continuously monitor market conditions, identify investment opportunities, and make informed decisions to adjust portfolios as needed.

The importance of portfolio management cannot be overstated. It helps organizations achieve their financial goals by:

- Maximizing returns: Diversifying investments across different asset classes and sectors can enhance returns and reduce risk.

- Managing risk: Implementing risk management strategies helps mitigate potential losses and protect investments from market volatility.

- Achieving investment objectives: Aligning portfolio management with the organization’s investment goals ensures that financial objectives are met.

CIOs play a vital role in managing investment portfolios and ensuring that they align with the organization’s financial objectives and risk tolerance. Effective portfolio management is essential for achieving long-term investment success and creating value for stakeholders.

Research and Analysis

Chief Investment Officers (CIOs) rely heavily on research and analysis to make informed investment decisions and achieve their financial goals. This process involves:

- Market Research: Analyzing economic data, industry trends, and company financials to identify investment opportunities.

- Company Analysis: Evaluating the financial health, competitive landscape, and management team of potential investments.

- Risk Assessment: Identifying and assessing potential risks that could impact investment performance.

- Trend Analysis: Monitoring market trends and economic indicators to anticipate future market movements.

By conducting thorough research and analysis, CIOs gain a deep understanding of the investment landscape and can make informed decisions about where to allocate capital. This is critical for achieving the organization’s financial objectives and creating value for stakeholders.

Here’s a real-life example:

A CIO conducted extensive research on the healthcare sector and identified a promising investment opportunity in a medical device company. Through in-depth analysis of the company’s financials, market share, and competitive landscape, the CIO determined that the company was undervalued and had the potential for significant growth. The CIO invested in the company, and over time, the investment generated substantial returns for the organization.

This example highlights the importance of research and analysis in the role of a CIO. By leveraging their expertise and conducting thorough due diligence, CIOs can make informed investment decisions that drive financial success.

Risk Management

Risk management is a critical aspect of a Chief Investment Officer’s (CIO) role. It involves identifying, assessing, and mitigating potential risks that could impact investment performance and jeopardize the organization’s financial objectives.

- Risk Identification: CIOs identify potential risks that could affect investment portfolios, such as market volatility, economic downturns, and geopolitical events.

- Risk Assessment: CIOs evaluate the likelihood and potential impact of identified risks, assessing their severity and potential consequences.

- Risk Mitigation: CIOs develop and implement risk management strategies to reduce the potential impact of identified risks. This may involve diversifying portfolios, hedging against risks, or adjusting investment strategies.

- Risk Monitoring: CIOs continuously monitor risks and adjust risk management strategies as needed in response to changing market conditions and new information.

Effective risk management is essential for CIOs to achieve the organization’s investment goals while preserving capital and protecting against potential losses. It enables CIOs to make informed decisions, manage volatility, and enhance the overall performance of investment portfolios.

Team Leadership

Team leadership is a critical component of a Chief Investment Officer’s (CIO) role. Leading a team of investment professionals requires exceptional leadership skills, effective communication, and the ability to foster a collaborative work environment.

CIOs are responsible for setting the strategic direction for their team and ensuring that all members are aligned with the organization’s investment objectives. They provide guidance, mentorship, and support to their team members, helping them develop their skills and knowledge.

Effective team leadership is essential for several reasons:

- Investment Performance: A well-led team can contribute to improved investment performance through collaboration, knowledge sharing, and diverse perspectives.

- Talent Retention: Strong leadership can foster a positive work environment that attracts and retains talented investment professionals.

- Risk Management: Team leadership promotes open communication and information sharing, which helps identify and mitigate risks.

- Succession Planning: CIOs play a crucial role in developing future leaders within the investment team.

Here’s a real-life example:

A CIO recognized the importance of team leadership and invested significant effort in developing his team. He created a culture of open communication, encouraged collaboration, and provided regular mentorship to his team members. As a result, the team developed a deep understanding of the investment strategies and consistently exceeded performance targets.

This example underscores the significance of team leadership in the role of a CIO. By effectively leading and mentoring their teams, CIOs can drive investment success and create a sustainable investment environment.

Stakeholder Management

Stakeholder management is a critical aspect of a Chief Investment Officer’s (CIO) role. CIOs are responsible for maintaining strong relationships with investors, clients, and other stakeholders to ensure alignment of interests and effective communication.

Effective stakeholder management is essential for several reasons:

- Trust and Confidence: Maintaining open and transparent communication builds trust and confidence among stakeholders, fostering long-term relationships.

- Feedback and Insights: Engaging with stakeholders provides valuable feedback and insights that can inform investment decisions and improve overall performance.

- Risk Mitigation: Proactive stakeholder management can help identify and mitigate potential risks, enhancing the resilience of investment portfolios.

- Reputation Management: A positive reputation among stakeholders is essential for attracting and retaining investors and clients.

Here’s a real-life example:

A CIO made a conscious effort to engage with investors and clients regularly, providing updates on investment performance and market trends. This proactive communication fostered trust and confidence, leading to increased investor loyalty and long-term relationships.

The connection between stakeholder management and what is a chief investment officer is evident in the critical role CIOs play in managing relationships and ensuring alignment with stakeholders’ interests. Effective stakeholder management contributes to the overall success and sustainability of investment strategies.

Performance Evaluation

Performance evaluation is a crucial component of a Chief Investment Officer’s (CIO) role. It involves regularly assessing the performance of investment portfolios against benchmarks and objectives, identifying areas for improvement, and making necessary adjustments to enhance returns and achieve investment goals.

The connection between performance evaluation and what is a chief investment officer lies in the CIO’s responsibility to ensure that investment strategies are aligned with the organization’s financial objectives and risk tolerance. Through performance evaluation, CIOs gain insights into the effectiveness of their investment decisions and can make informed adjustments to optimize portfolio performance.

Here’s a real-life example:

A CIO conducted a thorough performance evaluation of an equity portfolio and identified that a particular sector was underperforming. After careful analysis, the CIO decided to adjust the portfolio’s allocation, reducing exposure to the underperforming sector and increasing exposure to sectors with higher growth potential. This adjustment resulted in improved overall portfolio performance, bringing it closer to the desired risk-return profile.

This example demonstrates the practical significance of performance evaluation in the role of a CIO. By continuously evaluating performance and making necessary adjustments, CIOs can enhance the effectiveness of investment strategies, maximize returns, and mitigate risks.

| Key Insight | Practical Application |

|---|---|

| Regular performance evaluation enables CIOs to identify areas for improvement in investment strategies. | CIOs can make informed decisions to adjust asset allocation, risk management techniques, or investment objectives based on performance evaluation findings. |

| Performance evaluation helps CIOs stay aligned with the organization’s financial goals and risk tolerance. | CIOs can ensure that investment portfolios are meeting the desired risk-return profile and contributing to the organization’s long-term financial success. |

In summary, performance evaluation is an essential aspect of what is a chief investment officer, as it allows CIOs to assess the effectiveness of investment strategies, identify areas for improvement, and make necessary adjustments to optimize portfolio performance and achieve organizational financial objectives.

Compliance and Regulation

In the realm of finance, compliance and regulation play a pivotal role in ensuring the integrity and fairness of investment practices. Chief Investment Officers (CIOs) bear the responsibility of adhering to industry regulations and ethical standards, fostering transparency and accountability within their organizations.

- Regulatory Oversight: CIOs navigate complex regulatory landscapes, ensuring that investment activities align with established rules and guidelines. They work closely with legal and compliance teams to interpret and implement regulations, mitigating legal and reputational risks.

- Ethical Conduct: Beyond regulatory compliance, CIOs uphold ethical standards that govern investment decision-making. They avoid conflicts of interest, maintain confidentiality, and act with integrity in all their dealings. Ethical conduct fosters trust among investors and stakeholders, enhancing the reputation of the organization.

- Risk Management: Compliance and regulation are closely intertwined with risk management. By adhering to industry standards and ethical guidelines, CIOs proactively identify and manage risks that could jeopardize investments or damage the organization’s reputation.

- Investor Protection: Compliance and regulation serve as safeguards for investors, ensuring that their interests are protected. CIOs play a crucial role in implementing policies and procedures that promote fair treatment, transparency, and disclosure of relevant information.

The connection between compliance and regulation and “what is a chief investment officer” lies in the fundamental responsibility of CIOs to operate within the boundaries of the law and ethical conduct. By embracing compliance and regulation, CIOs demonstrate their commitment to responsible investment practices, inspire confidence among stakeholders, and contribute to the stability and integrity of the financial markets.

Continuing Education

In the dynamic and ever-evolving world of finance, continuing education is not merely an option but a necessity for Chief Investment Officers (CIOs). To stay ahead of the curve, CIOs engage in ongoing professional development to enhance their knowledge, skills, and expertise.

- Keeping Pace with Market Evolution: Financial markets are constantly changing, driven by technological advancements, regulatory shifts, and economic fluctuations. CIOs who continuously update their knowledge through seminars, conferences, and industry publications can better navigate these evolving landscapes and make informed investment decisions.

- Enhancing Investment Strategies: Ongoing professional development allows CIOs to explore innovative investment strategies, risk management techniques, and portfolio optimization methods. By staying abreast of best practices, they can refine their investment approaches to meet the evolving needs and objectives of their organizations.

- Expanding Industry Network: Professional development opportunities often provide platforms for CIOs to connect with peers, thought leaders, and industry experts. This networking fosters knowledge exchange, facilitates collaboration, and expands their professional circle, leading to valuable insights and potential investment opportunities.

- Maintaining Ethical Standards: The financial industry is built on trust and integrity. CIOs who participate in continuing education programs demonstrate their commitment to maintaining high ethical standards and adhering to industry regulations. This not only enhances their credibility but also inspires confidence among investors and stakeholders.

The connection between continuing education and “what is a chief investment officer” is evident in the critical role that ongoing professional development plays in shaping the knowledge, skills, and ethical foundation of CIOs. By continuously investing in their education, CIOs position themselves as leaders in the field, equipped to make sound investment decisions, adapt to changing market dynamics, and contribute to the overall success of their organizations.

Decision-Making

Decision-making is a cornerstone of a Chief Investment Officer’s (CIO) role, as it directly relates to the core function of managing investments and driving financial performance. CIOs are responsible for making critical investment decisions that can significantly impact the organization’s financial future.

- Data-Driven Decisions: CIOs leverage data analytics to identify investment opportunities, assess market trends, and make informed decisions. They use quantitative and qualitative data to build financial models, conduct risk assessments, and evaluate investment performance.

- Market Expertise: CIOs possess deep knowledge of financial markets, economic conditions, and industry dynamics. They monitor market movements, analyze industry trends, and stay abreast of geopolitical events to make well-informed investment decisions.

- Risk Management: Risk assessment is an integral part of CIOs’ decision-making process. They identify potential risks associated with investments, evaluate their likelihood and impact, and develop strategies to mitigate those risks.

- Investment Strategy Alignment: CIOs’ investment decisions are guided by the organization’s overall investment strategy and risk tolerance. They make decisions that align with the long-term financial goals and objectives of the organization.

These facets of decision-making collectively contribute to the success of a CIO. By making data-driven, market-informed, and risk-assessed investment decisions, CIOs can optimize investment performance, manage risks, and achieve the organization’s financial objectives.

FAQs on “What is a Chief Investment Officer”

This section addresses frequently asked questions to provide a comprehensive understanding of the role and responsibilities of a Chief Investment Officer (CIO).

Question 1: What are the primary responsibilities of a CIO?

CIOs are responsible for developing and executing investment strategies, managing investment portfolios, conducting research and analysis, implementing risk management strategies, leading investment teams, and ensuring compliance with industry regulations and ethical standards.

Question 2: What qualifications and skills are required to become a CIO?

Typically, CIOs hold advanced degrees in finance, economics, or a related field, and possess strong analytical, decision-making, and leadership skills. They must have a deep understanding of financial markets, investment strategies, and risk management techniques.

Question 3: What is the importance of risk management in a CIO’s role?

Risk management is crucial for CIOs as it enables them to identify, assess, and mitigate potential risks that could impact investment performance. Effective risk management helps protect investments, manage volatility, and achieve long-term financial goals.

Question 4: How do CIOs make investment decisions?

CIOs make investment decisions based on data analysis, market insights, and risk assessment. They use quantitative and qualitative data to build financial models, conduct risk assessments, and evaluate investment performance, ensuring that decisions align with the organization’s investment strategy and risk tolerance.

Question 5: What is the role of a CIO in stakeholder management?

CIOs are responsible for maintaining relationships with investors, clients, and other stakeholders. Effective stakeholder management fosters trust and confidence, provides valuable feedback and insights, helps mitigate risks, and enhances the organization’s reputation.

Question 6: How does continuing education contribute to the role of a CIO?

Continuing education is essential for CIOs to stay abreast of industry trends, enhance their knowledge and skills, and maintain ethical standards. By participating in professional development programs, CIOs demonstrate their commitment to ongoing learning and contribute to the overall success of their organizations.

Summary: CIOs play a critical role in managing investments and driving financial performance for organizations. Their responsibilities encompass a wide range of activities, including developing investment strategies, managing portfolios, conducting research, managing risk, leading teams, and ensuring compliance. Effective CIOs possess strong analytical, decision-making, and leadership skills, and are committed to ongoing professional development.

Transition to the next article section:

This concludes our FAQs on “What is a Chief Investment Officer.” For further insights into the world of finance and investment, explore our comprehensive article library.

Tips

Chief Investment Officers (CIOs) play a crucial role in managing investments and driving financial performance. Here are some tips to enhance your understanding of the role and its responsibilities:

Tip 1: Understand the Core Responsibilities of a CIO

CIOs are responsible for developing and executing investment strategies, managing investment portfolios, conducting research and analysis, implementing risk management strategies, leading investment teams, and ensuring compliance with industry regulations and ethical standards.

Tip 2: Develop Strong Analytical and Decision-Making Skills

CIOs must possess strong analytical skills to evaluate financial data, market trends, and investment opportunities. They should also have excellent decision-making abilities to make sound investment choices and manage risk effectively.

Tip 3: Stay Abreast of Industry Trends and Best Practices

The financial industry is constantly evolving, so it’s important for CIOs to stay up-to-date on the latest trends and best practices. Attending industry conferences, reading financial publications, and pursuing professional development opportunities can help CIOs enhance their knowledge and skills.

Tip 4: Build a Strong Network

Networking with other CIOs, industry experts, and potential investors can provide valuable insights, investment opportunities, and career growth prospects. Attending industry events and participating in professional organizations can help CIOs expand their network.

Tip 5: Seek Mentorship and Guidance

Finding a mentor who is an experienced CIO can provide valuable guidance and support. Mentors can share their insights, offer advice, and help CIOs navigate the challenges of the role.

Summary:

By following these tips, individuals can gain a deeper understanding of the role of a Chief Investment Officer and the essential skills and qualities required to succeed in this critical position.

Transition to the article’s conclusion:

This concludes our tips on “What is a Chief Investment Officer.” For further insights into the world of finance and investment, explore our comprehensive article library.

Conclusion

In conclusion, a Chief Investment Officer (CIO) plays a vital role in managing investments and driving financial performance for organizations. CIOs are responsible for developing and executing investment strategies, managing investment portfolios, conducting research and analysis, implementing risk management strategies, leading investment teams, and ensuring compliance with industry regulations and ethical standards.

Effective CIOs possess strong analytical, decision-making, and leadership skills, and are committed to ongoing professional development. They stay abreast of industry trends and best practices, build strong networks, and seek mentorship to enhance their knowledge and expertise.

The role of a CIO is critical to the success of organizations, as they are entrusted with managing and growing financial assets to achieve long-term financial goals.

Youtube Video: