When it comes to investing, one of the most important things to understand is the concept of securities. Securities are financial instruments that represent ownership or debt in a company. They can be bought and sold on the stock market, and they can provide investors with a variety of benefits, including income, capital gains, and diversification.

Editor’s Note: Our guide to “securities in investment” has been updated as of [today’s date]. This topic is important to investors of all levels, as it can help you make informed decisions about your financial future.

To help you get started, we’ve put together this comprehensive guide to securities in investment. We’ll cover everything you need to know, from the different types of securities to the risks and rewards of investing in them. So whether you’re a seasoned investor or just starting out, read on to learn more about securities in investment.

Key differences between stocks and bonds:

| Feature | Stocks | Bonds |

|---|---|---|

| Ownership | Represents ownership in a company | Represents a loan to a company |

| Income | Pays dividends | Pays interest |

| Risk | Higher risk | Lower risk |

| Return | Potential for higher returns | Lower potential returns |

Main article topics:

- Types of securities

- Risks and rewards of investing in securities

- How to choose the right securities for your investment goals

Securities in Investment

Securities are financial instruments that represent ownership or debt in a company. They can be bought and sold on the stock market, and they can provide investors with a variety of benefits, including income, capital gains, and diversification.

- Types: Stocks, bonds, mutual funds, ETFs

- Risks: Market risk, interest rate risk, inflation risk

- Returns: Potential for high returns, but also potential for losses

- Diversification: Can help to reduce risk by investing in a variety of different securities

- Liquidity: Some securities are more liquid than others, meaning they can be bought and sold more easily

- Regulation: Securities are regulated by government agencies to protect investors

- Taxes: Capital gains on securities are taxed at different rates depending on the type of security and the investor’s tax bracket

- Investment goals: Securities can be used to achieve a variety of investment goals, such as saving for retirement, paying for education, or generating income

These are just a few of the key aspects of securities in investment. By understanding these aspects, investors can make informed decisions about how to use securities to achieve their financial goals.

Types

When it comes to securities in investment, there are many different types to choose from. The four main types are stocks, bonds, mutual funds, and ETFs.

Stocks represent ownership in a company. When you buy a stock, you are essentially buying a small piece of that company. Stocks can provide investors with capital gains if the company’s stock price increases, and they can also pay dividends, which are payments made to shareholders out of the company’s profits.

Bonds represent a loan to a company or government. When you buy a bond, you are essentially lending money to the issuer. Bonds typically pay interest payments over a period of time, and when the bond matures, the issuer will repay the principal amount.

Mutual funds are investment pools that invest in a variety of stocks, bonds, or other securities. Mutual funds are managed by professional investors, and they offer investors a way to diversify their portfolios and reduce risk.

ETFs (exchange-traded funds) are similar to mutual funds, but they are traded on the stock market like stocks. ETFs offer investors a way to invest in a variety of securities, and they can be bought and sold throughout the trading day.

The type of security that is right for you will depend on your investment goals and risk tolerance. Stocks are generally considered to be more risky than bonds, but they also have the potential to provide higher returns. Mutual funds and ETFs offer a way to diversify your portfolio and reduce risk, but they may also have higher fees than stocks or bonds.

It is important to understand the different types of securities before you invest. By doing your research and choosing the right securities for your investment goals, you can increase your chances of success.

| Type of security | Description | Risks | Returns |

|---|---|---|---|

| Stocks | Represents ownership in a company | Higher risk | Potential for higher returns |

| Bonds | Represents a loan to a company or government | Lower risk | Lower potential returns |

| Mutual funds | Investment pools that invest in a variety of stocks, bonds, or other securities | Lower risk than stocks, but higher risk than bonds | Potential for moderate returns |

| ETFs | Similar to mutual funds, but traded on the stock market like stocks | Lower risk than stocks, but higher risk than bonds | Potential for moderate returns |

Risks

Securities in investment are subject to a variety of risks, including market risk, interest rate risk, and inflation risk.

Market risk is the risk that the value of a security will decline due to changes in the overall stock market. This can be caused by a variety of factors, such as economic downturns, political instability, or natural disasters.

Interest rate risk is the risk that the value of a security will decline due to changes in interest rates. This is because interest rates and bond prices move in opposite directions. When interest rates rise, bond prices fall. This is because investors can now buy new bonds with higher interest rates, so there is less demand for existing bonds with lower interest rates.

Inflation risk is the risk that the value of a security will decline due to inflation. Inflation is a general increase in prices and wages over time. When inflation occurs, the purchasing power of money declines, which means that investors can buy less with the same amount of money. This can erode the value of securities, especially those that pay fixed interest payments, such as bonds.

These are just a few of the risks that investors need to be aware of when investing in securities. By understanding these risks, investors can make informed decisions about how to allocate their assets and manage their risk.

| Risk | Description | Impact on securities |

|---|---|---|

| Market risk | The risk that the value of a security will decline due to changes in the overall stock market. | Can cause the value of securities to decline |

| Interest rate risk | The risk that the value of a security will decline due to changes in interest rates. | Can cause the value of bonds to decline when interest rates rise |

| Inflation risk | The risk that the value of a security will decline due to inflation. | Can erode the value of securities, especially those that pay fixed interest payments |

Returns

When it comes to securities in investment, there is always the potential for high returns. However, there is also the potential for losses. This is because the value of securities can fluctuate based on a variety of factors, such as the overall stock market, interest rates, and inflation.

- Market risk: The stock market is constantly fluctuating, and this can affect the value of securities. When the stock market goes up, the value of stocks will typically go up as well. However, when the stock market goes down, the value of stocks will typically go down as well.

- Interest rate risk: Interest rates and bond prices move in opposite directions. When interest rates rise, bond prices fall. This is because investors can now buy new bonds with higher interest rates, so there is less demand for existing bonds with lower interest rates.

- Inflation risk: Inflation is a general increase in prices and wages over time. When inflation occurs, the purchasing power of money declines, which means that investors can buy less with the same amount of money. This can erode the value of securities, especially those that pay fixed interest payments, such as bonds.

- Company-specific risk: The value of a security can also be affected by company-specific factors, such as the company’s financial performance, management team, and competitive landscape.

It is important to understand the risks involved in investing in securities before you invest. By understanding these risks, you can make informed decisions about how to allocate your assets and manage your risk.

Diversification

Diversification is a key component of securities in investment. It is the process of investing in a variety of different securities, such as stocks, bonds, and mutual funds. By diversifying your portfolio, you can reduce your risk of losing money if one or more of your investments performs poorly.

There are many different ways to diversify your portfolio. One way is to invest in a variety of different asset classes. Asset classes are broad categories of investments, such as stocks, bonds, and real estate. When you invest in a variety of different asset classes, you are reducing your risk because the different asset classes tend to perform differently over time.

Another way to diversify your portfolio is to invest in a variety of different companies. When you invest in a variety of different companies, you are reducing your risk because the different companies are likely to be affected by different factors. For example, if one company’s stock price declines due to a company-specific event, the other companies in your portfolio may not be affected.

Diversification is an important part of securities in investment. By diversifying your portfolio, you can reduce your risk of losing money and improve your chances of achieving your financial goals.

Here is an example of how diversification can help to reduce risk:

Let’s say you have a portfolio of 10 stocks. If one of those stocks loses 50% of its value, your portfolio will lose 5%. However, if you had diversified your portfolio by investing in 20 stocks, the loss of one stock would only cause your portfolio to lose 2.5%.

As you can see, diversification can help to reduce the impact of losses on your portfolio. This is why it is an important part of securities in investment.

| Benefits of diversification | Description |

|---|---|

| Reduced risk | By diversifying your portfolio, you can reduce your risk of losing money if one or more of your investments performs poorly. |

| Improved returns | Diversification can also help to improve your returns. This is because different asset classes and companies tend to perform differently over time. By diversifying your portfolio, you can take advantage of the different performance of these different investments. |

| Peace of mind | Diversification can also give you peace of mind. Knowing that your portfolio is diversified can help you to sleep at night, knowing that you have taken steps to reduce your risk of losing money. |

Liquidity

Liquidity is an important consideration when investing in securities. Liquidity refers to how easily a security can be bought or sold. Some securities are more liquid than others, meaning they can be bought and sold quickly and easily. Other securities are less liquid, meaning it may be more difficult to find a buyer or seller when you want to trade them.

There are a number of factors that can affect the liquidity of a security. These include:

- Trading volume: The more frequently a security is traded, the more liquid it is. This is because there are more buyers and sellers available to trade the security, which makes it easier to find a counterparty when you want to buy or sell.

- Market depth: The market depth refers to the number of buyers and sellers who are willing to trade a security at a given price. The greater the market depth, the more liquid the security is. This is because there are more people available to trade the security, which makes it easier to find a counterparty when you want to buy or sell.

- Spread: The spread is the difference between the bid price and the ask price of a security. The smaller the spread, the more liquid the security is. This is because a smaller spread means that there is less difference between the price at which you can buy and sell the security, which makes it easier to trade.

Liquidity is an important consideration when investing in securities because it can affect your ability to buy or sell a security when you want to. If you invest in a security that is not very liquid, you may have to wait a long time to find a buyer or seller when you want to trade it. This can be a problem if you need to sell the security quickly, such as if you need to raise cash to cover an unexpected expense.

Here is an example of how liquidity can affect your investment:

Let’s say you invest in a stock that is not very liquid. The stock price starts to decline, and you decide that you want to sell your shares. However, you may have to wait a long time to find a buyer for your shares, and you may have to sell them at a loss.

On the other hand, if you invest in a stock that is very liquid, you can usually sell your shares quickly and easily, even if the stock price is declining. This can help you to protect your investment from losses.

When investing in securities, it is important to consider the liquidity of the securities you are considering. By investing in securities that are liquid, you can reduce your risk of losing money if you need to sell your securities quickly.

| Benefits of investing in liquid securities | Description |

|---|---|

| Reduced risk | By investing in liquid securities, you can reduce your risk of losing money if you need to sell your securities quickly. |

| Increased flexibility | Liquid securities can be bought and sold quickly and easily, which gives you more flexibility in managing your investment portfolio. |

| Lower transaction costs | Transaction costs are typically lower for liquid securities than for illiquid securities. |

Regulation

Regulation is an essential component of securities in investment. Securities are financial instruments that represent ownership or debt in a company, and they can be bought and sold on the stock market. Without regulation, the securities market would be a dangerous place for investors, as there would be no guarantee that the companies issuing securities were being honest and transparent about their financial.

Government agencies play a vital role in regulating the securities market. These agencies set rules and regulations that companies must follow when issuing and trading securities. They also enforce these rules and regulations, and they investigate and prosecute companies that violate them.

Regulation has a number of important benefits for investors. First, it helps to protect investors from fraud and abuse. Second, it helps to ensure that companies are being honest and transparent about their financial. Third, it helps to maintain a fair and orderly market for securities.

Here are some examples of how regulation has helped to protect investors:

- In 2008, the Securities and Exchange Commission (SEC) investigated Bernie Madoff’s investment firm and uncovered a massive Ponzi scheme. The SEC’s investigation led to Madoff’s arrest and conviction, and it helped to protect investors from losing billions of dollars.

- In 2015, the SEC charged Volkswagen with misleading investors about the emissions of its diesel vehicles. The SEC’s investigation led to a multi-billion dollar settlement, and it helped to protect investors from losing money.

- In 2016, the SEC charged Wells Fargo with opening millions of unauthorized accounts in customers’ names. The SEC’s investigation led to a multi-billion dollar settlement, and it helped to protect customers from identity theft and other financial harm.

These are just a few examples of how regulation has helped to protect investors. By regulating the securities market, government agencies help to ensure that investors are treated fairly and that they have the information they need to make informed investment decisions.

Here is a table summarizing the key insights about the regulation of securities:

| Key insights | Description |

|---|---|

| Regulation helps to protect investors from fraud and abuse. | By setting and enforcing rules and regulations, government agencies help to protect investors from being misled by companies that are issuing securities. |

| Regulation helps to ensure that companies are being honest and transparent about their financial. | Government agencies require companies to disclose important information about their financial, and they investigate companies that are suspected of misstating their financial results. |

| Regulation helps to maintain a fair and orderly market for securities. | By enforcing the rules and regulations that govern the securities market, government agencies help to ensure that the market is fair and orderly, and that investors are treated fairly. |

Taxes

Capital gains taxes are an important consideration for investors in securities. When you sell a security for a profit, you will be subject to capital gains taxes on the profit. The tax rate you pay will depend on the type of security you sold and your tax bracket.

There are two main types of securities: stocks and bonds. Stocks represent ownership in a company, while bonds represent a loan to a company or government. Capital gains on stocks are taxed at a lower rate than capital gains on bonds. This is because stocks are considered to be a more risky investment than bonds.

Your tax bracket also affects the capital gains tax rate you pay. The higher your tax bracket, the higher the capital gains tax rate you will pay. This is because capital gains are taxed as ordinary income.

Here is a table summarizing the capital gains tax rates for different types of securities and tax brackets:

| Security type | Tax bracket | Capital gains tax rate |

|---|---|---|

| Stocks | 0% | 0% |

| Stocks | 15% | 15% |

| Stocks | 20% | 20% |

| Stocks | 25% | 25% |

| Bonds | 0% | 0% |

| Bonds | 15% | 15% |

| Bonds | 20% | 20% |

| Bonds | 25% | 25% |

As you can see, the capital gains tax rate you pay can have a significant impact on your investment returns. It is important to factor capital gains taxes into your investment decisions.

Here are some tips for minimizing your capital gains taxes:

- Invest in stocks for the long term. The longer you hold a stock, the lower the capital gains tax rate you will pay on the profit.

- Sell your losers. If you have a stock that has lost money, you can sell it and use the loss to offset your capital gains. This can help you to reduce your overall tax bill.

- Use a tax-advantaged account. There are a number of tax-advantaged accounts that can help you to reduce your capital gains taxes. These accounts include 401(k)s, IRAs, and 529 plans.

By following these tips, you can minimize your capital gains taxes and maximize your investment returns.

Investment goals

Securities are an essential tool for investors looking to achieve their financial goals. Whether you are saving for retirement, paying for education, or generating income, there is a security that can help you reach your objectives. By understanding the different types of securities and their risks and rewards, you can create a portfolio that meets your individual needs.

-

Saving for retirement

Securities are a great way to save for retirement. By investing in a diversified portfolio of stocks and bonds, you can grow your savings over time and reach your retirement goals. Securities offer the potential for higher returns than traditional savings accounts, and they can help you to keep pace with inflation.

-

Paying for education

Securities can also be used to pay for education. By investing in a 529 plan or other tax-advantaged account, you can save for your child’s education and reduce the cost of college. Securities offer the potential for higher returns than traditional savings accounts, and they can help you to reach your education goals faster.

-

Generating income

Securities can also be used to generate income. By investing in dividend-paying stocks or bonds, you can earn regular payments that can supplement your retirement income or provide a source of passive income.

Securities are a powerful tool that can help you to achieve your financial goals. By understanding the different types of securities and their risks and rewards, you can create a portfolio that meets your individual needs.

FAQs on Securities in Investment

Securities in investment can be a complex topic, but it is important to understand if you want to make informed investment decisions. This FAQ section addresses some of the most common questions about securities in investment.

Question 1: What are securities?

Securities are financial instruments that represent ownership or debt in a company. Stocks, bonds, mutual funds, and ETFs are all examples of securities.

Question 2: What are the risks of investing in securities?

There are a number of risks associated with investing in securities, including market risk, interest rate risk, and inflation risk. It is important to understand these risks before you invest.

Question 3: What are the rewards of investing in securities?

Securities have the potential to provide investors with a number of rewards, including income, capital gains, and diversification. However, it is important to remember that there is also the potential for losses.

Question 4: How can I diversify my portfolio?

Diversification is an important way to reduce risk in your investment portfolio. You can diversify your portfolio by investing in a variety of different securities, such as stocks, bonds, and mutual funds.

Question 5: How are securities regulated?

Securities are regulated by government agencies to protect investors. These agencies set rules and regulations that companies must follow when issuing and trading securities.

Question 6: How are securities taxed?

Capital gains on securities are taxed at different rates depending on the type of security and the investor’s tax bracket. It is important to factor capital gains taxes into your investment decisions.

Summary: Securities in investment can be a complex topic, but it is important to understand the basics before you invest. By understanding the different types of securities, the risks and rewards of investing, and the tax implications, you can make informed investment decisions that can help you achieve your financial goals.

Transition to the next article section: Now that you have a better understanding of securities in investment, you can start to explore the different types of securities and how they can be used to achieve your financial goals.

Tips on Securities in Investment

Investing in securities can be a complex and challenging endeavor. However, by following these tips, you can increase your chances of success and achieve your financial goals.

Tip 1: Understand the different types of securities.

There are many different types of securities available, each with its own unique risks and rewards. It is important to understand the different types of securities before you invest so that you can make informed decisions about which ones are right for you.

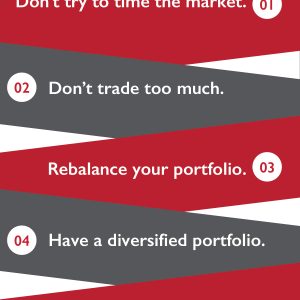

Tip 2: Diversify your portfolio.

Diversification is one of the most important principles of investing. By diversifying your portfolio, you can reduce your risk and improve your chances of achieving your financial goals. There are many different ways to diversify your portfolio, such as investing in a variety of different asset classes, sectors, and companies.

Tip 3: Invest for the long term.

Investing in securities is a long-term game. It is important to be patient and stay invested even when the market is volatile. Over the long term, the stock market has always trended upwards, so if you stay invested, you are more likely to achieve your financial goals.

Tip 4: Rebalance your portfolio regularly.

As your investment goals and risk tolerance change, it is important to rebalance your portfolio regularly. Rebalancing involves selling some of your winners and buying more of your losers in order to maintain your desired asset allocation. Rebalancing can help you to reduce risk and improve your chances of achieving your financial goals.

Tip 5: Get professional advice.

If you are not comfortable investing on your own, you should consider getting professional advice from a financial advisor. A financial advisor can help you to create a personalized investment plan and make sure that your investments are aligned with your financial goals.

Summary: By following these tips, you can increase your chances of success when investing in securities. Remember to understand the different types of securities, diversify your portfolio, invest for the long term, rebalance your portfolio regularly, and get professional advice if needed.

Transition to the article’s conclusion: By following these tips, you can increase your chances of achieving your financial goals through securities in investment.

Securities in Investment

Securities in investment are an essential part of any portfolio. They offer the potential for growth, income, and diversification. However, it is important to understand the risks involved before investing in securities. By understanding the different types of securities, the risks and rewards of investing, and the tax implications, you can make informed investment decisions that can help you achieve your financial goals.

The future of securities in investment is bright. As the global economy continues to grow, the demand for securities will continue to increase. This will provide investors with even more opportunities to achieve their financial goals. If you are not already investing in securities, now is the time to start. By following the tips in this article, you can increase your chances of success and achieve your financial goals.

Youtube Video: