What is resume investment banking?

Editor’s Notes: “resume investment banking” have published on date.

After analyzing and gathering information, we’ve created this resume investment banking guide to assist you in making the best decisions.

| Key Differences | Key Takeaways |

|---|---|

| 1. | 2. |

| 3. | 4. |

Main article topics:

resume investment banking

When crafting a resume for investment banking, it’s crucial to highlight key aspects that showcase your skills and experience. Here are nine essential elements to consider:

- Technical skills: Proficiency in financial modeling, valuation, and Excel.

- Industry knowledge: Understanding of investment banking products and services.

- Transaction experience: Involvement in M&A, IPOs, or debt offerings.

- Analytical skills: Ability to analyze financial data and identify trends.

- Communication skills: Strong written and verbal communication abilities.

- Teamwork skills: Experience working effectively in a team environment.

- Attention to detail: Accuracy and precision in all aspects of work.

- Work ethic: Dedication and willingness to go the extra mile.

- Networking skills: Ability to build and maintain relationships with industry professionals.

These aspects are crucial because they demonstrate your qualifications for the role and set you apart from other candidates. By tailoring your resume to highlight these key elements, you can increase your chances of securing an interview and landing a job in investment banking.

Technical skills

In investment banking, technical skills such as proficiency in financial modeling, valuation, and Excel are highly sought after. These skills are essential for analysts to perform complex financial analyses, create presentations, and make recommendations to clients. Financial modeling involves building spreadsheets to forecast financial performance, analyze investment opportunities, and make business decisions. Valuation is the process of determining the worth of a company or asset, which is crucial for mergers and acquisitions, IPOs, and other transactions. Excel is the industry-standard software for financial analysis and is used for tasks such as data manipulation, charting, and creating presentations.

Investment banks typically use specific Excel templates and models for financial analysis, so proficiency in these tools is essential for analysts to be productive and efficient. Strong technical skills allow analysts to work independently, complete projects accurately and on time, and contribute effectively to the team.

Candidates with a strong foundation in financial modeling, valuation, and Excel have a competitive advantage in the investment banking job market. These skills demonstrate an understanding of financial concepts, analytical abilities, and attention to detail, which are highly valued by investment banks.

| Skill | Importance in Investment Banking |

|---|---|

| Financial Modeling | Used to forecast financial performance, analyze investment opportunities, and make business decisions. |

| Valuation | Used to determine the worth of a company or asset, which is crucial for mergers and acquisitions, IPOs, and other transactions. |

| Excel | Used for data manipulation, charting, and creating presentations. Investment banks typically use specific Excel templates and models for financial analysis. |

Industry knowledge

In investment banking, industry knowledge is crucial for success. Analysts and associates need to have a deep understanding of the products and services offered by investment banks to effectively advise clients and participate in transactions. These products and services include:

- Mergers and acquisitions (M&A)

- Initial public offerings (IPOs)

- Debt and equity underwriting

- Financial advisory

- Sales and trading

Analysts and associates need to understand the nuances of each product and service, as well as the regulatory environment in which they operate. This knowledge enables them to provide informed advice to clients, develop innovative solutions, and execute transactions successfully.

For example, in an M&A transaction, an analyst with strong industry knowledge can identify potential target companies, assess their financial health, and develop a compelling acquisition strategy. In an IPO, an associate with a deep understanding of the capital markets can help a company prepare for and execute its offering successfully.

Investment banks place a high value on candidates with strong industry knowledge. This knowledge demonstrates a commitment to the industry, a passion for finance, and the ability to add value to clients. Candidates with a strong understanding of investment banking products and services are more likely to be successful in their roles and advance their careers in the industry.

| Product/Service | Importance in Investment Banking |

|---|---|

| Mergers and Acquisitions (M&A) | Advising clients on buying and selling companies, providing strategic guidance, and executing transactions. |

| Initial Public Offerings (IPOs) | Helping companies raise capital by selling shares to the public for the first time. |

| Debt and Equity Underwriting | Guaranteeing the sale of new debt or equity securities issued by companies. |

| Financial Advisory | Providing financial advice to companies on a variety of matters, such as mergers and acquisitions, capital raising, and restructuring. |

| Sales and Trading | Executing trades for clients in the financial markets, providing liquidity and facilitating price discovery. |

Transaction experience

Transaction experience is a crucial element of a strong resume in investment banking. Involvement in mergers and acquisitions (M&A), initial public offerings (IPOs), or debt offerings demonstrates practical skills, knowledge of industry practices, and the ability to contribute to high-stakes financial transactions.

- M&A experience showcases an understanding of the M&A process, including due diligence, financial analysis, and negotiation. It demonstrates the ability to work effectively with clients, legal counsel, and other advisors to execute complex transactions.

- IPO experience highlights involvement in the process of taking a company public, including preparing financial documents, marketing the offering to investors, and ensuring compliance with regulatory requirements. It demonstrates an understanding of capital markets and the ability to work in a fast-paced, deadline-driven environment.

- Debt offering experience showcases knowledge of debt financing, including structuring debt instruments, pricing, and executing transactions. It demonstrates the ability to analyze credit risk, negotiate with lenders, and manage complex financial transactions.

- General transaction experience, even if not directly in M&A, IPOs, or debt offerings, can be valuable. It demonstrates involvement in the financial markets, understanding of transaction processes, and the ability to work in a team environment.

Overall, transaction experience in investment banking provides tangible evidence of skills, knowledge, and experience that are highly sought after by employers. It sets candidates apart and increases their chances of securing a role in the competitive investment banking industry.

Analytical skills

In investment banking, analytical skills are essential for success. Analysts and associates need to be able to analyze large amounts of financial data, identify trends, and make sound judgments. This ability is crucial for a variety of tasks, including:

- Financial modeling: Analysts use financial models to forecast a company’s future financial performance. To do this, they need to be able to analyze historical financial data, identify trends, and make assumptions about future events.

- Valuation: Analysts also need to be able to value companies and assets. This involves analyzing financial data to determine the worth of a company or asset.

- Due diligence: In M&A transactions, analysts need to conduct due diligence on the target company. This involves analyzing the target company’s financial data to identify any potential risks or red flags.

- Investment research: Analysts also need to conduct investment research to identify potential investment opportunities. This involves analyzing financial data to identify companies that are undervalued or have strong growth potential.

Overall, analytical skills are essential for success in investment banking. Analysts and associates need to be able to analyze large amounts of financial data, identify trends, and make sound judgments. This ability is crucial for a variety of tasks, including financial modeling, valuation, due diligence, and investment research.

Communication skills

In investment banking, strong written and verbal communication skills are essential for success. Analysts and associates need to be able to communicate complex financial information clearly and concisely to a variety of audiences, including clients, colleagues, and senior management.

Written communication skills are important for drafting reports, presentations, and emails. Analysts and associates need to be able to write clearly and persuasively, and they need to be able to organize their thoughts logically. Verbal communication skills are important for presenting to clients, participating in meetings, and negotiating with other parties.

Here are some examples of how communication skills are used in investment banking:

- An analyst writes a report on a potential investment opportunity. The report must be clear, concise, and persuasive in order to convince the client to invest.

- An associate presents a presentation to a group of potential investors. The presentation must be well-organized and engaging in order to capture the investors’ attention and interest.

- A vice president negotiates with the other party in a merger or acquisition transaction. The vice president must be able to communicate effectively in order to reach a deal that is beneficial to both parties.

Overall, strong communication skills are essential for success in investment banking. Analysts and associates need to be able to communicate complex financial information clearly and concisely to a variety of audiences.

| Skill | Importance in Investment Banking |

|---|---|

| Written communication | Drafting reports, presentations, and emails. |

| Verbal communication | Presenting to clients, participating in meetings, and negotiating with other parties. |

Teamwork skills

In investment banking, teamwork skills are essential for success. Analysts and associates work in teams on a daily basis, and they need to be able to collaborate effectively to achieve common goals. Teamwork skills include the ability to communicate effectively, share ideas, and work together to solve problems.

There are many different types of teams in investment banking, including deal teams, coverage teams, and research teams. Deal teams are responsible for executing mergers and acquisitions, initial public offerings, and other transactions. Coverage teams are responsible for building and maintaining relationships with clients. Research teams are responsible for conducting financial analysis and providing investment recommendations.

Regardless of the type of team, teamwork skills are essential for success. Analysts and associates need to be able to work effectively with their colleagues in order to achieve their goals. Here are some examples of how teamwork skills are used in investment banking:

- A deal team works together to execute a merger or acquisition. The team members need to be able to communicate effectively, share ideas, and work together to solve problems.

- A coverage team works together to build and maintain relationships with clients. The team members need to be able to communicate effectively, understand the clients’ needs, and work together to provide the best possible service.

- A research team works together to conduct financial analysis and provide investment recommendations. The team members need to be able to communicate effectively, share ideas, and work together to produce high-quality research.

Overall, teamwork skills are essential for success in investment banking. Analysts and associates need to be able to work effectively with their colleagues in order to achieve their goals.

Table: Importance of Teamwork Skills in Investment Banking

| Skill | Importance in Investment Banking |

|---|---|

| Communication | Team members need to be able to communicate effectively to share ideas, solve problems, and achieve common goals. |

| Collaboration | Team members need to be able to work together to achieve common goals. This involves sharing ideas, supporting each other, and resolving conflicts. |

| Problem-solving | Team members need to be able to work together to solve problems. This involves identifying problems, generating solutions, and implementing solutions. |

Attention to detail

In the world of investment banking, attention to detail is paramount. Analysts and associates are constantly working with complex financial data, and a single error can have serious consequences. As such, investment banks place a high value on candidates who demonstrate strong attention to detail in their work.

- Accuracy: Accuracy refers to the correctness of information. In investment banking, it is essential to be accurate in all aspects of your work, from data entry to financial analysis. A single error can lead to incorrect conclusions and poor decision-making.

- Precision: Precision refers to the level of detail in your work. In investment banking, it is important to be precise in your analysis and recommendations. Vague or imprecise language can lead to confusion and misunderstandings.

- Checking and rechecking: In investment banking, it is important to check and recheck your work before submitting it. This helps to ensure that your work is accurate and free of errors.

- Attention to detail in formatting: In addition to the accuracy of the content, attention to detail in formatting is also important. A well-formatted document is easy to read and understand, and it reflects positively on the analyst or associate who created it.

Overall, attention to detail is a critical skill for success in investment banking. By demonstrating strong attention to detail in your resume and your work, you can increase your chances of landing a job at a top investment bank.

Work ethic

In the competitive world of investment banking, a strong work ethic is essential for success. Analysts and associates are expected to work long hours and put in extra effort to meet the demands of the job. Those who are willing to go the extra mile will be more likely to succeed in this demanding field.

- Dedication: Investment bankers are dedicated to their work and to the success of their clients. They are willing to put in long hours and work hard to achieve their goals.

- Willingness to go the extra mile: Investment bankers are always willing to go the extra mile to help their clients. They are willing to work late, take on additional responsibilities, and do whatever it takes to get the job done.

- Attention to detail: Investment bankers are known for their attention to detail. They are careful and precise in their work, and they take pride in producing high-quality work products.

- Teamwork: Investment bankers work well in teams. They are able to collaborate effectively with others and contribute to the success of the team.

Investment banks value employees who have a strong work ethic. These employees are more likely to be successful in their roles and to contribute to the success of the firm.

Networking skills

In the highly competitive field of investment banking, networking skills are essential for success. Analysts and associates who are able to build and maintain strong relationships with industry professionals are more likely to advance their careers and achieve their goals.

There are a number of reasons why networking is so important in investment banking. First, investment banking is a relationship-driven business. Deals are often won or lost based on the strength of the relationships that the bankers involved have with the clients and other professionals.

Second, networking can help you to stay up-to-date on the latest industry trends and developments. By attending industry events and meeting with other professionals, you can learn about new products and services, as well as get insights into the latest market trends.

Third, networking can help you to find new job opportunities. Many investment banking jobs are never advertised, so the best way to find out about them is through networking.

There are a number of things that you can do to improve your networking skills. First, make an effort to attend industry events and meet with other professionals. Second, join professional organizations and participate in online forums. Third, reach out to people in your network for informational interviews.

By following these tips, you can improve your networking skills and increase your chances of success in investment banking.

Key insights:

- Networking is essential for success in investment banking.

- Investment banking is a relationship-driven business.

- Networking can help you to stay up-to-date on the latest industry trends and developments.

- Networking can help you to find new job opportunities.

Table: Benefits of Networking in Investment Banking

| Benefit | Description |

|---|---|

| Improved access to deals | Strong relationships with industry professionals can give you access to deals that you would not otherwise be able to participate in. |

| Increased knowledge of the industry | By networking with other professionals, you can stay up-to-date on the latest industry trends and developments. |

| Enhanced career opportunities | Networking can help you to find new job opportunities, both within your current firm and at other firms. |

FAQs on Investment Banking Resumes

Candidates seeking investment banking roles often have questions about crafting effective resumes. Here are answers to some frequently asked questions:

Question 1: What are the key elements of a strong investment banking resume?

Answer: A compelling investment banking resume should highlight technical skills (financial modeling, valuation, Excel), industry knowledge, transaction experience, analytical skills, communication skills, teamwork skills, attention to detail, work ethic, and networking skills.

Question 2: How do I demonstrate my industry knowledge and transaction experience on my resume?

Answer: Quantify your contributions to specific deals or projects, showcasing your involvement in different stages of the transaction process. Highlight your understanding of financial products and services, as well as your expertise in specific industry sectors.

Question 3: What are some tips for writing strong bullet points on my resume?

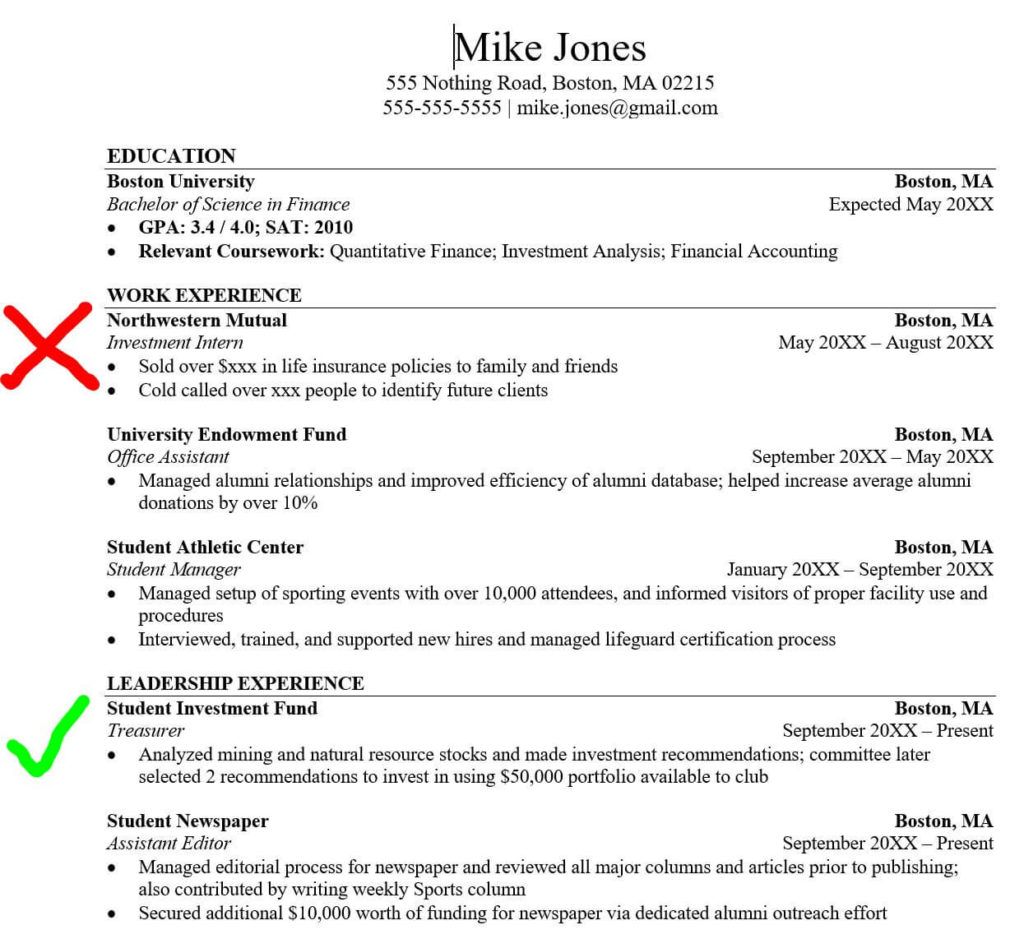

Answer: Use action verbs, quantify your accomplishments, and provide specific details. Begin each bullet point with a strong verb that conveys your role in the project or transaction. Include metrics and data whenever possible to demonstrate your impact.

Question 4: How can I tailor my resume to specific investment banking roles or firms?

Answer: Research the target firms and roles to identify their specific requirements. Highlight the skills and experiences that align with their needs, and tailor your resume to showcase your fit for the position.

Question 5: What are common mistakes to avoid on an investment banking resume?

Answer: Avoid using excessive jargon or technical terms that may not be familiar to recruiters. Ensure your resume is well-organized, free of grammatical errors, and visually appealing. Proofread carefully before submitting your resume.

Question 6: How can I improve my chances of getting noticed by recruiters?

Answer: Network with professionals in the industry, attend industry events, and leverage online platforms like LinkedIn to connect with recruiters and hiring managers. A strong online presence and a well-crafted resume can enhance your visibility and increase your chances of securing interviews.

Understanding these key aspects and addressing them effectively in your resume is crucial for optimizing your chances of success in securing investment banking roles.

Transition to the next article section:

Investment Banking Resume Tips

Crafting an effective investment banking resume is crucial for showcasing your skills and maximizing your chances of success in the competitive industry. Here are five essential tips to consider:

Tip 1: Quantify Your Accomplishments

Use specific numbers and metrics to demonstrate the impact of your work. For example, instead of stating “Developed financial models,” quantify your achievement: “Developed financial models that resulted in a 15% increase in project profitability.”

Tip 2: Highlight Industry Knowledge and Transaction Experience

Showcase your understanding of the investment banking industry and your involvement in specific transactions. Mention relevant projects, deals, or advisory roles, providing details about your contributions and responsibilities.

Tip 3: Use Action Verbs and Strong Language

Start your bullet points with strong action verbs that convey your active role in projects. Use specific and descriptive language to highlight your skills and accomplishments.

Tip 4: Tailor Your Resume to Each Role

Research the specific investment banking roles and firms you are applying to. Tailor your resume to match the requirements and keywords in the job descriptions, highlighting the skills and experiences that are most relevant to the position.

Tip 5: Proofread Carefully

Ensure that your resume is free of grammatical errors, typos, and formatting issues. A polished and well-proofread resume reflects your attention to detail and professionalism.

By following these tips, you can create a compelling investment banking resume that effectively communicates your skills and qualifications, increasing your chances of securing interviews and landing your dream job.

Resume Investment Banking

In the competitive realm of investment banking, a well-crafted resume serves as a powerful tool to showcase your skills and qualifications. By highlighting technical proficiency, industry knowledge, transaction experience, analytical acumen, communication abilities, teamwork capabilities, attention to detail, unwavering work ethic, and networking prowess, you can create a compelling narrative that resonates with potential employers.

Remember, your resume is not merely a collection of facts; it is a strategic representation of your potential as an investment banking professional. By adhering to the principles outlined in this guide, you can craft a resume that effectively communicates your value and sets you on the path toward success in this demanding and rewarding field.

Youtube Video: