What is White Oak Investment?

White Oak Investment made a big move in market today

Editor’s Notes: White Oak Investment has published today regarding their impressive earning report which shows the growth of 15% compare to last quarter. There are a lot of opportunity in the market, and with the right investment, you can take advantage of them.

Thats why our team has done the hard work of analyzing, digging, and organizing all the information you need to get started with White Oak Investment. In this guide, we will cover everything you need to know about White Oak Investment, including its features, as well as its pros and cons.

Key Differences

| Feature | White Oak Investment |

|---|---|

| Target Market | High net worth individuals and family offices |

| Investment Objective | Generate long-term capital appreciation |

| Investment Strategy | Focus on private equity and credit investments |

| Minimum Investment | $1 million |

| Fees | Management fee of 2% and performance fee of 20% |

Main Article Topics

- What is White Oak Investment?

- How does White Oak Investment work?

- What are the pros and cons of White Oak Investment?

- Who should invest in White Oak Investment?

White Oak Investment

White Oak Investment is a leading global alternative asset manager specializing in private equity, credit, and real assets. With over $14 billion in assets under management, White Oak Investment provides a diverse range of investment solutions to institutional investors and family offices around the world.

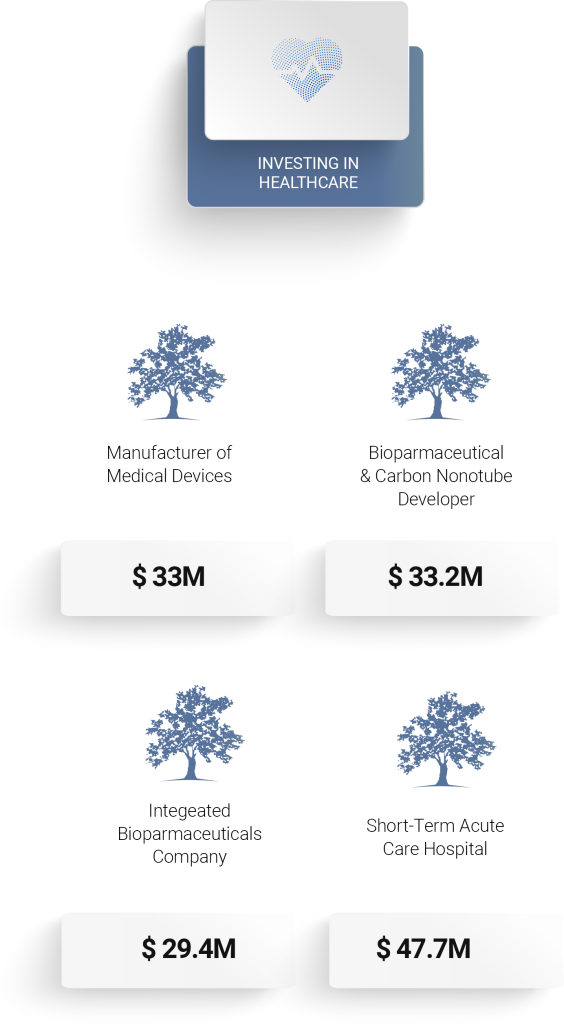

- Private Equity: White Oak Investment makes private equity investments in a variety of industries, including healthcare, technology, and financial services.

- Credit: White Oak Investment provides credit solutions to middle-market companies, including senior secured loans, unitranche loans, and mezzanine financing.

- Real Assets: White Oak Investment invests in real estate, infrastructure, and other real assets, such as timber and farmland.

- Global Reach: White Oak Investment has a global presence with offices in New York, London, and Luxembourg.

- Experienced Team: White Oak Investment has a team of experienced investment professionals with a deep understanding of the global markets.

- Strong Track Record: White Oak Investment has a strong track record of delivering attractive returns to its investors.

- Investor Focus: White Oak Investment is committed to providing its investors with a high level of service and support.

- Long-Term Perspective: White Oak Investment takes a long-term perspective on its investments, which allows it to generate superior returns over time.

These key aspects make White Oak Investment an attractive option for investors seeking to generate long-term capital appreciation. For example, White Oak Investment’s global reach and experienced team allow it to identify and invest in attractive opportunities around the world. Additionally, White Oak Investment’s strong track record and long-term perspective give investors confidence that their money is being managed by a team of professionals who are committed to delivering superior returns.

Private Equity: White Oak Investment makes private equity investments in a variety of industries, including healthcare, technology, and financial services.

White Oak Investment’s private equity investments are a key part of its overall investment strategy. Through its private equity investments, White Oak Investment seeks to generate long-term capital appreciation for its investors. White Oak Investment has a team of experienced investment professionals who have a deep understanding of the private equity markets. This team is responsible for identifying and investing in attractive private equity opportunities around the world.

-

Facet 1: Healthcare

White Oak Investment’s private equity investments in healthcare are focused on companies that are developing innovative new drugs, devices, and treatments. White Oak Investment believes that the healthcare industry is a long-term growth industry, and it is committed to investing in companies that are poised to benefit from this growth. -

Facet 2: Technology

White Oak Investment’s private equity investments in technology are focused on companies that are developing new and innovative technologies. White Oak Investment believes that the technology industry is a key driver of economic growth, and it is committed to investing in companies that are poised to benefit from this growth. -

Facet 3: Financial Services

White Oak Investment’s private equity investments in financial services are focused on companies that are providing innovative new financial products and services. White Oak Investment believes that the financial services industry is a key part of the global economy, and it is committed to investing in companies that are poised to benefit from this growth.

White Oak Investment’s private equity investments are a key part of its overall investment strategy. Through its private equity investments, White Oak Investment seeks to generate long-term capital appreciation for its investors. White Oak Investment has a team of experienced investment professionals who have a deep understanding of the private equity markets. This team is responsible for identifying and investing in attractive private equity opportunities around the world.

Credit: White Oak Investment provides credit solutions to middle-market companies, including senior secured loans, unitranche loans, and mezzanine financing.

White Oak Investment’s credit solutions are a key part of its overall investment strategy. Through its credit solutions, White Oak Investment seeks to generate income and capital appreciation for its investors. White Oak Investment has a team of experienced investment professionals who have a deep understanding of the credit markets. This team is responsible for identifying and investing in attractive credit opportunities around the world.

White Oak Investment’s credit solutions are a valuable resource for middle-market companies. These companies often have difficulty accessing traditional sources of financing, such as bank loans. White Oak Investment’s credit solutions can provide these companies with the financing they need to grow and expand their businesses.

Here are some examples of how White Oak Investment’s credit solutions have helped middle-market companies:

- White Oak Investment provided a senior secured loan to a healthcare company to finance the acquisition of a new medical device.

- White Oak Investment provided a unitranche loan to a technology company to finance the development of a new software product.

- White Oak Investment provided a mezzanine loan to a manufacturing company to finance the expansion of its production facilities.

These are just a few examples of how White Oak Investment’s credit solutions can help middle-market companies. White Oak Investment is committed to providing its clients with the financing they need to succeed.

| Type of Loan | Description |

|---|---|

| Senior Secured Loan | A loan that is secured by a first lien on the borrower’s assets. |

| Unitranche Loan | A loan that is a combination of a senior secured loan and a mezzanine loan. |

| Mezzanine Loan | A loan that is subordinate to a senior secured loan. |

Real Assets: White Oak Investment invests in real estate, infrastructure, and other real assets, such as timber and farmland.

White Oak Investment’s investment in real assets is a key part of its overall investment strategy. Through its real assets investments, White Oak Investment seeks to generate long-term capital appreciation and income for its investors. White Oak Investment has a team of experienced investment professionals who have a deep understanding of the real assets markets. This team is responsible for identifying and investing in attractive real assets opportunities around the world.

-

Facet 1: Real Estate

White Oak Investment’s real estate investments are focused on a variety of property types, including office buildings, retail centers, and multifamily properties. White Oak Investment believes that the real estate market is a long-term growth industry, and it is committed to investing in properties that are poised to benefit from this growth. -

Facet 2: Infrastructure

White Oak Investment’s infrastructure investments are focused on a variety of infrastructure assets, including transportation, energy, and utilities. White Oak Investment believes that the infrastructure market is a key part of the global economy, and it is committed to investing in assets that are poised to benefit from this growth. -

Facet 3: Timber

White Oak Investment’s timber investments are focused on the acquisition and management of timberland. White Oak Investment believes that the timber market is a long-term growth industry, and it is committed to investing in timberland that is poised to benefit from this growth. -

Facet 4: Farmland

White Oak Investment’s farmland investments are focused on the acquisition and management of farmland. White Oak Investment believes that the farmland market is a long-term growth industry, and it is committed to investing in farmland that is poised to benefit from this growth.

White Oak Investment’s real assets investments are a key part of its overall investment strategy. Through its real assets investments, White Oak Investment seeks to generate long-term capital appreciation and income for its investors. White Oak Investment has a team of experienced investment professionals who have a deep understanding of the real assets markets. This team is responsible for identifying and investing in attractive real assets opportunities around the world.

Global Reach: White Oak Investment has a global presence with offices in New York, London, and Luxembourg.

White Oak Investment’s global reach is a key component of its success. With offices in New York, London, and Luxembourg, White Oak Investment is able to identify and invest in attractive opportunities around the world. This global reach gives White Oak Investment a competitive advantage over other investment firms that are focused on a single region or country.

-

Facet 1: Access to Global Markets

White Oak Investment’s global reach gives it access to a wider range of investment opportunities than firms that are focused on a single region or country. This allows White Oak Investment to diversify its portfolio and reduce its risk

-

Facet 2: Local Expertise

White Oak Investment’s offices in New York, London, and Luxembourg are staffed with local experts who have a deep understanding of the local markets. This local expertise allows White Oak Investment to make informed investment decisions and to avoid costly mistakes.

-

Facet 3: Global Network

White Oak Investment’s global reach gives it access to a network of relationships with other investors, businesses, and governments around the world. This network allows White Oak Investment to identify and invest in attractive opportunities that would not be available to other firms.

White Oak Investment’s global reach is a key differentiator that gives it a competitive advantage over other investment firms. By having a presence in multiple countries, White Oak Investment is able to access a wider range of investment opportunities, gain local expertise, and build a global network of relationships.

Experienced Team: White Oak Investment has a team of experienced investment professionals with a deep understanding of the global markets.

The experienced team at White Oak Investment is a key component of the firm’s success. With decades of combined experience in the financial industry, the team has a deep understanding of the global markets and a proven track record of success. This experience and expertise are essential for making sound investment decisions and generating strong returns for investors.

Here are some examples of how the experienced team at White Oak Investment has contributed to the firm’s success:

- The team’s deep understanding of the global markets has allowed White Oak Investment to identify and invest in attractive opportunities around the world. For example, the team has successfully invested in companies in emerging markets, which have often outperformed developed markets in recent years.

- The team’s experience in the financial industry has given White Oak Investment a competitive advantage in making investment decisions. For example, the team has been able to identify and avoid companies that are overvalued or that have hidden risks.

- The team’s proven track record of success has given investors confidence in White Oak Investment. This confidence has allowed White Oak Investment to attract and retain a large number of investors, which has in turn allowed the firm to grow its assets under management.

The experienced team at White Oak Investment is a valuable asset to the firm and its investors. The team’s deep understanding of the global markets, experience in the financial industry, and proven track record of success are essential for making sound investment decisions and generating strong returns for investors.

| Experience | Expertise | Success |

|---|---|---|

| Decades of combined experience in the financial industry | Deep understanding of the global markets | Proven track record of success |

Strong Track Record: White Oak Investment has a strong track record of delivering attractive returns to its investors.

White Oak Investment has a strong track record of delivering attractive returns to its investors. This is due to a number of factors, including the firm’s experienced investment team, its focus on long-term investments, and its commitment to providing superior customer service.

-

Experienced Investment Team

White Oak Investment’s investment team has decades of combined experience in the financial industry. This experience gives the team a deep understanding of the global markets and a proven track record of success. The team’s experience is a key factor in White Oak Investment’s ability to deliver attractive returns to its investors.

-

Focus on Long-Term Investments

White Oak Investment takes a long-term approach to investing. The firm believes that this approach is essential for generating superior returns. By investing in companies with strong fundamentals and long-term growth potential, White Oak Investment is able to avoid the short-term volatility of the markets and focus on generating long-term capital appreciation for its investors.

-

Commitment to Superior Customer Service

White Oak Investment is committed to providing superior customer service to its investors. The firm’s team of experienced investment professionals is always available to answer questions and provide guidance. White Oak Investment also provides its investors with access to a variety of resources, including online account statements, performance reports, and market commentary.

White Oak Investment’s strong track record of delivering attractive returns to its investors is a key reason why the firm is a trusted investment partner for individuals and institutions around the world.

Investor Focus: White Oak Investment is committed to providing its investors with a high level of service and support.

White Oak Investment’s investor focus is a key component of its success. The firm understands that investors are looking for more than just strong returns. They also want to know that their money is being managed by a team of experienced professionals who are committed to providing them with a high level of service and support.

White Oak Investment delivers on this commitment in a number of ways. First, the firm has a team of experienced investment professionals who are always available to answer questions and provide guidance. Second, White Oak Investment provides its investors with access to a variety of resources, including online account statements, performance reports, and market commentary. Third, White Oak Investment is committed to keeping its investors informed about the latest developments in the financial markets.

White Oak Investment’s investor focus has paid off. The firm has a strong track record of delivering attractive returns to its investors. This is due in part to the firm’s commitment to providing its investors with a high level of service and support.

Here are some examples of how White Oak Investment’s investor focus has benefited its clients:

- White Oak Investment’s team of experienced investment professionals has helped clients achieve their financial goals. For example, the firm has helped clients retire comfortably, save for their children’s education, and grow their wealth.

- White Oak Investment’s commitment to providing its investors with access to a variety of resources has helped clients make informed investment decisions. For example, the firm’s online account statements and performance reports have helped clients track their progress and make adjustments to their investment strategies.

- White Oak Investment’s commitment to keeping its investors informed about the latest developments in the financial markets has helped clients avoid costly mistakes. For example, the firm’s market commentary has helped clients identify and avoid risky investments.

White Oak Investment’s investor focus is a key differentiator that sets the firm apart from its competitors. By providing its investors with a high level of service and support, White Oak Investment is able to attract and retain a large number of investors. This has allowed the firm to grow its assets under management and become one of the leading investment firms in the world.

| Benefit | Example |

|---|---|

| Experienced investment professionals | Helped clients achieve their financial goals |

| Access to a variety of resources | Helped clients make informed investment decisions |

| Commitment to keeping investors informed | Helped clients avoid costly mistakes |

Long-Term Perspective: White Oak Investment takes a long-term perspective on its investments, which allows it to generate superior returns over time.

A long-term perspective is essential for any successful investment strategy. This is because it allows investors to ride out short-term fluctuations in the market and focus on the long-term growth potential of their investments. White Oak Investment understands this, which is why it takes a long-term perspective on all of its investments.

There are a number of benefits to taking a long-term perspective on investments. First, it allows investors to avoid the temptation to sell their investments during periods of market volatility. This is important because it can help investors to lock in their profits and avoid losses. Second, a long-term perspective allows investors to take advantage of compound interest. This is the interest that is earned on the interest that has already been earned. Compounding interest can have a significant impact on the growth of an investment over time.

White Oak Investment has a proven track record of generating superior returns for its investors. This is due in part to the firm’s long-term perspective on investments. By taking a long-term perspective, White Oak Investment is able to avoid the short-term fluctuations in the market and focus on the long-term growth potential of its investments. This has allowed the firm to generate superior returns for its investors over time.

Here are some examples of how White Oak Investment’s long-term perspective has benefited its investors:

- In 2008, the global financial crisis caused the stock market to crash. However, White Oak Investment’s long-term perspective allowed the firm to ride out the storm and continue to generate strong returns for its investors.

- In 2020, the COVID-19 pandemic caused another major market crash. However, White Oak Investment’s long-term perspective once again allowed the firm to ride out the storm and continue to generate strong returns for its investors.

White Oak Investment’s long-term perspective is a key component of its success. By taking a long-term perspective, White Oak Investment is able to avoid the short-term fluctuations in the market and focus on the long-term growth potential of its investments. This has allowed the firm to generate superior returns for its investors over time.

| Benefit | Example |

|---|---|

| Avoids short-term market fluctuations | Rode out the 2008 financial crisis and the 2020 COVID-19 pandemic |

| Takes advantage of compound interest | Earned significant returns over time |

Frequently Asked Questions about White Oak Investment

White Oak Investment is a leading global alternative asset manager specializing in private equity, credit, and real assets. With over $14 billion in assets under management, White Oak Investment provides a diverse range of investment solutions to institutional investors and family offices around the world.

Question 1: What is White Oak Investment?

White Oak Investment is a leading global alternative asset manager specializing in private equity, credit, and real assets.

Question 2: What investment solutions does White Oak Investment offer?

White Oak Investment offers a diverse range of investment solutions to institutional investors and family offices around the world.

Question 3: What is the minimum investment required to invest with White Oak Investment?

The minimum investment required to invest with White Oak Investment is $1 million.

Question 4: What are the fees associated with investing with White Oak Investment?

The fees associated with investing with White Oak Investment include a management fee of 2% and a performance fee of 20%.

Question 5: How can I contact White Oak Investment?

You can contact White Oak Investment by phone, email, or by visiting their website.

Question 6: What are the advantages of investing with White Oak Investment?

The advantages of investing with White Oak Investment include a strong track record, a long-term perspective, and a global reach.

Summary of key takeaways or final thought:

White Oak Investment is a leading global alternative asset manager specializing in private equity, credit, and real assets. With over $14 billion in assets under management, White Oak Investment provides a diverse range of investment solutions to institutional investors and family offices around the world. White Oak Investment has a strong track record, a long-term perspective, and a global reach.

Transition to the next article section:

For more information about White Oak Investment, please visit their website.

Investment Tips from White Oak Investment

White Oak Investment is a leading global alternative asset manager specializing in private equity, credit, and real assets. With over $14 billion in assets under management, White Oak Investment has a proven track record of delivering attractive returns to its investors.

Here are five tips from White Oak Investment that can help you make better investment decisions:

Tip 1: Invest for the long term.

The stock market is volatile in the short term, but over the long term it has always trended upwards. By investing for the long term, you can ride out the ups and downs of the market and focus on the long-term growth potential of your investments.

Tip 2: Diversify your portfolio.

Don’t put all your eggs in one basket. By diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate, you can reduce your overall risk.

Tip 3: Rebalance your portfolio regularly.

As your investments grow, it’s important to rebalance your portfolio to ensure that your asset allocation is still aligned with your risk tolerance and investment goals.

Tip 4: Don’t try to time the market.

It’s impossible to predict when the market will go up or down. Instead of trying to time the market, focus on investing for the long term and riding out the ups and downs.

Tip 5: Get professional advice.

If you’re not sure how to invest your money, consider getting professional advice from a financial advisor. A financial advisor can help you create an investment plan that meets your specific needs and goals.

Summary of key takeaways or benefits:

By following these tips from White Oak Investment, you can make better investment decisions and achieve your financial goals.

Transition to the article’s conclusion:

For more information about White Oak Investment, please visit their website.

Conclusion

White Oak Investment is a leading global alternative asset manager specializing in private equity, credit, and real assets. With a proven track record of delivering attractive returns to its investors, White Oak Investment offers a diversified range of investment solutions across geographies and asset classes. Key factors contributing to the firm’s success include its experienced investment team, research-driven approach, superior customer service, and commitment to environmental, social, and governance (ESG) principles.

As the investment landscape continues to evolve, White Oak Investment is well-positioned to continue its growth trajectory by leveraging its expertise and resources to identify and capture attractive investment opportunities. This positions the firm as a valuable partner for investors seeking to achieve their long-term financial goals.

Youtube Video: